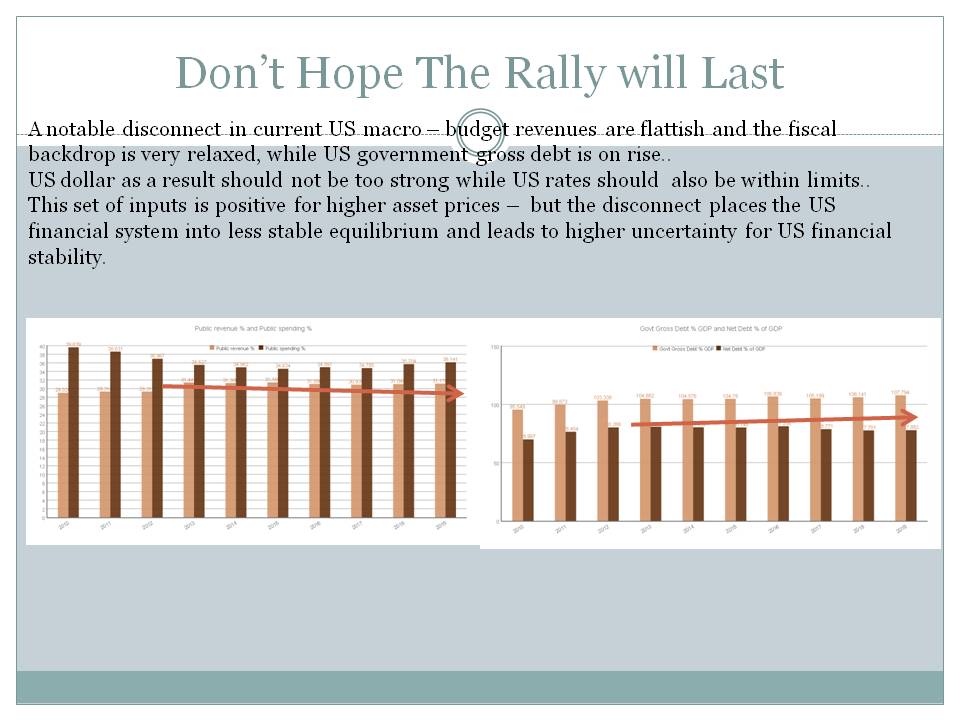

Don’t Hope The Rally will Last

Reasons to be constructive on Economic Nationalism Trades

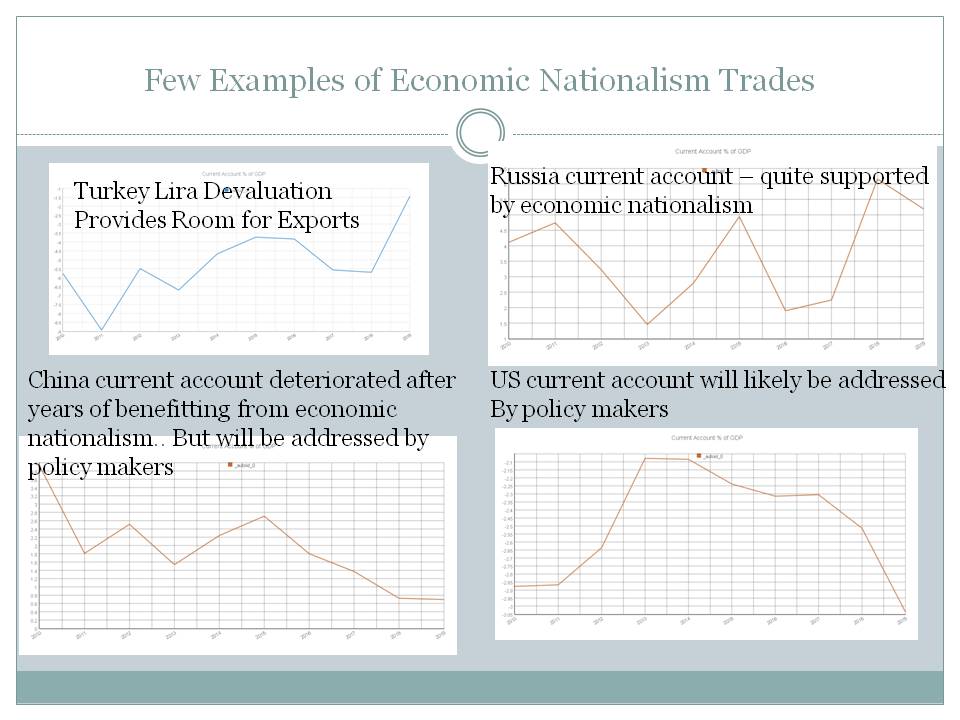

Few Examples of Economic Nationalism Trades

