If your are viewing this document on a mobile device click here to skip part with data and go directly to content part

Tockenising Midlincoln Crafts

This section contains links to materials about Midlincoln Rural Crafts Initiatives

Midlincoln is testing rural co-working model as its core business. Half of the co-working space is dedicated to investment analytics service and half of the space is industrial, creative environment with machines and tools which can be used in product development and small scale production.

Investing into Midlincoln Craft fund tokens is a comprehensive investment into all of the portfolio companies and funds. But each of the mentioned companies and funds are also accessible for investment directly also via tokens. Each of the portfolio company or a fund can be considered as a standalone franchise and Stoken could provide security token investment for qualified investors in any of them.

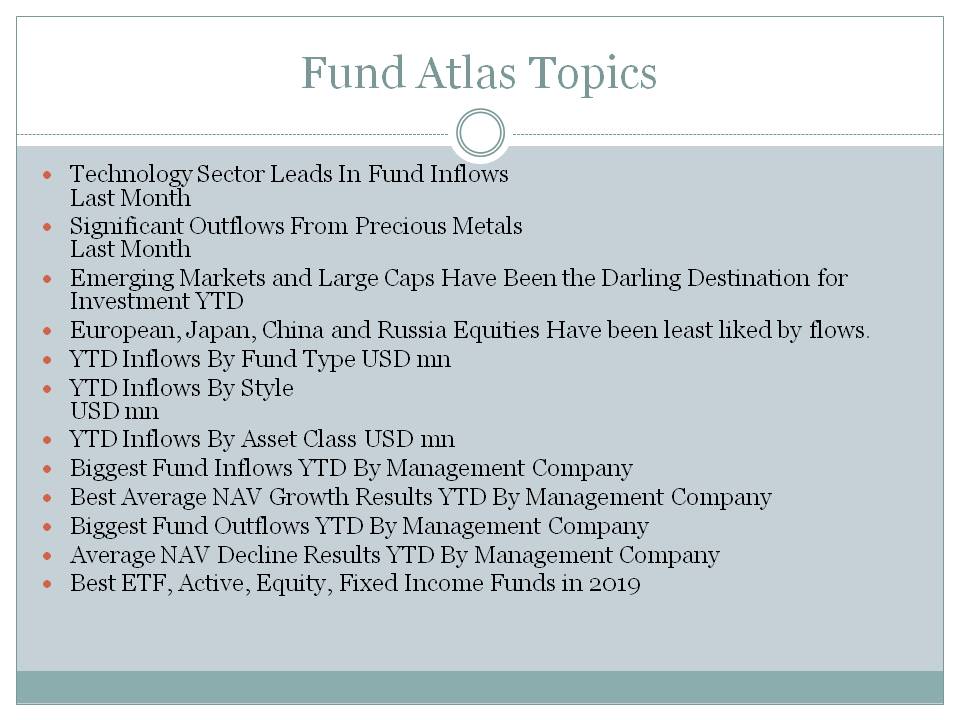

Period Flows By Objective In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| industry | TECHNOLOGY SECTOR | Equity | 4570.04 |

| industry | REAL ESTATE SECTOR | Equity | 1881.23 |

| industry | UTILITIES SECTOR | Equity | 1249.24 |

| Sector | CONSUMER DISCRETIONARY | Equity | 763.13 |

| region | ASIAN PACIFIC REGION | Fixed Income | 742.26 |

| Sector | CONSUMER STAPLES | Equity | 669.53 |

| region | ASIAN PACIFIC REGION | Equity | 543.91 |

| industry | COMMUNICATIONS SECTOR | Equity | 466.44 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 463.54 |

| region | LATIN AMERICAN REGION | Fixed Income | 445.25 |

| industry | ENERGY SECTOR | Equity | 337.30 |

| industry | BASIC MATERIALS SECTOR | Equity | 284.91 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | 279.36 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 218.87 |

| country | AUSTRALIA | Fixed Income | 214.76 |

| region | LATIN AMERICAN REGION | Equity | 187.59 |

| industry | FINANCIAL SECTOR | Equity | 162.25 |

| country | INDIA | Equity | 110.65 |

| region | EUROPEAN REGION | Mixed Allocation | 82.83 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | 71.09 |

| country | BRAZIL | Equity | 52.58 |

| segment | BRIC | Equity | 44.26 |

| Sector | AGRICULTURE | Commodity | 40.73 |

| segment | GCC | Fixed Income | 35.38 |

| country | JAPAN | Fixed Income | 5.72 |

| region | MIDDLE EAST REGION | Equity | 5.72 |

| region | EASTERN EUROPEAN REGION | Fixed Income | 4.89 |

| Risk | GOVERNMENT BOND | Alternative | 3.46 |

| Country | EGYPT | Equity | 0.33 |

| Sector | AGRICULTURE | Equity | 0.00 |

| country | AUSTRALIA | Mixed Allocation | -0.05 |

| Risk | GOVERNMENT BOND | Equity | -0.08 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.33 |

| region | MIDDLE EAST REGION | Fixed Income | -0.45 |

| industry | MULTIPLE SECTOR | Equity | -0.95 |

| Risk | LONG SHORT | Mixed Allocation | -0.95 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -1.38 |

| segment | MENA | Equity | -3.31 |

| segment | MENA | Fixed Income | -3.36 |

| Size | MID-CAP | Commodity | -3.59 |

| segment | EMEA | Equity | -4.27 |

| country | JAPAN | Mixed Allocation | -4.60 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -4.83 |

| segment | GCC | Equity | -5.66 |

| region | NORTH AMERICAN REGION | Fixed Income | -5.93 |

| country | CHINA | Fixed Income | -6.91 |

| country | INDIA | Fixed Income | -8.18 |

| segment | EMEA | Fixed Income | -8.54 |

| Risk | LONG SHORT | Fixed Income | -10.61 |

| country | TURKEY | Equity | -12.48 |

| segment | GCC | Mixed Allocation | -12.61 |

| country | RUSSIA | Fixed Income | -13.86 |

| region | AFRICAN REGION | Equity | -13.86 |

| country | POLAND | Equity | -16.37 |

| country | ISRAEL | Equity | -19.20 |

| Risk | INFLATION PROTECTED | Brazil | -21.35 |

| Risk | GOVERNMENT BOND | Fixed Income | -24.07 |

| country | AUSTRALIA | Equity | -24.72 |

| Size | SMALL-CAP | Equity | -42.78 |

| Commodities | INDUSTRIAL METALS | Commodity | -61.28 |

| country | SPAIN | Equity | -64.53 |

| segment | BRIC | Fixed Income | -72.57 |

| country | SOUTH AFRICA | Equity | -82.10 |

| region | NORTH AMERICAN REGION | Equity | -89.01 |

| country | KOREA | Equity | -107.37 |

| region | EASTERN EUROPEAN REGION | Equity | -116.72 |

| industry | INDUSTRIAL SECTOR | Equity | -183.07 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -192.44 |

| industry | NATURAL RESOURCES SECTOR | Equity | -194.58 |

| country | UNITED KINGDOM | Equity | -211.37 |

| Country | TAIWAN | Equity | -256.35 |

| country | BRAZIL | Fixed Income | -271.92 |

| region | NORDIC REGION | Equity | -296.87 |

| country | RUSSIA | Equity | -330.53 |

| Risk | LONG SHORT | Alternative | -343.39 |

| Risk | LONG SHORT | Equity | -405.81 |

| country | JAPAN | Equity | -672.34 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -720.57 |

| industry | HEALTH CARE SECTOR | Equity | -807.09 |

| Risk | INFLATION PROTECTED | Fixed Income | -810.65 |

| Size | MID-CAP | Equity | -880.17 |

| segment | EMERGING MARKETS | Equity | -1474.71 |

| region | EUROPEAN REGION | Fixed Income | -1532.90 |

| segment | DEVELOPED MARKETS | Equity | -1633.57 |

| region | EUROPEAN REGION | Equity | -2303.87 |

| Size | LARGE-CAP | Equity | -3179.93 |

| country | CHINA | Equity | -3646.41 |

| Commodities | PRECIOUS METALS | Commodity | -3795.95 |

Fund flows YTD

| Focus | Objective | Asset Class | Flow USD mn |

| segment | EMERGING MARKETS | Equity | 13701.04 |

| Size | LARGE-CAP | Equity | 13508.94 |

| industry | HEALTH CARE SECTOR | Equity | 11857.08 |

| industry | UTILITIES SECTOR | Equity | 2850.41 |

| region | ASIAN PACIFIC REGION | Fixed Income | 1678.22 |

| Size | MID-CAP | Equity | 1660.22 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 1486.05 |

| industry | COMMUNICATIONS SECTOR | Equity | 1370.07 |

| Risk | GOVERNMENT BOND | Fixed Income | 1306.02 |

| region | LATIN AMERICAN REGION | Fixed Income | 1154.48 |

| industry | REAL ESTATE SECTOR | Equity | 1013.35 |

| country | UNITED KINGDOM | Equity | 974.94 |

| country | BRAZIL | Equity | 936.38 |

| region | EUROPEAN REGION | Mixed Allocation | 806.95 |

| country | KOREA | Equity | 712.40 |

| Size | SMALL-CAP | Equity | 680.68 |

| region | LATIN AMERICAN REGION | Equity | 631.29 |

| Sector | CONSUMER DISCRETIONARY | Equity | 628.38 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | 574.40 |

