Key Equity Performance Summary

Monthly performance is between 2019-07-01 and 2019-05-31

Best global markets YTD USA +18.52%, EUROPE +13.41%, EM LATIN AMERICA +11.73%,

While worst global markets YTD FM (FRONTIER MARKETS) 8.54%, EFM ASIA 9.45%, EM (EMERGING MARKETS) 10.15%,

Best global markets last month USA +7.69%, EM LATIN AMERICA +6.83%, EUROPE +6.75%,

While worst global markets last month FM (FRONTIER MARKETS) 1.86%, EFM ASIA 6.61%, EM (EMERGING MARKETS) 6.62%,

Source: ML

- All You Need To Know Going Into Trade On July 15

- Zithers Market – Major Technology Giants in Buzz Again | Music ...

- Edited Transcript of GMG.AX earnings conference call or ...

- Edited Transcript of INWI.ST earnings conference call or ...

- Wintrust Financial Corporation Reports Second Quarter 2019 Net ...

- Absolute Equity Performance Fund Limited, AEG:ASX summary - FT ...

- Credit Suisse Global Investment Returns ... - WordPress.com

- Global Private Equity Report 2019 - Bain & Company

- Hallmarks of Successful Active Equity Managers - Semantic Scholar

- Equity, performance and accountability - NCSEHE

- Credit Suisse Global Investment Returns ... - WordPress.com

- Hallmarks of Successful Active Equity Managers - Semantic Scholar

