Chart: Commodities Strategy

October 2025

Source:

Midlincoln Commodities Rankings from best to worst

| Name | Rank |

|---|---|

| Platinum SpotUSD/t oz. | 34.58 |

| Natural Gas (Nymex)USD/MMBtu | 33.41 |

| Silver (Comex)USD/t oz. | 33.27 |

| Gold SpotUSD/t oz. | 31.48 |

| Coffee 'C' (ICE)USd/lb. | 30.96 |

| Palladium SpotUSD/t oz. | 22.87 |

| 3Mo Tin (LME)USD/MT | 13.92 |

| Feeder Cattle (CME)USd/lb. | 13.15 |

| Copper (Comex)USd/lb. | 12.84 |

| Live Cattle (CME)USd/lb. | 11.84 |

| 3Mo Aluminum (LME)USD/MT | 9.67 |

| 3Mo Zinc (LME)USD/MT | 6.91 |

| Canola (ICE)CAD/MT | 3.98 |

| Corn (CBOT)USd/bu. | 0.79 |

| Wheat (CBOT)USd/bu. | -0.85 |

| NickelUSD/MT | -2.29 |

| SteelUSD/MT | -4.05 |

| Lean Hogs (CME)USd/lb. | -8.52 |

| Cocking CoalCNY/MT | -8.54 |

| Brent Crude (ICE)USD/bbl. | -9.56 |

| Cotton #2 (ICE)USd/lb. | -9.74 |

| Rough Rice (CBOT)USD/cwt | -19.17 |

| Cocoa (ICE)USD/MT | -19.84 |

| Sugar #11 (ICE)USd/lb. | -22.11 |

| Orange Juice (ICE)USd/lb. | -30.33 |

Commodities Monthly Performance

| Name | Units | LastPrice | Currency | WeekChange USDpct |

|---|---|---|---|---|

| Natural Gas (Nymex) | USD/MMBtu | 3.85 | USD | 71.82 |

| Silver (Tokyo) | JPY/g | 223.00 | JPY | 22.71 |

| Silver/Japanese Yen Spot | JPY/t oz. | 7421.7100 | JPY | 21.02 |

| Coffee 'C' (ICE) | USd/lb. | 3.8539999999999996 | USD | 17.48 |

| Silver/Euro Spot | EUR/t oz. | 41.5975 | EUR | 17.01 |

| Silver (Comex) | USD/t oz. | 47.66 | USD | 16.63 |

| Silver Spot | USD/t oz. | 48.1330 | USD | 16.57 |

| 3Mo Tin (LME) | USD/MT | 36184.00 | USD | 16.25 |

| Silver/British Pound Spot | GBP/t oz. | 36.5956 | GBP | 15.34 |

| ECX Emissions (ICE) | EUR/MT | 79.26 | USD | 13.77 |

| 3Mo Zinc (LME) | USD/MT | 3082.50 | USD | 13.61 |

| Wheat (CBOT) | USd/bu. | 5.27 | USD | 12.66 |

| Copper (Comex) | USd/lb. | 5.144500000000001 | USD | 11.68 |

| Orange Juice (ICE) | USd/lb. | 1.805 | USD | 11.62 |

| 3Mo Copper (LME) | USD/MT | 11183.50 | USD | 10.06 |

| 3Mo Aluminum (LME) | USD/MT | 2887.00 | USD | 8.41 |

| Soybean Meal (CBOT) | USD/T. | 314.90 | USD | 6.97 |

| Gold (Tokyo) | JPY/g | 20013.00 | JPY | 6.94 |

| Gold/Japanese Yen Spot | JPY/t oz. | 613291.7500 | JPY | 6.56 |

| Platinum Spot | USD/t oz. | 1589.9200 | USD | 5.72 |

| Gold/Indian Rupee Spot | INR/t oz. | 352238.4375 | INR | 5.05 |

| Feeder Cattle (CME) | USd/lb. | 3.3402999999999996 | USD | 3.60 |

| Gold/Euro Spot | EUR/t oz. | 3438.3000 | EUR | 2.97 |

| Corn (CBOT) | USd/bu. | 4.345 | USD | 2.85 |

| Canola (ICE) | CAD/MT | 641.70 | CAD | 2.63 |

| Gold Spot | USD/t oz. | 3978.2500 | USD | 2.59 |

| Gold (Comex) | USD/t oz. | 3980.90 | USD | 2.57 |

| Gold/British Pound Spot | GBP/t oz. | 3024.4800 | GBP | 1.53 |

| Cocking Coal | CNY/MT | 1100 | CNY | 0.82 |

| Rubber (Tokyo) | USD/kg | 173.80 | JPY | 0.00 |

| Ethanol (CBOT) | USD/gal. | 2.16 | USD | 0.00 |

| Live Cattle (CME) | USd/lb. | 2.309 | USD | -0.73 |

| Soybean (CBOT) | USd/bu. | 10.235 | USD | -0.92 |

| Kerosene (Tokyo) | JPY/kl | 84000.00 | JPY | -1.81 |