| country | AUSTRALIA | Fixed Income | 384.13 |

| Commodities | PRECIOUS METAL SECTOR | Equity | 380.63 |

| segment | BRIC | Equity | 202.44 |

| industry | INDUSTRIAL SECTOR | Equity | 149.46 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | 121.33 |

| Commodities | INDUSTRIAL METALS | Commodity | 89.49 |

| Sector | CONSUMER STAPLES | Equity | 86.27 |

| country | JAPAN | Fixed Income | 85.25 |

| segment | GCC | Fixed Income | 36.01 |

| region | NORTH AMERICAN REGION | Fixed Income | 30.25 |

| Risk | GOVERNMENT BOND | Alternative | 27.44 |

| Risk | GOVERNMENT BOND | Mixed Allocation | 19.73 |

| Country | EGYPT | Equity | 18.02 |

| segment | GCC | Mixed Allocation | 12.77 |

| region | EASTERN EUROPEAN REGION | Fixed Income | 12.15 |

| Size | MID-CAP | Commodity | 4.27 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Risk | GOVERNMENT BOND | Equity | -0.12 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.58 |

| Risk | LONG SHORT | Mixed Allocation | -1.77 |

| country | AUSTRALIA | Mixed Allocation | -1.82 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -2.25 |

| industry | MULTIPLE SECTOR | Equity | -2.88 |

| segment | EMEA | Fixed Income | -5.10 |

| country | POLAND | Equity | -8.96 |

| segment | MENA | Fixed Income | -11.00 |

| country | ISRAEL | Equity | -16.86 |

| segment | EMEA | Equity | -17.88 |

| country | JAPAN | Mixed Allocation | -18.92 |

| region | MIDDLE EAST REGION | Fixed Income | -19.88 |

| country | CHINA | Fixed Income | -21.25 |

| segment | GCC | Equity | -21.36 |

| Risk | LONG SHORT | Fixed Income | -29.83 |

| segment | MENA | Equity | -31.63 |

| Risk | INFLATION PROTECTED | Brazil | -34.69 |

| country | SOUTH AFRICA | Equity | -43.50 |

| country | RUSSIA | Fixed Income | -53.81 |

| Sector | AGRICULTURE | Commodity | -77.01 |

| country | INDIA | Fixed Income | -85.06 |

| region | AFRICAN REGION | Equity | -114.69 |

| region | MIDDLE EAST REGION | Equity | -115.66 |

| segment | BRIC | Fixed Income | -135.97 |

| industry | TECHNOLOGY SECTOR | Equity | -167.69 |

| country | TURKEY | Equity | -186.44 |

| country | AUSTRALIA | Equity | -243.15 |

| region | EASTERN EUROPEAN REGION | Equity | -265.35 |

| Commodities | PRECIOUS METALS | Commodity | -265.54 |

| country | BRAZIL | Fixed Income | -461.99 |

| country | SPAIN | Equity | -549.71 |

| industry | BASIC MATERIALS SECTOR | Equity | -583.11 |

| country | INDIA | Equity | -617.99 |

| Country | TAIWAN | Equity | -621.27 |

| region | NORTH AMERICAN REGION | Equity | -866.40 |

| industry | ENERGY SECTOR | Equity | -879.51 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -893.49 |

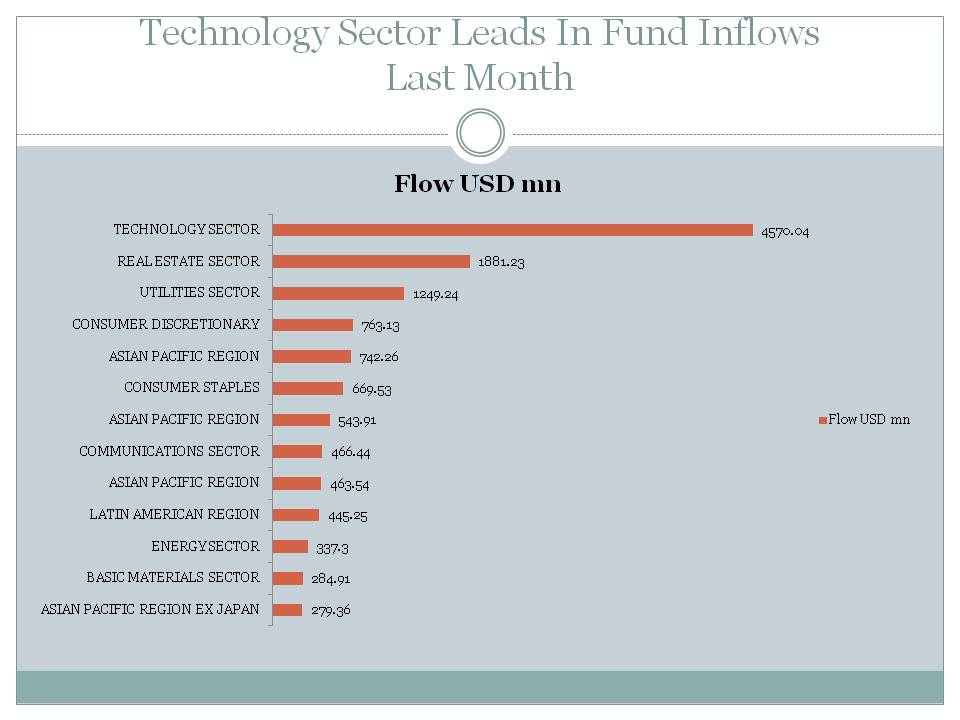

| country | RUSSIA | Equity | -1037.52 |

| industry | FINANCIAL SECTOR | Equity | -1229.10 |

| Risk | LONG SHORT | Equity | -1392.21 |

| industry | NATURAL RESOURCES SECTOR | Equity | -1470.75 |

| region | ASIAN PACIFIC REGION | Equity | -1800.31 |

| region | NORDIC REGION | Equity | -1804.71 |

| segment | DEVELOPED MARKETS | Equity | -2286.80 |

| Risk | LONG SHORT | Alternative | -2620.60 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | -2793.20 |