- financial performance summary - IFC

- Global Private Equity Report 2019 - Bain & Company

- equity manager selection - Mercer

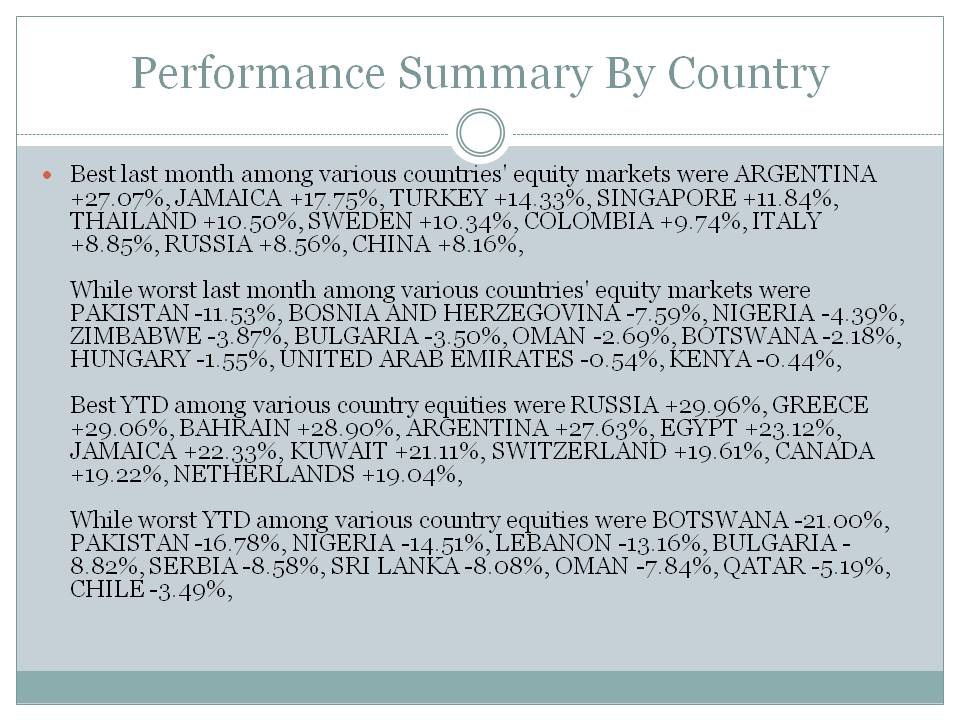

Performance Summary By Country

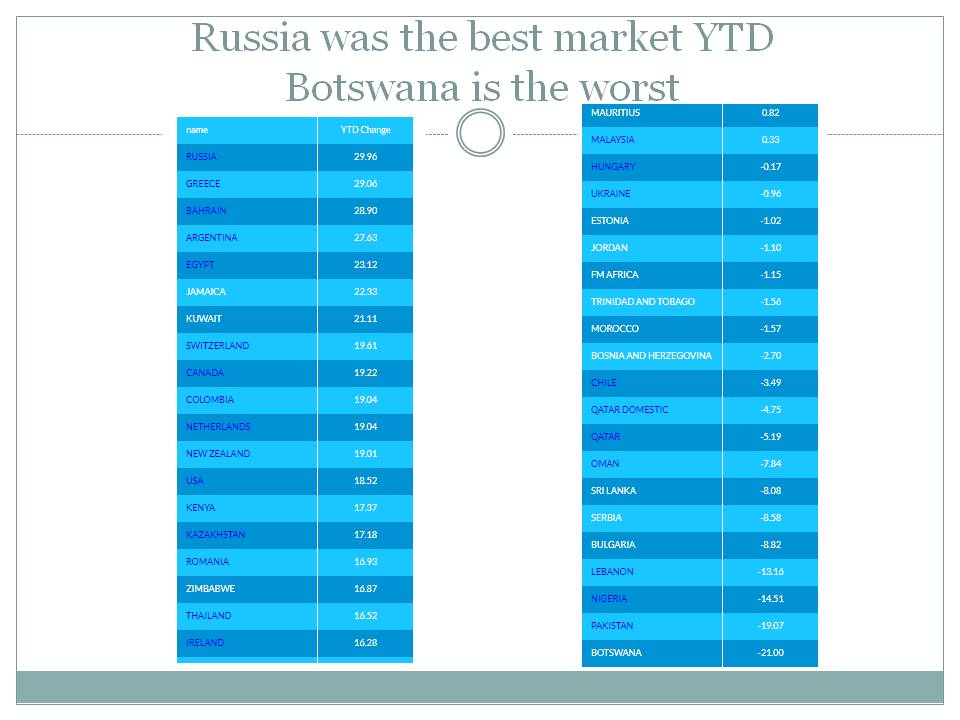

Best YTD among various country equities were RUSSIA +29.96%, GREECE +29.06%, BAHRAIN +28.90%, ARGENTINA +27.63%, EGYPT +23.12%, JAMAICA +22.33%, KUWAIT +21.11%, SWITZERLAND +19.61%, CANADA +19.22%, NETHERLANDS +19.04%,

While worst YTD among various country equities were BOTSWANA -21.00%, PAKISTAN -16.78%, NIGERIA -14.51%, LEBANON -13.16%, BULGARIA -8.82%, SERBIA -8.58%, SRI LANKA -8.08%, OMAN -7.84%, QATAR -5.19%, CHILE -3.49%,

Source: ML

- Government of Canada Selects Fortinet to Secure Its Enterprise ...

- Thai airports report mixed performance

- Reformer Mnangagwa leaves US unsure: State Department judges ...

- Japan Generic Drug Market Trends, Share, Size, Growth ...

- Analysis on the $1.22Bn Croatian Defense Market (2019-2024): The ...

- Country Portfolio Performance Review | African Development Bank ...

- Environmental Performance Index: Welcome

- 2018 ENVIRONMENTAL PERFORMANCE INDEX

- Aligning Asian Development Bank and Country Systems for ...