Globalisation Trades

Re-farming Trades

Policy mistakes are expensive

Money is the message

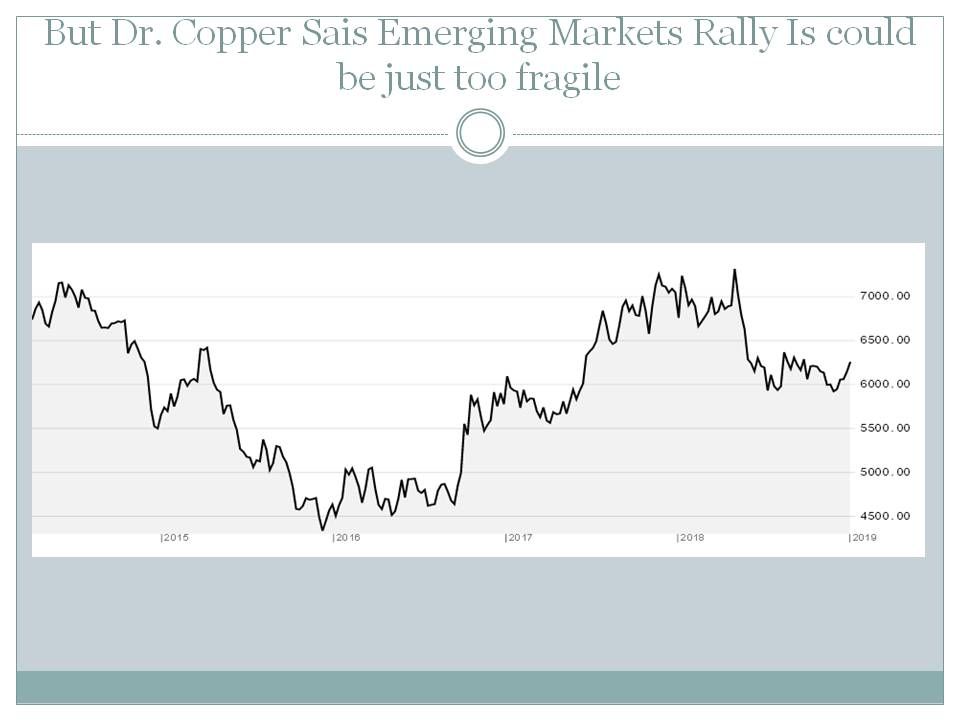

But Dr. Copper Sais Emerging Markets Rally Is could be just too fragile

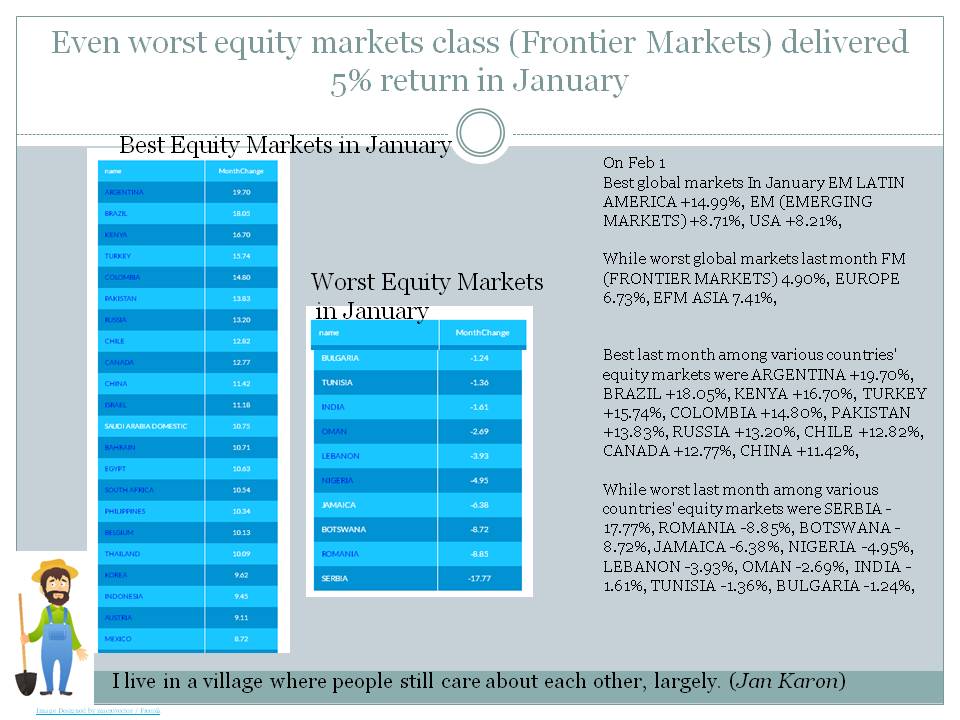