| country | CHINA | Equity | -2822.61 |

| region | EUROPEAN REGION | Fixed Income | -3752.75 |

| Risk | INFLATION PROTECTED | Fixed Income | -4220.74 |

| country | JAPAN | Equity | -7014.10 |

| region | EUROPEAN REGION | Equity | -12028.35 |

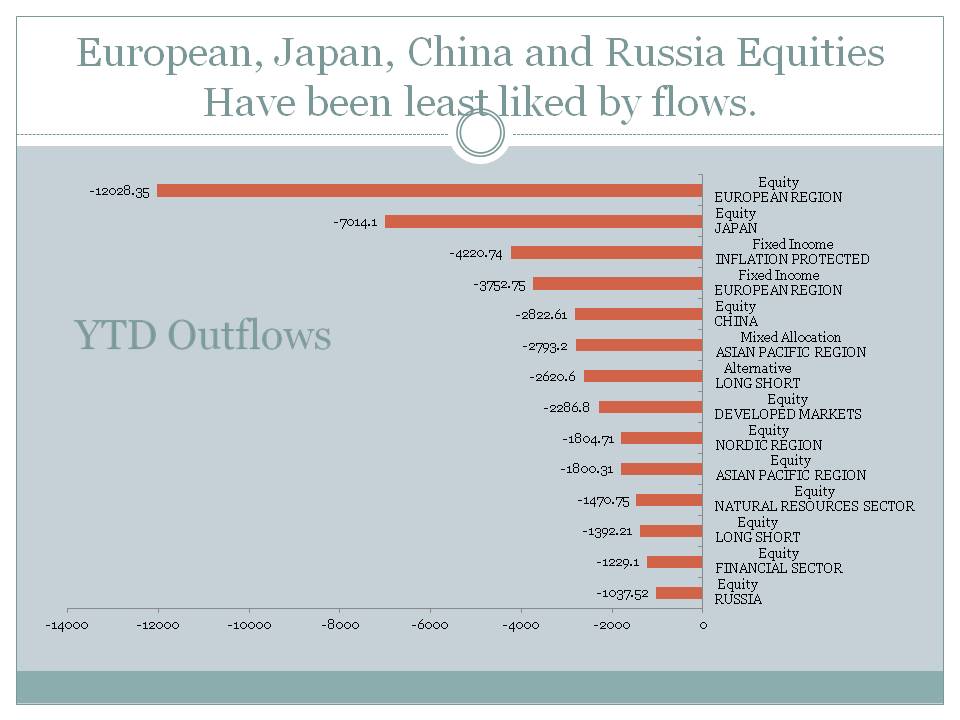

YTD Inflows By Fund Type USD mn

| type | ytdflow |

| CLOSED-END FUND | 823.9 |

| ETF | 20504.6 |

| FUND OF FUNDS | 5347.3 |

| OPEN-END FUND | -27642.7 |

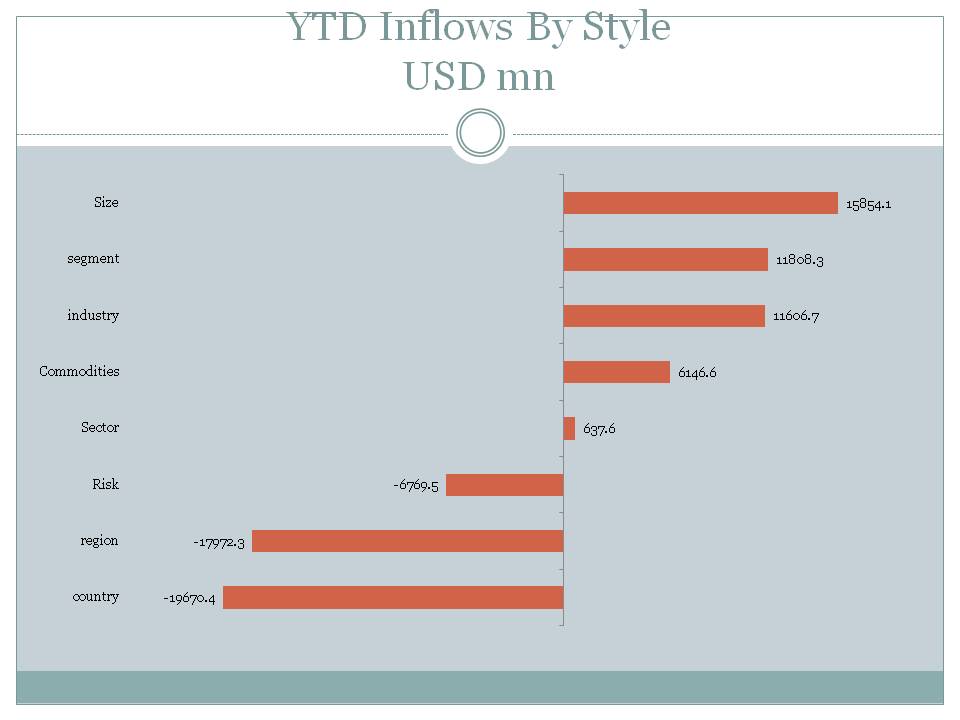

YTD Inflows By Style USD mn

| style | ytdflow |

| country | -19670.4 |

| region | -17972.3 |

| Risk | -6769.5 |

| Sector | 637.6 |

| Commodities | 6146.6 |

| industry | 11606.7 |

| segment | 11808.3 |

| Size | 15854.1 |

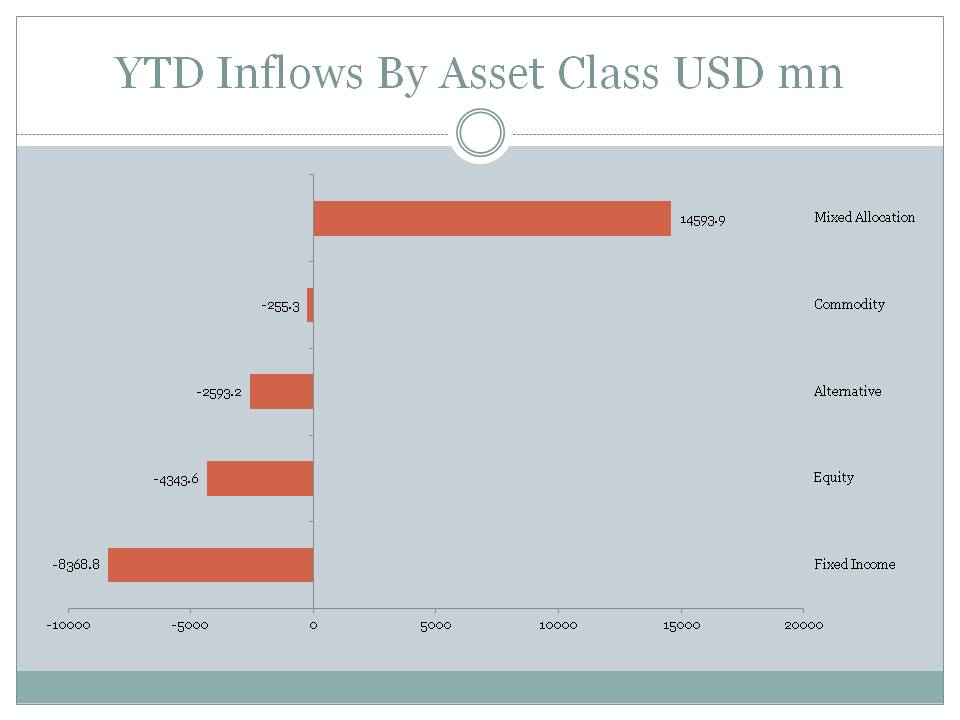

YTD Inflows By Asset Class USD mn

| assclass | ytdflow |

| Fixed Income | -8368.8 |

| Equity | -4343.6 |

| Alternative | -2593.2 |

| Commodity | -255.3 |

| Mixed Allocation | 14593.9 |

Biggest Fund Inflows YTD By Management Company

| manager | flowytd |

| Vanguard | 16147.2 |

| Nikkei | 12809.7 |

| TOPIX | 11583.3 |

| iShares | 7535.9 |

| Fidelity | 3283.8 |

| American | 2099.5 |

| UBS | 1587.4 |

| Consumer | 1495.9 |

| Pictet | 1379.3 |

| Eastspring | 1359.8 |

| Schwab | 1251.3 |

| T. | 1210.7 |

| FPA | 1105.8 |

| Compass | 1027.0 |

| Franklin | 743.0 |

| DWS | 716.1 |

| Assurance | 624.9 |

| Deutsche | 589.7 |

| Janus | 583.2 |

| Matws | 415.9 |

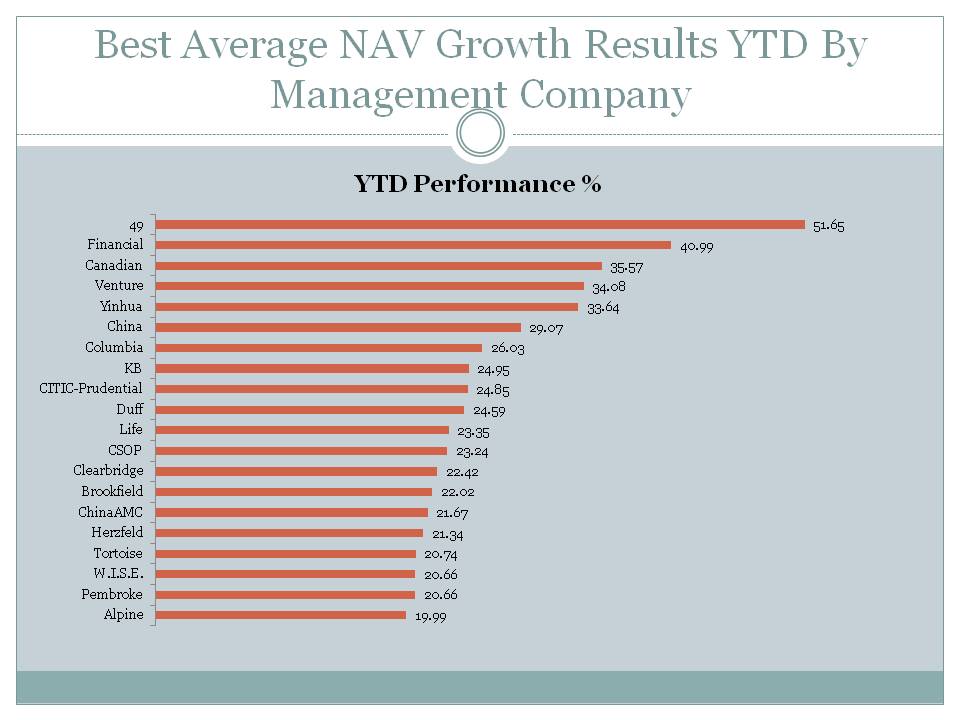

Best Average NAV Growth Results YTD By Mngmt Company

| manager | YTDPerfPct |

| 49 | 51.65 |

| Financial | 40.99 |

| Canadian | 35.57 |

| Venture | 34.08 |

| Yinhua | 33.64 |

| China | 29.07 |

| Columbia | 26.03 |

| KB | 24.95 |

| CITIC-Prudential | 24.85 |

| Duff | 24.59 |

| Life | 23.35 |

| CSOP | 23.24 |

| Clearbridge | 22.42 |

| Brookfield | 22.02 |

| ChinaAMC | 21.67 |

| Herzfeld | 21.34 |

| Tortoise | 20.74 |

| W.I.S.E. | 20.66 |

| Pembroke | 20.66 |

| Alpine | 19.99 |

Biggest Fund Outflows YTD By Management Company

| manager | flowytd |

| SPDR | -14155.2 |

| Invesco | -4451.0 |

| Ivy | -3685.8 |

| db | -3646.1 |

| First | -2863.5 |

| WisdomTree | -2399.6 |

| Plato | -2220.0 |

| BlueBay | -1982.2 |

| Boston | -1677.8 |

| FI | -1557.8 |

| BlackRock | -1456.0 |

| PIMCO | -1416.3 |

| Allianz | -1359.3 |

| Henderson | -1338.9 |

| JPMorgan | -1232.0 |

| HSBC | -1137.4 |

| Lyxor | -1104.0 |

| Hang | -1053.4 |

| Aberdeen | -1047.8 |

| AXA | -853.9 |

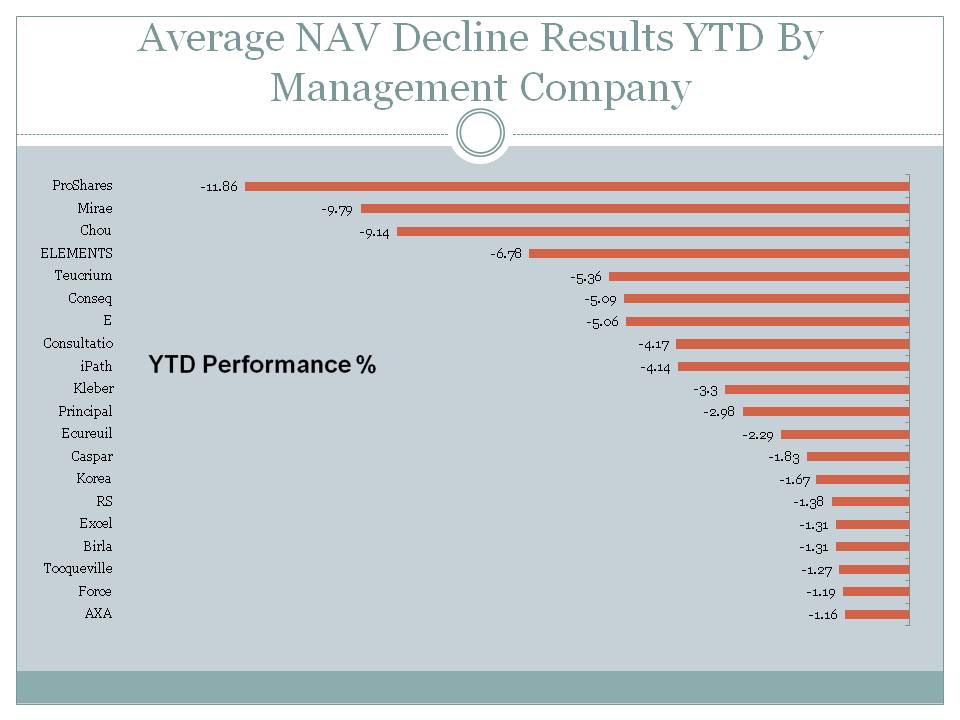

Average NAV Decline Results YTD By Management Company

| manager | YTDPerfPct |

| ProShares | -11.86 |

| Mirae | -9.79 |

| Chou | -9.14 |

| ELEMENTS | -6.78 |

| Teucrium | -5.36 |

| Conseq | -5.09 |

| E | -5.06 |

| Consultatio | -4.17 |

| iPath | -4.14 |

| Kleber | -3.30 |

| Principal | -2.98 |

| Ecureuil | -2.29 |

| Caspar | -1.83 |

| Korea | -1.67 |

| RS | -1.38 |

| Excel | -1.31 |

| Birla | -1.31 |

| Tocqueville | -1.27 |

| Force | -1.19 |

| AXA | -1.16 |

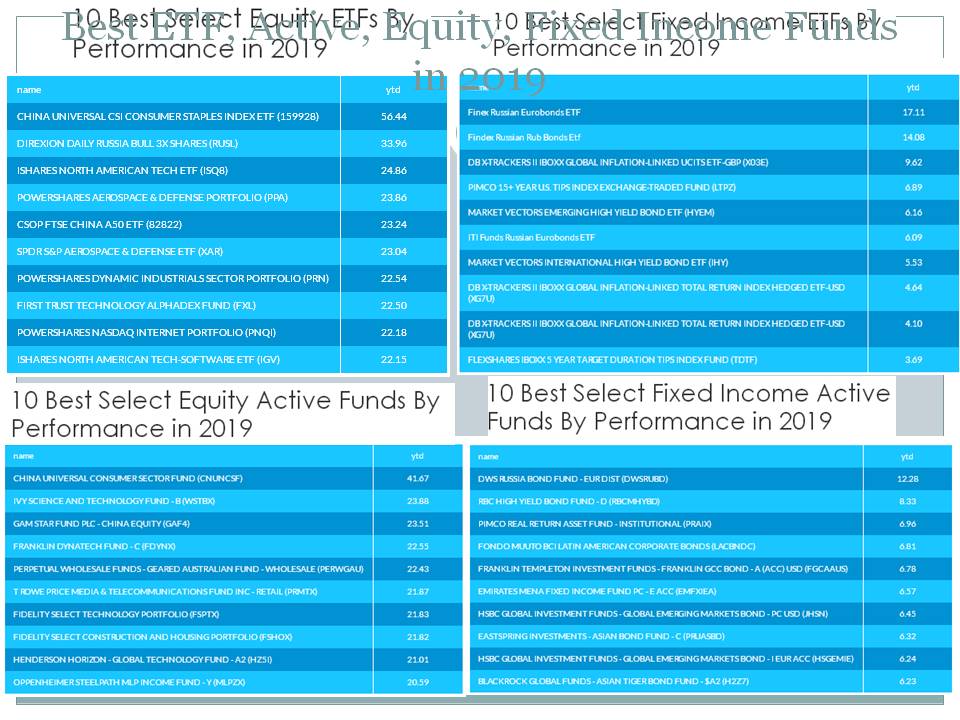

10 Best Select Equity ETFs By Performance in 2019

| name | ytd |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 56.44 |

| DIREXION DAILY RUSSIA BULL 3X SHARES (RUSL) | 33.96 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | 24.86 |

| POWERSHARES AEROSPACE & DEFENSE PORTFOLIO (PPA) | 23.86 |

| CSOP FTSE CHINA A50 ETF (82822) | 23.24 |

| SPDR S&P AEROSPACE & DEFENSE ETF (XAR) | 23.04 |

