Chart: Commodities Strategy

January 2026

Source:

Midlincoln Commodities Rankings from best to worst

Commodities Monthly Performance

| Name | Units | LastPrice | Currency | WeekChange USDpct |

|---|---|---|---|---|

| Silver (Tokyo) | JPY/g | 380.00 | JPY | 70.40 |

| Silver/Japanese Yen Spot | JPY/t oz. | 12054.2600 | JPY | 62.42 |

| Silver (Comex) | USD/t oz. | 73.81 | USD | 54.87 |

| Silver Spot | USD/t oz. | 74.1023 | USD | 53.95 |

| Silver/Euro Spot | EUR/t oz. | 63.6146 | EUR | 52.93 |

| Silver/British Pound Spot | GBP/t oz. | 55.2308 | GBP | 50.92 |

| Platinum Spot | USD/t oz. | 2209.3600 | USD | 38.96 |

| 3Mo Tin (LME) | USD/MT | 44323.00 | USD | 22.49 |

| Palladium Spot | USD/t oz. | 1718.2500 | USD | 21.37 |

| Orange Juice (ICE) | USd/lb. | 2.1545 | USD | 19.36 |

| Nickel | USD/MT | 17895 | USD | 16.46 |

| 3Mo Copper (LME) | USD/MT | 12899.50 | USD | 15.34 |

| Gold (Tokyo) | JPY/g | 22941.00 | JPY | 14.63 |

| Gold/Japanese Yen Spot | JPY/t oz. | 694542.0000 | JPY | 13.25 |

| Gold/Indian Rupee Spot | INR/t oz. | 398563.4688 | INR | 13.15 |

| Copper (Comex) | USd/lb. | 5.758500000000001 | USD | 11.94 |

| Gold (Comex) | USD/t oz. | 4433.00 | USD | 11.36 |

| Gold Spot | USD/t oz. | 4420.6500 | USD | 11.12 |

| ECX Emissions (ICE) | EUR/MT | 87.48 | USD | 10.37 |

| Gold/Euro Spot | EUR/t oz. | 3792.3900 | EUR | 10.30 |

| Gold/British Pound Spot | GBP/t oz. | 3295.7100 | GBP | 8.97 |

| 3Mo Aluminum (LME) | USD/MT | 3088.50 | USD | 6.98 |

| Feeder Cattle (CME) | USd/lb. | 3.555 | USD | 6.43 |

| Rubber (Tokyo) | USD/kg | 184.70 | JPY | 6.27 |

| Sugar #11 (ICE) | USd/lb. | 0.1497 | USD | 5.94 |

| Lean Hogs (CME) | USd/lb. | 0.848 | USD | 4.98 |

| Steel | USD/MT | 565 | USD | 4.24 |

| Cocoa (ICE) | USD/MT | 6144.00 | USD | 3.54 |

| 3Mo Zinc (LME) | USD/MT | 3167.50 | USD | 2.76 |

| Corn (CBOT) | USd/bu. | 4.4625 | USD | 2.70 |

| Kerosene (Tokyo) | JPY/kl | 86000.00 | JPY | 2.38 |

| Live Cattle (CME) | USd/lb. | 2.3453 | USD | 1.57 |

| Rough Rice (CBOT) | USD/cwt | 10.38 | USD | 0.68 |

| Oats (CBOT) | USd/bu. | 2.945 | USD | 0.00 |

| Soybean (CBOT) | USd/bu. | 10.235 | USD | 0.00 |

| Ethanol (CBOT) | USD/gal. | 2.16 | USD | 0.00 |

| Coffee 'C' (ICE) | USd/lb. | 3.8235 | USD | -0.79 |

| Soybean Oil (CBOT) | USd/lb. | 0.49479999999999996 | USD | -0.80 |

| Cotton #2 (ICE) | USd/lb. | 0.6456999999999999 | USD | -0.94 |

| Wheat (CBOT) | USd/bu. | 5.18 | USD | -1.71 |

| Canola (ICE) | CAD/MT | 624.80 | CAD | -2.63 |

| Soybean Meal (CBOT) | USD/T. | 304.40 | USD | -3.33 |

| Cocking Coal | CNY/MT | 1046 | CNY | -4.91 |

| WTI Crude Oil (Nymex) | USD/bbl. | 57.07 | USD | -4.93 |

| Brent Crude (ICE) | USD/bbl. | 61.13 | USD | -5.09 |

| Crude Oil (Tokyo) | JPY/kl | 57650.00 | JPY | -6.76 |

| Natural Gas (Nymex) | USD/MMBtu | 3.47 | USD | -9.87 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.7402000000000002 | USD | -11.12 |

