Recent Quants ChartArt

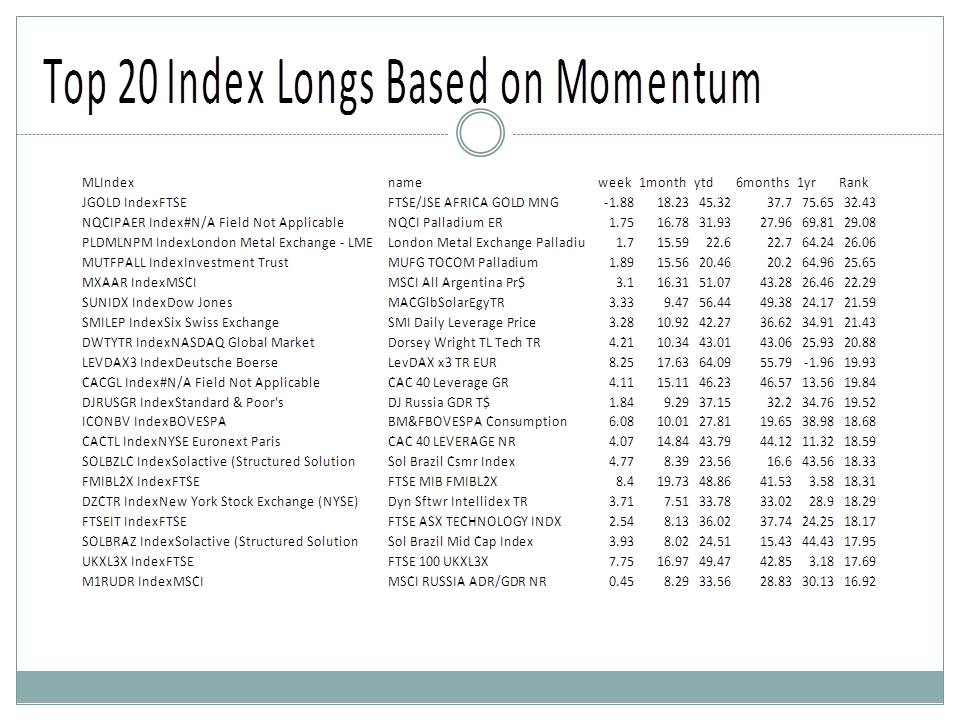

Top 20 Index Longs Based on Momentum

| MLIndex | name | week | 1month | ytd | 6months | 1yr | Rank |

| JGOLD IndexFTSE | FTSE/JSE AFRICA GOLD MNG | 3.35 | 13.97 | 61.49 | 44.17 | 90.64 | 38.03 |

| SUNIDX IndexDow Jones | MACGlbSolarEgyTR | 4.43 | 2.97 | 62.04 | 28.94 | 33.58 | 17.48 |

| TFTMIGMI IndexFTSE | FTSE Gold Mines Index TR | 0.39 | 7.39 | 33.48 | 25.58 | 35.85 | 17.30 |

| FTMIGMI IndexFTSE | FTSE Gold Mines Index | 0.39 | 7.39 | 32.77 | 24.92 | 34.28 | 16.75 |

| GDMNTR IndexNew York Stock Exchange (NYSE) | NYSE Arca Gold MinersNTR | 0.14 | 8.87 | 31.79 | 24.54 | 32.58 | 16.53 |

| SOLBZLC IndexSolactive (Structured Solution | Sol Brazil Csmr Index | 1.68 | 6.48 | 34.86 | 18.92 | 38.77 | 16.46 |

| JCGMGGI IndexMarkit | Global Mining Glob Gol | 0.08 | 7.32 | 32.44 | 23.97 | 33.61 | 16.24 |

| TTGDAR IndexStandard & Poor's | S&P/TSX Glob Gold TR Idx | -0.34 | 7.35 | 31.86 | 25.17 | 31.16 | 15.84 |

| NTCCS4LV IndexNikkei | Nikkei-TOCOM LV Gold | 2.69 | 4.48 | 23.37 | 17.97 | 37.06 | 15.55 |

| HUINTR IndexNew York Stock Exchange (NYSE) | NYSE Arca Gold BUGS TR | -0.39 | 8.10 | 30.28 | 24.59 | 27.46 | 14.94 |

| DWTYTR IndexNASDAQ Global Market | Dorsey Wright TL Tech TR | 0.36 | 2.59 | 47.49 | 28.12 | 26.40 | 14.37 |

| ICONBV IndexBOVESPA | BM&FBOVESPA Consumption | 0.66 | 5.45 | 36.69 | 18.87 | 32.34 | 14.33 |

| SOLBRAZ IndexSolactive (Structured Solution | Sol Brazil Mid Cap Index | 0.10 | 3.94 | 31.05 | 13.50 | 35.66 | 13.30 |

| XTLNCT IndexBloomberg | CMCI Nickel Hdg CHF TR | 5.68 | 21.38 | 37.79 | 16.83 | 8.40 | 13.07 |

| XAU IndexNASDAQ OMX PSX | PHILA GOLD & SILVER INDX | -1.10 | 9.19 | 28.54 | 20.52 | 19.36 | 11.99 |

| BCOMNI IndexBloomberg | BBG Nickel | 3.93 | 19.78 | 38.15 | 14.55 | 7.92 | 11.55 |

| NQCIPAER Index#N/A Field Not Applicable | NQCI Palladium ER | -9.43 | -10.03 | 18.57 | 4.99 | 57.68 | 10.80 |

| MUTFPALL IndexInvestment Trust | MUFG TOCOM Palladium | -6.83 | -8.17 | 9.88 | 3.47 | 54.31 | 10.70 |

| MSLUBRZ IndexMSCI | Brazil | -0.60 | 1.81 | 25.75 | 11.46 | 29.40 | 10.52 |

| DZCTR IndexNew York Stock Exchange (NYSE) | Dyn Sftwr Intellidex TR | -2.81 | 0.48 | 34.87 | 18.93 | 25.49 | 10.52 |

