Analysts growth forecasts are rarely negative but when is the crash

Brexit and the pound how long is to short

Hong Kong, Russia protests similarities and difference and market impact

Study of Trump tweets impact markets or not

Impact of Fed rates decisions on valuations

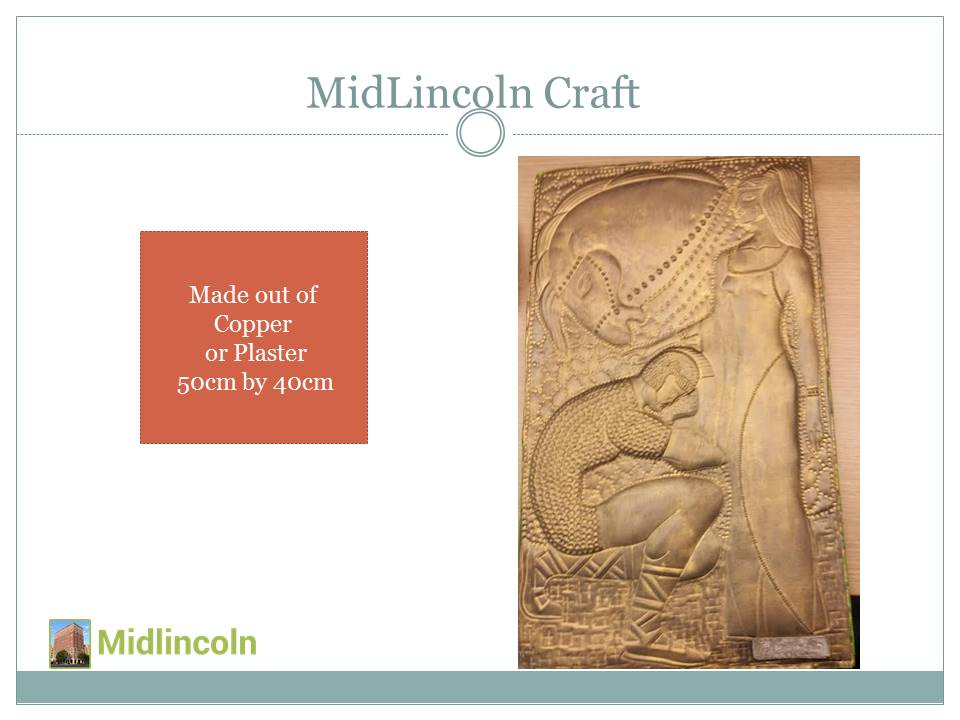

Recent Strategy Chart Art

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