| POWERSHARES DYNAMIC INDUSTRIALS SECTOR PORTFOLIO (PRN) | 22.54 |

| FIRST TRUST TECHNOLOGY ALPHADEX FUND (FXL) | 22.50 |

| POWERSHARES NASDAQ INTERNET PORTFOLIO (PNQI) | 22.18 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | 22.15 |

10 Best Select Fixed Income ETFs By Performance in 2019

| name | ytd |

| Finex Russian Eurobonds ETF | 17.11 |

| Findex Russian Rub Bonds Etf | 14.08 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED UCITS ETF-GBP (X03E) | 9.62 |

| PIMCO 15+ YEAR U.S. TIPS INDEX EXCHANGE-TRADED FUND (LTPZ) | 6.89 |

| MARKET VECTORS EMERGING HIGH YIELD BOND ETF (HYEM) | 6.16 |

| ITI Funds Russian Eurobonds ETF | 6.09 |

| MARKET VECTORS INTERNATIONAL HIGH YIELD BOND ETF (IHY) | 5.53 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 4.64 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 4.10 |

| FLEXSHARES IBOXX 5 YEAR TARGET DURATION TIPS INDEX FUND (TDTF) | 3.69 |

10 Best Select Equity Active Funds By Performance in 2019

| name | ytd |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | 41.67 |

| IVY SCIENCE AND TECHNOLOGY FUND - B (WSTBX) | 23.88 |

| GAM STAR FUND PLC - CHINA EQUITY (GAF4) | 23.51 |

| FRANKLIN DYNATECH FUND - C (FDYNX) | 22.55 |

| PERPETUAL WHOLESALE FUNDS - GEARED AUSTRALIAN FUND - WHOLESALE (PERWGAU) | 22.43 |

| T ROWE PRICE MEDIA & TELECOMMUNICATIONS FUND INC - RETAIL (PRMTX) | 21.87 |

| FIDELITY SELECT TECHNOLOGY PORTFOLIO (FSPTX) | 21.83 |

| FIDELITY SELECT CONSTRUCTION AND HOUSING PORTFOLIO (FSHOX) | 21.82 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 21.01 |

| OPPENHEIMER STEELPATH MLP INCOME FUND - Y (MLPZX) | 20.59 |

10 Best Select Fixed Income Active Funds By Performance in 2019

| name | ytd |

| DWS RUSSIA BOND FUND - EUR DIST (DWSRUBD) | 12.28 |

| RBC HIGH YIELD BOND FUND - D (RBCMHYBD) | 8.33 |

| PIMCO REAL RETURN ASSET FUND - INSTITUTIONAL (PRAIX) | 6.96 |

| FONDO MUUTO BCI LATIN AMERICAN CORPORATE BONDS (LACBNDC) | 6.81 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - FRANKLIN GCC BOND - A (ACC) USD (FGCAAUS) | 6.78 |

| EMIRATES MENA FIXED INCOME FUND PC - E ACC (EMFXIEA) | 6.57 |

| HSBC GLOBAL INVESTMENT FUNDS - GLOBAL EMERGING MARKETS BOND - PC USD (JHSN) | 6.45 |

| EASTSPRING INVESTMENTS - ASIAN BOND FUND - C (PRUASBD) | 6.32 |

| HSBC GLOBAL INVESTMENT FUNDS - GLOBAL EMERGING MARKETS BOND - I EUR ACC (HSGEMIE) | 6.24 |

| BLACKROCK GLOBAL FUNDS - ASIAN TIGER BOND FUND - $A2 (H2Z7) | 6.23 |

Chart: May 2019 Fund Altas

Technology Sector Leads In Fund Inflows Last Month

Significant Outflows From Precious Metals Last Month

Emerging Markets and Large Caps Have Been the Darling Destination for Investment YTD

European, Japan, China and Russia Equities Have been least liked by flows.

YTD Inflows By Fund Type USD mn

YTD Inflows By Style USD mn

YTD Inflows By Asset Class USD mn

Biggest Fund Inflows YTD By Management Company

Best Average NAV Growth Results YTD By Management Company

Biggest Fund Outflows YTD By Management Company

Average NAV Decline Results YTD By Management Company

Best ETF, Active, Equity, Fixed Income Funds in 2019

Source: ML

Download All Slides in Power Point

Download All Slides in Power PointKey Topics and News

- Time to shop? 150 stocks at attractive valuations vs historical levels

- Kraken opposes Canadian regulators' proposed changes to crypto ...

- Ripple's quarterly reports understated XRP released from escrow by ...