| Crude Oil (Tokyo) | JPY/kl | 61830.00 | JPY | -2.88 |

| Steel | USD/MT | 542 | USD | -4.17 |

| Brent Crude (ICE) | USD/bbl. | 64.41 | USD | -5.23 |

| Oats (CBOT) | USd/bu. | 2.945 | USD | -5.54 |

| WTI Crude Oil (Nymex) | USD/bbl. | 60.03 | USD | -5.65 |

| Rough Rice (CBOT) | USD/cwt | 10.31 | USD | -5.97 |

| Nickel | USD/MT | 15366 | USD | -6.00 |

| Heating Oil (Nymex) | USd/gal. | 2.4034999999999997 | USD | -6.19 |

| Cocoa (ICE) | USD/MT | 5934.00 | USD | -6.38 |

| Gasoil (Nymex) | USD/MT | 712.00 | USD | -6.98 |

| Soybean Oil (CBOT) | USd/lb. | 0.4988 | USD | -8.92 |

| Lean Hogs (CME) | USd/lb. | 0.8078 | USD | -9.04 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.9580000000000002 | USD | -10.04 |

| Palladium Spot | USD/t oz. | 1415.6700 | USD | -11.04 |

| Sugar #11 (ICE) | USd/lb. | 0.1413 | USD | -17.76 |

| Cotton #2 (ICE) | USd/lb. | 0.6518 | USD | -21.77 |

| Lumber (CME) | USD/1000 board feet | -- | USD |

Commodities YTD Performance

| Name | Units | LastPrice | Currency | YTDChange USDpct |

|---|---|---|---|---|

| Platinum Spot | USD/t oz. | 1589.9200 | USD | 68.49 |

| Silver/Japanese Yen Spot | JPY/t oz. | 7421.7100 | JPY | 62.00 |

| Gold/Indian Rupee Spot | INR/t oz. | 352238.4375 | INR | 57.66 |

| Silver Spot | USD/t oz. | 48.1330 | USD | 57.55 |

| Gold (Tokyo) | JPY/g | 20013.00 | JPY | 56.62 |

| Gold/Japanese Yen Spot | JPY/t oz. | 613291.7500 | JPY | 55.01 |

| Silver (Comex) | USD/t oz. | 47.66 | USD | 53.89 |

| Silver (Tokyo) | JPY/g | 223.00 | JPY | 51.70 |

| Silver/British Pound Spot | GBP/t oz. | 36.5956 | GBP | 51.47 |

| Gold Spot | USD/t oz. | 3978.2500 | USD | 50.76 |

| Gold (Comex) | USD/t oz. | 3980.90 | USD | 49.68 |

| Gold/British Pound Spot | GBP/t oz. | 3024.4800 | GBP | 44.91 |

| Palladium Spot | USD/t oz. | 1415.6700 | USD | 44.47 |

| Silver/Euro Spot | EUR/t oz. | 41.5975 | EUR | 42.80 |

| Gold/Euro Spot | EUR/t oz. | 3438.3000 | EUR | 36.67 |

| Coffee 'C' (ICE) | USd/lb. | 3.8539999999999996 | USD | 30.18 |

| Feeder Cattle (CME) | USd/lb. | 3.3402999999999996 | USD | 30.05 |

| 3Mo Tin (LME) | USD/MT | 36184.00 | USD | 26.64 |

| Copper (Comex) | USd/lb. | 5.144500000000001 | USD | 24.97 |

| 3Mo Copper (LME) | USD/MT | 11183.50 | USD | 24.36 |

| Live Cattle (CME) | USd/lb. | 2.309 | USD | 22.86 |

| Soybean Oil (CBOT) | USd/lb. | 0.4988 | USD | 21.42 |

| Natural Gas (Nymex) | USD/MMBtu | 3.85 | USD | 19.94 |

| ECX Emissions (ICE) | EUR/MT | 79.26 | USD | 15.15 |

| 3Mo Aluminum (LME) | USD/MT | 2887.00 | USD | 11.47 |

| Heating Oil (Nymex) | USd/gal. | 2.4034999999999997 | USD | 10.42 |

| Canola (ICE) | CAD/MT | 641.70 | CAD | 10.28 |

| Soybean Meal (CBOT) | USD/T. | 314.90 | USD | 9.00 |

| Gasoil (Nymex) | USD/MT | 712.00 | USD | 7.11 |

| Kerosene (Tokyo) | JPY/kl | 84000.00 | JPY | 5.00 |

| Soybean (CBOT) | USd/bu. | 10.235 | USD | 3.94 |

| Rubber (Tokyo) | USD/kg | 173.80 | JPY | 3.51 |

| Nickel | USD/MT | 15366 | USD | 2.44 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.9580000000000002 | USD | 2.20 |

