Tockenising Midlincoln Crafts

This section contains links to materials about Midlincoln Rural Crafts Initiatives

Midlincoln is testing rural co-working model as its core business. Half of the co-working space is dedicated to investment analytics service and half of the space is industrial, creative environment with machines and tools which can be used in product development and small scale production.

Investing into Midlincoln Craft fund tokens is a comprehensive investment into all of the portfolio companies and funds. But each of the mentioned companies and funds are also accessible for investment directly also via tokens. Each of the portfolio company or a fund can be considered as a standalone franchise and Stoken could provide security token investment for qualified investors in any of them.

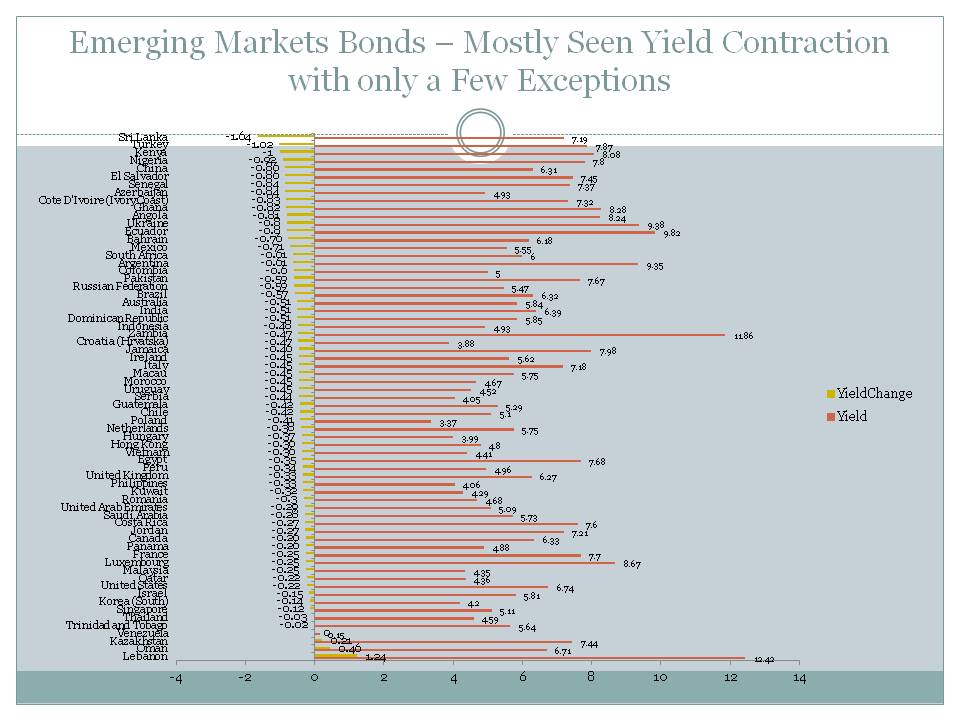

Country Average Sovereign+Corporate USD Yields Ordered by Weekly Change

| country | Yield | YieldChange |

| Lebanon | 12.42 | 1.24 |

| Oman | 6.71 | 0.46 |

| Kazakhstan | 7.44 | 0.21 |

| Venezuela | 0.15 | 0.00 |

| Trinidad and Tobago | 5.64 | -0.02 |

| Thailand | 4.59 | -0.03 |

| Singapore | 5.11 | -0.12 |

| Korea (South) | 4.20 | -0.14 |

| Israel | 5.81 | -0.15 |

| United States | 6.74 | -0.22 |

| Qatar | 4.36 | -0.22 |

| Malaysia | 4.35 | -0.25 |

| Luxembourg | 8.67 | -0.25 |

| France | 7.70 | -0.25 |

| Panama | 4.88 | -0.26 |

| Canada | 6.33 | -0.26 |

| Jordan | 7.21 | -0.27 |

| Costa Rica | 7.60 | -0.27 |

| Saudi Arabia | 5.73 | -0.28 |

| United Arab Emirates | 5.09 | -0.29 |

| Romania | 4.68 | -0.30 |

| Kuwait | 4.29 | -0.32 |

| Philippines | 4.06 | -0.33 |

| United Kingdom | 6.27 | -0.33 |

| Peru | 4.96 | -0.34 |

| Egypt | 7.68 | -0.35 |

| Vietnam | 4.41 | -0.36 |

| Hong Kong | 4.80 | -0.36 |

| Hungary | 3.99 | -0.37 |

| Netherlands | 5.75 | -0.38 |

| Poland | 3.37 | -0.41 |

| Chile | 5.10 | -0.42 |

| Guatemala | 5.29 | -0.42 |

| Serbia | 4.05 | -0.44 |

| Uruguay | 4.52 | -0.45 |

| Morocco | 4.67 | -0.45 |

| Macau | 5.75 | -0.45 |

| Italy | 7.18 | -0.45 |

| Ireland | 5.62 | -0.45 |

| Jamaica | 7.98 | -0.46 |

| Croatia (Hrvatska) | 3.88 | -0.47 |

| Zambia | 11.86 | -0.47 |

| Indonesia | 4.93 | -0.48 |

| Dominican Republic | 5.85 | -0.51 |

| India | 6.39 | -0.51 |

| Australia | 5.84 | -0.51 |

| Brazil | 6.32 | -0.57 |

| Russian Federation | 5.47 | -0.59 |

| Pakistan | 7.67 | -0.59 |

| Colombia | 5.00 | -0.60 |

| Argentina | 9.35 | -0.61 |

| South Africa | 6.00 | -0.61 |

| Mexico | 5.55 | -0.71 |

| Bahrain | 6.18 | -0.76 |