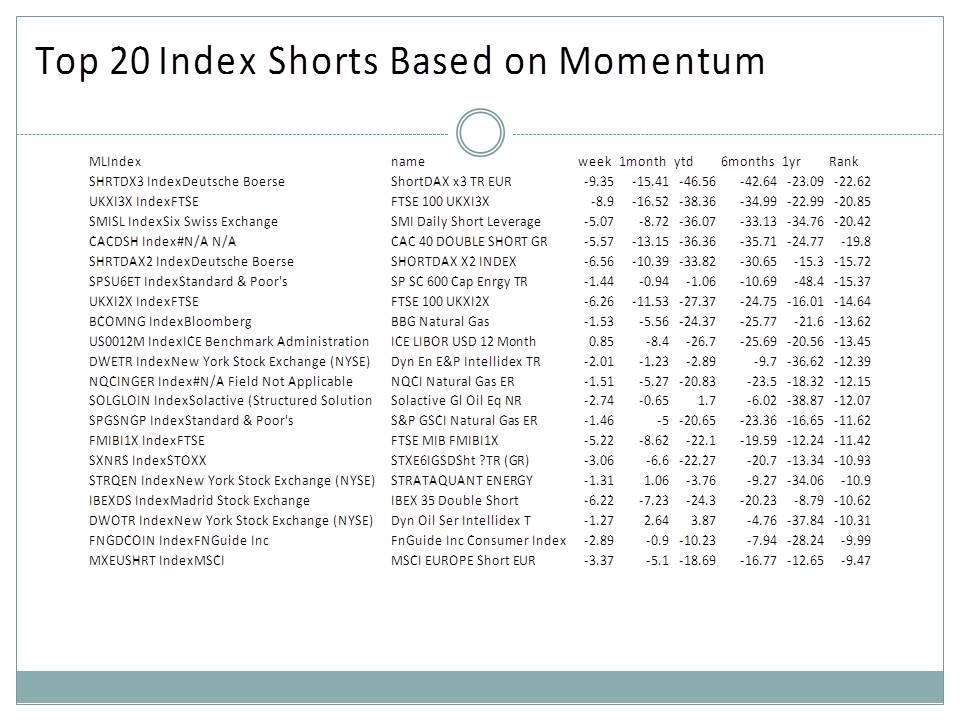

Top 20 Index Shorts Based on Momentum

| MLIndex | name | week | 1month | ytd | 6months | 1yr | Rank |

| SPSU6ET IndexStandard & Poor's | SP SC 600 Cap Enrgy TR | -0.34 | -11.99 | -12.32 | -25.99 | -54.38 | -23.18 |

| KRXSHIP IndexKOSPI Stock Market | KRX Machinery & Equip | -9.16 | -19.11 | -27.59 | -31.59 | -29.36 | -22.31 |

| XTCTET Index#N/A N/A | CMCI Cotton Hdg EUR TR | -9.46 | -13.62 | -23.46 | -24.36 | -38.00 | -21.36 |

| KOSPI2LG IndexKOSPI Stock Market | KOSPI200 Leverage IDX | -10.22 | -15.42 | -13.54 | -26.78 | -32.75 | -21.29 |

| DWOTR IndexNew York Stock Exchange (NYSE) | Dyn Oil Ser Intellidex T | -3.09 | -11.66 | -6.96 | -25.16 | -44.73 | -21.16 |

| KRXCST IndexKOSPI Stock Market | KRX CONSTRUCTIONS INDX | -7.44 | -19.58 | -25.47 | -29.39 | -27.07 | -20.87 |

| SOLGLOIN IndexSolactive (Structured Solution | Solactive Gl Oil Eq NR | -2.88 | -12.78 | -10.55 | -19.99 | -45.03 | -20.17 |

| FNGDCOIN IndexFNGuide Inc | FnGuide Inc Consumer Index | -5.70 | -14.11 | -21.84 | -22.43 | -33.57 | -18.95 |

| XTCTCT Index#N/A N/A | CMCI Cotton Hdg CHF TR | -7.95 | -11.54 | -20.86 | -20.82 | -34.49 | -18.70 |

| NTCS11LV IndexNikkei | Nikkei-TOCOM LV Cr Oil | -10.12 | -11.21 | 16.99 | -12.91 | -38.75 | -18.25 |

| STRQEN IndexNew York Stock Exchange (NYSE) | STRATAQUANT ENERGY | -2.19 | -8.68 | -11.43 | -21.77 | -38.96 | -17.90 |

| KSP2EC IndexKOSPI Stock Market | KOSPI200 Eng&Chem | -6.86 | -13.37 | -19.49 | -23.00 | -26.74 | -17.49 |

| DWETR IndexNew York Stock Exchange (NYSE) | Dyn En E&P Intellidex TR | -1.75 | -7.63 | -9.52 | -17.80 | -40.01 | -16.80 |

| BCOMNG IndexBloomberg | BBG Natural Gas | -1.13 | -12.48 | -30.09 | -25.16 | -27.74 | -16.63 |

| KRXENCM IndexKOSPI Stock Market | KRX ENERGY & CHEM INDX | -6.06 | -12.51 | -16.63 | -21.20 | -26.76 | -16.63 |

| FNGDSBLC IndexFNGuide Inc | FnGuide Inc MKF Star Bluechip | -3.99 | -13.40 | -19.01 | -18.88 | -29.73 | -16.50 |

| FNGDAIRN IndexFNGuide Inc | FnGuide Inc Steel and Metal+ I | -4.98 | -11.94 | -15.93 | -22.36 | -24.86 | -16.04 |

| DWENTR IndexNASDAQ Global Market | Dorsey Wright TL En TR | -3.72 | -8.57 | -4.51 | -15.72 | -35.24 | -15.81 |

| KRXMETEL IndexKOSPI Stock Market | KRX MEDIA & TELECOM INDX | -2.42 | -10.76 | -24.74 | -22.28 | -27.31 | -15.69 |

| KRX1EWI IndexKOSPI Stock Market | KRX100 EWI | -6.73 | -12.59 | -17.44 | -20.31 | -22.07 | -15.42 |