| Corn (CBOT) | USd/bu. | 4.345 | USD | 0.29 |

| 3Mo Zinc (LME) | USD/MT | 3082.50 | USD | 0.20 |

| Ethanol (CBOT) | USD/gal. | 2.16 | USD | 0.00 |

| Wheat (CBOT) | USd/bu. | 5.27 | USD | -4.31 |

| Steel | USD/MT | 542 | USD | -5.74 |

| Crude Oil (Tokyo) | JPY/kl | 61830.00 | JPY | -7.98 |

| Lean Hogs (CME) | USd/lb. | 0.8078 | USD | -8.15 |

| Cotton #2 (ICE) | USd/lb. | 0.6518 | USD | -8.26 |

| Cocking Coal | CNY/MT | 1100 | CNY | -8.33 |

| Brent Crude (ICE) | USD/bbl. | 64.41 | USD | -10.23 |

| WTI Crude Oil (Nymex) | USD/bbl. | 60.03 | USD | -11.68 |

| Oats (CBOT) | USd/bu. | 2.945 | USD | -20.99 |

| Rough Rice (CBOT) | USD/cwt | 10.31 | USD | -32.44 |

| Sugar #11 (ICE) | USd/lb. | 0.1413 | USD | -32.94 |

| Cocoa (ICE) | USD/MT | 5934.00 | USD | -36.89 |

| Orange Juice (ICE) | USd/lb. | 1.805 | USD | -64.66 |

| Lumber (CME) | USD/1000 board feet | -- | USD |

Key Topics and News

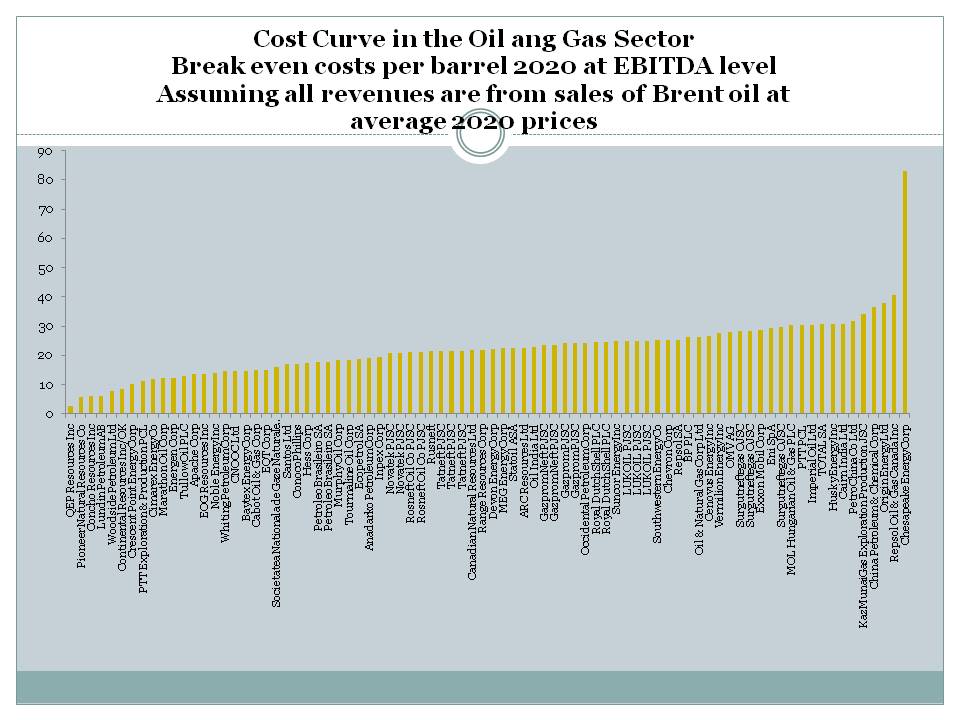

Oil Production Cost Curve

- Marginal cost of U.S. shale to move from $70 to $95 WTI by mid-2030sEnverusEnverus Intelligence® Research has released a report highlighting the impending depletion of North America's core oil and gas inventory and...