| Ecuador | 9.82 | -0.80 |

| Ukraine | 9.38 | -0.80 |

| Angola | 8.24 | -0.81 |

| Ghana | 8.28 | -0.82 |

| Cote D'Ivoire (Ivory Coast) | 7.32 | -0.83 |

| Azerbaijan | 4.93 | -0.84 |

| Senegal | 7.37 | -0.84 |

| El Salvador | 7.45 | -0.86 |

| China | 6.31 | -0.86 |

| Nigeria | 7.80 | -0.92 |

| Kenya | 8.08 | -1.00 |

| Turkey | 7.87 | -1.02 |

| Sri Lanka | 7.19 | -1.64 |

Country Average Sovereign+Corporate USD Yields Ordered By YTD Yield Change

| country | Yield | YieldChange |

| Lebanon | 12.42 | 1.24 |

| Zambia | 11.86 | -0.47 |

| Ecuador | 9.82 | -0.80 |

| Ukraine | 9.38 | -0.80 |

| Argentina | 9.35 | -0.61 |

| Luxembourg | 8.67 | -0.25 |

| Ghana | 8.28 | -0.82 |

| Angola | 8.24 | -0.81 |

| Kenya | 8.08 | -1.00 |

| Jamaica | 7.98 | -0.46 |

| Turkey | 7.87 | -1.02 |

| Nigeria | 7.80 | -0.92 |

| France | 7.70 | -0.25 |

| Egypt | 7.68 | -0.35 |

| Pakistan | 7.67 | -0.59 |

| Costa Rica | 7.60 | -0.27 |

| El Salvador | 7.45 | -0.86 |

| Kazakhstan | 7.44 | 0.21 |

| Senegal | 7.37 | -0.84 |

| Cote D'Ivoire (Ivory Coast) | 7.32 | -0.83 |

| Jordan | 7.21 | -0.27 |

| Sri Lanka | 7.19 | -1.64 |

| Italy | 7.18 | -0.45 |

| United States | 6.74 | -0.22 |

| Oman | 6.71 | 0.46 |

| India | 6.39 | -0.51 |

| Canada | 6.33 | -0.26 |

| Brazil | 6.32 | -0.57 |

| China | 6.31 | -0.86 |

| United Kingdom | 6.27 | -0.33 |

| Bahrain | 6.18 | -0.76 |

| South Africa | 6.00 | -0.61 |

| Dominican Republic | 5.85 | -0.51 |

| Australia | 5.84 | -0.51 |

| Israel | 5.81 | -0.15 |

| Macau | 5.75 | -0.45 |

| Netherlands | 5.75 | -0.38 |

| Saudi Arabia | 5.73 | -0.28 |

| Trinidad and Tobago | 5.64 | -0.02 |

| Ireland | 5.62 | -0.45 |

| Mexico | 5.55 | -0.71 |

| Russian Federation | 5.47 | -0.59 |

| Guatemala | 5.29 | -0.42 |

| Singapore | 5.11 | -0.12 |

| Chile | 5.10 | -0.42 |

| United Arab Emirates | 5.09 | -0.29 |

| Colombia | 5.00 | -0.60 |

| Peru | 4.96 | -0.34 |

| Azerbaijan | 4.93 | -0.84 |

| Indonesia | 4.93 | -0.48 |

| Panama | 4.88 | -0.26 |

| Hong Kong | 4.80 | -0.36 |

| Romania | 4.68 | -0.30 |

| Morocco | 4.67 | -0.45 |

| Thailand | 4.59 | -0.03 |

| Uruguay | 4.52 | -0.45 |

| Vietnam | 4.41 | -0.36 |

| Qatar | 4.36 | -0.22 |

| Malaysia | 4.35 | -0.25 |

| Kuwait | 4.29 | -0.32 |

| Korea (South) | 4.20 | -0.14 |

| Philippines | 4.06 | -0.33 |

| Serbia | 4.05 | -0.44 |

| Hungary | 3.99 | -0.37 |

| Croatia (Hrvatska) | 3.88 | -0.47 |

| Poland | 3.37 | -0.41 |

| Venezuela | 0.15 | 0.00 |

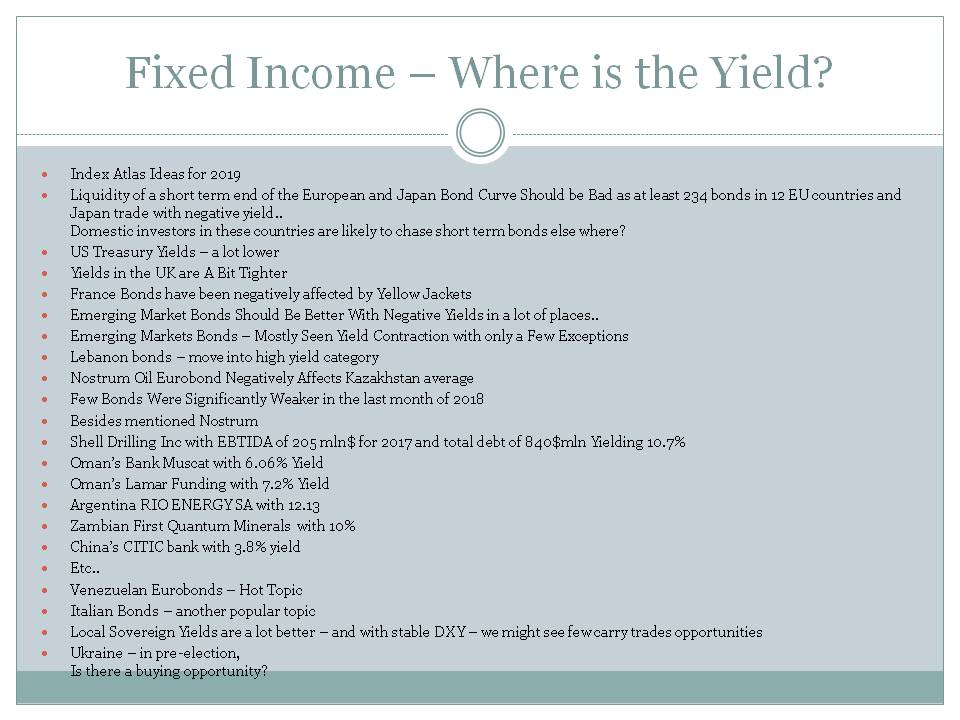

Chart: Fixed Income – Where is the Yield?