- 2018 ENVIRONMENTAL PERFORMANCE INDEX

- Guidelines for Preparing Performance Evaluation Reports ... - OECD

- • Figure I.• Comparing Countries' and eConomies' performanCe

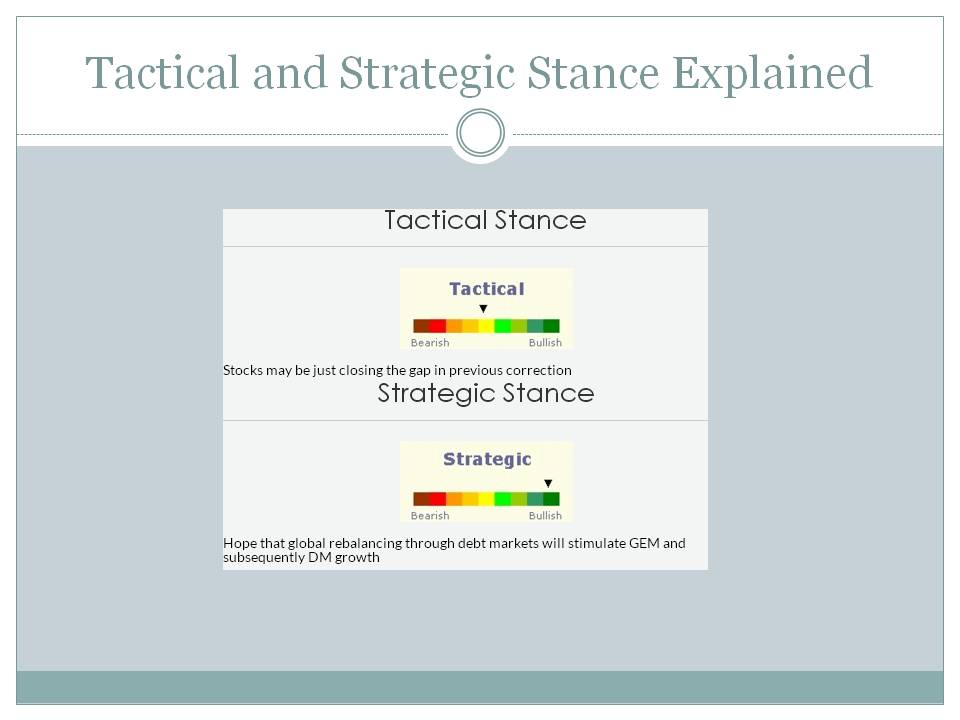

Tactical and Strategic Stance Explained

Russia was the best market YTD�Botswana is the worst

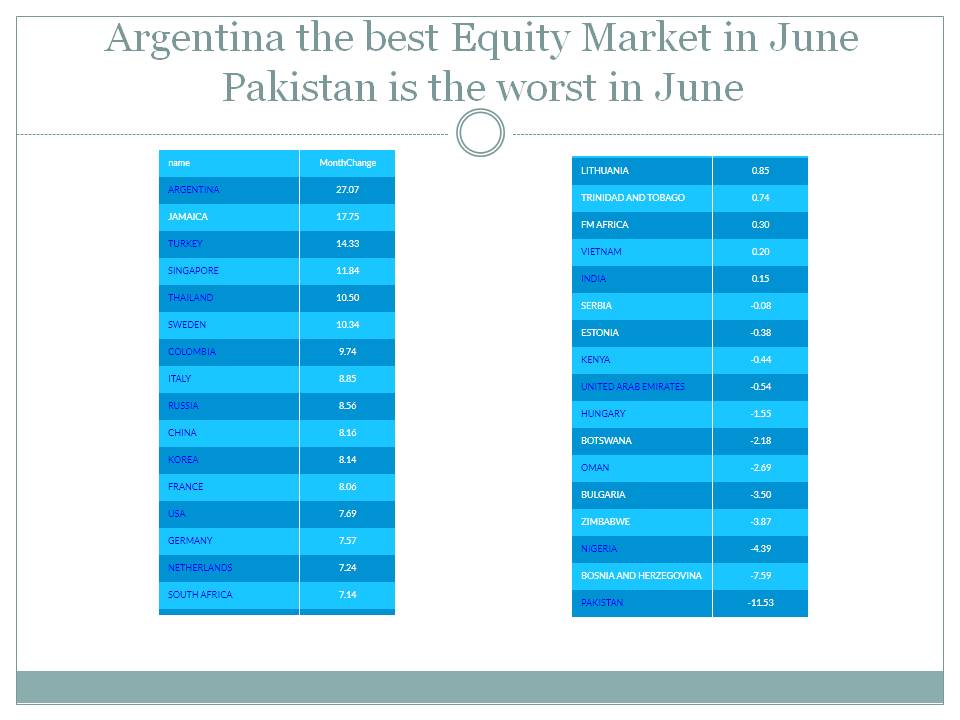

Argentina the best Equity Market in June Pakistan is the worst in June

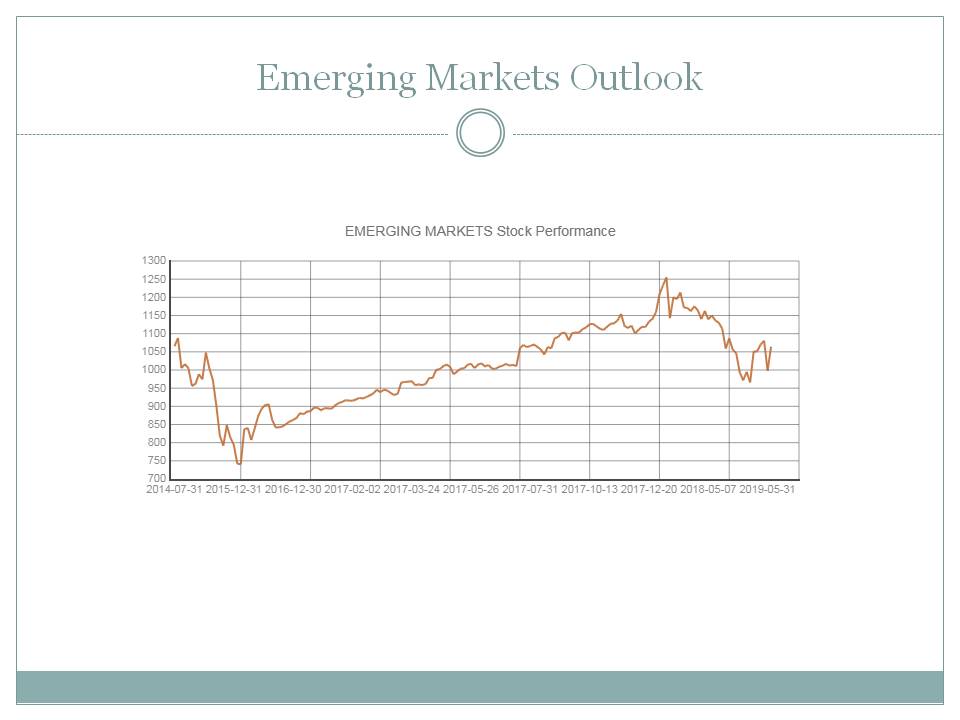

Emerging Markets Outlook

US Market Outlook

European Markets Outlook

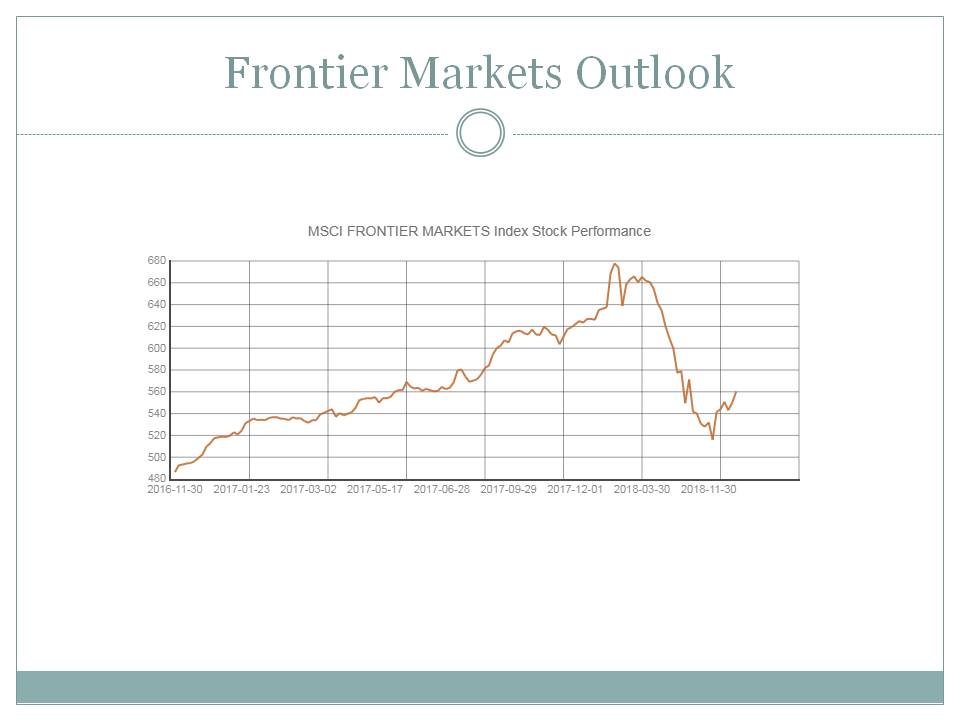

Frontier Markets Outlook

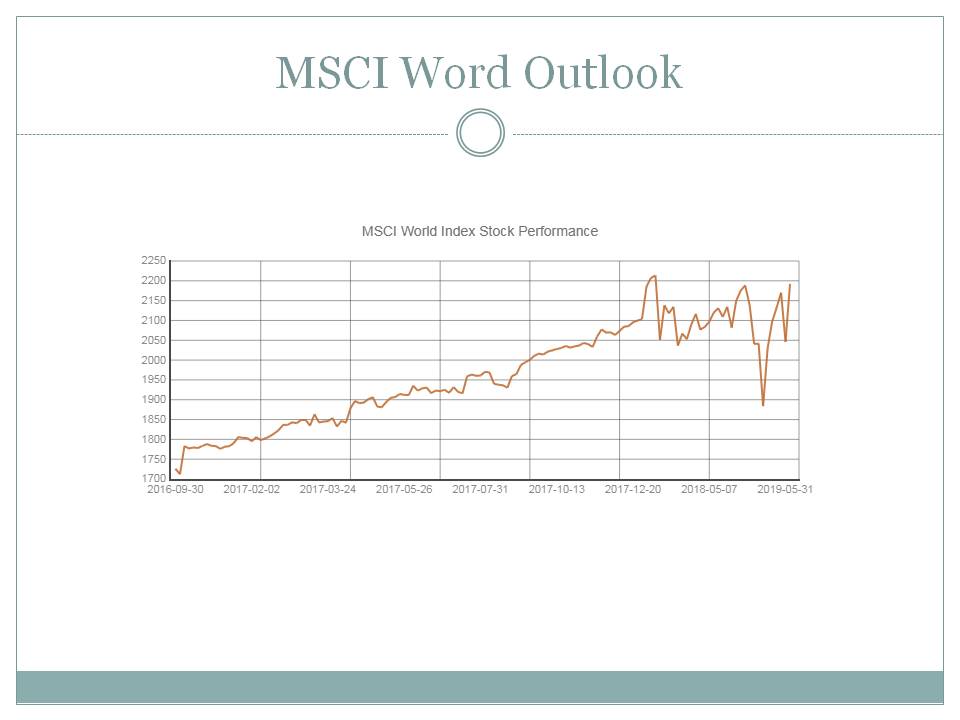

MSCI Word Outlook

Recent Strategy Chart Art

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

Comment

Monthly performance is between 2019-07-01 and 2019-05-31

Best global markets YTD USA +18.52%, EUROPE +13.41%, EM LATIN AMERICA +11.73%,

While worst global markets YTD FM (FRONTIER MARKETS) 8.54%, EFM ASIA 9.45%, EM (EMERGING MARKETS) 10.15%,

