Report: Midlincoln Report- 2018 Fund FLow in Review

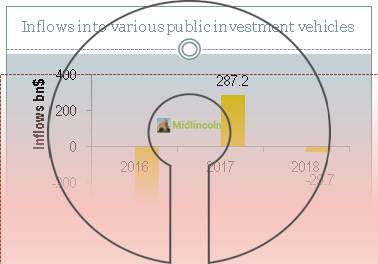

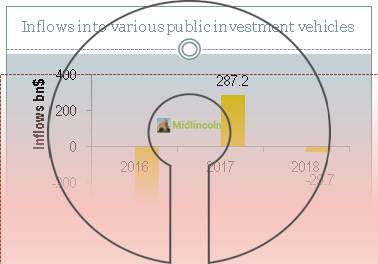

After stellar 2017 when new money generation was extreamly robust and net inflows into various public investment vehicles stood at 287$bn while MSCI World index was up 20.1% (data ex HF and FO) 2018 was a year when most of the things reversed direction vs. 2017

Source: ML

You will be able to download all slides in power point for this report

You will be able to download all slides in power point for this reportMidlincoln Report- 2018 Fund FLow in Review

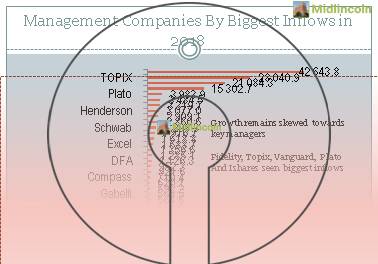

Management Companies By Biggest Inflows in 2018

Inflows vs. Returns for Management Companies with Top Inflows

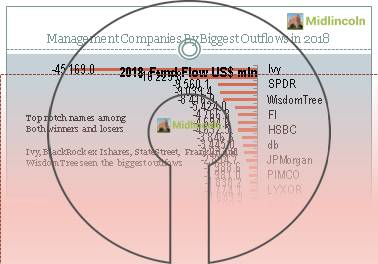

Management Companies By Biggest Outflows in 2018

Inflows vs. Returns for Management Companies with Top Outflows

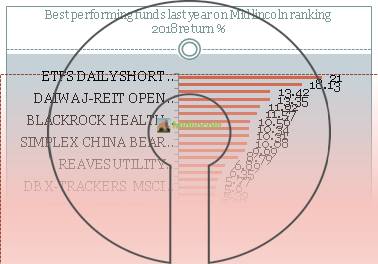

Best performing funds last year on Midlincoln ranking

2018 return % in USD

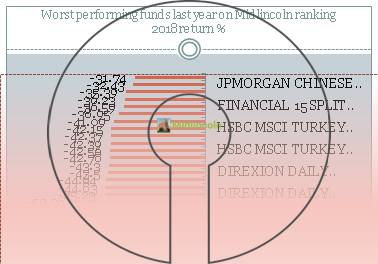

Worst performing funds last year on Midlincoln ranking

2018 return %

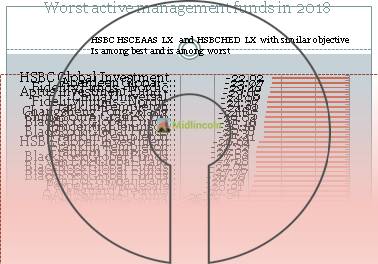

Worst active management funds in 2018 by performance in USD

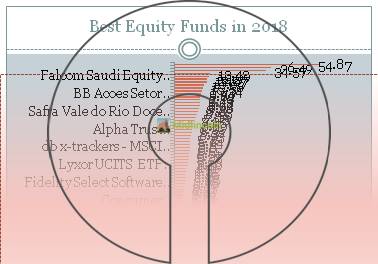

Best Equity Funds in 2018

Worst Equity Funds in 2018

Worst Fixed Income Funds

Best Fixed Income Funds

ETFs are still posting biggest inflows in 2018

Best Active Management Funds in 2018

Inflows by Midlincoln Style Factors in 2018

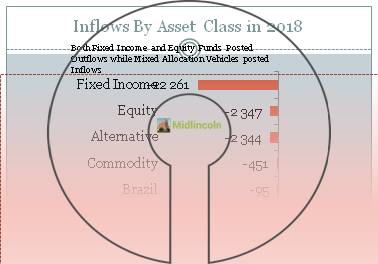

Inflows By Asset Class in 2018

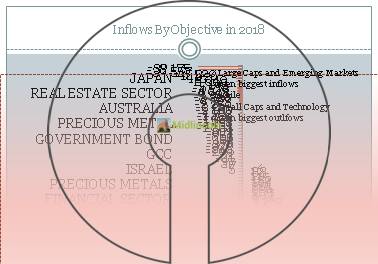

Inflows By Objective in 2018

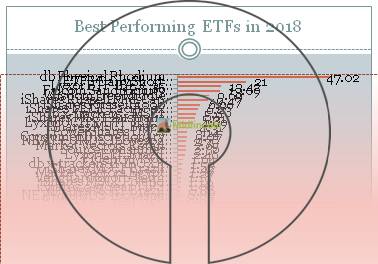

Best Performing ETFs in 2018

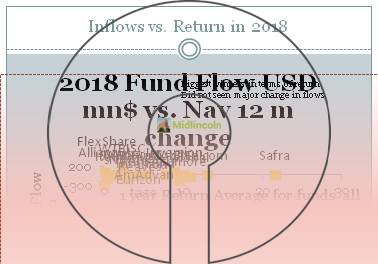

Inflows vs. Return in 2018

Top Notch Management Companies by 2018 Return

10btps difference between active manager vs. passive managers in performance is reflected in cost

Worst Performing ETFs in 2018

2018 was not the best year for investors – Egypt was an outlier

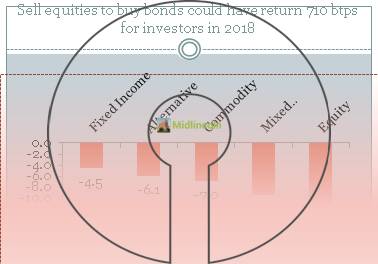

Sell equities to buy bonds could have return 710 btps for investors in 2018

Returns by Midlincoln Style Factors in 2018