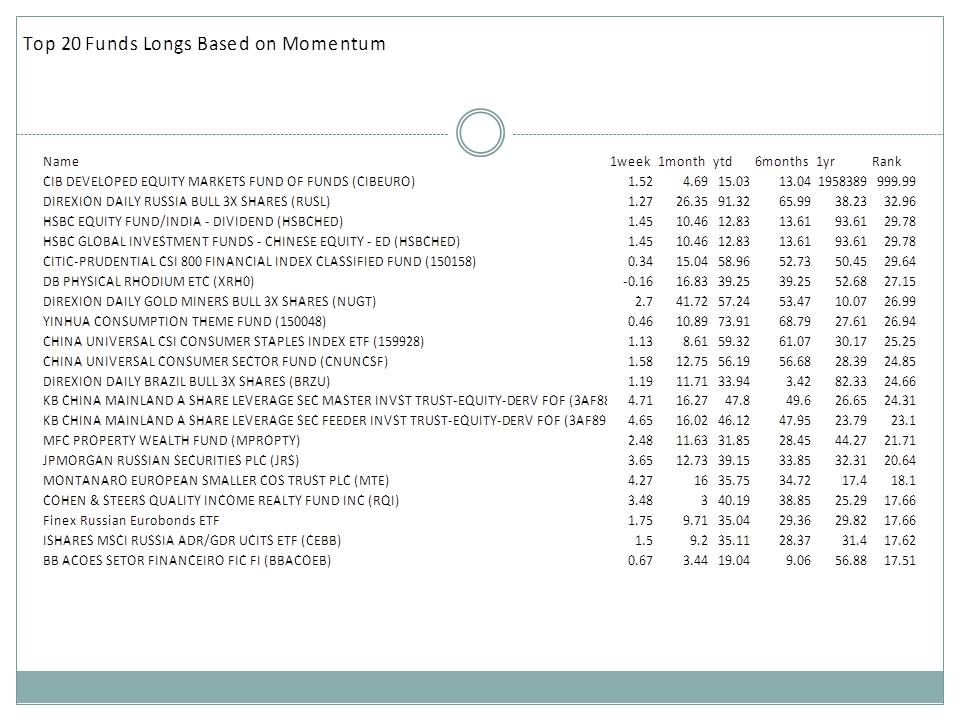

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -1.50 | 25.89 | 92.32 | 67.95 | 63.87 | 39.05 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 1.44 | 8.12 | 51.83 | 47.73 | 61.40 | 29.67 |

| ALPHA TRUST - ANDROMEDA INVESTMENT TRUST SA (ANDRO) | 6.95 | 6.20 | 17.16 | 24.68 | 41.14 | 19.74 |

| MARKET VECTORS JUNIOR GOLD MINERS ETF (VE42) | 3.38 | 17.39 | 37.93 | 22.82 | 26.57 | 17.54 |

| ASA GOLD AND PRECIOUS METALS LTD (XXASAXX) | 0.67 | 10.01 | 32.80 | 25.45 | 31.65 | 16.95 |

| GABELLI UTILITY TRUST (GUT) | 1.37 | 5.38 | 31.49 | 20.51 | 38.85 | 16.53 |

| YINHUA CONSUMPTION THEME FUND (150048) | -5.25 | -7.46 | 61.77 | 54.16 | 22.72 | 16.04 |

| FONDUL PROPRIETATEA SA/FUND (FP) | 0.04 | -1.73 | 27.36 | 40.24 | 24.98 | 15.88 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | -2.94 | -3.75 | 50.41 | 36.07 | 33.11 | 15.62 |

| MFC PROPERTY WEALTH FUND (MPROPTY) | 0.89 | -1.45 | 29.63 | 20.17 | 37.23 | 14.21 |

| FIDELITY SELECT GOLD PORTFOLIO (FSAGX) | -0.30 | 7.00 | 27.73 | 22.31 | 26.60 | 13.90 |

| OPPENHEIMER GOLD & SPECIAL MINERALS FUND - C (OGMCX) | -1.64 | 6.51 | 32.98 | 21.86 | 27.88 | 13.65 |

| TOCQUEVILLE GOLD FUND/THE (TGLDX) | 0.99 | 9.78 | 29.19 | 22.50 | 21.12 | 13.60 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -5.36 | -6.35 | 52.19 | 35.71 | 29.92 | 13.48 |

| SECURITY - FONDO DE INVERSION IFUND MSCI BRAZIL SMALL CAP INDEX (IFBRASC) | 0.85 | 3.46 | 29.39 | 14.95 | 34.01 | 13.32 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - $C2 (MLWORGC) | 0.24 | 8.34 | 28.32 | 19.11 | 24.06 | 12.94 |

| PINEBRIDGE WORLD GOLD FUND - GROWTH (AIGWGLG) | 0.42 | 10.38 | 30.06 | 22.66 | 17.03 | 12.62 |

| COHEN & STEERS QUALITY INCOME REALTY FUND INC (RQI) | 0.57 | 2.60 | 43.31 | 21.43 | 25.46 | 12.52 |

| DSP BLACKROCK WORLD GOLD FUND - GROWTH (DSPWGOG) | -0.33 | 7.55 | 27.56 | 18.66 | 23.34 | 12.31 |

| DYNAMIC STRATEGIC GOLD CLASS - A (DYNSTGOA) | -0.10 | 6.46 | 23.24 | 15.64 | 26.48 | 12.12 |

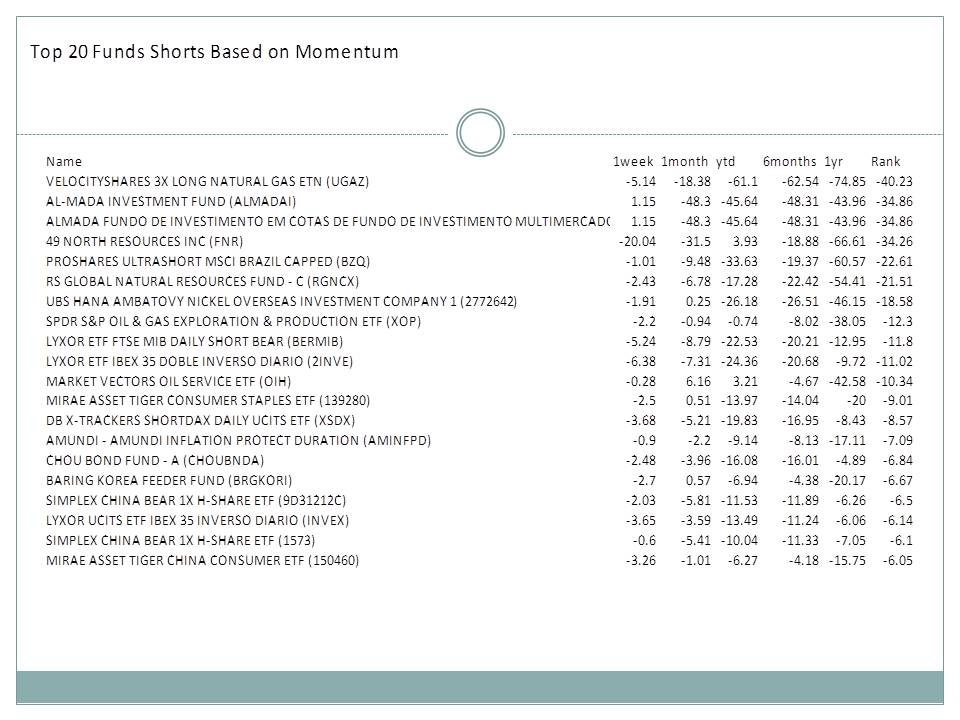

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 1.85 | -30.66 | -68.64 | -59.47 | -79.30 | -41.89 |