- U.S. Shale Costs to Soar to $95 per Barrel Within a DecadeCrude Oil Prices Today | OilPrice.comBreakevens may rise from ~$70 to as much as $95 per barrel by the mid-2030s as core inventory depletes.

- Oil Price Analysis: The Impact of Supply and DemandInvestopediaOil is the crown jewel of commodities. It's used in many ways, from making plastics and asphalt to processing fuel. Price changes in oil...

- Shale project economics still reign supreme as cost of new oil production rises furtherRystad EnergyNew research from Rystad Energy shows that the average breakeven cost of a non-OPEC oil project grew to $47 per barrel of Brent crude, a 5% increase in the...

- Breakeven oil prices underscore shale’s impact on the marketFederal Reserve Bank of DallasThe average breakeven price of oil has fallen 4 percent (or $2 per barrel) over the past year, to $50 per barrel, according to the latest Dallas Fed Energy...

Source:

Oil Supply and Demand

- Oil Market Report - October 2025 – AnalysisIEA – International Energy AgencyOil Market Report - October 2025 - Analysis and key findings. A report by the International Energy Agency.

- Snapshot of global oil supply and demand: August 2025McKinsey & CompanyGlobal oil demand. Global liquids demand remained relatively steady at 104.6 MMb/d in August. The largest decline in demand was associated with...

- Oil Prices Dropped 18%, Helping Drivers, but Squeezing the IndustryThe New York TimesOil prices have fallen sharply this year as the global supply has remained strong and demand has been slow to grow.

- Global oil market looks ‘bloated’ amid lackluster demand from major economiesCNNWorld oil supply will rise more rapidly than expected this year and next as OPEC+ members further increase output and supply from outside...

- Crude realities: Shaky balance in oil’s supply and demand shiftsWorld Bank BlogsGlobal oil supply is expected to increase by 1.2 mb/d in 2025—almost double the rise seen in 2024—reaching a new all-time high of 104.2 mb/d. On...

Aluminium Cost Curve

- CITIC Securities: Indonesia Project May Alter the Global Alumina Cost Curve; Continued Optimism for Investment Opportunities in the Electrolytic Aluminum Industry富途牛牛CITICSecurities released a research report stating that, thanks to its abundant aluminum and coal resources, Indonesia has become a hotspot...

- Aluminium chip drying gets a rethink, and the cost curve bends sharplyalcircleThe shift revolves around a patented chip dryer system known as Thermofuge, which is being deployed inside the casting house of one of the...

- Aluminum prices have shown a fluctuating trend in the near term, with a bullish outlook for long-term prices. However, the risk of overexpansion in other regions remains [ICM conference] | SMMShanghai Metals MarketAt the 2025 Indonesia Mining Conference & Critical Metals Conference - Aluminum Industry Forum, Duncan Hobbs, Director of Industry Research at Concord...

- Century Aluminium's Jamalco investmentAluminium International TodayCentury Aluminium expect to invest up to a total of $30 million in Jamalco next year. Jamalco is a bauxite mining and alumina production...

- Bank of America Downgrades Alcoa Amid Aluminium and Alumina Price ConcernsDiscovery AlertBank of America's recent double downgrade of Alcoa (NYSE:AA) has sent ripples through the aluminum industry, highlighting deeper concerns...

Aluminium Supply and Demand

- The US aluminium industry debates demand destruction following tariffsFastmarketsThe US aluminum industry is experiencing challenges related to tariffs, which have contributed to higher prices and premiums, raising questions about potential...

- Aluminium prices driven higher by global supply squeezeFinancial TimesGlobal aluminium prices are being driven higher by a rare squeeze on supply, rising demand and US President Donald Trump's tariffs,...

- Global aluminium market faces a year of trade turbulenceReutersIt's going to be a busy year for aluminium traders as the global market navigates multiple geopolitical storms.

- Copper, aluminium, zinc hit record-highs as gold and silver's shine fades; what's fuelling the rally?MoneycontrolBase metals including copper, aluminium, and zinc are rallying on supply shortages, strong industrial demand, and a weaker dollar,...

- Metals on fire: What's driving the unstoppable rally in copper, aluminium, and zincThe Economic TimesCopper, aluminium, and zinc prices are rallying globally amid supply constraints, strong demand, geopolitical tensions, and green energy...

Nickel Metal Cost Curve

- Modeling interconnected minerals markets with multicommodity supply curves: examining the copper-cobalt-nickel systemNatureDemand for many of the metals used in the energy transition is expected to grow rapidly. Many of these are by-products, often considered...