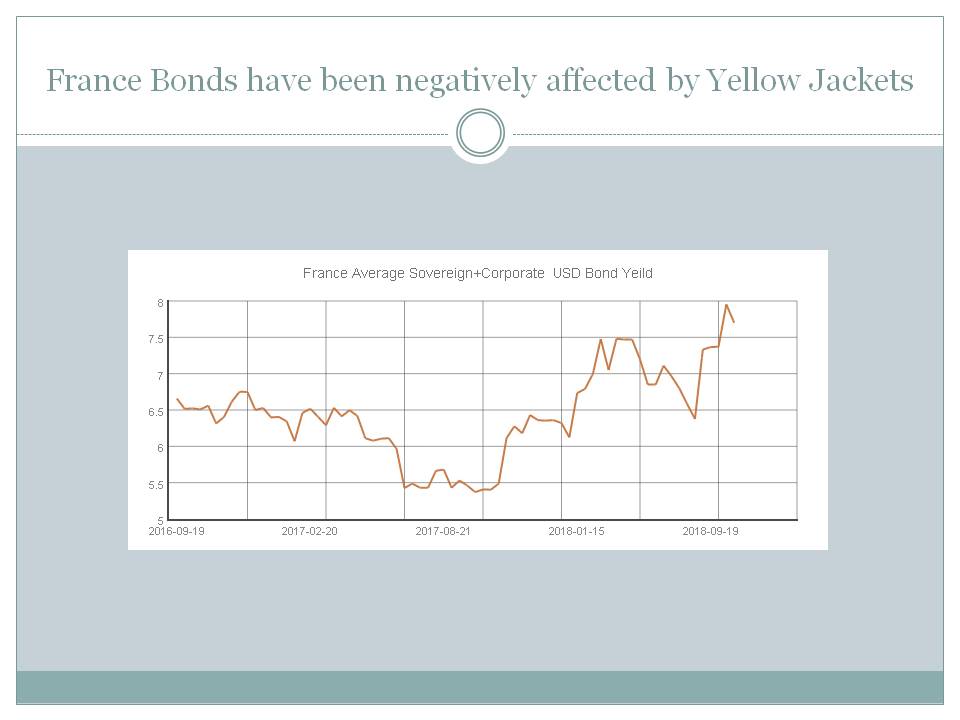

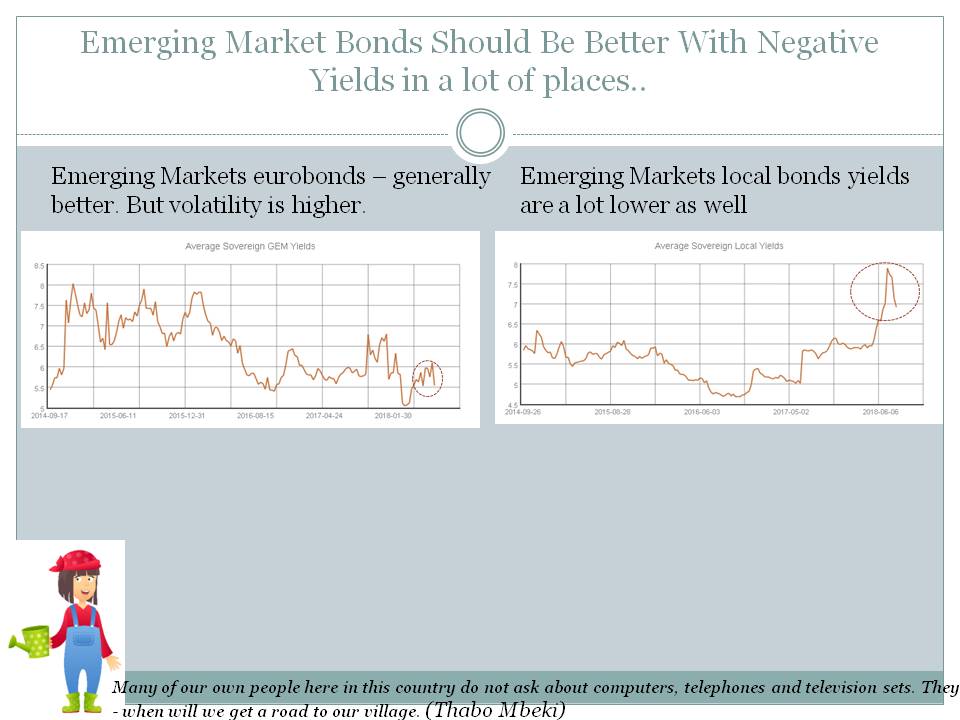

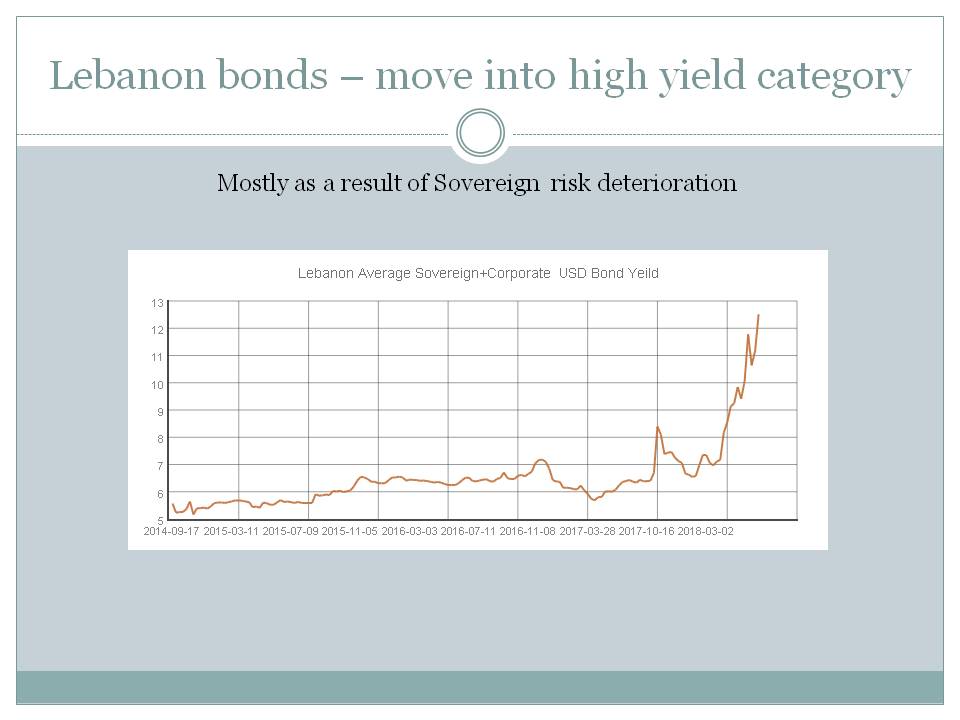

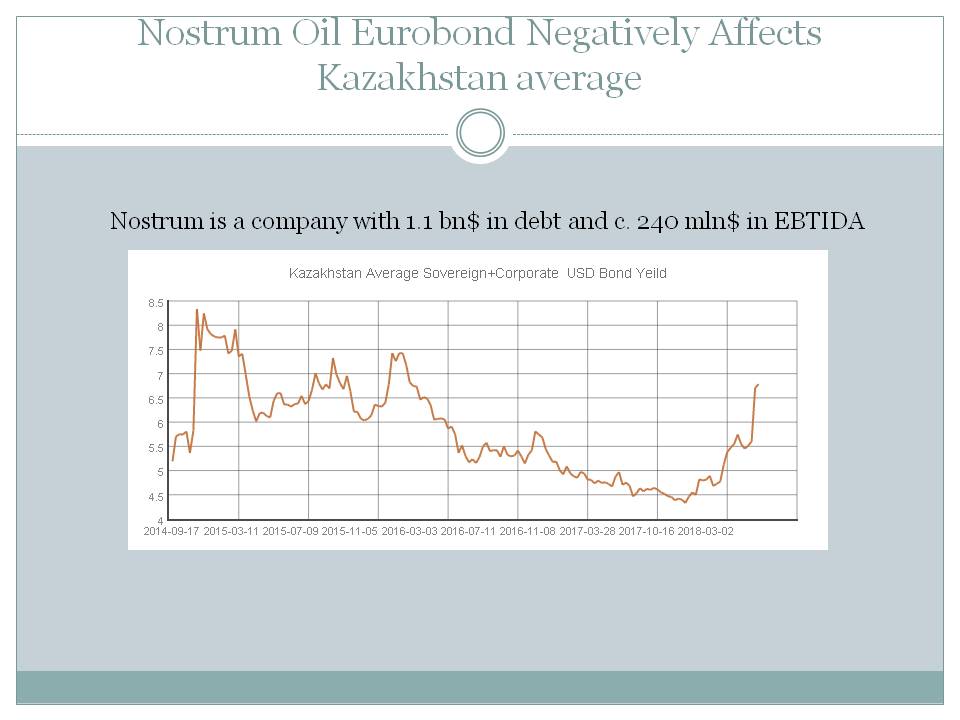

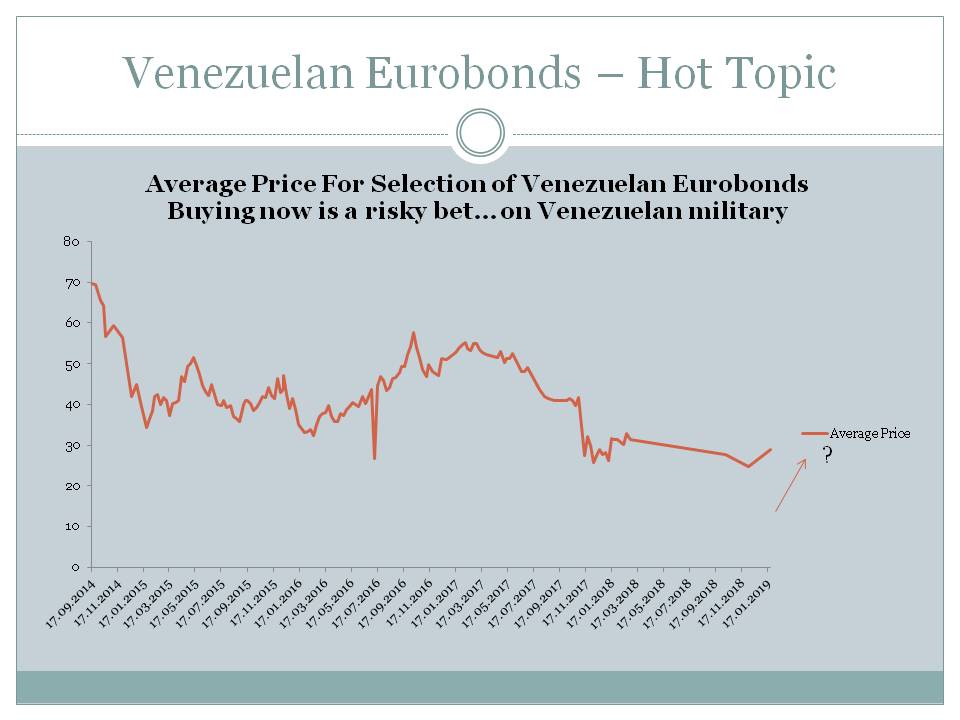

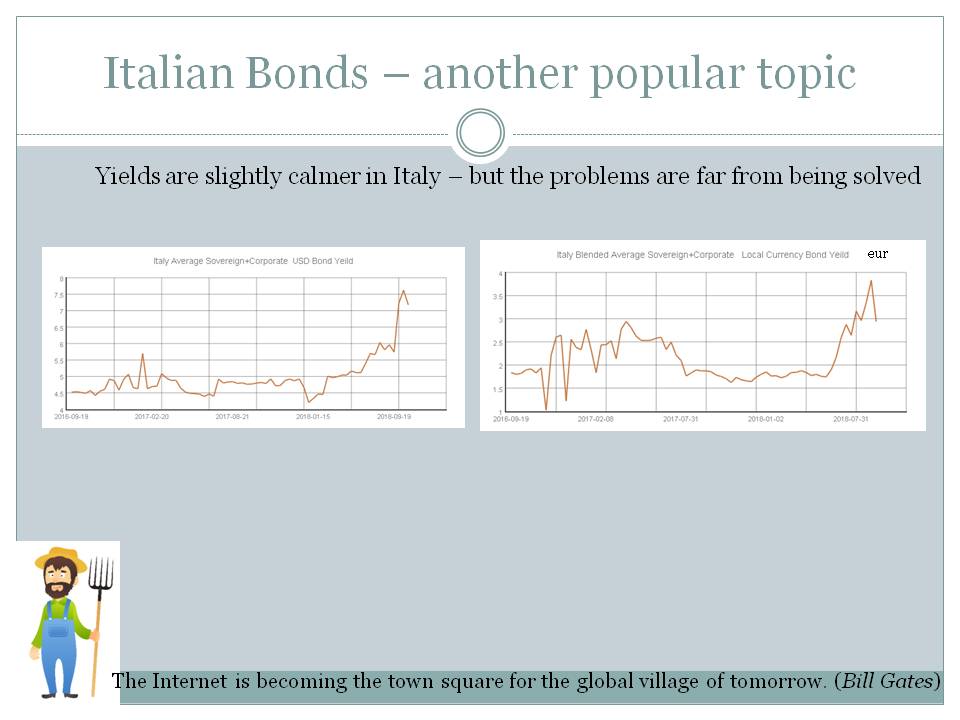

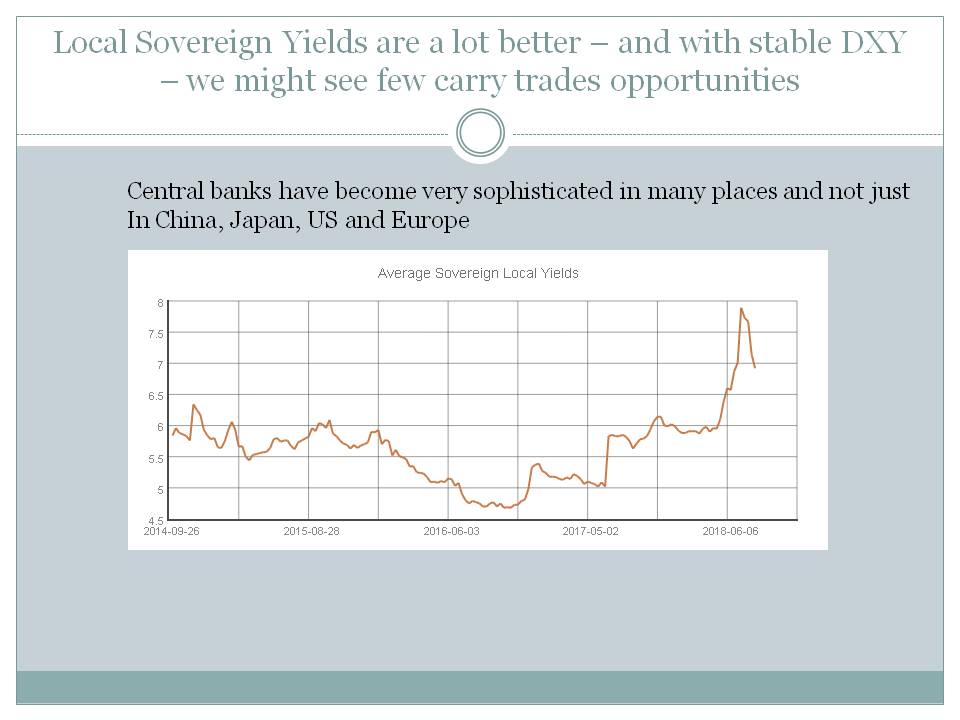

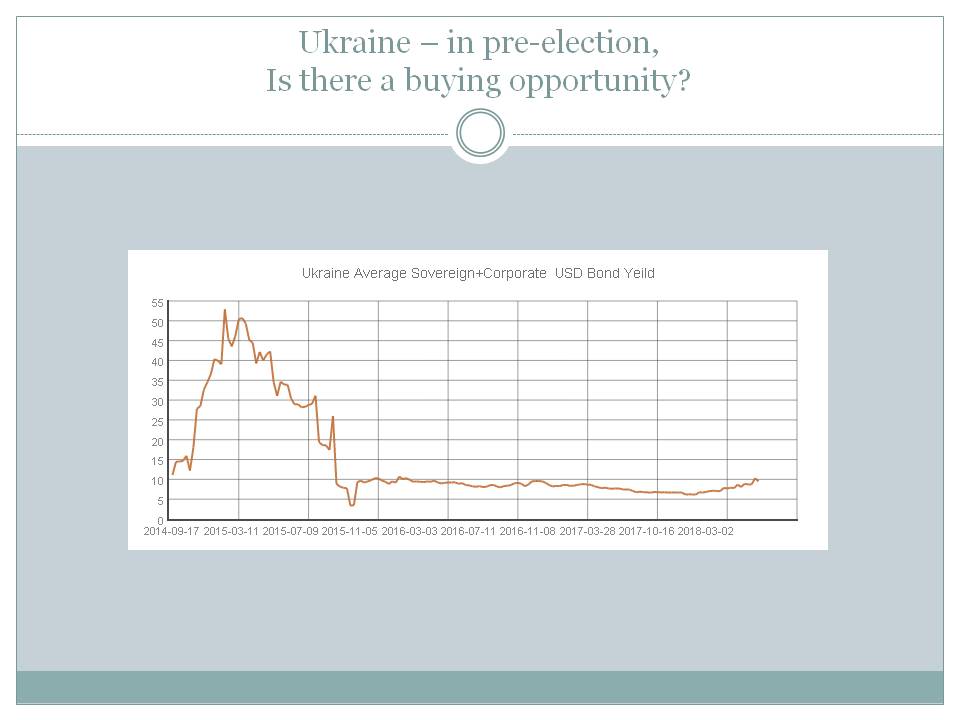

Index Atlas Ideas for 2019 Liquidity of a short term end of the European and Japan Bond Curve Should be Bad as at least 234 bonds in 12 EU countries and Japan trade with negative yield.. Domestic investors in these countries are likely to chase short term bonds else where? US Treasury Yields – a lot lower Yields in the UK are A Bit Tighter France Bonds have been negatively affected by Yellow Jackets Emerging Market Bonds Should Be Better With Negative Yields in a lot