| RS GLOBAL NATURAL RESOURCES FUND - C (RGNCX) | -1.77 | -19.44 | -33.36 | -39.26 | -61.52 | -30.50 |

| AL-MADA INVESTMENT FUND (ALMADAI) | -0.89 | 0.30 | -45.08 | -48.75 | -46.74 | -24.02 |

| ALMADA FUNDO DE INVESTIMENTO EM COTAS DE FUNDO DE INVESTIMENTO MULTIMERCADO CP (ALMADAI) | -0.89 | 0.30 | -45.08 | -48.75 | -46.74 | -24.02 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -5.46 | -11.22 | -7.48 | -25.62 | -48.00 | -22.58 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -2.36 | -12.49 | -12.03 | -22.47 | -44.21 | -20.38 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -14.07 | -19.41 | 4.49 | -22.42 | -25.29 | -20.30 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | -8.17 | -15.20 | -26.65 | -25.16 | -30.07 | -19.65 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | -8.13 | -17.52 | -22.35 | -22.20 | -26.08 | -18.48 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | -14.55 | -18.27 | 31.92 | 2.17 | -40.49 | -17.79 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -8.63 | -9.09 | 17.18 | -10.65 | -36.97 | -16.34 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -0.99 | 4.08 | -23.10 | -25.44 | -41.96 | -16.08 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -6.97 | -9.42 | 29.47 | -4.23 | -43.65 | -16.07 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | -13.55 | -15.07 | -0.77 | -10.73 | -21.03 | -15.10 |

| ISHARES GLOBAL TIMBER & FORESTRY ETF (WOOD) | -5.57 | -9.28 | -1.33 | -15.28 | -24.46 | -13.65 |

| LYXOR ETF MSCI KOREA (KOR) | -7.48 | -9.56 | -9.64 | -18.36 | -19.06 | -13.61 |

| DB X-TRACKERS MSCI KOREA TRN INDEX UCITS ETF (DBX8) | -7.39 | -9.20 | -8.35 | -18.32 | -19.39 | -13.58 |

| VALUE KOREA ETF (3041) | -4.93 | -10.41 | -11.17 | -17.88 | -20.84 | -13.52 |

| MIRAE ROGERS AGRICULTURAL PRODUCT INDEX SPECIAL ASSET INVEST CMDTY-DERIVATIVE (5620974) | -5.93 | -8.72 | -15.05 | -16.71 | -20.80 | -13.04 |

| BLACKROCK GLOBAL FUNDS - WORLD ENERGY FUND (H2Z6) | -3.79 | -8.26 | -2.30 | -11.72 | -28.22 | -13.00 |

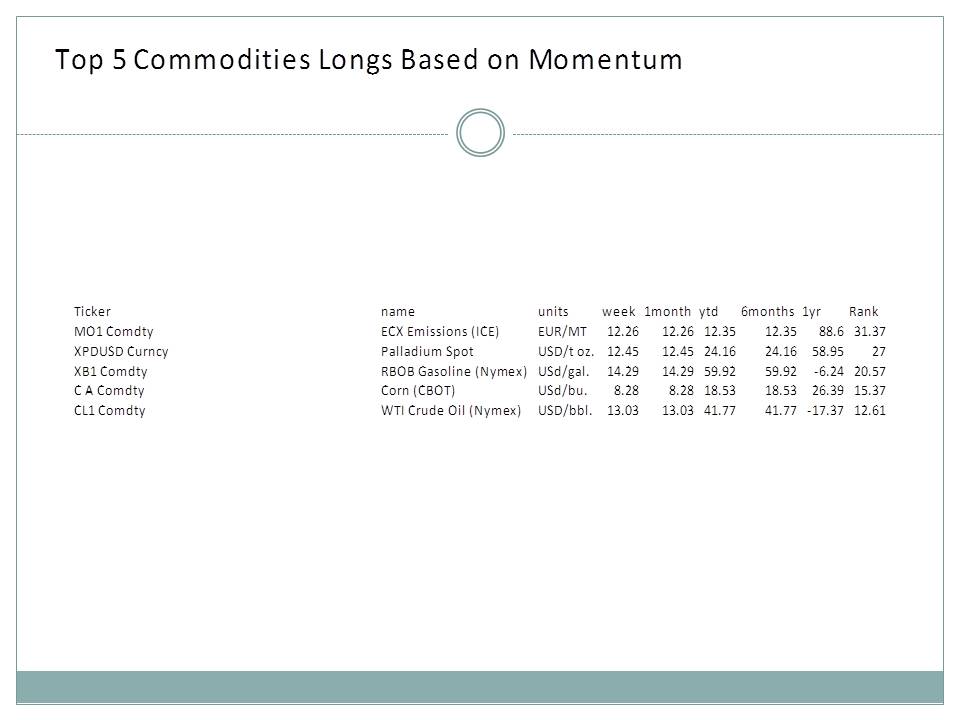

Top 5 Commodities Longs Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

| LMNIDS03 Comdty | Nickel | USD/MT | 21.51 | 21.51 | 44.35 | 44.35 | 8.20 | 23.89 |

| XAGGBP Curncy | Silver/British Pound Spot | GBP/t oz. | 22.52 | 22.52 | 26.60 | 20.42 | 19.64 | 21.28 |

| XAGEUR Curncy | Silver/Euro Spot | EUR/t oz. | 21.95 | 21.95 | 26.56 | 20.51 | 15.83 | 20.06 |

| XAUGBP Curncy | Gold/British Pound Spot | GBP/t oz. | 11.28 | 11.28 | 24.80 | 23.62 | 27.86 | 18.51 |

| XAUINR Curncy | Gold/Indian Rupee Spot | INR/t oz. | 14.00 | 14.00 | 23.37 | 20.87 | 25.18 | 18.51 |

