Lack of ownership.

Post-modernistic corporations.

State owned is really the same as large free float.

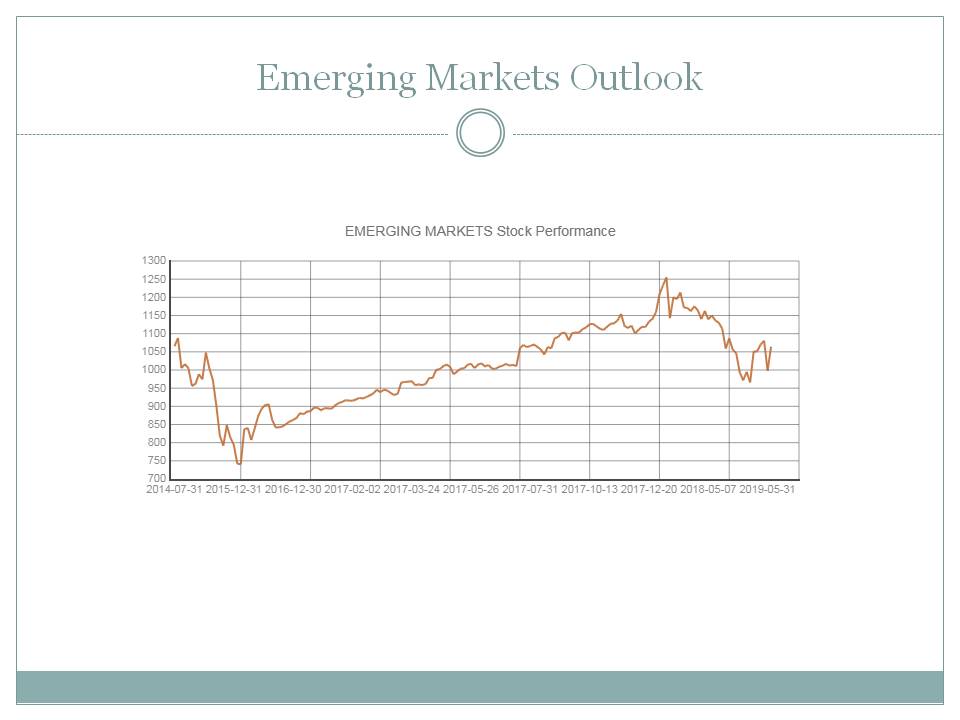

Which emerging and developed markets counties are set to benefit the most in the current environment

Low rates environment good for asset prices or not

Recent Strategy Chart Art

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

ARGENTINA: EMERGING MARKETS-Most Latam stocks, FX fall amid growth and ...

| AUSTRALIA: Australia shares gain as rate cut hopes solidify; New Zealand up

| AUSTRIA: Austria's 'century bond' rally highlights demand for long-term debt

| BAHRAIN: Saudi Stocks Drop as Tensions Surge After Aramco Drone Attacks

| BELGIUM: Fluxys Belgium SA (ENXTBR:FLUX) Seeing 0.05698 in Sales ...

|

BRAZIL: EMERGING MARKETS-Most Latam stocks, FX fall amid growth and ...

| BRITAIN: US stocks flat with global equities on cautious footing

| CANADA: There's a bull case for Canadian stocks even after record highs

| CHILE: EMERGING MARKETS-Most Latam stocks, FX fall amid growth and ...

| CHINA: Second Round of China A Shares Inclusion Completes

|

COLOMBIA: EMERGING MARKETS-Most Latam stocks, FX fall amid growth and ...

| CZECH: Czech Republic - Factors To Watch on Sept 18

| DENMARK: European stocks close slightly higher as US-China trade talks ...

| EGYPT: Egypt Assets Extend Declines After Anti-Government Protests

| FINLAND: Stocks have 'sufficient tailwind' to climb higher, so keep buying ...

|

FRANCE: US stocks flat with global equities on cautious footing

| GERMANY: US stocks flat with global equities on cautious footing

| GREECE: A Greek ETF Rises, After Earlier Turmoil

| HONG KONG: Hong Kong investors switch to bonds from equities - Refinitiv Lipper ...