Comment

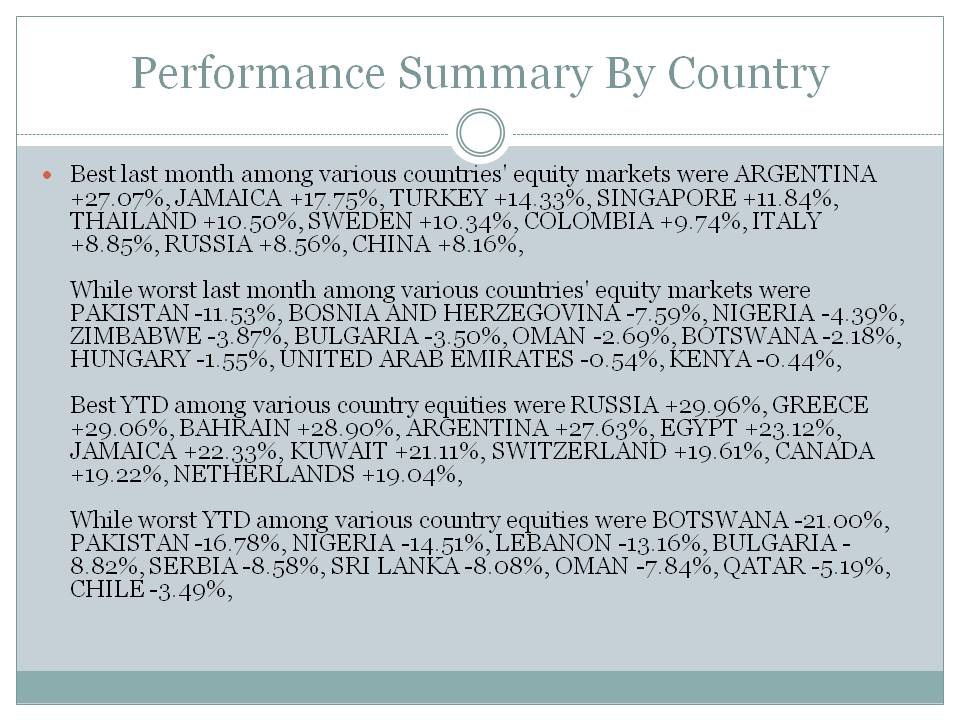

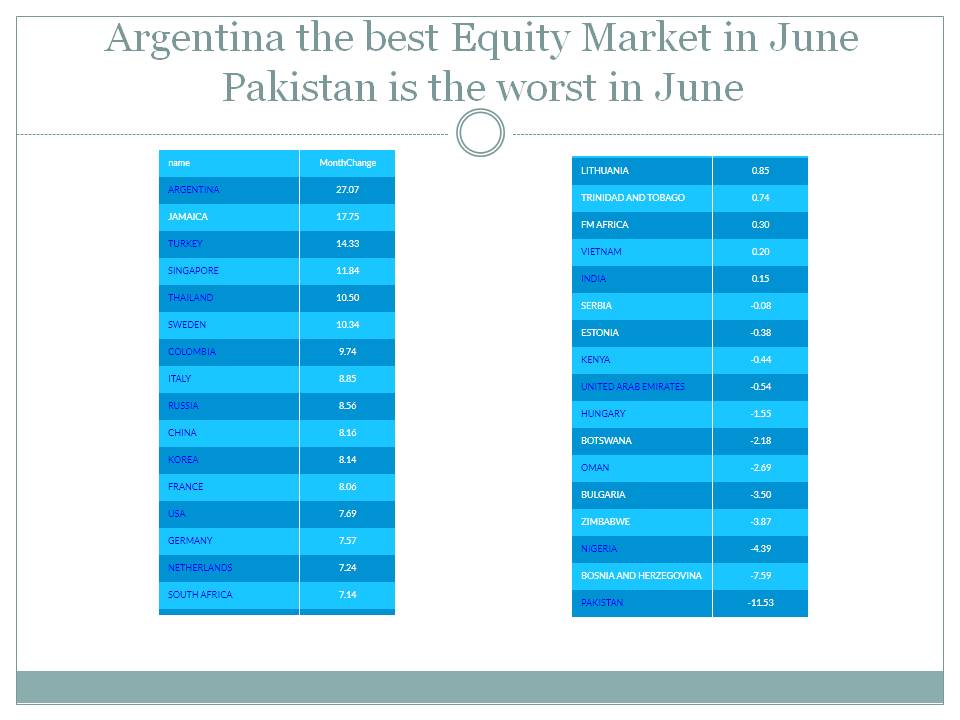

Monthly performance is between 2019-07-31 and 2019-07-01

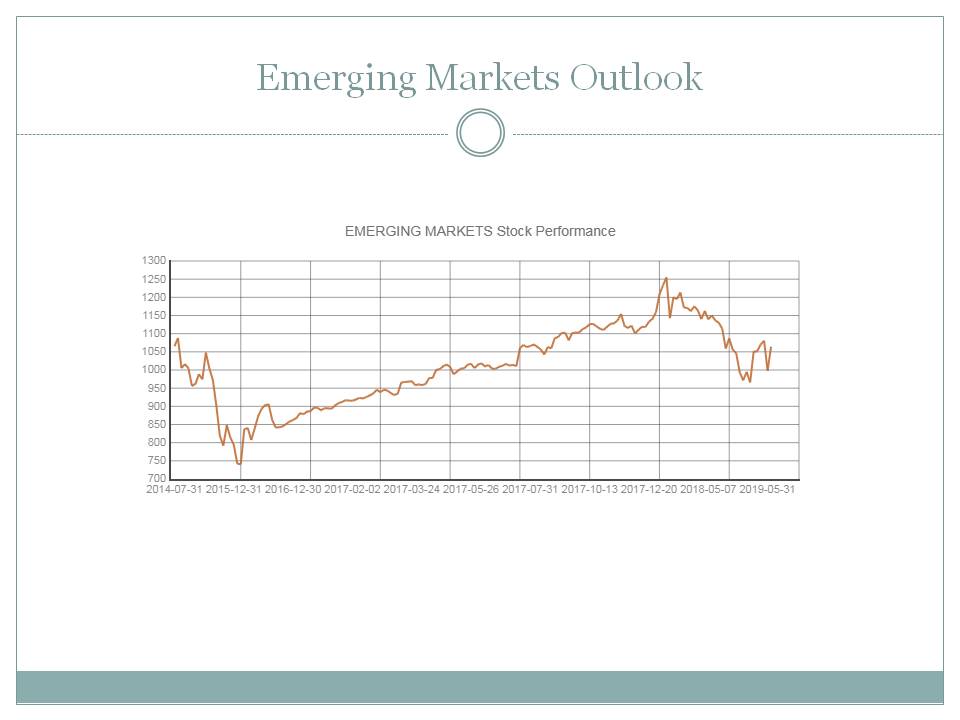

Best global markets YTD USA +19.29%, EUROPE +10.95%, FM (FRONTIER MARKETS) +10.92%,

While worst global markets YTD EFM ASIA 6.34%, EM (EMERGING MARKETS) 7.35%, EM LATIN AMERICA 10.82%,

