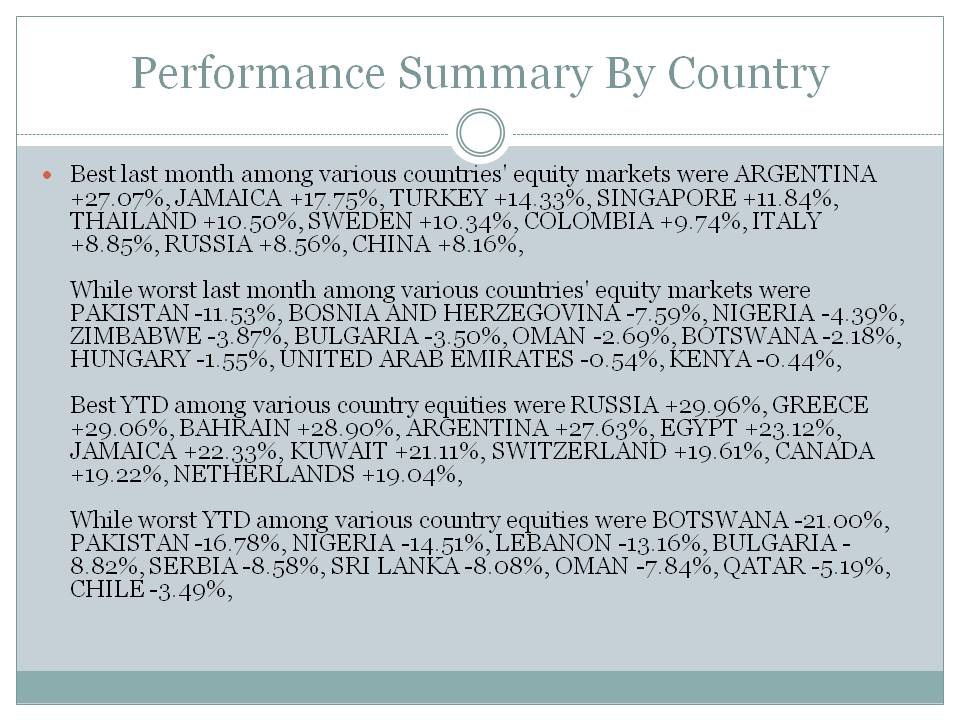

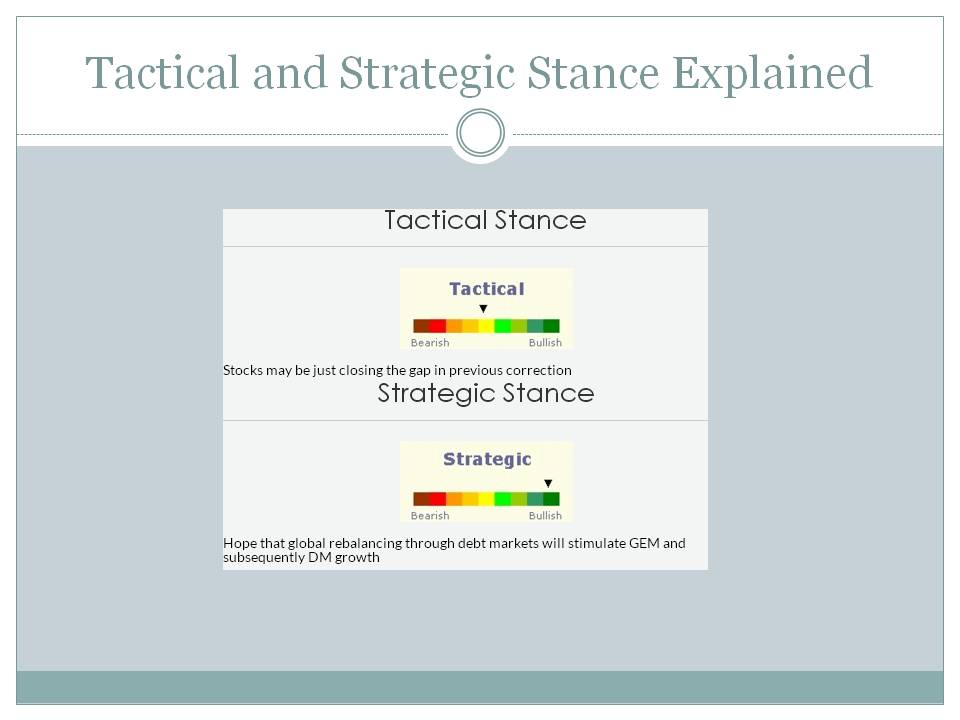

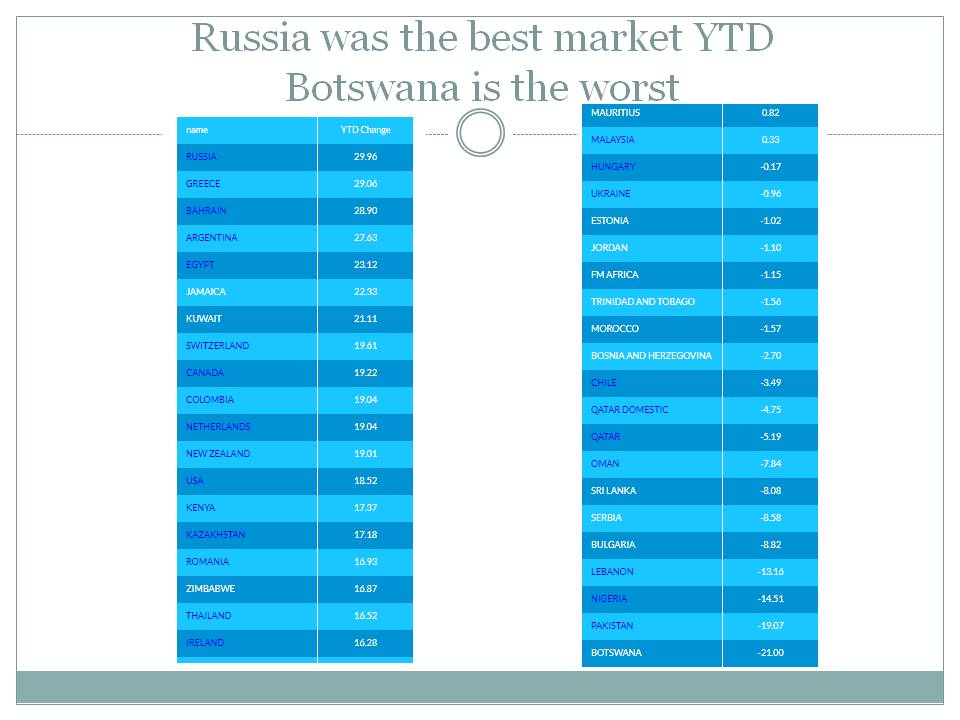

Tactical Stance

Still under pressure from various vectors trading wars, currency wars, brexit money and etc.

Strategic Stance

Weaker dollar is the moto for long term gains

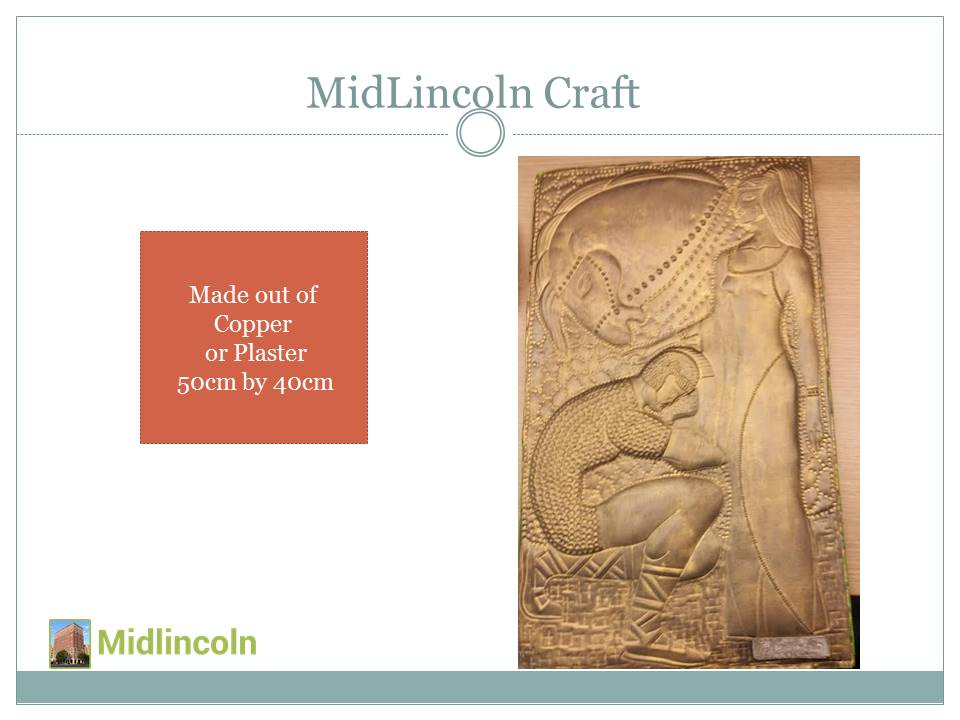

Tockenising Midlincoln Crafts

This section contains links to materials about Midlincoln Rural Crafts Initiatives

Midlincoln is testing rural co-working model as its core business. Half of the co-working space is dedicated to investment analytics service and half of the space is industrial, creative environment with machines and tools which can be used in product development and small scale production.

Investing into Midlincoln Craft fund tokens is a comprehensive investment into all of the portfolio companies and funds. But each of the mentioned companies and funds are also accessible for investment directly also via tokens. Each of the portfolio company or a fund can be considered as a standalone franchise and Stoken could provide security token investment for qualified investors in any of them.

Download All Slides in Power Point

Download All Slides in Power Point