Even worst equity markets class (Frontier Markets) delivered 5% return in January

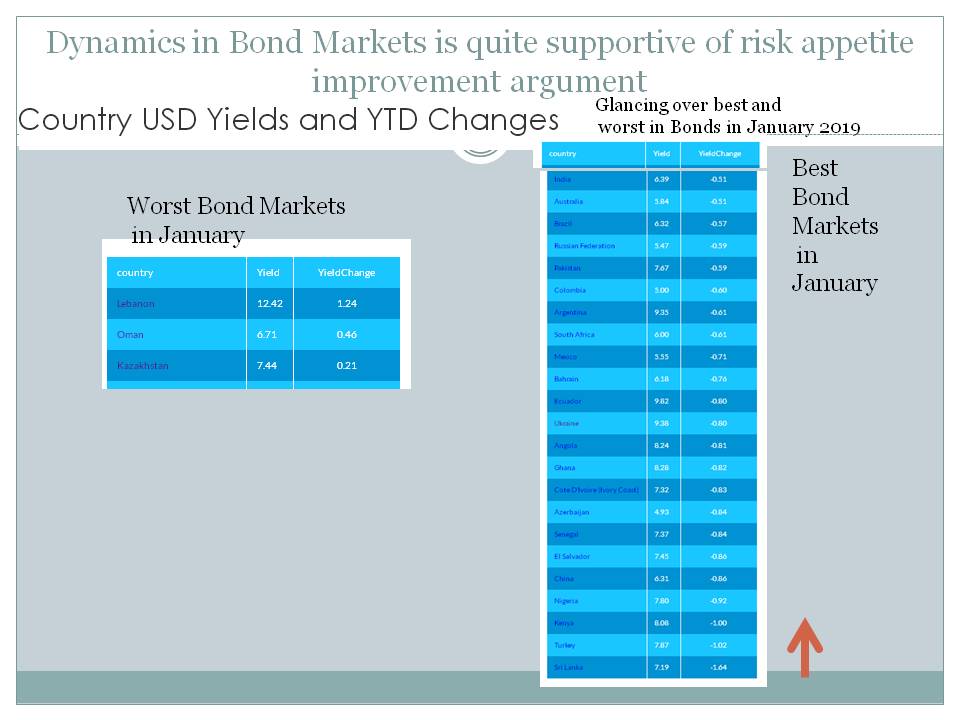

Dynamics in Bond Markets is quite supportive of risk appetite improvement argument