- More than 20% of nickel supply loss-making at current prices, Benchmark analysis showsBenchmark SourceMore than one-fifth of the nickel industry is cash negative at current prices, Benchmark's newly released nickel cost model illustrates.

- Nickel Price Collapse Forces Market Repricing as Oversupply & Weak Demand Challenge ProducersCrux InvestorNickel prices hit multi-year lows near US$15000/t as oversupply and weak demand pressure producers, spotlighting secure, low-cost projects like Canada...

- Nickel: A tale of two citiesScienceDirect.comAsides from subsea manganese nodules, there are essentially three main sources of nickel (Ni) supply: newly mined (1) magmatic Ni sulfide ore,...

- Nickel prices outlook remains bearish as UBS warns of persistent surplusInvesting.comThe global nickel market is expected to remain in surplus through 2026 despite recent production cuts, according to a new UBS analysis released this week.

Nickel Metal Supply Demand

- Nickel Price Update: Q2 2025 in ReviewInvesting News NetworkNickel prices saw better stability in Q3, but the market continues to suffer from oversupply.

- [SMM Analysis] The Dual Game of Cost and Supply-Demand: Where Will High-Grade NPI Prices Head in Q4 2025?Shanghai Metals MarketRecently, the domestic NPI market showed a game between supply and demand sides, with prices fluctuating downward. Upstream cost support gradually...

- The Nickel Market is Changing Big Time: Is a Supply-Demand Shift Underway?CarbonCredits.comNickel, a key component in electric vehicle (EV) batteries and stainless steel, is experiencing significant changes in supply dynamics and pricing.

- Nickel oversupply to persist on expansion, slower demand growth, industry experts sayReutersOversupply in the global nickel market is expected to persist over the next few years given production capacity expansion and slower growth...

- Modeling interconnected minerals markets with multicommodity supply curves: examining the copper-cobalt-nickel systemNatureDemand for many of the metals used in the energy transition is expected to grow rapidly. Many of these are by-products, often considered...

Copper Cost Curve

- Modeling interconnected minerals markets with multicommodity supply curves: examining the copper-cobalt-nickel systemNatureDemand for many of the metals used in the energy transition is expected to grow rapidly. Many of these are by-products, often considered...

- From Surplus to Scarcity: How Slower Production Growth Is Driving a Structural Copper Deficit by 2026Crux InvestorThe ICSG projects a 150000-ton copper deficit by 2026 as production growth slows to 0.9%. Declining grades, rising capex,...

- Glencore signs 20-year renewables pact as copper spikesNAI500Glencore secures 20-year renewable power deal in South Africa amid rising copper prices, reshaping mining economics and emphasizing the...

- BHP Insights: how copper will shape our futureBHPWe expect copper to remain an essential building block to modern life as the world seeks to improve living standards for billions of people.

- Unlocking Copper Investment Opportunities: Strategic Moves for 2025Discovery AlertDiscover strategic copper investment opportunities amid electrification, renewables, and supply constraints driving long-term value growth.

Copper Supply Demand

- Copper Hits Record High as Mine Disruptions Add to Supply RisksBloomberg.comCopper hit a record in London, with the prospect of an imminent easing in US-China tensions providing a fresh catalyst to a scorching rally...

- Copper Study Group highlights impact of mine supply hitsReutersCopper has a long history of mine supply disruption, but this year is proving to be a particularly troubled one for a sector that has been...

- McEwen Mining Copper: 2026 Strategies For Global ImpactFarmonautExplore copper mining trends in 2025, from rising demand and advanced technologies to sustainable practices and supply chain strategies...

- Catalyzing copper: Supply shocks and betting billionsKITCOCopper Breaks Out: Copper topped $10000/ metric ton in September amid major supply shocks; miners surged, led by juniors up 72.46% YTD.

- The copper supply-demand balance is under strain as crisis loomsYahoo FinanceRecent disruptions to supply. Accidents and disruptions this year have highlighted the fragility of the copper supply chain. Notable events...

Recent Commodities Ideas ChartArt

Top 5 Commodities Longs Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| XAGJPY Curncy | Silver/Japanese Yen Spot | JPY/t oz. | 21.02 | -0.73 | 62.00 | 62.00 | 60.92 | 35.80 |

| XAUINR Curncy | Gold/Indian Rupee Spot | INR/t oz. | 5.05 | -1.97 | 57.66 | 57.66 | 82.28 | 35.75 |

| XPTUSD Curncy | Platinum Spot | USD/t oz. | 5.72 | -2.10 | 68.49 | 68.49 | 66.22 | 34.58 |

| XAGUSD Curncy | Silver Spot | USD/t oz. | 16.57 | -1.38 | 57.55 | 57.55 | 64.11 | 34.21 |

| JG1 Comdty | Gold (Tokyo) | JPY/g | 6.94 | 1.16 | 56.62 | 56.62 | 70.60 | 33.83 |