of places.. Emerging Markets Bonds – Mostly Seen Yield Contraction with only a Few Exceptions Lebanon bonds – move into high yield category Nostrum Oil Eurobond Negatively Affects Kazakhstan average Few Bonds Were Significantly Weaker in the last month of 2018 Besides mentioned Nostrum Shell Drilling Inc with EBTIDA of 205 mln$ for 2017 and total debt of 840$mln Yielding 10.7% Oman’s Bank Muscat with 6.06% Yield Oman’s Lamar Funding with 7.2% Yield Argentina RIO ENERGY SA with 12.13 Zambian First Quantum Minerals with 10% China’s CITIC bank with 3.8% yield Etc.. Venezuelan Eurobonds – Hot Topic Italian Bonds – another popular topic Local Sovereign Yields are a lot better – and with stable DXY – we might see few carry trades opportunities Ukraine – in pre-election, Is there a buying opportunity?

Source: ML

Download file in Power PointKey Topics and News

- Form 6-K NOVO NORDISK AS For: Dec 31

- News in July 2015

- 복지부국 스웨덴을 이끄는 몇 가지 원칙(ⅴ)

- Overview - Eurostat - European Commission - Europa

- Key elements of the EU-Japan Economic Partnership ... - europa.eu

- THE ECONOMICS OF MONEY,BANKING, AND FINANCIAL MARKETS

- THE ECONOMICS OF MONEY,BANKING, AND FINANCIAL MARKETS

- Overview - Eurostat - European Commission - Europa

- The Next Japan: How Deflation Threatens The European Union

- The Negative Rates of Europe's Central Banks - Investopedia

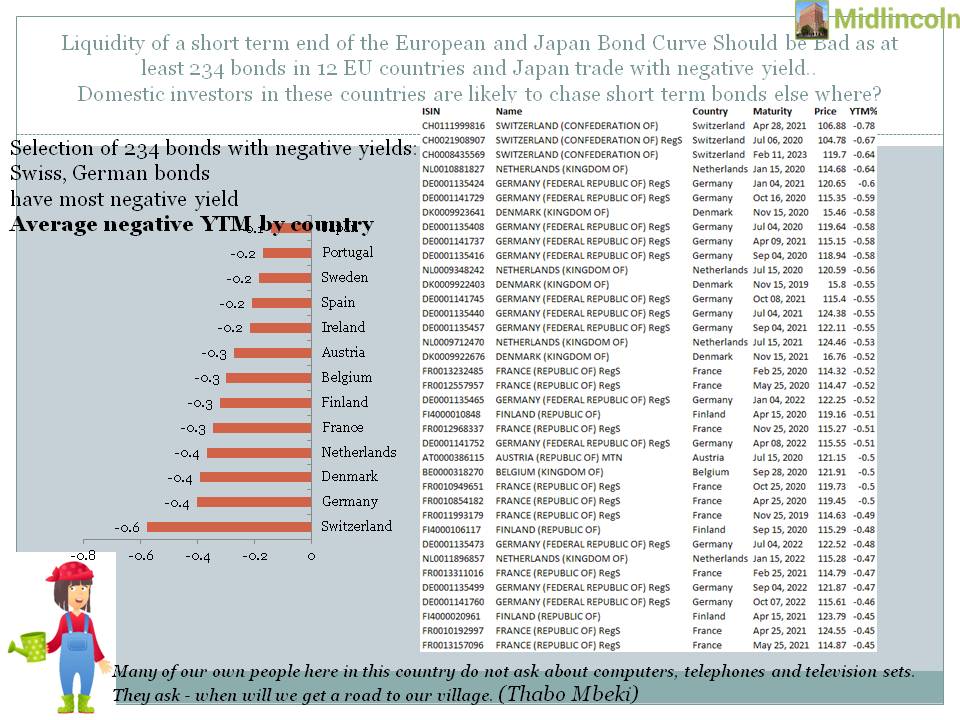

Selection of 234 bonds with negative yields: Swiss, German bonds have most negative yield Average negative YTM by country

Source: ML

- Ten-Year Treasury Yield at Lowest Level in a Year as Investors Flee ...

- Wall Street weighs in on the Fed's big change

- Global equities and bond yields lower; most major currencies haven ...

- JGBs gain tracking US Treasuries after Fed holds rates

- 10-year Treasury yield falls to 11-month low amid global growth jitters

- How U.S. Treasury Yields Affect the Economy - The Balance

- 10-Year U.S. Treasury Note: Definition, Why It's the Most Important

- Treasury yields slip amid heightened fears of an economic slowdown

- 10-year Treasury yield dips below 3% following Powell's rate ...

- US Treasury yield curve flattens further on fears of slowing growth

- A Roadmap for the Upcoming US Treasury Bull Market - Advisor ...

- Long-Term Government Bond Yields: 10-year: Main (Including ...

- Why does the yield-curve slope predict recessions? - Federal ...