- Where has all the money gone? US-China trade war triggers capital ...

- Time to cast your vote in the Eurovision fund contest

- SMH: $26.45 Million in Fund Outflows in Trailing 12-Month Period ...

- China's 'funds by phone' culture leads the world | Financial Times

- Time to cast your vote in the Eurovision fund contest | Financial Times

- Time to shop? 150 stocks at attractive valuations vs historical levels ...

- IT & ITeS Industry in India: Market Size, Opportunities, Growth...IBEF

- IT & ITeS Industry in India: Market Size, Opportunities, Growth...IBEF

- (PDF).pdf - Vostok Emerging Finance

- Market Returns and Mutual Fund Flows - Federal Reserve Bank of ...

- 2019 Investment Management Industry Outlook | Deloitte US

- Global Private Equity Report 2019 - Bain & Company

Source: ML

- Trade War Talks and Geopolitics Will Continue Guiding Metals ...

- Commodities for the Trump-China trade war: Gold for bears, copper ...

- Global ETF Holdings Decline During April

- Read This if You're Frustrated With Gold Right Now

- GLD: Key Players Are Guiding Markets

- COLUMN: Commodities for the Trump-China trade war: Gold for ...

- Vanguard Dropping 'Precious Metals'; Traders Ask Is This The ...

- Why Palladium's Suddenly an Especially Precious Metal: QuickTake ...

- A Silver Price Forecast For 2019 | Investing Haven

- Precious Metals are Finally on the Move - FXStreet

- 2019 precious metals forecast survey - LBMA

- Precious Metals Report 2019 - Swiss Resource Capital AG

- Precious Metals Watch - Strong conviction in higher prices - Insights

- (PDF) Substantial Outflows of Platinum Group Metals Identified ...

- A Review of Precious Metals in 2018 and The Outlook for ... - Mindex

Source: ML

- Colony Capital Inc (CLNY) Q1 2019 Earnings Call Transcript

- Why is China's Stock Market In A Bull Market Despite The Trade War?

- Local market pares gains after RBA rate hold

- The 19 Best ETFs to Buy for a Prosperous 2019

- Bad year for big caps

Source: ML

- MORNING BID EUROPE-As EU vote nears, White House welcomes ...

- Trump to meet Xi after defiant China slaps US with $60 bil in new tariffs

- Russia in Review, May 10-17, 2019

- EU welcomes auto tariff delay and says ready to negotiate deal

- 7 French fighter jets make emergency landing in Indonesia

Source: ML

- The Majority of Retirees Spend Below Their Income, a New Study ...

- Victory Capital Holdings, Inc. (VCTR) Q1 2019 Earnings Call ...

- 5 Cheap Stocks to Buy in 2019

- Edited Transcript of OTEX.TO earnings conference call or ...

- Broadridge Financial Solutions Inc (BR) Q3 2019 Earnings Call ...

Source: ML

- Assets Invested In Global ETF/ETP Industry Reached Record $5.57 ...

- The Language Around Bitcoin Has Changed: Professionals Are ...

- A Lens Over Two Stocks – CUV, AD8

- The Year's ETF Inflows Near $80B

- Victory Capital Reports First Quarter 2019 Financial Results

Source: ML

- The Year's ETF Inflows Near $80B

- First Weekly ETF Outflows In 6 Weeks

- Calian Reports Second Quarter Results

- Latin American M&A Slowly Coming Back To Life

- Edited Transcript of AZM.MI earnings conference call or presentation ...

Source: ML

- 4 Best Vanguard Mutual Funds From Q1

- 'TAWK' ETF Claims Largest Leveraged Gain in AUM

- Weekly Commentary: Officially On 'Periphery' Contagion Watch

- May MFI Features: Prime Comeback; ICI Fact Book; SSGA Files ESG ...

- The Net Inflows Of Communication Services Select Sector SPDR ...

Source: ML

- Can Washington Federal, Inc. (WAFD) And Navistar International ...

- Wednesday's analyst upgrades and downgrades

- Navistar International Corporation (NAV) have in prospect to touch ...

- Reviewing REGENXBIO Inc. (RGNX)'s and Fortress Biotech Inc ...

- MUTUAL FUNDS & ETFs

Source: ML

- Weekly Commentary: Deal Or No Deal

- The Net Inflows Of Communication Services Select Sector SPDR ...

- The Net Flows Of Vanguard S&P 500 ETF Point to $-535.31M ...

- Credit Suisse investor survey reveals increasing capital flows to ...

- Hedge Fund and Insider Trading News: Crispin Odey, BlueMountain ...

Source: ML

- Net Asset Value as at 31 March 2019

- Navistar International Corporation (NAV) have in prospect to touch ...

- Wednesday's analyst upgrades and downgrades

- Blackrock Inc. Securities Approach Crash Level Declines

- Takeaways From The Citi Global Real Estate Conference

Source: ML

- The Woman Who Predicted the 2018 Stock Market Volatility Blowup ...

- Why Smart-Beta ETFs Protect Investors

- 5 Active Vanguard Funds That You Have to Own

- Wunderlich Securities, Inc. Buys PIMCO Active Bond Exchange ...

- The Best Fintech Stocks to Buy in 2019 and Beyond

Source: ML

Emerging markets fund flow showed -1474.7 USD mn of outflow.. While Frontier Markets funds showed -0.2 USD mn of outflows.

BRAZIL Equity funds showed 52.6 USD mn of inflow.

BRAZIL Fixed Income funds showed -271.9 USD mn of outflow.

CHINA Equity funds showed -3646.4 USD mn of outflow.

CHINA Fixed Income funds showed -6.9 USD mn of outflow.

INDIA Equity funds showed 110.7 USD mn of inflow.

INDIA Fixed Income funds showed -8.2 USD mn of outflow.

KOREA Equity funds showed -107.4 USD mn of outflow.

RUSSIA Equity funds showed -330.5 USD mn of outflow.

RUSSIA Fixed Income funds showed -13.9 USD mn of outflow.

SOUTH AFRICA Equity funds showed -82.1 USD mn of outflow.

TURKEY Equity funds showed -12.5 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed 466.4 USD mn of inflow.

ENERGY SECTOR Equity funds showed 337.3 USD mn of inflow.

ENERGY SECTOR Mixed Allocation funds showed -0.3 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed 162.2 USD mn of inflow.

REAL ESTATE SECTOR Equity funds showed 1881.2 USD mn of inflow.

TECHNOLOGY SECTOR Equity funds showed 4570.0 USD mn of inflow.

UTILITIES SECTOR Equity funds showed 1249.2 USD mn of inflow.

LONG SHORT Alternative funds showed -343.4 USD mn of outflow.

LONG SHORT Equity funds showed -405.8 USD mn of outflow.

LONG SHORT Fixed Income funds showed -10.6 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed -1.0 USD mn of outflow.

Latest ML Comics

Markets

Market performance is between 2019-04-01 and 2019-03-01Best global markets since the begining of the week USA +2.19%, EFM ASIA +2.14%, EM (EMERGING MARKETS) +1.76%,

While worst global markets since the begining of the week EM LATIN AMERICA 0.26%, EUROPE 0.96%, FM (FRONTIER MARKETS) 1.24%,

Best since the start of the week among various stock markets were KUWAIT +9.24%, INDIA +8.58%, ROMANIA +7.25%, KENYA +5.69%, SAUDI ARABIA DOMESTIC +5.34%, SERBIA +5.30%, COLOMBIA +4.86%, BAHRAIN +4.64%, NEW ZEALAND +4.45%, PERU +3.15%,

While worst since the start of the week among various stock markets were ZIMBABWE -23.72%, TURKEY -11.04%, JORDAN -7.51%, BULGARIA -5.97%, ARGENTINA -5.57%, PAKISTAN -5.49%, MAURITIUS -5.34%, QATAR -3.94%, MALAYSIA -3.92%, NIGERIA -3.59%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| YINHUA CONSUMPTION THEME FUND (150048) | 4.18 | 4.10 | 78.13 | 75.96 | 7.90 | 23.04 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 5.90 | 3.84 | 56.44 | 58.50 | 12.49 | 20.18 |

| GLOBAL 10 LARGE CAP INDEX FUND (GLLCIFD) | 2.93 | 1.43 | 19.61 | 21.01 | 29.79 | 13.79 |

| COHEN & STEERS TOTAL RETURN REALTY FUND INC (RFI) | 3.00 | 3.95 | 30.99 | 20.49 | 20.96 | 12.10 |

| REAVES UTILITY INCOME FUND (UTG) | 2.62 | 0.79 | 19.00 | 13.90 | 30.92 | 12.06 |

| COHEN & STEERS QUALITY INCOME REALTY FUND INC (RQI) | 1.46 | 2.10 | 30.62 | 18.23 | 25.78 | 11.89 |

| DB PHYSICAL RHODIUM ETC (XRH0) | -2.67 | 1.30 | 16.94 | 13.33 | 34.48 | 11.61 |

| GABELLI UTILITY TRUST (GUT) | 0.88 | -1.15 | 19.01 | 14.53 | 30.51 | 11.19 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | -0.84 | -3.21 | 41.67 | 38.31 | 5.51 | 9.94 |