Top 5 Commodities Shorts Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| JO1 Comdty | Orange Juice (ICE) | USd/lb. | 11.62 | -12.34 | -64.66 | -64.66 | -55.93 | -30.33 |

| SB1 Comdty | Sugar #11 (ICE) | USd/lb. | -17.76 | -13.10 | -32.94 | -32.94 | -24.64 | -22.11 |

| CC1 Comdty | Cocoa (ICE) | USD/MT | -6.38 | -0.19 | -36.89 | -36.89 | -35.88 | -19.84 |

| RR1 Comdty | Rough Rice (CBOT) | USD/cwt | -5.97 | -5.06 | -32.44 | -32.44 | -33.23 | -19.17 |

| CL1 Comdty | WTI Crude Oil (Nymex) | USD/bbl. | -5.65 | -2.12 | -11.68 | -11.68 | -23.53 | -10.75 |

Estimates of Commodities Avg Annual Prices

| Name | Units | Avg2017 | Avg2018 | Avg2019 | Avg2020 | Avg2021 | Avg2022 | Avg2023 | Avg2024 |

|---|---|---|---|---|---|---|---|---|---|

| WTI Crude Oil (Nymex) | USD/bbl. | 51.20 | 66.47 | 56.15 | 40.18 | 66.87 | 95.03 | 78.28 | 73.18 |

| Brent Crude (ICE) | USD/bbl. | 54.93 | 72.13 | 63.14 | 43.55 | 69.56 | 99.45 | 83.04 | 78.32 |

| Crude Oil (Tokyo) | JPY/kl | 37180.83 | 47237.50 | 40296.67 | 29553.33 | 44018.33 | 70425.00 | 71472.50 | 71550.00 |

| Natural Gas (Nymex) | USD/MMBtu | 3.10 | 2.99 | 2.62 | 2.09 | 3.69 | 6.67 | 2.64 | 2.93 |

| RBOB Gasoline (Nymex) | USd/gal. | 1.66 | 1.97 | 1.70 | 1.21 | 2.05 | 2.93 | 2.49 | 2.14 |

| Heating Oil (Nymex) | USd/gal. | 1.67 | 2.09 | 1.92 | 1.28 | 2.03 | 3.47 | 2.78 | 2.67 |

| Gasoil (Nymex) | USD/MT | 495.81 | 645.10 | 584.38 | 379.44 | 575.48 | 1028.06 | 814.38 | 787.50 |

| Kerosene (Tokyo) | JPY/kl | 49809.17 | 64072.50 | 57185.83 | 43763.33 | 60145.00 | 81399.17 | 77566.67 | 82500.00 |

| ECX Emissions (ICE) | EUR/MT | 6.28 | 15.05 | 24.64 | 24.78 | 51.47 | 80.81 | 83.86 | 63.58 |

| Cocking Coal | CNY/MT | 1268.21 | 1413.17 | 1308.79 | 1264.71 | 1978.75 | 2485.29 | 1698.58 | 1954.00 |

| Gold (Comex) | USD/t oz. | 1261.42 | 1296.03 | 1393.65 | 1789.18 | 1793.08 | 1809.72 | 1959.54 | 2014.00 |

| Gold (Tokyo) | JPY/g | 4528.00 | 4513.17 | 4856.42 | 6090.50 | 6300.08 | 7543.58 | 8749.67 | 9557.00 |

| Gold Spot | USD/t oz. | 1260.77 | 1291.16 | 1390.27 | 1781.96 | 1792.23 | 1802.74 | 1946.00 | 2012.69 |

| Gold/Euro Spot | EUR/t oz. | 1119.38 | 1082.19 | 1241.64 | 1555.33 | 1512.17 | 1713.25 | 1814.65 | 1847.41 |

| Gold/British Pound Spot | GBP/t oz. | 977.94 | 953.38 | 1094.40 | 1384.48 | 1303.82 | 1456.45 | 1582.13 | 1585.39 |

| Gold/Japanese Yen Spot | JPY/t oz. | 141150.35 | 140707.55 | 151395.17 | 189708.44 | 196137.93 | 235376.45 | 272542.25 | 297258.19 |

| Gold/Indian Rupee Spot | INR/t oz. | 82136.46 | 86707.74 | 97986.21 | 132303.55 | 132329.73 | 140790.36 | 161008.04 | 167306.44 |

| Silver (Comex) | USD/t oz. | 17.22 | 16.02 | 16.17 | 20.67 | 25.07 | 21.79 | 23.56 | 22.76 |