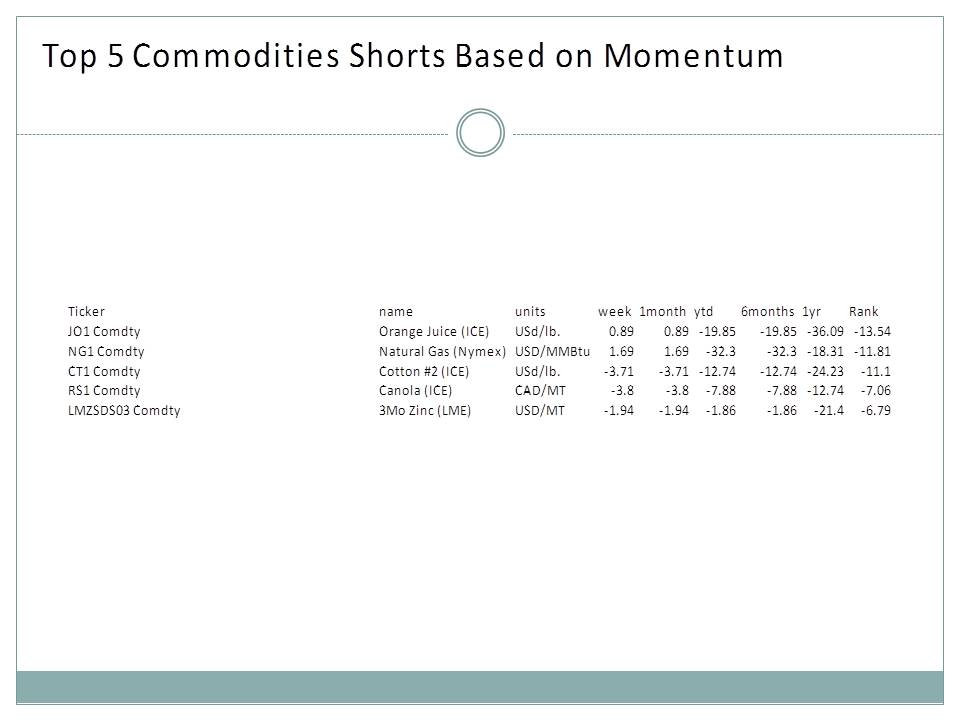

Top 5 Commodities Shorts Based on Momentum

| Ticker | name | units | week | 1month | ytd | 6months | 1yr | Rank |

| LMSNDS03 Comdty | 3Mo Tin (LME) | USD/MT | -14.15 | -14.15 | -18.71 | -21.51 | -22.89 | -18.18 |

| NG1 Comdty | Natural Gas (Nymex) | USD/MMBtu | -9.13 | -9.13 | -38.48 | -28.66 | -25.76 | -18.17 |

| CT1 Comdty | Cotton #2 (ICE) | USd/lb. | -8.10 | -8.10 | -19.81 | -20.05 | -30.37 | -16.66 |

| CP1 Comdty | Crude Oil (Tokyo) | JPY/kl | -13.48 | -13.48 | 7.92 | -9.00 | -27.56 | -15.88 |

| JO1 Comdty | Orange Juice (ICE) | USd/lb. | -0.29 | -0.29 | -20.09 | -18.27 | -36.27 | -13.78 |

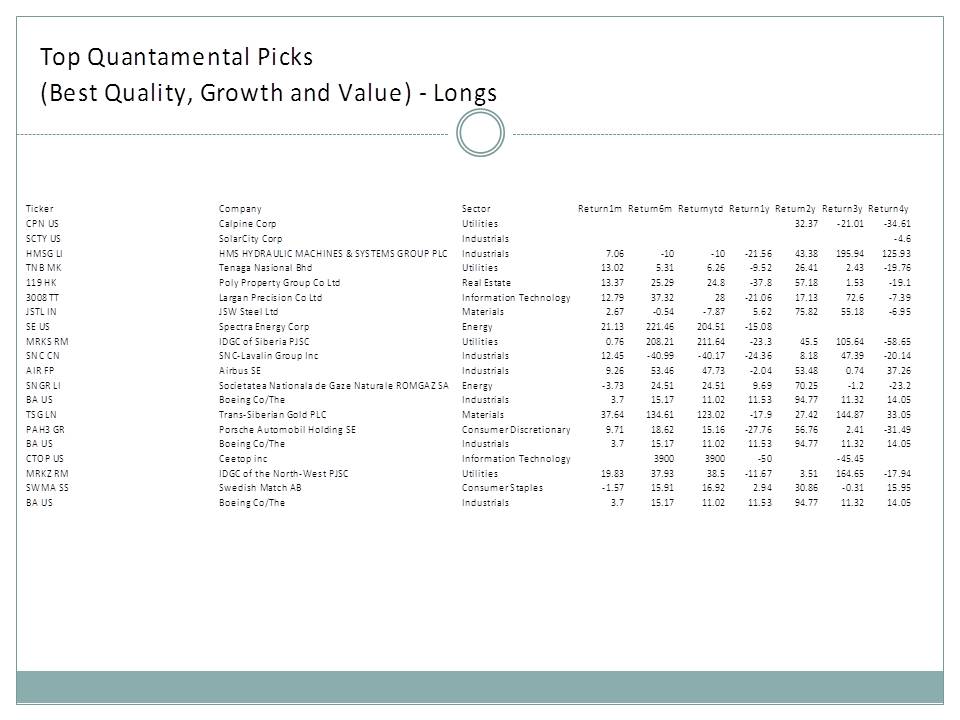

Top Quantamental Picks

|

| link | country | Universe Stocks |

| Top Picks | AUSTRALIA | 52 |

| Top Picks | BRAZIL | 78 |

| Top Picks | BRITAIN | 109 |

| Top Picks | CANADA | 68 |

| Top Picks | CHILE | 22 |

| Top Picks | CHINA | 114 |

| Top Picks | COLOMBIA | 16 |

| Top Picks | DENMARK | 12 |

| Top Picks | FRANCE | 56 |

| Top Picks | GERMANY | 38 |

| Top Picks | HONG KONG | 54 |

| Top Picks | INDIA | 98 |

| Top Picks | INDONESIA | 30 |

| Top Picks | ITALY | 17 |

| Top Picks | JAPAN | 110 |

| Top Picks | MALAYSIA | 42 |

| Top Picks | MEXICO | 29 |

| Top Picks | NETHERLANDS | 20 |

| Top Picks | PHILIPPINES | 22 |

| Top Picks | RUSSIA | 135 |

| Top Picks | SOUTH AFRICA | 51 |

| Top Picks | SOUTH KOREA | 115 |

| Top Picks | SPAIN | 25 |

| Top Picks | SWEDEN | 25 |

| Top Picks | SWITZERLAND | 37 |

| Top Picks | TAIWAN | 119 |

| Top Picks | THAILAND | 27 |

| Top Picks | TURKEY | 28 |

| Top Picks | UNITED STATES | 563 |

Top Global Long Picks

| Ticker | Company | Sector | 1m | 6m | YTD | 1yr | 2yr | 3yr | 4yr | PE RATIO 2019 | EV/EBITDA 2019 | P/S 2019 | P/B 2019 | DIVIDEND YIELD 2019 | GROSS MARGIN 2019 | ROA 2019 | ROE 2019 | CUR RATIO 2018 | QUICK RATIO 2018 | INTEREST COVERAGE RATIO 2018 | Debt/Equity 2018 | EBITDA Margin 2019 | revenue Growth 2020 | Net Income Growth 2020 | DPS Growth 2019 | EBITDA Growth 2020 | BPS Growth 2020 | Capex Growth 2020 | FCF Growth 2020 | PEG Ratio 2019 | 1 month return 2019 | 6 month return 2019 |