| Heating Oil (Nymex) | USd/gal. | 2.0905 | USD | -13.02 |

| Gasoil (Nymex) | USD/MT | 610.00 | USD | -14.33 |

| Lumber (CME) | USD/1000 board feet | -- | USD |

Commodities YTD Performance

| Name | Units | LastPrice | Currency | YTDChange USDpct |

|---|---|---|---|---|

| Silver/Japanese Yen Spot | JPY/t oz. | 12054.2600 | JPY | 163.13 |

| Silver (Tokyo) | JPY/g | 380.00 | JPY | 158.50 |

| Silver Spot | USD/t oz. | 74.1023 | USD | 142.56 |

| Silver (Comex) | USD/t oz. | 73.81 | USD | 138.33 |

| Platinum Spot | USD/t oz. | 2209.3600 | USD | 134.13 |

| Silver/British Pound Spot | GBP/t oz. | 55.2308 | GBP | 128.60 |

| Silver/Euro Spot | EUR/t oz. | 63.6146 | EUR | 118.38 |

| Gold (Tokyo) | JPY/g | 22941.00 | JPY | 79.54 |

| Gold/Indian Rupee Spot | INR/t oz. | 398563.4688 | INR | 78.39 |

| Gold/Japanese Yen Spot | JPY/t oz. | 694542.0000 | JPY | 75.55 |

| Palladium Spot | USD/t oz. | 1718.2500 | USD | 75.35 |

| Gold Spot | USD/t oz. | 4420.6500 | USD | 67.53 |

| Gold (Comex) | USD/t oz. | 4433.00 | USD | 66.68 |

| Gold/British Pound Spot | GBP/t oz. | 3295.7100 | GBP | 57.90 |

| 3Mo Tin (LME) | USD/MT | 44323.00 | USD | 55.12 |

| Gold/Euro Spot | EUR/t oz. | 3792.3900 | EUR | 50.75 |

| 3Mo Copper (LME) | USD/MT | 12899.50 | USD | 43.45 |

| Copper (Comex) | USd/lb. | 5.758500000000001 | USD | 39.89 |

| Feeder Cattle (CME) | USd/lb. | 3.555 | USD | 38.41 |

| Coffee 'C' (ICE) | USd/lb. | 3.8235 | USD | 29.15 |

| ECX Emissions (ICE) | EUR/MT | 87.48 | USD | 27.10 |

| Live Cattle (CME) | USd/lb. | 2.3453 | USD | 24.80 |

| Soybean Oil (CBOT) | USd/lb. | 0.49479999999999996 | USD | 20.45 |

| Nickel | USD/MT | 17895 | USD | 19.30 |

| 3Mo Aluminum (LME) | USD/MT | 3088.50 | USD | 19.25 |

| Rubber (Tokyo) | USD/kg | 184.70 | JPY | 10.01 |

| Natural Gas (Nymex) | USD/MMBtu | 3.47 | USD | 8.10 |

| Kerosene (Tokyo) | JPY/kl | 86000.00 | JPY | 7.50 |

| Canola (ICE) | CAD/MT | 624.80 | CAD | 7.37 |

| Soybean Meal (CBOT) | USD/T. | 304.40 | USD | 5.37 |

| Soybean (CBOT) | USd/bu. | 10.235 | USD | 3.94 |

| Corn (CBOT) | USd/bu. | 4.4625 | USD | 3.00 |

| 3Mo Zinc (LME) | USD/MT | 3167.50 | USD | 2.96 |

| Ethanol (CBOT) | USD/gal. | 2.16 | USD | 0.00 |

| Steel | USD/MT | 565 | USD | -1.74 |

| Lean Hogs (CME) | USd/lb. | 0.848 | USD | -3.58 |

| Heating Oil (Nymex) | USd/gal. | 2.0905 | USD | -3.96 |

| Wheat (CBOT) | USd/bu. | 5.18 | USD | -5.95 |

| Gasoil (Nymex) | USD/MT | 610.00 | USD | -8.24 |

| Cotton #2 (ICE) | USd/lb. | 0.6456999999999999 | USD | -9.12 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.7402000000000002 | USD | -9.17 |