| Silver (Tokyo) | JPY/g | 61.41 | 55.99 | 56.49 | 70.08 | 88.20 | 89.96 | 104.98 | 110.10 |

| Silver Spot | USD/t oz. | 17.24 | 16.02 | 16.15 | 20.53 | 25.01 | 21.71 | 23.40 | 22.65 |

| Silver/Euro Spot | EUR/t oz. | 15.33 | 13.42 | 14.42 | 17.84 | 21.08 | 20.60 | 21.81 | 20.79 |

| Silver/British Pound Spot | GBP/t oz. | 13.39 | 11.82 | 12.71 | 15.91 | 18.18 | 17.51 | 19.02 | 17.84 |

| Silver/Japanese Yen Spot | JPY/t oz. | 1930.39 | 1744.57 | 1758.40 | 2183.74 | 2735.59 | 2827.78 | 3275.58 | 3344.06 |

| Platinum Spot | USD/t oz. | 958.52 | 908.21 | 861.19 | 896.21 | 1090.11 | 954.68 | 993.07 | 894.95 |

| Palladium Spot | USD/t oz. | 862.40 | 1026.02 | 1512.27 | 2195.90 | 2423.55 | 2148.35 | 1397.87 | 932.98 |

| Copper (Comex) | USd/lb. | 2.81 | 2.97 | 2.71 | 2.76 | 4.20 | 4.01 | 3.81 | 3.74 |

| 3Mo Copper (LME) | USD/MT | 6196.00 | 6659.25 | 5991.08 | 6143.96 | 9216.29 | 8863.00 | 8437.08 | 8268.00 |

| 3Mo Aluminum (LME) | USD/MT | 1957.67 | 2138.58 | 1817.92 | 1723.33 | 2437.92 | 2737.04 | 2293.88 | 2178.00 |

| 3Mo Zinc (LME) | USD/MT | 2872.25 | 3032.00 | 2483.58 | 2239.13 | 2956.58 | 3476.17 | 2622.67 | 2466.00 |

| 3Mo Tin (LME) | USD/MT | 20154.17 | 20428.33 | 18467.50 | 17087.33 | 30047.00 | 31787.75 | 25346.33 | 25233.00 |

| Nickel | USD/MT | 10585.83 | 13551.67 | 13755.83 | 13669.25 | 18449.67 | 26612.08 | 22084.58 | 16660.00 |

| Steel | USD/MT | 493.71 | 548.13 | 451.42 | 446.42 | 679.28 | 734.83 | 638.00 | 592.00 |

| Corn (CBOT) | USd/bu. | 3.74 | 3.66 | 3.85 | 3.58 | 5.71 | 6.79 | 5.77 | 4.44 |

| Wheat (CBOT) | USd/bu. | 4.63 | 4.91 | 4.95 | 5.36 | 7.08 | 8.94 | 6.45 | 5.83 |

| Oats (CBOT) | USd/bu. | 2.41 | 2.51 | 2.83 | 2.82 | 4.73 | 5.41 | 3.67 | 3.60 |

| Rough Rice (CBOT) | USD/cwt | 10.95 | 11.50 | 11.50 | 12.80 | 13.45 | 16.57 | 16.37 | 17.64 |

| Soybean (CBOT) | USd/bu. | 9.77 | 9.42 | 8.95 | 9.31 | 13.70 | 15.03 | 13.97 | 12.11 |

| Soybean Meal (CBOT) | USD/T. | 312.35 | 340.27 | 306.84 | 313.10 | 387.33 | 426.30 | 431.56 | 359.50 |

| Soybean Oil (CBOT) | USd/lb. | 0.34 | 0.30 | 0.29 | 0.31 | 0.56 | 0.68 | 0.55 | 0.48 |

| Canola (ICE) | CAD/MT | 509.64 | 503.82 | 461.20 | 492.67 | 787.28 | 956.78 | 725.55 | 626.80 |

| Cocoa (ICE) | USD/MT | 2018.42 | 2266.75 | 2386.25 | 2486.17 | 2496.25 | 2472.67 | 3179.33 | 4448.00 |

| Coffee 'C' (ICE) | USd/lb. | 1.34 | 1.14 | 1.02 | 1.13 | 1.67 | 2.16 | 1.71 | 1.80 |

| Sugar #11 (ICE) | USd/lb. | 0.16 | 0.12 | 0.12 | 0.13 | 0.18 | 0.18 | 0.24 | 0.22 |

| Orange Juice (ICE) | USd/lb. | 1.55 | 1.51 | 1.08 | 1.16 | 1.22 | 1.71 | 2.95 | 2.91 |