| CPN US zranks | Calpine Corp | Utilities | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | 32.37 | -21.01 | -34.61 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.2 | 10.4 | 1.0 | 0.7 | 1.2 | 376.9 | 33.8 | 0% | 0% | 0% | -0% | 0% | 0% | 0% | 0.0 | 0.0 | 0.0 |

| SCTY US zranks | SolarCity Corp | Industrials | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | -4.60 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 32.9 | -8.8 | -403.7 | 0.5 | 0.4 | -5.6 | 40.3 | -67.6 | 10% | 0% | 0% | 0% | 1080% | -100% | 0% | 0.0 | 0.0 | 0.0 |

| SE US zranks | Spectra Energy Corp | Energy | -4.73 | 130.64 | 200.53 | -15.08 | #N/A N/A | #N/A N/A | #N/A N/A | 0.0 | 0.0 | 6.5 | 34.3 | 0.0 | 16.2 | -30.9 | -12.6 | 1.4 | 2.2 | -31.6 | 14.3 | -10.1 | 40% | 0% | 0% | 0% | 700% | 10% | 0% | 0.0 | -4.7 | 130.6 |

| HMSG LI zranks | HMS HYDRAULIC MACHINES & SYSTEMS GROUP PLC | Industrials | -14.00 | -33.52 | -30.76 | -21.56 | 43.38 | 195.94 | 125.93 | 4.2 | 3.4 | 0.1 | 0.4 | 17.4 | 26.4 | 0.0 | 13.4 | 1.8 | 0.7 | 2.6 | 120.5 | 12.2 | 0% | 30% | 380% | 10% | 10% | -20% | 30% | 0.0 | -14.0 | -33.5 |

| 119 HK zranks | Poly Property Group Co Ltd | Real Estate | -10.61 | -4.23 | 12.76 | -37.80 | 57.18 | 1.53 | -19.10 | 2.8 | 5.6 | 0.3 | 0.3 | 9.1 | 30.0 | 2.7 | 11.6 | 1.7 | 0.3 | 1.8 | 181.7 | 22.2 | 20% | 10% | 80% | 0% | 10% | 10% | 150% | 0.0 | -10.6 | -4.2 |

| TNB MK zranks | Tenaga Nasional Bhd | Utilities | 0.50 | 2.04 | 2.22 | -9.52 | 26.41 | 2.43 | -19.76 | 14.1 | 8.9 | 1.6 | 1.4 | 3.9 | 34.9 | 3.9 | 9.5 | 1.4 | 1.6 | 2.7 | 66.2 | 31.8 | 0% | 0% | -0% | 0% | 0% | -0% | 50% | 1.7 | 0.5 | 2.0 |

| 3008 TT zranks | Largan Precision Co Ltd | Information Technology | -2.50 | 0.63 | 17.35 | -21.06 | 17.13 | 72.60 | -7.39 | 17.8 | 11.1 | 9.0 | 4.0 | 2.2 | 69.4 | 20.0 | 24.2 | 4.1 | 3.6 | 0.0 | 0.3 | 66.9 | 20% | 20% | 0% | 20% | 20% | 10% | 20% | 1.2 | -2.5 | 0.6 |

| JSTL IN zranks | JSW Steel Ltd | Materials | -19.79 | -18.53 | -28.28 | 5.62 | 75.82 | 55.18 | -6.95 | 10.0 | 5.1 | 0.6 | 1.4 | 1.7 | 18.5 | 5.6 | 14.5 | 0.8 | 0.2 | 4.2 | 224.8 | 19.7 | 10% | 20% | -10% | 20% | 10% | -0% | 0% | 0.2 | -19.8 | -18.5 |

| MRKS RM zranks | IDGC of Siberia PJSC | Utilities | -5.80 | 69.04 | 185.68 | -23.30 | 45.50 | 105.64 | -58.65 | 27.3 | 5.6 | 0.4 | 1.4 | 1.5 | 0.0 | 3.5 | 12.7 | 0.5 | 0.7 | 1.3 | 137.5 | 17.9 | 0% | -0% | 0% | -0% | 0% | -10% | 0% | 0.0 | -5.8 | 69.0 |

| SNC CN zranks | SNC-Lavalin Group Inc | Industrials | -33.57 | -51.02 | -59.71 | -24.36 | 8.18 | 47.39 | -20.14 | 0.0 | 20.6 | 0.3 | 0.0 | 1.6 | 3.4 | -12.4 | -15.1 | 0.8 | 0.5 | -6.5 | 22.6 | 4.0 | -0% | 0% | -70% | 100% | 0% | 0% | 0% | 0.0 | -33.6 | -51.0 |

| AIR FP zranks | Airbus SE | Industrials | -2.94 | 21.42 | 43.07 | -2.04 | 53.48 | 0.74 | 37.26 | 19.9 | 9.4 | 1.3 | 7.4 | 1.8 | 16.2 | 4.0 | 41.5 | 1.0 | 0.4 | 10.7 | 152.8 | 13.1 | 10% | 20% | 20% | 20% | 30% | 10% | 30% | 1.9 | -2.9 | 21.4 |

| SNGR LI zranks | Societatea Nationala de Gaze Naturale ROMGAZ SA | Energy | -2.60 | 17.96 | 20.49 | 9.69 | 70.25 | -1.20 | -23.20 | 9.9 | 4.5 | 2.5 | 0.0 | 12.9 | 0.0 | 0.0 | 0.0 | 3.4 | 2.9 | 0.0 | 0.0 | 46.1 | 0% | 10% | 0% | 0% | 0% | 0% | 0% | 0.0 | -2.6 | 18.0 |