| HUNGARY: US stocks end higher as China comments spur trade war optimism

|

INDIA: India scraps tax increase to lift equities

| INDONESIA: FOCUS: Tax cut lays floor, but secular bull run distant for equities

| IRELAND: Investec making cuts to Irish equity team as Brexit looms

| ISRAEL: Pounding the Pavement on Shares of Israel Chemicals Ltd. (TASE ...

| ITALY: CFA Society Italy joins Thematic Forum Milan 2019

|

JAPAN: Japan Stocks Hit Maximum Pessimism With Abenomics Buying ...

| KAZAKHSTAN: There's a New Way to Buy Booming Russian Stocks – ETFs

| LEBANON: Reinvention of Lebanese equities and the coming capital market

| MALAYSIA: Malaysia equity outflow lowest in Asean on back of global uncertainty

| MEXICO: EMERGING MARKETS-Most Latam stocks, FX fall amid growth and ...

|

NETHERLANDS: Dutch Hewlett Packard scheme dumps hedge funds, scales back ...

| NEW ZEALAND: Foreign ownership of NZ stocks drops in June quarter - brokers

| NIGERIA: Nigeria equities market rebound by N133bn

| NORWAY: Norway's Fund Wants to Add Up to $100 Billion in US Stocks

| OMAN: Vodafone share price: Telco in partnership with Oman

|

PAKISTAN: Will bulls charge to Pakistan equities again?

| PERU: EMERGING MARKETS-Most Latam stocks, FX fall amid growth and ...

| PHILIPPINES: Philippines Equity Brokerage Revenue is Expected to Reach Over ...

| POLAND: Poland - Factors to Watch Sept 9

| PORTUGAL: Market bounce boosts second-quarter gains for Portuguese funds

|

QATAR: Qatar shares extend losses as foreign funds book profit

| QATAR: Qatar shares extend losses as foreign funds book profit

| ROMANIA: Romania - Factors to watch on Sept 19

| RUSSIA: Russia stocks likely to falter this year, rebound in 2020: Reuters poll

| SINGAPORE: Singapore shares open lower on Monday; STI down 0.04% to 3158.45

|

SOUTH AFRICA: Bonds, equities lose their lustre

| SOUTH KOREA: RPT-Scarred by trade war, South Korea's stocks whipped by oil shock

| SPAIN: Spanish funds continue climb with second-quarter return

| SWEDEN: Sweden's AP2 logs 10.7% return in 2019's first half

| SWITZERLAND: Time to stick with expensive assets, says Schroders

|

TAIWAN: Rush of Foreign Money Into Taiwan Sends Stocks Near Record

| THAILAND: Chinese exodus to Thai sites begins

| TURKEY: EMERGING MARKETS-Trade tensions roil FX, stocks; Turkish lira hit ...

| UAE: UAE, GCC equities see major sell-off as regional bourses follow ...

| UKRAINE: Egypt Stocks Decline Most Since 2016 After Protests

|

UNITED STATES: INSIGHT: The Often Unknown Tax Liability Facing Foreign Investors ...

| VIETNAM: Trade War Has Vietnamese Companies Raising Capital With Bonds ...

|

Comment

Monthly performance is between 2019-08-30 and 2019-07-31

Best global markets YTD USA +16.95%, FM (FRONTIER MARKETS) +9.09%, EUROPE +7.82%,

While worst global markets YTD EM LATIN AMERICA 1.36%, EM (EMERGING MARKETS) 1.89%, EFM ASIA 2.16%,

Best global markets last month FM (FRONTIER MARKETS)-1.65%, USA-1.96%, EUROPE-2.82%,

While worst global markets last month EM LATIN AMERICA -8.54%, EM (EMERGING MARKETS) -5.08%, EFM ASIA -3.94%,

US stocks flat with global equities on cautious footingStocks End Flat as Treasuries, Dollar Advance: Markets WrapYield Mania Is Back as Bond Sales Revive in Emerging MarketsEMERGING MARKETS-Trade anxiety, growth worries keep stocks in ...Chinese stocks decline after US trade talks show signs of falteringFresh US-China trade worries push stocks downEuropean Equities: Private Sector PMIs and Geopolitics in FocusEuropean Equities: Economic Data and Geopolitics in FocusUS Shale Kept Oil Prices From Surging After Attacks On Saudi OilChina's Stockpiling Slowdown Could Cripple Oil DemandSteel Stocks Are Thrashed by Wall Street Because Prices Aren't ...PRICING NOTICE: Discontinuation of weekly southern China steel ...Gold prices today up ₹500 from one-month lows, silver rates surgeGold Price Preview: September 23 - 27