| Cotton #2 (ICE) | USd/lb. | 0.75 | 0.82 | 0.67 | 0.63 | 0.92 | 1.09 | 0.83 | 0.82 |

| Lumber (CME) | USD/1000 board feet | 379.39 | 464.43 | 362.89 | 496.94 | 837.69 | 725.05 | 163.36 | 0.00 |

| Rubber (Tokyo) | USD/kg | 241.90 | 177.54 | 181.20 | 167.08 | 167.90 | 167.90 | 167.90 | 167.90 |

| Ethanol (CBOT) | USD/gal. | 1.52 | 1.40 | 1.37 | 1.21 | 2.10 | 2.16 | 2.16 | 2.16 |

| Live Cattle (CME) | USd/lb. | 1.18 | 1.14 | 1.15 | 1.07 | 1.24 | 1.42 | 1.72 | 1.76 |

| Feeder Cattle (CME) | USd/lb. | 1.43 | 1.48 | 1.42 | 1.37 | 1.51 | 1.74 | 2.25 | 2.30 |

| Lean Hogs (CME) | USd/lb. | 0.70 | 0.69 | 0.72 | 0.58 | 0.91 | 0.97 | 0.80 | 0.78 |

Commodities News, Table of Contents:

Oil 64.41 (USD/bbl.)

Natural Gas 3.85 (USD/MMBtu)

Cocking Coal 1,100.00 (CNY/MT)

Gold 3,978.25 (USD/t oz.)

Silver 47.66 (USD/t oz.)

Platinum 1,589.92 (USD/t oz.)

Palladium 1,415.67 (USD/t oz.)

Copper 5.14 (USd/lb.)

3Mo Aluminum 2,887.00 (USD/MT)

3Mo Zinc 3,082.50 (USD/MT)

3Mo Tin 36,184.00 (USD/MT)

Nickel 15,366.00 (USD/MT)

Steel 542.00 (USD/MT)

Corn 4.35 (USd/bu.)

Wheat 5.27 (USd/bu.)

Oats 2.95 (USd/bu.)

Rough Rice 10.31 (USD/cwt)

Soybean 10.24 (USd/bu.)

Canola 641.70 (CAD/MT)

Cocoa 5,934.00 (USD/MT)

Coffee 3.85 (USd/lb.)

Sugar 0.14 (USd/lb.)

Orange Juice 1.81 (USd/lb.)

Cotton 0.65 (USd/lb.)

Lumber 0.00 (USD/1000 board feet)

Ethanol 2.16 (USD/gal.)

Live Cattle 2.31 (USd/lb.)

Feeder Cattle 3.34 (USd/lb.)

Lean Hogs 0.81 (USd/lb.)

Best Commodities 1yr

| Ticker | name | units | ytd | week | 1month | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| XAUINR Curncy | Gold/Indian Rupee Spot | INR/t oz. | 57.66 | 5.05 | -1.97 | 57.66 | 82.28 | 35.75 |

| KC1 Comdty | Coffee 'C' (ICE) | USd/lb. | 30.18 | 17.48 | 2.16 | 30.18 | 74.03 | 30.96 |

| XAUUSD Curncy | Gold Spot | USD/t oz. | 50.76 | 2.59 | 0.55 | 50.76 | 72.02 | 31.48 |

| GC1 Comdty | Gold (Comex) | USD/t oz. | 49.68 | 2.57 | 0.20 | 49.68 | 70.80 | 30.81 |

| JG1 Comdty | Gold (Tokyo) | JPY/g | 56.62 | 6.94 | 1.16 | 56.62 | 70.60 | 33.83 |

Worst Commodities 1yr

| Ticker | name | units | ytd | week | 1month | 6months | 1yr | Rank |

|---|---|---|---|---|---|---|---|---|

| JO1 Comdty | Orange Juice (ICE) | USd/lb. | -64.66 | 11.62 | -12.34 | -64.66 | -55.93 | -30.33 |

| CC1 Comdty | Cocoa (ICE) | USD/MT | -36.89 | -6.38 | -0.19 | -36.89 | -35.88 | -19.84 |

| RR1 Comdty | Rough Rice (CBOT) | USD/cwt | -32.44 | -5.97 | -5.06 | -32.44 | -33.23 | -19.17 |

| CKCK7 COMB Comdty | Cocking Coal | CNY/MT | -8.33 | 0.82 | 4.96 | -8.33 | -31.59 | -8.54 |

| SB1 Comdty | Sugar #11 (ICE) | USd/lb. | -32.94 | -17.76 | -13.10 | -32.94 | -24.64 | -22.11 |