| Cocking Coal | CNY/MT | 1046 | CNY | -12.83 |

| Crude Oil (Tokyo) | JPY/kl | 57650.00 | JPY | -14.20 |

| Brent Crude (ICE) | USD/bbl. | 61.13 | USD | -14.80 |

| WTI Crude Oil (Nymex) | USD/bbl. | 57.07 | USD | -16.04 |

| Oats (CBOT) | USd/bu. | 2.945 | USD | -20.99 |

| Sugar #11 (ICE) | USd/lb. | 0.1497 | USD | -28.95 |

| Rough Rice (CBOT) | USD/cwt | 10.38 | USD | -31.98 |

| Cocoa (ICE) | USD/MT | 6144.00 | USD | -34.65 |

| Orange Juice (ICE) | USd/lb. | 2.1545 | USD | -57.81 |

| Lumber (CME) | USD/1000 board feet | -- | USD |

Key Topics and News

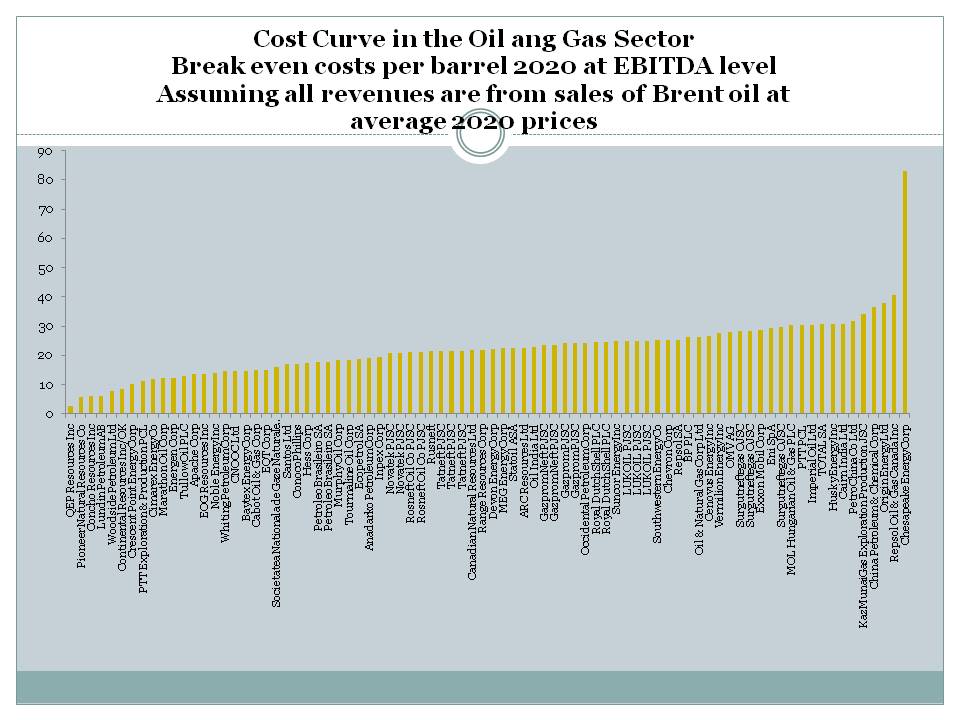

Oil Production Cost Curve

- Enverus — Marginal cost of U.S. shale to move from $70 to $95 WTI by mid-2030s — Enverus Intelligence® Research has released a report highlighting the impending depletion of North America's core oil and gas inventory and....Sep 23, 2025

- Institute for Energy Economics and Financial Analysis (IEEFA)Oil producers face profit squeeze amid shifting policy landscape — A recent survey reveals a dark mood in the fossil fuel sector, as tariff talk shakes industry confidence..Apr 3, 2025

- Crude Oil Prices Today | Oil — Price.com — U.S. Shale Costs to Soar to $95 per Barrel Within a Decade — Breakevens may rise from ~$70 to as much as $95 per barrel by the mid-2030s as core inventory depletes..Sep 25, 2025

- Rystad Energy — Shale project economics still reign supreme as cost of new oil production rises further — New research from Rystad Energy shows that the average breakeven cost of a non-OPEC oil project grew to $47 per barrel of Brent crude, a 5% increase in the....Oct 1, 2024

- Oil & Gas Journal — Rystad Energy: Cost of new upstream oil projects rises further — The cost of developing new upstream oil projects is continuing to rise as inflationary pressure and supply chain woes endure..Oct 1, 2024

Source:

Oil Supply and Demand

- U.S. Energy Information Administration (EIA) (.gov)Crude oil prices fell in 2025 amid oversupply — Crude oil prices generally declined in 2025 with supplies in the global crude oil market exceeding demand. Crude oil inventory builds in....