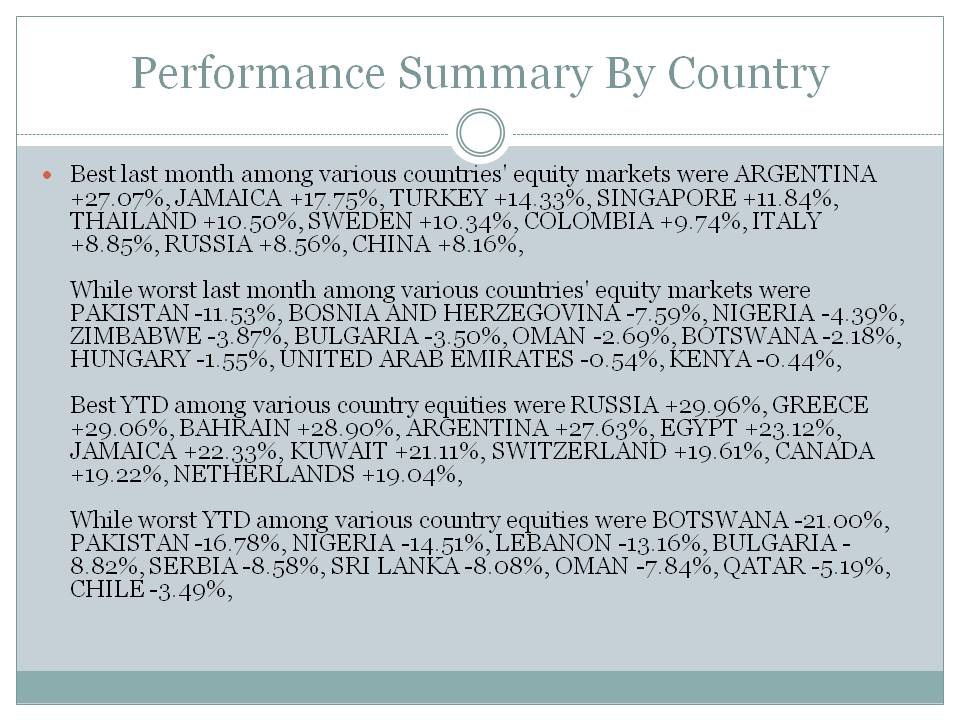

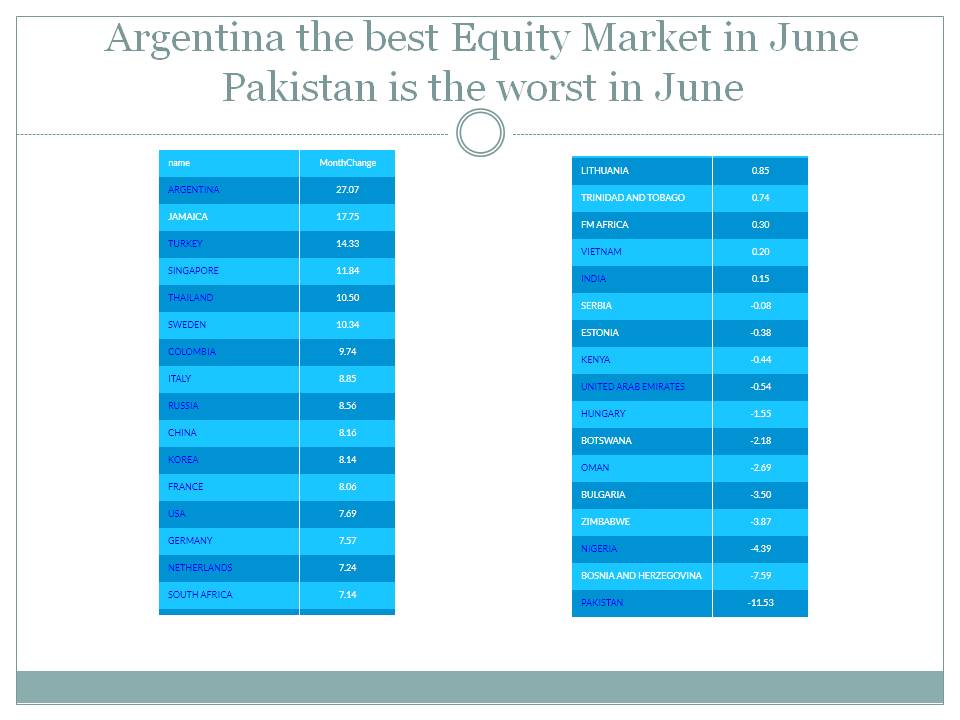

Best last month among various countries' equity markets were EGYPT +9.90%, OMAN +8.65%, MAURITIUS +4.75%, TUNISIA +4.34%, BOSNIA AND HERZEGOVINA +2.52%, DENMARK +2.14%, KENYA +1.30%, MOROCCO +0.48%, JAMAICA +0.45%, SWITZERLAND +0.27%,

While worst last month among various countries' equity markets were ARGENTINA -50.53%, BOTSWANA -36.82%, ZIMBABWE -18.63%, TRINIDAD AND TOBAGO -11.35%, TURKEY -10.73%, BRAZIL -9.73%, POLAND -9.51%, SAUDI ARABIA DOMESTIC -9.08%, SOUTH AFRICA -9.01%, HONG KONG -8.64%,