Best global markets last month USA +7.69%, EM LATIN AMERICA +6.83%, EUROPE +6.75%,

While worst global markets last month FM (FRONTIER MARKETS) 1.86%, EFM ASIA 6.61%, EM (EMERGING MARKETS) 6.62%,

US stocks edge up to new records as investors eye earnings seasonUS Equities Outlook: Bulls Inspired By Resilient EconomyDoes investing in emerging markets still make sense?Good News and Bad News Make Emerging Markets a Short-Term ...China Stocks Recover as Earnings, Economic Data Boost SentimentChina's stocks rise as data shows lowest quarterly growth in 27 yearsEuropean Equities: Stats Out of China May Not Be Enough…Investing In European EquitiesShale Investors Fear Bloodbath As Earnings Season Kicks OffLibya's Oil Revenue Takes A BeatingStop steel exports at lower than domestic price: Consumers ...US Steel Companies Announce Price HikesGold prices settle at nearly two-week peakGold prices fall, silver follows suit

Best last month among various countries' equity markets were ARGENTINA +27.07%, JAMAICA +17.75%, TURKEY +14.33%, SINGAPORE +11.84%, THAILAND +10.50%, SWEDEN +10.34%, COLOMBIA +9.74%, ITALY +8.85%, RUSSIA +8.56%, CHINA +8.16%,

While worst last month among various countries' equity markets were PAKISTAN -11.53%, BOSNIA AND HERZEGOVINA -7.59%, NIGERIA -4.39%, ZIMBABWE -3.87%, BULGARIA -3.50%, OMAN -2.69%, BOTSWANA -2.18%, HUNGARY -1.55%, UNITED ARAB EMIRATES -0.54%, KENYA -0.44%,

Best YTD among various country equities were RUSSIA +29.96%, GREECE +29.06%, BAHRAIN +28.90%, ARGENTINA +27.63%, EGYPT +23.12%, JAMAICA +22.33%, KUWAIT +21.11%, SWITZERLAND +19.61%, CANADA +19.22%, NETHERLANDS +19.04%,

While worst YTD among various country equities were BOTSWANA -21.00%, PAKISTAN -16.78%, NIGERIA -14.51%, LEBANON -13.16%, BULGARIA -8.82%, SERBIA -8.58%, SRI LANKA -8.08%, OMAN -7.84%, QATAR -5.19%, CHILE -3.49%,

Download All Slides in Power Point

Download All Slides in Power Point