- Reuters — Oil prices forecast to ease in 2026 under pressure from ample supply — The global oil market is likely to be under pressure in 2026 as growing supply and weak demand curb prices, and traders monitor OPEC+ for....

- World Bank Blogs — Oil Market Glut: Rising Supply and Slowing Demand Shape 2025 Outlook — The World Bank's October 2025 Commodity Markets Outlook highlights growing oversupply in the oil market. Global output is projected to rise....Nov 4, 2025

- Mc — Kinsey & Company — Snapshot of global oil supply and demand: August 2025Global oil demand. Global liquids demand remained relatively steady at 104.6 MMb/d in August. The largest decline in demand was associated with....Oct 1, 2025

- Financial Times — Donald Trump’s Venezuela action raises threat for China’s oil supplies — Chinese producers fear similar US intervention in Iran would disrupt access to discounted crude supplies..

Aluminium Cost Curve

- Linked — In — Outlook 2026 | Aluminium prices ending 2025 at its highs, more steam left? Nigel Dsouza Explains #CNBCTV18Market #Aluminium #stocks #stockmarket #stocknews2 weeks ago

- 富途牛牛CITIC Securities: Indonesia Project May Alter the Global Alumina Cost Curve; Continued Optimism for Investment Opportunities in the Electrolytic Aluminum Industry — For alumina, thanks to tax incentives and significantly favorable bauxite costs, at an alumina price of $450 and current bauxite prices,....Oct 28, 2025

- alcircle — Aluminium chip drying gets a rethink, and the cost curve bends sharply — The shift revolves around a patented chip dryer system known as Thermofuge, which is being deployed inside the casting house of one of the....Jul 28, 2025

- Shanghai Metals Market — Aluminum prices have shown a fluctuating trend in the near term, with a bullish outlook for long-term prices. However, the risk of overexpansion in other regions remains [ICM conference] | SMMAt the 2025 Indonesia Mining Conference & Critical Metals Conference - Aluminum Industry Forum, Duncan Hobbs, Director of Industry Research....Jun 3, 2025

- Price — Pedia — Analysis of Aluminum Market Fundamentals Through 2050In the article The use of relative prices to study the evolution of commodity markets it was highlighted how relative prices can represent a....Sep 29, 2025

Aluminium Supply and Demand

- alcircle — LME aluminium contract crosses $3000/t as supply deficit deepens with China’s 45-MT cap, smelter cuts, and US tariffs — Tightened supply outlook and long-term demand bets have taken the three-month LME aluminium contract to more than $3000/t..

- Chem — Analyst — US Aluminium Ingot Market Tightens as Supply Shrinks and Prices Surge — Supply constraints and strategic demand growth have caused a dramatic shift in the US aluminium ingot market, as pricing trends change....

- Reuters — Aluminium's years of plenty are drawing to a close — The global aluminium market has been in structural supply surplus for so long that it's hard to imagine a genuine shortage of the light....Sep 18, 2025

- ANI News — China output cap, tight supply and energy transition may keep aluminium prices on upward trajectory this year: Analysts — Aluminium prices in domestic and global markets are expected to keep an upward trajectory this year as China's output cap restricts supply....

- Discovery Alert — Aluminium Price Spikes Driven by Global Supply Concerns in 2026Global aluminum prices spike to $3000+ amid China production caps and European energy costs forcing supply cuts..

Nickel Metal Cost Curve

- Nature — Modeling interconnected minerals markets with multicommodity supply curves: examining the copper-cobalt-nickel system — Demand for many of the metals used in the energy transition is expected to grow rapidly. Many of these are by-products, often considered....Aug 7, 2025

- Crux Investor — Lifezone Metals: First-Quartile Nickel Project Advances Amid Market Oversupply — Lifezone's high-grade Kabanga project advances toward 2026 FID with first-quartile costs, strategic U.S. backing, and robust economics....3 weeks ago

- Bloomberg.com — The World’s Most Profitable Nickel Plants Face Cost Challenge — A pioneering group of Indonesian nickel smelters with the world's lowest production costs has been hit by a jump in the price of a key raw material..Jun 18, 2025

- Mining.com — Indonesia may slash nickel output to steady prices — The Indonesian government is proposing a 34% reduction in production from this year's total to 250 million tonnes next year..3 weeks ago

- Investing.com — Nickel prices outlook remains bearish as UBS warns of persistent surplus — The global nickel market is expected to remain in surplus through 2026 despite recent production cuts, according to a new UBS analysis released this week..Jul 18, 2025

Nickel Metal Supply Demand

- Shanghai Metals Market — Interpreting Global Nickel and Indonesia Stainless Steel Industries: Supply-Demand Dynamics and Outlook"Stainless Steel Industries | SMM1.Global Nickel Market Overview. - Global primary nickel supply and demand grew at similar rates (6.6% and 6.7% annualized) from 2016 to 2021,....