- Interest rate risk — When Interest rates Go up, Prices of Fixed-rate ...

- When the Fed yields - BlackRock

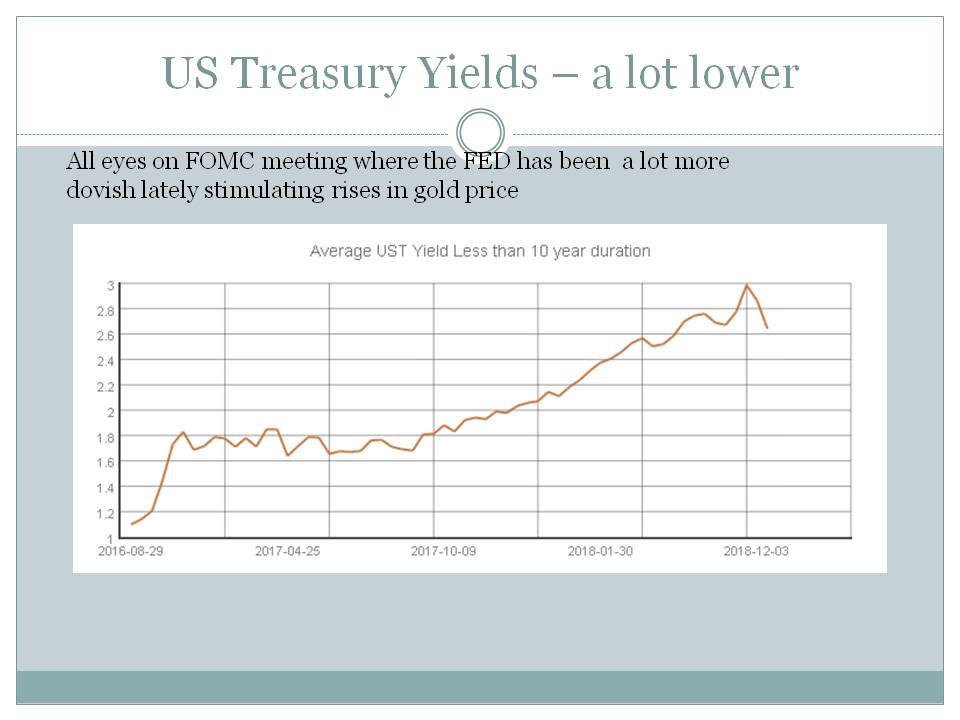

All eyes on FOMC meeting where the FED has been a lot more dovish lately stimulating rises in gold price

Source: ML

- UPDATE 2-Weak China data, looming Brexit deal vote, push euro ...

- 2 dividend stocks to lift next year's January blues

- February's Market: Volatility, Geopolitics And Earnings Are On Watch

- CANADA FX DEBT-C$ notches biggest gain in 4 months as investor ...

- Trump hails 'tremendous news' after Dow passes 25000 milestone ...

Source: ML

- Gilets jaunes (yellow jackets): learning from history and acting now

- Mario Draghi: I won't mediate Italian budget standoff

- Commission calls for disciplinary action against Italy over budget plans

- Assassination attempt, killer nurse: Six stories to know about today

- Israel's social protestors to take to streets in yellow vests

Source: ML

- EMs may revive in Q1 but India likely to underperform: Geoff Dennis

- House prices keep falling, ahead of federal election and banking ...

- How the 2018 Bargain Shares Portfolio fared

- It Is Always Everything Else But the One Thing That's Wrong

- Central Banks Shift on Plans to Pull Back Stimulus

Emerging Markets eurobonds – generally better. But volatility is higher.

Source: ML

- 2019 World Economic Outlook - A Weakening Global Expansion

- Euro Area inflation data remains subdued while GDP was mixed

- ASX seen lower as IMF tips slower global growth

- FTSE 10O closes in red after ECB meet; Vodafone top laggard

- American Electric Power (AEP) Q4 2018 Earnings Conference Call ...

Source: ML

- Form 485BPOS AB GLOBAL BOND FUND,

- Planning to Retire in 2019: A Complete Guide

- Form 485BPOS VANGUARD HORIZON FUNDS

- Form 485BPOS ADVISORS SERIES TRUST

- News from around our 50 States

Source: ML

- Aberdeen Investment Funds

- Form N-CSR SUNAMERICA INCOME FUNDS For: Mar 31

- This Weekend's Kids & Family Activities in Bronx

Source: ML

- Capstead Mortgage Corp (CMO) Q4 2018 Earnings Conference Call ...

- OMNOVA Solutions Inc (OMN) Q4 2018 Earnings Conference Call ...

- Is Tesla still a growth company?

- How the 2018 Bargain Shares Portfolio fared

- Where some of the world's top hedge funds will invest in 2019

Besides mentioned Nostrum Shell Drilling Inc with EBTIDA of 205 mln$ for 2017 and total debt of 840$mln Yielding 10.7% Oman’s Bank Muscat with 6.06% Yield Oman’s Lamar Funding with 7.2% Yield Argentina RIO ENERGY SA with 12.13 Zambian First Quantum Minerals with 10% China’s CITIC bank with 3.8% yield Etc..

Source: ML

- Form 424B5 Colfax CORP

- Central Banker Report Cards 2018: End Of Easing Street

- Russian industry seeks cleaner image with sustainability drive

- Form 485BPOS VANGUARD SPECIALIZED

- IPSCO Tubulars Inc.

Average Price For Selection of Venezuelan Eurobonds Buying now is a risky bet… on Venezuelan military

Source: ML

- Gold Market Outlook Report, Q2 2018 - ResearchAndMarkets.com

- Maximizing Your Study Away Experience

- Have you met Ms Jones?

- Cryptos Would Only Have Value in 'Dystopian' Economy: JPMorgan

- Italian banks stock up on government bonds

Yields are slightly calmer in Italy – but the problems are far from being solved

Source: ML

- Form N-CSR Investment Managers Seri For: Oct 31

- A Mere Pause or True Reversal for EURUSD and S&P 500 Next ...