| BA US zranks | Boeing Co/The | Industrials | -6.97 | -17.82 | 3.77 | 11.53 | 94.77 | 11.32 | 14.05 | 44.2 | 24.2 | 2.1 | 0.0 | 2.4 | 15.9 | 4.6 | -203.8 | 1.1 | 0.2 | 21.1 | 155.8 | 9.3 | 40% | 330% | 10% | 140% | 0% | 10% | 690% | 5.6 | -7.0 | -17.8 |

| TSG LN zranks | Trans-Siberian Gold PLC | Materials | 8.45 | 90.93 | 167.59 | -17.90 | 27.42 | 144.87 | 33.05 | 9.3 | 4.6 | 2.1 | 0.0 | 510.5 | 38.0 | 0.0 | 0.0 | 1.9 | 0.7 | 19.7 | 25.0 | 49.0 | 10% | -0% | 31570% | 10% | 0% | -0% | 0% | 0.0 | 8.5 | 90.9 |

| SWMA SS zranks | Swedish Match AB | Consumer Staples | -11.07 | -9.54 | 4.11 | 2.94 | 30.86 | -0.31 | 15.95 | 16.1 | 13.1 | 4.5 | 0.0 | 3.3 | 62.5 | 31.0 | -71.4 | 1.5 | 1.2 | 14.1 | 3,280.2 | 40.9 | 10% | 10% | 10% | 10% | 0% | -20% | 10% | 0.0 | -11.1 | -9.5 |

| BA US zranks | Boeing Co/The | Industrials | -6.97 | -17.82 | 3.77 | 11.53 | 94.77 | 11.32 | 14.05 | 44.2 | 24.2 | 2.1 | 0.0 | 2.4 | 15.9 | 4.6 | -203.8 | 1.1 | 0.2 | 21.1 | 155.8 | 9.3 | 40% | 330% | 10% | 140% | 0% | 10% | 690% | 5.6 | -7.0 | -17.8 |

| PAH3 GR zranks | Porsche Automobil Holding SE | Consumer Discretionary | -2.89 | 6.62 | 13.14 | -27.76 | 56.76 | 2.41 | -31.49 | 4.2 | 12.5 | 155.5 | 0.5 | 4.6 | 84.9 | 13.8 | 13.1 | 6.8 | 7.4 | -42.0 | 1.1 | 1,180.2 | 10% | 10% | 10% | 40% | 10% | 60% | 30% | 0.0 | -2.9 | 6.6 |

| UPS US zranks | United Parcel Service Inc | Industrials | 12.14 | 8.36 | 19.93 | -15.48 | 7.14 | 22.71 | -10.93 | 15.3 | 11.4 | 1.3 | 14.9 | 3.3 | 12.2 | 12.4 | 132.8 | 1.2 | 1.0 | 10.0 | 575.4 | 14.1 | 0% | 10% | 10% | 10% | 50% | 0% | 120% | 1.7 | 12.1 | 8.4 |

| SNGR LI zranks | Societatea Nationala de Gaze Naturale ROMGAZ SA | Energy | -2.60 | 17.96 | 20.49 | 9.69 | 70.25 | -1.20 | -23.20 | 9.9 | 4.5 | 2.5 | 0.0 | 12.9 | 0.0 | 0.0 | 0.0 | 3.4 | 2.9 | 0.0 | 0.0 | 46.1 | 0% | 10% | 0% | 0% | 0% | 0% | 0% | 0.0 | -2.6 | 18.0 |

| UPS US zranks | United Parcel Service Inc | Industrials | 12.14 | 8.36 | 19.93 | -15.48 | 7.14 | 22.71 | -10.93 | 15.3 | 11.4 | 1.3 | 14.9 | 3.3 | 12.2 | 12.4 | 132.8 | 1.2 | 1.0 | 10.0 | 575.4 | 14.1 | 0% | 10% | 10% | 10% | 50% | 0% | 120% | 1.7 | 12.1 | 8.4 |

Portfolio Longs Average Return 1m -4.7%, 6m 11.1%, YTD 30.8%, 2017 -9.0%, 2016 40.9%, 2015 33.7%, 2014 -1.5%

Top Global Short Picks

| Ticker | Company | Sector | 1m | 6m | YTD | 1yr | 2yr | 3yr | 4yr | PE RATIO 2019 | EV/EBITDA 2019 | P/S 2019 | P/B 2019 | DIVIDEND YIELD 2019 | GROSS MARGIN 2019 | ROA 2019 | ROE 2019 | CUR RATIO 2018 | QUICK RATIO 2018 | INTEREST COVERAGE RATIO 2018 | Debt/Equity 2018 | EBITDA Margin 2019 | revenue Growth 2020 | Net Income Growth 2020 | DPS Growth 2019 | EBITDA Growth 2020 | BPS Growth 2020 | Capex Growth 2020 | FCF Growth 2020 | PEG Ratio 2019 | 1 month return 2019 | 6 month return 2019 |

| MMC MK zranks | MMC Corp Bhd | Industrials | -11.37 | 28.38 | 29.54 | -59.04 | -1.19 | 16.18 | -32.36 | 17.5 | 7,433,062.0 | 0.7 | 0.3 | 3.2 | 36.0 | 0.9 | 2.2 | 0.9 | 0.6 | 1.3 | 87.5 | 0.0 | 0% | 10% | 0% | 0% | 0% | 0% | 0% | 0.0 | -11.4 | 28.4 |

| GEO LN zranks | Georgian Mining Corp | Materials | -22.29 | -78.38 | -79.99 | -68.28 | 152.14 | -24.59 | -72.42 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.8 | 6.2 | 0.0 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | -22.3 | -78.4 |

| PAH3 GR zranks | Porsche Automobil Holding SE | Consumer Discretionary | -2.89 | 6.62 | 13.14 | -27.76 | 56.76 | 2.41 | -31.49 | 4.2 | 12.5 | 155.5 | 0.5 | 4.6 | 84.9 | 13.8 | 13.1 | 6.8 | 7.4 | -42.0 | 1.1 | 1,180.2 | 10% | 10% | 10% | 40% | 10% | 60% | 30% | 0.0 | -2.9 | 6.6 |

| TSLA US zranks | Tesla Inc | Consumer Discretionary | -2.05 | -25.75 | -31.39 | 6.89 | 45.70 | -10.97 | 7.91 | 0.0 | 24.3 | 1.7 | 6.2 | 0.0 | 16.5 | -1.5 | -12.2 | 0.8 | 0.5 | -0.5 | 234.2 | 8.6 | 20% | 0% | 0% | 50% | 10% | 50% | 0% | 0.0 | -2.1 | -25.8 |