- Investing News Network — Nickel Price Update: Q2 2025 in Review — Nickel is expected to remain in oversupply through 2026 on the back of high output from Indonesia and soft demand from the manufacturing and....2 weeks ago

- ING THINK economic and financial analysis | ING Think — Nickel still capped by surplus — Global nickel supply is expected to outpace demand again in 2026. Indonesia accounts for around 60% of global nickel output and is the....1 month ago

- Carbon — Credits.com — The Nickel Market is Changing Big Time: Is a Supply-Demand Shift Underway?Nickel, a key component in electric vehicle (EV) batteries and stainless steel, is experiencing significant changes in supply dynamics and pricing..May 21, 2025

- Wood Mackenzie — Nickel: looking for a route back to safety — The outlook for the nickel market, particularly for use in batteries, is not as bullish as it once was - but demand is still buoyant in the....May 21, 2025

Copper Cost Curve

- Seeking Alpha — Southern Copper: King Of The Cost Curve, But Hold Your Horses (NYSE:SCCO)Summary · Southern Copper stands out as a stable, low-cost copper producer with the highest copper reserves among listed peers, supporting long-....1 month ago

- Nature — Modeling interconnected minerals markets with multicommodity supply curves: examining the copper-cobalt-nickel system — Demand for many of the metals used in the energy transition is expected to grow rapidly. Many of these are by-products, often considered....Aug 7, 2025

- Benchmark Source — LME copper three month price climbs to record high — Reports that the US and China were close to reaching an agreement on trade sparked a copper price rally on 29 October that saw the LME forward curve climb....Oct 31, 2025

- Investing News Network — MOD Feasibility Study Confirms Robust Capital Intensity and 31%+ IRR; Maiden Ore Reserve — The Full Announcement is Available in PDF here: Marimaca Copper Corp. is pleased to announce the results of the Definitive Feasibility Study....Aug 25, 2025

- Crux Investor — From Surplus to Scarcity: How Slower Production Growth Is Driving a Structural Copper Deficit by 2026The ICSG projects a 150000-ton copper deficit by 2026 as production growth slows to 0.9%. Declining grades, rising capex,....Oct 9, 2025

Copper Supply Demand

- PR Newswire'Substantial Shortfall' in Copper Supply Widens as the Race for AI and Growing Defense Spending Add to Accelerating Demand, New S&P Global Study Finds — PRNewswire/ -- A looming copper supply gap is poised to widen as electricity demand accelerates and new vectors—such as the race for....

- Reuters — AI to boost copper demand 50% by 2040, but more mines needed to ensure supply, S&P says — Growth in the artificial intelligence and defense sectors will boost global copper demand 50% by 2040, but supplies are expected to fall....

- Axios — AI and military needs could worsen looming copper supply gap, study says — Copper supply is foundational to energy transition including EVs and renewables — even as traditional uses grow..

- Seeking Alpha — AI and defense boom could push copper demand 50% by 2040, supply shortfall looms: S&P (HG1:COM:Commodity)S&P Global forecasts copper demand up 50% by 2040 on AI and defense, risking 10M+ ton shortages..

- IT Pro — AI’s future rests on copper, and global supply shortages could hamper big tech infrastructure plans — Copper demand is expected to skyrocket over the next two decades, and the AI industry is guzzling up large volumes worldwide..

Recent Commodities Ideas ChartArt

Top 5 Commodities Longs Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| JI1 Comdty | Silver (Tokyo) | JPY/g | 70.40 | 70.40 | 158.50 | 54.47 | 158.50 | 88.44 |

| XAGJPY Curncy | Silver/Japanese Yen Spot | JPY/t oz. | 62.42 | 62.42 | 163.13 | 61.23 | 163.13 | 87.30 |

| SI1 Comdty | Silver (Comex) | USD/t oz. | 54.87 | 54.87 | 138.33 | 56.01 | 138.33 | 76.02 |

| XAGUSD Curncy | Silver Spot | USD/t oz. | 53.95 | 53.95 | 142.56 | 51.83 | 142.56 | 75.57 |

| XAGGBP Curncy | Silver/British Pound Spot | GBP/t oz. | 50.92 | 50.92 | 128.60 | 50.53 | 128.60 | 70.24 |