| COHEN & STEERS QUALITY INCOME REALTY FUND INC (XRQIX) | 1.98 | 0.16 | 21.34 | 12.72 | 23.50 | 9.59 |

| MFC PROPERTY WEALTH FUND (MPROPTY) | 0.52 | 0.54 | 15.63 | 14.42 | 20.42 | 8.98 |

| BLACKROCK UTILITY AND INFRASTRUCTURE TRUST (BUI) | 2.82 | 0.19 | 11.61 | 15.38 | 16.28 | 8.67 |

| ISHARES COHEN & STEERS REIT ETF (ICF) | 1.93 | -0.37 | 17.46 | 10.25 | 22.77 | 8.65 |

| COHEN & STEERS REALTY SHARES INC (CSRSX) | 1.66 | 0.44 | 19.00 | 11.77 | 20.38 | 8.56 |

| NEUBERGER BERMAN REAL ESTATE SECURITIES INCOME FUND INC (NRO) | 1.20 | 2.23 | 25.58 | 14.82 | 15.77 | 8.50 |

| DFA REAL ESTATE SECURITIES PORTFOLIO - INSTITUTIONAL (DFREX) | 1.83 | -0.16 | 17.66 | 10.40 | 21.79 | 8.47 |

| NEUBERGER BERMAN REAL ESTATE SECURITIES INCOME FUND INC (XNROX) | 1.47 | -0.72 | 21.33 | 11.36 | 20.86 | 8.24 |

| FRANKLIN UTILITIES FUND - C (FRUSX) | 2.12 | 0.55 | 12.86 | 9.13 | 21.06 | 8.22 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | -1.22 | -1.41 | 22.15 | 17.50 | 17.65 | 8.13 |

| CIMB - PRINCIPAL PROPERTY INCOME FUND - IPROP A (CIMPPIA) | 0.80 | 1.77 | 14.44 | 14.68 | 14.94 | 8.05 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| 49 NORTH RESOURCES INC (FNR) | -25.06 | -50.43 | 51.65 | -26.81 | -55.96 | -39.57 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 4.50 | -0.04 | -34.33 | -82.49 | -56.38 | -33.60 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -1.37 | -31.56 | 10.90 | -8.13 | -53.48 | -23.63 |

| RS GLOBAL NATURAL RESOURCES FUND - C (RGNCX) | -2.96 | -12.64 | -1.38 | -27.27 | -46.73 | -22.40 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -3.12 | -10.85 | -27.25 | -29.77 | -45.75 | -22.37 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -10.33 | -17.19 | -2.22 | -18.47 | -39.19 | -21.30 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -14.09 | -13.61 | -6.45 | -20.94 | -33.83 | -20.62 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -2.97 | -14.30 | 9.34 | -18.85 | -44.90 | -20.26 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -1.66 | -13.10 | -16.38 | -17.43 | -35.18 | -16.84 |

| LYXOR ETF TURKEY EURO (TURU) | 0.46 | -10.34 | -13.88 | -15.94 | -34.25 | -15.02 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 0.20 | -10.43 | -13.78 | -15.17 | -33.45 | -14.71 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.15 | -10.38 | -13.87 | -15.34 | -33.07 | -14.66 |

| MIRAE ROGERS AGRICULTURAL PRODUCT INDEX SPECIAL ASSET INVEST CMDTY-DERIVATIVE (5620974) | -4.10 | -11.74 | -14.57 | -16.15 | -26.40 | -14.60 |

| IPATH DOW JONES-UBS COFFEE SUBINDEX TOTAL RETURN ETN (JO) | 2.19 | -3.35 | -15.19 | -25.87 | -31.26 | -14.57 |

| SANTANDER FIC FI VALE 3 ACOES (REALRIO) | -4.36 | -10.51 | -10.43 | -21.82 | -20.75 | -14.36 |

| SAFRA VALE DO RIO DOCE FIC FIA (SAFVRDA) | -4.34 | -10.47 | -10.24 | -21.60 | -20.62 | -14.26 |

| ETFS WHEAT (OD7S) | -3.92 | -9.74 | -18.80 | -18.98 | -21.68 | -13.58 |

| BARING KOREA FEEDER FUND (BRGKORI) | -6.05 | -11.45 | -6.32 | -9.02 | -27.04 | -13.39 |

| BB ACOES SIDERURGIA FICFI (BBACOSI) | -5.14 | -9.97 | -5.72 | -15.97 | -22.31 | -13.35 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -1.01 | -8.14 | 11.35 | -14.77 | -29.17 | -13.27 |

Best Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 5.87 | 56.44 | 5.90 | 3.84 | 58.50 | 12.49 | 20.18 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.61 | 78.13 | 4.18 | 4.10 | 75.96 | 7.90 | 23.04 |

| DB X-TRACKERS FTSE VIETNAM UCITS ETF (XVTD) | 0.81 | 11.09 | 3.03 | -2.43 | 10.95 | -9.92 | 0.41 |

| BARRAMUNDI LTD (BRM) | 1.35 | 6.91 | 2.97 | 0.14 | -0.09 | 8.06 | 2.77 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 0.72 | -15.48 | 2.54 | 3.82 | -13.42 | 1.71 | -1.34 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.85 | -8.00 | 2.44 | 7.78 | -4.06 | 8.81 | 3.74 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.13 | -18.34 | 2.31 | 5.49 | -10.56 | 1.41 | -0.34 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | -0.24 | -2.67 | 2.25 | -4.57 | 4.68 | -14.85 | -3.12 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | 0.08 | -15.41 | 2.11 | -0.30 | -8.28 | -0.86 | -1.83 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 2.11 | 61.33 | 1.92 | -4.01 | -2.71 | -13.18 | -4.50 |

| ETFS DAILY SHORT COPPER (SCOP) | -0.59 | -2.73 | 1.84 | 6.70 | 0.41 | 10.18 | 4.78 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (1323) | -0.25 | 10.50 | 1.83 | 1.57 | 11.30 | -18.65 | -0.99 |

| ETFS AGRICULTURE DJ-UBSCI (AIGA) | 0.49 | -7.79 | 1.78 | -4.64 | -9.28 | -19.33 | -7.87 |

| ISHARES EUROPEAN PROPERTY YIELD UCITS ETF (IPRP) | 0.69 | 11.81 | 1.69 | 1.06 | 4.92 | -1.31 | 1.59 |

| JPMORGAN FUNDS - RUSSIA FUND - A$ (FH5Q) | -0.14 | 14.76 | 1.51 | 0.98 | 12.27 | 6.73 | 5.37 |

| PICTET - EMERGING LOCAL CURRENCY DEBT (PJAC) | 0.65 | 2.02 | 1.44 | -2.44 | 2.62 | -3.44 | -0.45 |

| CONSUMER STAPLES SELECT SECTOR SPDR FUND (SD7I) | -0.38 | 16.27 | 1.42 | 2.13 | 4.50 | 19.90 | 6.99 |

| XETRA-GOLD (4GLD) | 0.08 | 1.68 | 1.34 | 0.78 | 6.29 | 0.38 | 2.20 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED UCITS ETF-CHF (XG7G) | 0.65 | 0.25 | 1.32 | 0.68 | 2.36 | 1.59 | 1.49 |

| ZKB GOLD ETF (ZGLD) | 0.11 | 1.71 | 1.31 | 0.67 | 6.02 | -0.36 | 1.91 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -1.37 | 24.44 | -6.18 | -16.79 | 10.30 | -20.90 | -8.39 |

| SAMSUNG KODEX 200 EXCHANGE TRADED FUNDS (1313) | 0.69 | 0.16 | -6.14 | -11.74 | -7.57 | -21.17 | -11.66 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -1.37 | 25.45 | -6.14 | -16.64 | 11.51 | -19.09 | -7.59 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF (XMIN) | -2.01 | -6.18 | -6.11 | -9.89 | -2.75 | -0.07 | -4.71 |

| HSBC CHINA DRAGON FUND (820) | -2.17 | 11.23 | -5.95 | -14.12 | 7.36 | -19.66 | -8.09 |

| ISHARES MSCI BRAZIL UCITS ETF (CSBR) | -0.46 | -0.84 | -5.70 | -4.73 | -4.09 | -6.05 | -5.14 |

| BNY MELLON GLOBAL FUNDS PLC - BRAZIL EQUITY FUND (HZ5R) | -2.34 | 0.98 | -5.69 | -4.15 | -4.58 | -2.73 | -4.29 |

| BLACKROCK GLOBAL FUNDS - LATIN AMERICA FUND - EURA2 (ERDP) | -2.39 | 1.24 | -5.66 | -5.71 | -2.61 | -4.96 | -4.74 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | 0.81 | 14.33 | -5.56 | -14.92 | 1.52 | -24.79 | -10.94 |

| ISHARES MSCI ITALY CAPPED ETF (ISVQ) | -1.17 | 6.71 | -5.21 | -8.46 | 5.19 | -19.03 | -6.88 |

| LYXOR ETF MSCI KOREA (KOR) | -0.16 | -3.10 | -5.16 | -11.48 | -5.43 | -22.04 | -11.03 |

| MERCANTILE INVESTMENT CO LTD (21IA) | -0.09 | -8.69 | -4.88 | -3.73 | -15.78 | -17.36 | -10.44 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | -0.03 | -12.84 | -4.71 | -10.35 | -6.81 | -22.21 | -11.02 |

| SPDR S&P METALS & MINING ETF (SSGG) | -0.58 | 4.98 | -4.64 | -9.32 | -11.93 | -25.84 | -12.93 |

| JPMORGAN FUNDS - KOREA EQUITY FUND (JR63) | 0.60 | -2.85 | -4.58 | -10.34 | -1.84 | -17.00 | -8.44 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | 0.62 | -1.95 | -4.35 | -11.41 | 0.47 | -18.81 | -8.52 |