Specialist sector funds see outflows

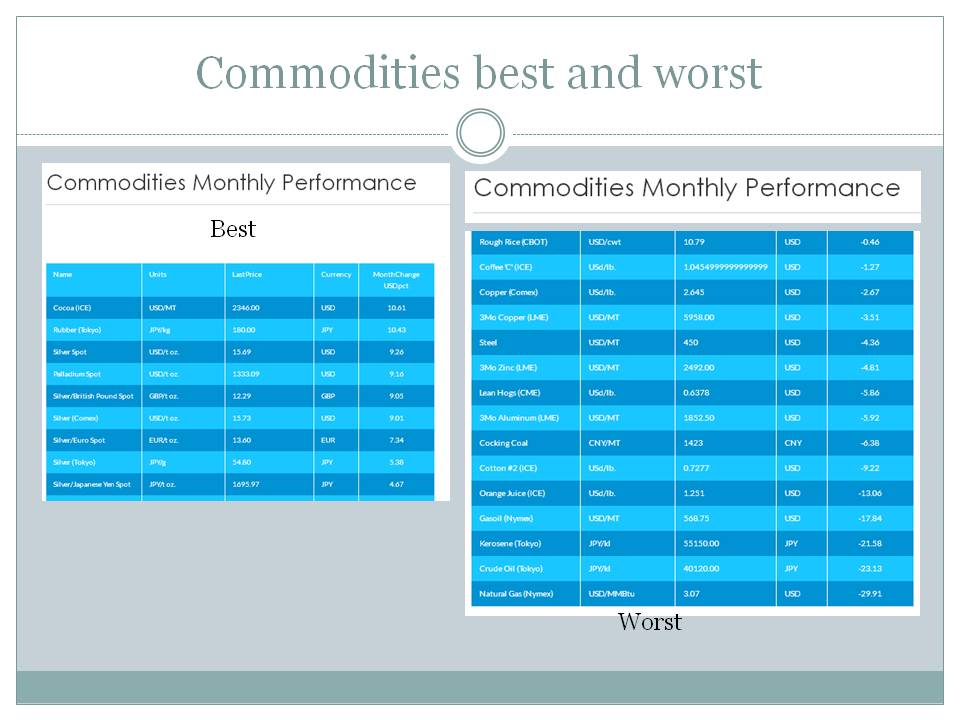

Commodities best and worst

Recent Strategy Chart Art

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

Comment

Monthly performance is between 2019-02-01 and 2019-01-01

Best global markets YTD EM LATIN AMERICA +14.99%, EM (EMERGING MARKETS) +8.71%, USA +8.21%,

While worst global markets YTD FM (FRONTIER MARKETS) 4.90%, EUROPE 6.73%, EFM ASIA 7.41%,

Best global markets last month EM LATIN AMERICA +14.99%, EM (EMERGING MARKETS) +8.71%, USA +8.21%,

While worst global markets last month FM (FRONTIER MARKETS) 4.90%, EUROPE 6.73%, EFM ASIA 7.41%,

Stocks close mostly higher as new round of US-China trade talks ...US stocks push higher as shutdown and trade talk fears easeEmerging-market stocks are the 'most crowded trade' for first time on ...Emerging markets are red hot right now. Here are three investments ...5 Excellent China Stocks for Year of the PigChina stocks rally after Trump hints at trade truce extensionGet Paid To Wait On This Europe ETF's ResurgenceInvestment Outlook: European equities looking cheap, says Franklin ...Hedge Funds Unsure Where Oil Prices Are GoingOil Prices Rise After API Reports Surprise Crude DrawSector headwind to continue for Tata SteelTata Steel: Soft steel prices slam earnings outlook in near termGold Prices Fall For Second Straight Session: 5 Things To KnowGold Price Slightly Higher as Possible Deal Reached to Avoid ...

Best last month among various countries' equity markets were ARGENTINA +19.70%, BRAZIL +18.05%, KENYA +16.70%, TURKEY +15.74%, COLOMBIA +14.80%, PAKISTAN +13.83%, RUSSIA +13.20%, CHILE +12.82%, CANADA +12.77%, CHINA +11.42%,

While worst last month among various countries' equity markets were SERBIA -17.77%, ROMANIA -8.85%, BOTSWANA -8.72%, JAMAICA -6.38%, NIGERIA -4.95%, LEBANON -3.93%, OMAN -2.69%, INDIA -1.61%, TUNISIA -1.36%, BULGARIA -1.24%,

Best YTD among various country equities were ARGENTINA +19.70%, BRAZIL +18.05%, PAKISTAN +17.05%, KENYA +16.70%, TURKEY +15.74%, COLOMBIA +14.80%, RUSSIA +13.20%, CHILE +12.82%, CANADA +12.77%, ISRAEL +11.97%,

While worst YTD among various country equities were SERBIA -17.77%, ROMANIA -8.85%, BOTSWANA -8.72%, JAMAICA -6.38%, NIGERIA -4.95%, LEBANON -3.93%, OMAN -2.69%, TUNISIA -1.36%, INDIA -1.33%, BULGARIA -1.24%,