Best global markets last month FM (FRONTIER MARKETS) +2.19%, USA +0.65%, EM LATIN AMERICA-0.81%,

While worst global markets last month EFM ASIA -2.84%, EM (EMERGING MARKETS) -2.54%, EUROPE -2.17%,

US Stock Futures Drop as Trade-Talk Doubts Swirl: Markets WrapJP Morgan: The stock market 'will advance into year-end'EMERGING MARKETS-HK stocks, China data boost emerging ...Future Returns: There's Still Opportunity in Emerging Market StocksDow ends lower after new China tariffs kick in and manufacturing ...China stocks climb on upbeat services sector survey, sharp HK gainsEuropean equities surge higher to start the dayEuropean Equities: Service Sector PMIs and Geopolitics in FocusOil Plunges As Trade War RagesOPEC Not Only Produced More Oil In August, But Shipped More TooChinese Steel Slowdown Slams Iron-Ore PricesFitch Solutions lowers 2019 global steel price forecast to $600 a tonneGold prices today fall sharply after hitting new high but silver rates riseGold Price Preview: September 3 - 6

Best last month among various countries' equity markets were BAHRAIN +8.77%, UNITED ARAB EMIRATES +8.02%, SRI LANKA +6.27%, KAZAKHSTAN +5.90%, BELGIUM +5.87%, LITHUANIA +5.28%, KUWAIT +5.09%, TURKEY +4.64%, JAMAICA +4.63%, NEW ZEALAND +4.60%,

While worst last month among various countries' equity markets were BOTSWANA -10.39%, NIGERIA -9.02%, INDIA -6.10%, PERU -6.08%, KOREA -5.90%, MEXICO -5.57%, POLAND -5.39%, SWEDEN -5.26%, BANGLADESH -5.04%, CHILE -4.99%,

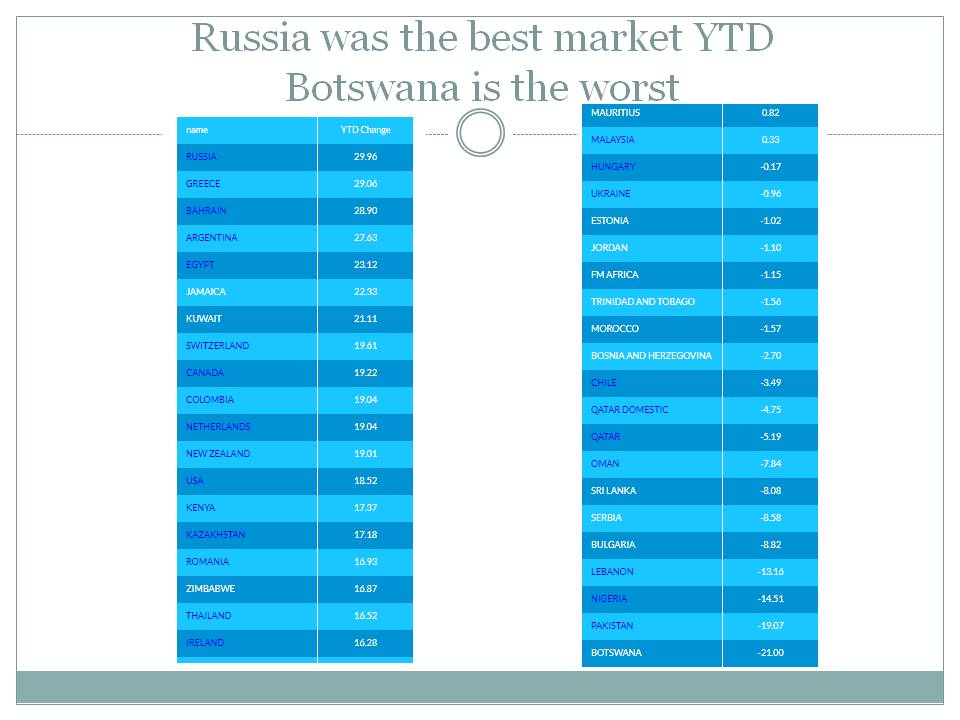

Best YTD among various country equities were BAHRAIN +40.21%, GREECE +28.72%, JAMAICA +28.00%, KUWAIT +27.27%, ARGENTINA +25.54%, RUSSIA +25.40%, NEW ZEALAND +24.49%, KAZAKHSTAN +24.09%, BELGIUM +22.81%, ROMANIA +21.98%,

While worst YTD among various country equities were BOTSWANA -29.21%, NIGERIA -22.23%, LEBANON -16.38%, PAKISTAN -16.29%, BULGARIA -10.72%, SERBIA -9.19%, CHILE -8.31%, OMAN -7.38%, QATAR -5.43%, UKRAINE -3.54%,

Download All Slides in Power Point

Download All Slides in Power Point