| POWERSHARES DB AGRICULTURE FUND (P44A) | -0.08 | -9.19 | -4.27 | -8.62 | -9.03 | -17.96 | -9.97 |

| MIRAE ROGERS AGRICULTURAL PRODUCT INDEX SPECIAL ASSET INVEST CMDTY-DERIVATIVE (5620974) | -0.88 | -14.57 | -4.10 | -11.74 | -16.15 | -26.40 | -14.60 |

| GOLDMAN SACHS BRICS PORTFOLIO (GSBLU) | 0.51 | 11.07 | -4.07 | -7.33 | 9.61 | -6.99 | -2.20 |

| SCHRODER BRICS SECURITIES FEEDER INVESTMENT TRUST A - EQUITY (0525291) | -0.41 | 5.10 | -4.06 | -8.93 | 2.13 | -16.19 | -6.76 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.85 | -8.00 | 2.44 | 7.78 | -4.06 | 8.81 | 3.74 |

| ETFS DAILY SHORT COPPER (SCOP) | -0.59 | -2.73 | 1.84 | 6.70 | 0.41 | 10.18 | 4.78 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.13 | -18.34 | 2.31 | 5.49 | -10.56 | 1.41 | -0.34 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.61 | 78.13 | 4.18 | 4.10 | 75.96 | 7.90 | 23.04 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 5.87 | 56.44 | 5.90 | 3.84 | 58.50 | 12.49 | 20.18 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 0.72 | -15.48 | 2.54 | 3.82 | -13.42 | 1.71 | -1.34 |

| JUPITER EUROPEAN OPPORTUNITIES TRUST PLC (JEO) | 0.91 | 17.79 | -0.92 | 3.00 | 9.22 | -2.60 | 2.18 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 1.89 | 4.64 | 0.55 | 2.73 | 2.21 | 7.14 | 3.16 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (1559) | 1.19 | 10.61 | -0.01 | 2.39 | 8.48 | 0.02 | 2.72 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | -0.06 | -2.83 | 0.07 | 2.28 | -0.66 | -21.74 | -5.01 |

| CONSUMER STAPLES SELECT SECTOR SPDR FUND (SD7I) | -0.38 | 16.27 | 1.42 | 2.13 | 4.50 | 19.90 | 6.99 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 0.32 | 6.67 | 0.78 | 1.66 | -1.70 | 6.31 | 1.76 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (1323) | -0.25 | 10.50 | 1.83 | 1.57 | 11.30 | -18.65 | -0.99 |

| ISHARES EUROPEAN PROPERTY YIELD UCITS ETF (IPRP) | 0.69 | 11.81 | 1.69 | 1.06 | 4.92 | -1.31 | 1.59 |

| BLACKROCK GLOBAL FUNDS - ASIAN TIGER BOND FUND - $A2 (H2Z7) | 0.56 | 6.23 | 0.53 | 1.02 | 8.20 | 6.65 | 4.10 |

| ITI Funds Russian Eurobonds ETF | -0.54 | 6.09 | 0.37 | 0.99 | 7.79 | 7.19 | 4.09 |

| JPMORGAN FUNDS - RUSSIA FUND - A$ (FH5Q) | -0.14 | 14.76 | 1.51 | 0.98 | 12.27 | 6.73 | 5.37 |

| Findex Russian Rub Bonds Etf | 0.22 | 14.08 | 0.49 | 0.95 | 8.77 | 6.62 | 4.21 |

| SPDR GOLD SHARES (GLD) | -0.27 | 1.45 | 0.79 | 0.88 | 6.49 | -1.62 | 1.64 |

| GOLD BULLION SECURITIES LTD (GBS) | 0.29 | 1.03 | 1.28 | 0.79 | 6.14 | -0.11 | 2.03 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.85 | -8.00 | 2.44 | 7.78 | -4.06 | 8.81 | 3.74 |

| ETFS DAILY SHORT COPPER (SCOP) | -0.59 | -2.73 | 1.84 | 6.70 | 0.41 | 10.18 | 4.78 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.13 | -18.34 | 2.31 | 5.49 | -10.56 | 1.41 | -0.34 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.61 | 78.13 | 4.18 | 4.10 | 75.96 | 7.90 | 23.04 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 5.87 | 56.44 | 5.90 | 3.84 | 58.50 | 12.49 | 20.18 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 0.72 | -15.48 | 2.54 | 3.82 | -13.42 | 1.71 | -1.34 |

| JUPITER EUROPEAN OPPORTUNITIES TRUST PLC (JEO) | 0.91 | 17.79 | -0.92 | 3.00 | 9.22 | -2.60 | 2.18 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 1.89 | 4.64 | 0.55 | 2.73 | 2.21 | 7.14 | 3.16 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (1559) | 1.19 | 10.61 | -0.01 | 2.39 | 8.48 | 0.02 | 2.72 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | -0.06 | -2.83 | 0.07 | 2.28 | -0.66 | -21.74 | -5.01 |

| CONSUMER STAPLES SELECT SECTOR SPDR FUND (SD7I) | -0.38 | 16.27 | 1.42 | 2.13 | 4.50 | 19.90 | 6.99 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 0.32 | 6.67 | 0.78 | 1.66 | -1.70 | 6.31 | 1.76 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (1323) | -0.25 | 10.50 | 1.83 | 1.57 | 11.30 | -18.65 | -0.99 |

| ISHARES EUROPEAN PROPERTY YIELD UCITS ETF (IPRP) | 0.69 | 11.81 | 1.69 | 1.06 | 4.92 | -1.31 | 1.59 |

| BLACKROCK GLOBAL FUNDS - ASIAN TIGER BOND FUND - $A2 (H2Z7) | 0.56 | 6.23 | 0.53 | 1.02 | 8.20 | 6.65 | 4.10 |

| ITI Funds Russian Eurobonds ETF | -0.54 | 6.09 | 0.37 | 0.99 | 7.79 | 7.19 | 4.09 |

| JPMORGAN FUNDS - RUSSIA FUND - A$ (FH5Q) | -0.14 | 14.76 | 1.51 | 0.98 | 12.27 | 6.73 | 5.37 |

| Findex Russian Rub Bonds Etf | 0.22 | 14.08 | 0.49 | 0.95 | 8.77 | 6.62 | 4.21 |

| SPDR GOLD SHARES (GLD) | -0.27 | 1.45 | 0.79 | 0.88 | 6.49 | -1.62 | 1.64 |

| GOLD BULLION SECURITIES LTD (GBS) | 0.29 | 1.03 | 1.28 | 0.79 | 6.14 | -0.11 | 2.03 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.61 | 78.13 | 4.18 | 4.10 | 75.96 | 7.90 | 23.04 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 2.11 | 61.33 | 1.92 | -4.01 | -2.71 | -13.18 | -4.50 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 5.87 | 56.44 | 5.90 | 3.84 | 58.50 | 12.49 | 20.18 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | 3.22 | 43.89 | 0.30 | -13.33 | 19.51 | -3.97 | 0.63 |

| UNITED STATES OIL FUND LP (U9N) | -1.59 | 35.79 | -2.79 | -4.73 | 2.52 | -14.00 | -4.75 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.71 | 31.84 | -0.17 | -2.79 | 5.08 | -11.03 | -2.23 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -1.37 | 25.45 | -6.14 | -16.64 | 11.51 | -19.09 | -7.59 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | 0.94 | 24.86 | -3.26 | -2.16 | 13.28 | 10.67 | 4.63 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -1.37 | 24.44 | -6.18 | -16.79 | 10.30 | -20.90 | -8.39 |

| GAM STAR FUND PLC - CHINA EQUITY (GAF4) | 0.27 | 23.51 | -2.51 | -6.67 | 12.67 | -17.04 | -3.39 |

| CSOP FTSE CHINA A50 ETF (82822) | 1.78 | 23.24 | -0.09 | -6.95 | 15.33 | -4.67 | 0.90 |

| CHINAAMC ETF SERIES - CHINAAMC CSI 300 INDEX ETF (83188) | 1.46 | 21.67 | -0.05 | -8.75 | 13.72 | -11.05 | -1.53 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 0.57 | 21.01 | -2.81 | -3.19 | 12.24 | 3.46 | 2.43 |

| POLAR CAPITAL TECHNOLOGY TRUST PLC (PCT) | 1.21 | 20.90 | -2.28 | -2.01 | 13.36 | 1.94 | 2.75 |

| BOCI-PRUDENTIAL - W.I.S.E. - CSI CHINA TRACKER FUND (2827) | 1.50 | 20.66 | -0.74 | -9.63 | 13.71 | -12.43 | -2.27 |

| INDUSTRIAL SELECT SECTOR SPDR FUND (SD7X) | 0.39 | 20.59 | -1.63 | -2.89 | 5.37 | 2.72 | 0.89 |

| DB X-TRACKERS MSCI CANADA TRN INDEX UCITS ETF (D5BH) | 0.90 | 19.37 | -0.43 | -2.53 | 6.61 | -2.09 | 0.39 |

| ISHARES CORE S&P 500 ETF (ISQ2) | -1.43 | 18.25 | -0.11 | -0.62 | 6.87 | 8.10 | 3.56 |

| JUPITER EUROPEAN OPPORTUNITIES TRUST PLC (JEO) | 0.91 | 17.79 | -0.92 | 3.00 | 9.22 | -2.60 | 2.18 |

| Finex Russian Eurobonds ETF | -0.01 | 17.11 | 0.72 | 0.03 | 11.03 | 10.98 | 5.69 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -1.13 | -27.25 | -3.12 | -10.85 | -29.77 | -45.75 | -22.37 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | -0.13 | -18.34 | 2.31 | 5.49 | -10.56 | 1.41 | -0.34 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -2.06 | -16.38 | -1.66 | -13.10 | -17.43 | -35.18 | -16.84 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 0.72 | -15.48 | 2.54 | 3.82 | -13.42 | 1.71 | -1.34 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | 0.08 | -15.41 | 2.11 | -0.30 | -8.28 | -0.86 | -1.83 |