| GEO LN zranks | Georgian Mining Corp | Materials | -22.29 | -78.38 | -79.99 | -68.28 | 152.14 | -24.59 | -72.42 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.8 | 6.2 | 0.0 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | -22.3 | -78.4 |

| WYNN US zranks | Wynn Resorts Ltd | Consumer Discretionary | -16.35 | -11.18 | 13.94 | -40.16 | 98.06 | 27.91 | -52.24 | 17.9 | 10.5 | 1.7 | 6.0 | 3.4 | 30.2 | 5.4 | 31.2 | 1.4 | 1.6 | 1.7 | 42,246.6 | 26.8 | 10% | 30% | 40% | 20% | 10% | -60% | 180% | 1.6 | -16.4 | -11.2 |

| PLL US zranks | Pall Corp | Industrials | -14.81 | 28.34 | 56.61 | -60.91 | #N/A N/A | #N/A N/A | #N/A N/A | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 3.7 | 7.4 | 0.0 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | -14.8 | 28.3 |

| PLL US zranks | Pall Corp | Industrials | -14.81 | 28.34 | 56.61 | -60.91 | #N/A N/A | #N/A N/A | #N/A N/A | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 3.7 | 7.4 | 0.0 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | -14.8 | 28.3 |

| KMB US zranks | Kimberly-Clark Corp | Consumer Staples | -2.50 | 19.85 | 19.24 | -2.10 | 9.05 | -7.69 | 13.75 | 19.6 | 12.9 | 2.5 | 0.0 | 3.1 | 34.0 | 15.2 | -2,317.9 | 0.8 | 0.5 | 8.5 | 7,476.0 | 22.7 | 0% | 0% | 0% | 0% | 0% | -10% | 30% | 4.2 | -2.5 | 19.9 |

| CIE US zranks | Cobalt International Energy Inc | Energy | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 4.1 | 1.8 | -3.0 | 91.2 | 0.0 | 20% | 0% | 0% | 0% | 30% | 300% | 0% | 0.0 | 0.0 | 0.0 |

| PFC LN zranks | Petrofac Ltd | Energy | -4.45 | 0.98 | -14.95 | -7.82 | -31.59 | -3.54 | 12.05 | 5.8 | 3.4 | 0.3 | 1.8 | 7.8 | 10.9 | 4.9 | 32.8 | 1.1 | 0.4 | 2.2 | 145.3 | 9.8 | -0% | -0% | 0% | -0% | 10% | -0% | 40% | 0.0 | -4.5 | 1.0 |

| RMH SJ zranks | RMB Holdings Ltd | Financials | -15.07 | -16.02 | -8.03 | -10.09 | 39.28 | 41.62 | -32.87 | 11.1 | 0.0 | 0.0 | 2.0 | 5.1 | 0.0 | 0.0 | 20.0 | 0.5 | 0.5 | -0.5 | 0.1 | 0.0 | 0% | 10% | -10% | 0% | 10% | 0% | 0% | 0.0 | -15.1 | -16.0 |

| TME LI zranks | Trader Media East Ltd | Consumer Discretionary | 0.00 | 0.00 | 0.00 | -97.73 | 0.00 | 0.00 | 0.00 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | -6.0 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | 0.0 | 0.0 |

| RKKE RM zranks | PJSC SPC Energia | Industrials | -0.80 | -21.47 | -18.69 | 5.19 | -5.96 | 126.14 | -34.88 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.9 | 0.5 | 0.9 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | -0.8 | -21.5 |

| ACHR SP zranks | Anchor Resources Ltd/SG | Materials | -1.50 | -50.89 | -43.83 | -42.58 | -53.61 | #N/A N/A | #N/A N/A | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.5 | 1.0 | -3.6 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | -1.5 | -50.9 |

| CO FP zranks | Casino Guichard Perrachon SA | Consumer Staples | 5.59 | -19.90 | -6.82 | -25.77 | 34.02 | 14.82 | -48.13 | 12.0 | 10.5 | 0.1 | 0.5 | 9.2 | 24.8 | 0.7 | 5.8 | 1.0 | 0.3 | 2.3 | 94.5 | 5.2 | 0% | 20% | -10% | 10% | 0% | 0% | 40% | 1.0 | 5.6 | -19.9 |

| VK FP zranks | Vallourec SA | Energy | 4.08 | 80.18 | 67.43 | -69.25 | -12.38 | 22.97 | -64.80 | 0.0 | 11.4 | 0.3 | 0.8 | 0.0 | 13.6 | 0.0 | -12.5 | 1.3 | 0.9 | -1.5 | 69.7 | 8.1 | 10% | 0% | 0% | 50% | -0% | 30% | 0% | 0.0 | 4.1 | 80.2 |

| SUEL LI zranks | Suzlon Energy Ltd | Industrials | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | #N/A N/A | 11.82 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.6 | 0.3 | -0.3 | 0.0 | 0.0 | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0.0 | 0.0 | 0.0 |

| SBIN IN zranks | State Bank of India | Financials | -21.29 | 5.63 | -0.75 | -10.82 | 31.83 | 8.42 | -29.93 | 9.0 | 0.0 | 1.3 | 1.1 | 1.5 | 0.0 | 0.6 | 12.2 | 0.0 | 0.0 | 0.0 | 214.4 | 0.0 | 10% | 10% | 0% | 0% | 10% | 0% | 0% | 0.0 | -21.3 | 5.6 |

| CYRE3 BZ zranks | Cyrela Brazil Realty SA Empreendimentos e Participacoes | Consumer Discretionary | 7.40 | 45.98 | 60.87 | 8.09 | 27.42 | 71.17 | -53.00 | 33.2 | 19.2 | 2.6 | 1.9 | 4.9 | 31.0 | 4.1 | 6.5 | 3.5 | 1.5 | -0.3 | 56.0 | 15.1 | 10% | 70% | 120% | 50% | -0% | 0% | 10% | 1.1 | 7.4 | 46.0 |

Portfolio Longs Average Return 1m -4.7%, 6m 11.1%, YTD 30.8%, 2017 -9.0%, 2016 40.9%, 2015 33.7%, 2014 -1.5%

Portfolio Shorts Average Return 1m -6.8%, 6m -2.9%, YTD 1.6%, 2017 -31.6%, 2016 27.1%, 2015 13.0%, 2014 -24.0%

Top Momentum Picks

|

Download All Slides in Power Point

Download All Slides in Power Point