Top 5 Commodities Shorts Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| QS1 Comdty | Gasoil (Nymex) | USD/MT | -14.33 | -14.33 | -8.24 | -9.90 | -8.24 | -11.70 |

| XB1 Comdty | RBOB Gasoline (Nymex) | USd/gal. | -11.12 | -11.12 | -9.17 | -7.29 | -9.17 | -9.67 |

| HO1 Comdty | Heating Oil (Nymex) | USd/gal. | -13.02 | -13.02 | -3.96 | -8.05 | -3.96 | -9.51 |

| CP1 Comdty | Crude Oil (Tokyo) | JPY/kl | -6.76 | -6.76 | -14.20 | -9.14 | -14.20 | -9.22 |

| RR1 Comdty | Rough Rice (CBOT) | USD/cwt | 0.68 | 0.68 | -31.98 | -4.42 | -31.98 | -8.76 |

Estimates of Commodities Avg Annual Prices

Commodities News, Table of Contents:

Oil 61.13 (USD/bbl.)

Natural Gas 3.47 (USD/MMBtu)

Cocking Coal 1,046.00 (CNY/MT)

Gold 4,420.65 (USD/t oz.)

Silver 73.81 (USD/t oz.)

Platinum 2,209.36 (USD/t oz.)

Palladium 1,718.25 (USD/t oz.)

Copper 5.76 (USd/lb.)

3Mo Aluminum 3,088.50 (USD/MT)

3Mo Zinc 3,167.50 (USD/MT)

3Mo Tin 44,323.00 (USD/MT)

Nickel 17,895.00 (USD/MT)

Steel 565.00 (USD/MT)

Corn 4.46 (USd/bu.)

Wheat 5.18 (USd/bu.)

Oats 2.95 (USd/bu.)

Rough Rice 10.38 (USD/cwt)

Soybean 10.24 (USd/bu.)

Canola 624.80 (CAD/MT)

Cocoa 6,144.00 (USD/MT)

Coffee 3.82 (USd/lb.)

Sugar 0.15 (USd/lb.)

Orange Juice 2.15 (USd/lb.)

Cotton 0.65 (USd/lb.)

Lumber 0.00 (USD/1000 board feet)

Ethanol 2.16 (USD/gal.)

Live Cattle 2.35 (USd/lb.)

Feeder Cattle 3.56 (USd/lb.)

Lean Hogs 0.85 (USd/lb.)

Best Commodities 1yr

| Ticker | name | units | ytd | week | 1month | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| XAGJPY Curncy | Silver/Japanese Yen Spot | JPY/t oz. | 163.13 | 62.42 | 62.42 | 61.23 | 163.13 | 87.30 |

| JI1 Comdty | Silver (Tokyo) | JPY/g | 158.50 | 70.40 | 70.40 | 54.47 | 158.50 | 88.44 |

| XAGUSD Curncy | Silver Spot | USD/t oz. | 142.56 | 53.95 | 53.95 | 51.83 | 142.56 | 75.57 |

| SI1 Comdty | Silver (Comex) | USD/t oz. | 138.33 | 54.87 | 54.87 | 56.01 | 138.33 | 76.02 |

| XPTUSD Curncy | Platinum Spot | USD/t oz. | 134.13 | 38.96 | 38.96 | 36.04 | 134.13 | 62.02 |

Worst Commodities 1yr

| Ticker | name | units | ytd | week | 1month | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| JO1 Comdty | Orange Juice (ICE) | USd/lb. | -57.81 | 19.36 | 19.36 | 4.64 | -57.81 | -3.61 |

| CC1 Comdty | Cocoa (ICE) | USD/MT | -34.65 | 3.54 | 3.54 | 3.35 | -34.65 | -6.06 |

| RR1 Comdty | Rough Rice (CBOT) | USD/cwt | -31.98 | 0.68 | 0.68 | -4.42 | -31.98 | -8.76 |

| SB1 Comdty | Sugar #11 (ICE) | USd/lb. | -28.95 | 5.94 | 5.94 | -7.93 | -28.95 | -6.25 |

| CL1 Comdty | WTI Crude Oil (Nymex) | USD/bbl. | -16.04 | -4.93 | -4.93 | -6.95 | -16.04 | -8.21 |