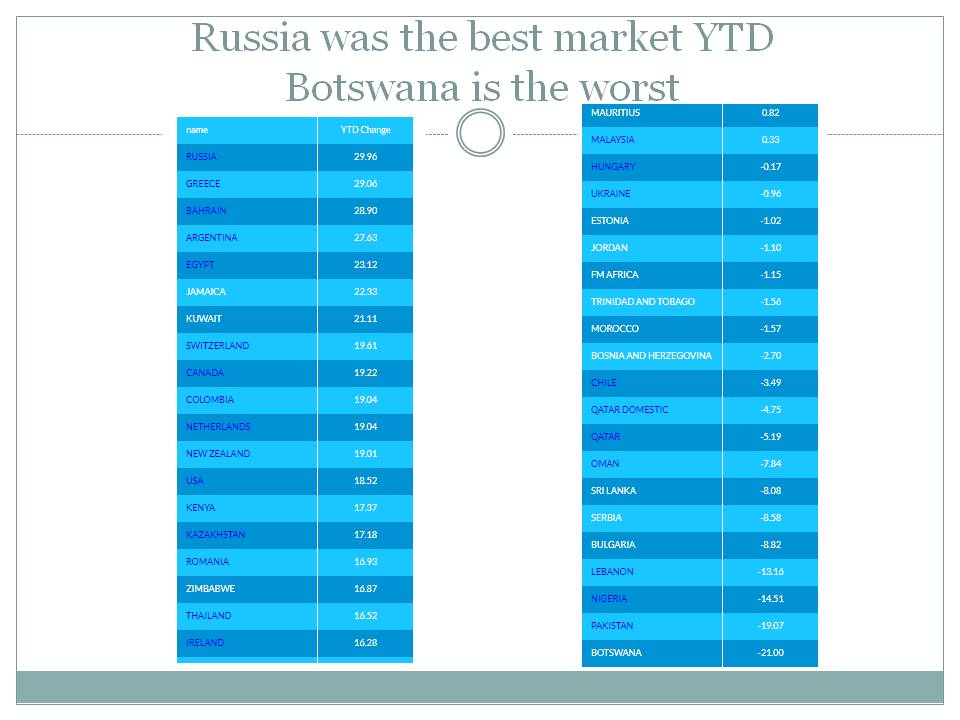

Best YTD among various country equities were BAHRAIN +37.28%, EGYPT +32.62%, JAMAICA +28.57%, KUWAIT +23.41%, GREECE +21.88%, KAZAKHSTAN +20.47%, ROMANIA +19.79%, SWITZERLAND +19.55%, RUSSIA +19.49%, NETHERLANDS +17.24%,

While worst YTD among various country equities were BOTSWANA -55.27%, ARGENTINA -37.90%, NIGERIA -25.91%, PAKISTAN -23.30%, LEBANON -21.14%, CHILE -14.21%, TRINIDAD AND TOBAGO -13.62%, BULGARIA -13.34%, POLAND -12.52%, SERBIA -11.47%,

Download All Slides in Power Point

Download All Slides in Power Point