| MIRAE ROGERS AGRICULTURAL PRODUCT INDEX SPECIAL ASSET INVEST CMDTY-DERIVATIVE (5620974) | -0.88 | -14.57 | -4.10 | -11.74 | -16.15 | -26.40 | -14.60 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | -0.03 | -12.84 | -4.71 | -10.35 | -6.81 | -22.21 | -11.02 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | -0.02 | -10.86 | -1.37 | -3.25 | -10.09 | -3.56 | -4.57 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | -1.80 | -9.84 | 0.78 | -4.13 | -10.25 | -18.77 | -8.09 |

| POWERSHARES DB AGRICULTURE FUND (P44A) | -0.08 | -9.19 | -4.27 | -8.62 | -9.03 | -17.96 | -9.97 |

| MERCANTILE INVESTMENT CO LTD (21IA) | -0.09 | -8.69 | -4.88 | -3.73 | -15.78 | -17.36 | -10.44 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.85 | -8.00 | 2.44 | 7.78 | -4.06 | 8.81 | 3.74 |

| ETFS AGRICULTURE DJ-UBSCI (AIGA) | 0.49 | -7.79 | 1.78 | -4.64 | -9.28 | -19.33 | -7.87 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF (XMIN) | -2.01 | -6.18 | -6.11 | -9.89 | -2.75 | -0.07 | -4.71 |

| LYXOR ETF WIG20 (ETFW20L) | 0.08 | -6.18 | -1.98 | -9.57 | -1.49 | -8.66 | -5.43 |

| HSBC MSCI INDONESIA UCITS ETF (HIDD) | -0.42 | -5.61 | -3.86 | -8.26 | -2.33 | 2.66 | -2.95 |

| AMUNDI ETF MSCI EASTERN EUROPE EX RUSSIA UCITS ETF - EUR (CE9U) | 0.10 | -5.59 | -2.45 | -9.01 | -1.16 | -7.79 | -5.10 |

| E FUND GOLD THEME FUND QDII LOF (161116) | 0.58 | -5.06 | -1.23 | -6.08 | -1.17 | -8.52 | -4.25 |

| COMSTAGE ETF MSCI EM EASTERN EUROPE TRN UCITS ETF (CBNDUEEM) | -0.17 | -4.86 | -2.24 | -9.39 | -1.99 | -7.69 | -5.33 |

| HSBC MSCI MALAYSIA UCITS ETF (HMYR) | 0.01 | -4.65 | -1.82 | -3.23 | -5.30 | -14.80 | -6.29 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CONSUMER STAPLES SELECT SECTOR SPDR FUND (SD7I) | -0.38 | 16.27 | 1.42 | 2.13 | 4.50 | 19.90 | 6.99 |

| ISHARES GLOBAL INFRASTRUCTURE UCITS ETF (IDIN) | -0.41 | 13.36 | 0.43 | -0.71 | 9.10 | 13.96 | 5.70 |

| ISHARES GLOBAL INFRASTRUCTURE UCITS ETF (IQQI) | -0.49 | 13.86 | 0.24 | -0.61 | 9.03 | 13.25 | 5.48 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 5.87 | 56.44 | 5.90 | 3.84 | 58.50 | 12.49 | 20.18 |

| ISHARES MSCI RUSSIA ADR/GDR UCITS ETF (CEBB) | 1.10 | 16.37 | 0.82 | -1.50 | 10.58 | 11.21 | 5.28 |

| ISHARES DEVELOPED MARKETS PROPERTY YIELD UCITS ETF (IWDP) | 0.24 | 14.23 | 0.95 | -0.64 | 9.07 | 11.05 | 5.11 |

| Finex Russian Eurobonds ETF | -0.01 | 17.11 | 0.72 | 0.03 | 11.03 | 10.98 | 5.69 |

| HSBC MSCI RUSSIA CAPPED UCITS ETF $ (H4ZM) | -0.22 | 15.69 | 0.78 | -1.41 | 9.93 | 10.74 | 5.01 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | 0.94 | 24.86 | -3.26 | -2.16 | 13.28 | 10.67 | 4.63 |

| UBS ETF - MSCI SWITZERLAND 20/35 100% HEDGED TO USD UCITS ETF (S2USBH) | 0.14 | 16.84 | -2.14 | -0.14 | 10.44 | 10.59 | 4.69 |

| ETFS DAILY SHORT COPPER (SCOP) | -0.59 | -2.73 | 1.84 | 6.70 | 0.41 | 10.18 | 4.78 |

| LYXOR ETF MSCI WORLD TELECOMMUNICATION SERVICES TR (LYPI) | -0.35 | 13.21 | -2.37 | -2.75 | 7.93 | 9.56 | 3.09 |

| ITI Funds RTS ETF | 0.26 | 14.48 | 0.39 | -0.31 | 10.57 | 9.44 | 5.02 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.85 | -8.00 | 2.44 | 7.78 | -4.06 | 8.81 | 3.74 |

| DB X-TRACKERS - MSCI RUSSIA CAPPED INDEX UCITS ETF - 2D (XMRC) | 2.44 | 14.18 | 0.70 | -1.73 | 9.45 | 8.66 | 4.27 |

| ISHARES US TELECOMMUNICATIONS ETF (ISQC) | 1.09 | 12.49 | -1.99 | -6.49 | 1.89 | 8.19 | 0.40 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 0.50 | 4.87 | -0.03 | -1.49 | -1.60 | 8.18 | 1.27 |

| DB X-TRACKERS SMI UCITS ETF DR (XSMI) | 0.28 | 12.73 | -0.90 | -0.30 | 7.85 | 8.17 | 3.71 |

| ISHARES CORE S&P 500 ETF (ISQ2) | -1.43 | 18.25 | -0.11 | -0.62 | 6.87 | 8.10 | 3.56 |

| BARRAMUNDI LTD (BRM) | 1.35 | 6.91 | 2.97 | 0.14 | -0.09 | 8.06 | 2.77 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | -0.02 | 10.90 | -1.37 | -31.56 | -8.13 | -53.48 | -23.63 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -1.13 | -27.25 | -3.12 | -10.85 | -29.77 | -45.75 | -22.37 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -2.06 | -16.38 | -1.66 | -13.10 | -17.43 | -35.18 | -16.84 |

| MIRAE ROGERS AGRICULTURAL PRODUCT INDEX SPECIAL ASSET INVEST CMDTY-DERIVATIVE (5620974) | -0.88 | -14.57 | -4.10 | -11.74 | -16.15 | -26.40 | -14.60 |

| SPDR S&P METALS & MINING ETF (SSGG) | -0.58 | 4.98 | -4.64 | -9.32 | -11.93 | -25.84 | -12.93 |

| BLACKROCK GLOBAL FUNDS - WORLD ENERGY FUND (H2Z6) | -1.31 | 7.25 | -0.93 | -6.29 | -4.70 | -25.83 | -9.44 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | 0.81 | 14.33 | -5.56 | -14.92 | 1.52 | -24.79 | -10.94 |

| BLACKROCK GLOBAL FUNDS - WORLD MINING FUND (B92A) | -0.55 | 1.81 | -0.91 | -11.14 | -1.61 | -23.56 | -9.31 |

| BLACKROCK GLOBAL FUNDS - CHINA FUND - HEDGE EURA2 (H2ZP) | 0.46 | 7.77 | -1.41 | -8.66 | 2.10 | -23.40 | -7.84 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | -1.25 | 6.30 | -3.72 | -10.32 | 1.29 | -22.51 | -8.82 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | -0.03 | -12.84 | -4.71 | -10.35 | -6.81 | -22.21 | -11.02 |

| LYXOR ETF MSCI KOREA (KOR) | -0.16 | -3.10 | -5.16 | -11.48 | -5.43 | -22.04 | -11.03 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | -0.06 | -2.83 | 0.07 | 2.28 | -0.66 | -21.74 | -5.01 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -0.62 | 12.76 | -2.85 | -8.22 | 1.56 | -21.43 | -7.73 |

| SAMSUNG KODEX 200 EXCHANGE TRADED FUNDS (1313) | 0.69 | 0.16 | -6.14 | -11.74 | -7.57 | -21.17 | -11.66 |

| DWS INVEST - AFRICA - DS1 GBP DIST (HVJG) | -0.33 | 0.13 | 0.47 | -2.12 | -0.72 | -20.98 | -5.84 |

| JAPAN SMALLER CAPITALIZATION FUND INC (JSM) | 0.47 | 0.99 | -2.16 | -4.73 | -5.85 | -20.97 | -8.43 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -1.37 | 24.44 | -6.18 | -16.79 | 10.30 | -20.90 | -8.39 |

| DWS INVEST - AFRICA - A2 USD ACC (HVJF) | -0.42 | 1.69 | 0.39 | -1.99 | 0.85 | -20.10 | -5.21 |

| SCHRODER JAPAN GROWTH FUND PLC (SJG) | -0.66 | -1.13 | -3.49 | -5.27 | -10.66 | -19.76 | -9.80 |