- The Case For A Benign US Dollar

- Dow Wilts on Government Shutdown Threats, Pound Kept Off ...

- 17 reasons for a weak dollar

Central banks have become very sophisticated in many places and not just In China, Japan, US and Europe

Source: ML

- Espresso TV sold to Ukrainian oligarch's son

- Needed: Leaders Like JFK and Khrushchev

- When Israel/Neocons Favored Iran

- LBJ's 'X' File on Nixon's 'Treason'

As usual with elections

Source: ML

Recent Fixed Income Ideas ChArt

Average Sovereign GEM Yields (USD)

Average Sov. Dev. Markets Yields (blended currency)

Average UST Yield (Where Duration is less than 10 years)

Average Sovereign Local Currency Yields

Bonds Datamine Queries

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondLEBANON (REPUBLIC OF) MTN RegS 21LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS 22LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS 23LAMAR FUNDING LTD RegS 25

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondSRI LANKA DEMOCRATIC SOCIALIST (RE RegS 21SRI LANKA (DEMOCRATIC SOCIALIST RE RegS 23MEXICO CITY AIRPORT TRUST RegS 26SRI LANKA DEMOCRATIC SOCIALIST (RE RegS 22

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondNOSTRUM OIL & GAS FINANCE BV RegS 22SHELF DRILLING HOLDINGS LTD RegS 25BANK MUSCAT SAOG MTN RegS 21PTTEP TREASURY CENTER COMPANY LIMI RegS 49

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondKAISA GROUP HOLDINGS LTD RegS 22OVPH LIMITED RegS 49YAPI VE KREDI BANKASI AS MTN RegS 26TURKIYE IS BANKASI AS MTN RegS 21

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryLebanonOmanUnited StatesVenezuelaTrinidad and Tobago

Country Average Corporate Yield Change USD Eurobonds Weekly

CountryKazakhstanOmanZambiaPhilippinesUnited States

Top 30 GEM Souvereign Eurobonds by Yield

NameLEBANON (REPUBLIC OF) MTN RegSZAMBIA (REPUBLIC OF) RegSZAMBIA (REPUBLIC OF) RegS

Top 30 GEM Corporate Eurobonds by Yield

NameODEBRECHT OFFSHORE DRILLING FINANC RegSDIGICEL GROUP THREE LTD 144ANOSTRUM OIL & GAS FINANCE BV RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameARGENTINA REPUBLIC OF GOVERNMENTARGENTINA REPUBLIC OF GOVERNMENTARGENTINA REPUBLIC OF GOVERNMENT

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondUK CONV GILT RegS 21NETHERLANDS (KINGDOM OF) 20FRANCE (REPUBLIC OF) RegS 19UK CONV GILT RegS 20

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondITALY (REPUBLIC OF) RegS 22ITALY (REPUBLIC OF) 22ITALY (REPUBLIC OF) 23ITALY (REPUBLIC OF) RegS 24

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsNEW LOOK SECURED ISSUER PLC RegS 22United Kingdom50.0019.58NEIMAN MARCUS GROUP LTD LLC 144A 21United States50.0016.37BANCA MONTE DEI PASCHI DI SIENA SP RegS 28Italy32.3613.36SENVION HOLDING GMBH RegS 22Germany23.439.45NORDDEUTSCHE LANDESBANK NY GIROZEN MTN 20Germany13.815.77

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsCHS/COMMUNITY HEALTH SYSTEMS INC 22United States29.85-5.33HARLAND CLARKE HOLDINGS CORP 144A 21United States10.52-3.22REYNOLDS GROUP ISSUER LLC 20United States2.60-3.19TRANSDIGM INC 20United States2.36-3.19CODERE FINANCE 2 (LUXEMBOURG) SA RegS 21Spain9.56-3.00

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWITALY (REPUBLIC OF)IT0004923998ItalySep 01, 20444.753.64ITALY (REPUBLIC OF) RegSIT0004532559ItalySep 01, 20405.003.61ITALY (REPUBLIC OF)IT0005273013ItalyMar 01, 20483.453.61

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWNEIMAN MARCUS GROUP LTD LLC 144AUS570254AA03United StatesOct 15, 20218.0050.00NEW LOOK SECURED ISSUER PLC RegSXS1248516616United KingdomJul 01, 20226.5050.00HEXION US FINANCE CORP/HEXION NOVAUS428303AM35United StatesNov 15, 20209.0050.00

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

| Bond | Country | Yield | Yield Change % pts |

| LEBANON (REPUBLIC OF) MTN RegS 21 | Lebanon | 14.95 | 3.44 |

| LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS 22 | Lebanon | 13.42 | 2.03 |

| LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS 23 | Lebanon | 12.84 | 1.40 |

| LAMAR FUNDING LTD RegS 25 | Oman | 7.24 | 0.65 |

| LEBANON (REPUBLIC OF) RegS 27 | Lebanon | 11.85 | 0.60 |

| OMAN SOVEREIGN SUKUK SAOC 144A 25 | Oman | 6.60 | 0.51 |

| OMAN SOVEREIGN SUKUK SAOC RegS 24 | Oman | 6.29 | 0.50 |

| LEBANON (REPUBLIC OF) MTN RegS 26 | Lebanon | 11.67 | 0.47 |

| OMAN SULTANATE OF (GOVERNMENT) RegS 21 | Oman | 5.30 | 0.47 |

| LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS 27 | Lebanon | 11.59 | 0.46 |

| OMAN SULTANATE OF (GOVERNMENT) RegS 22 | Oman | 5.72 | 0.46 |

| OMAN SULTANATE OF (GOVERNMENT) RegS 26 | Oman | 6.77 | 0.30 |

| OMAN SULTANATE OF (GOVERNMENT) MTN RegS 23 | Oman | 5.94 | 0.24 |

| OMAN SULTANATE OF (GOVERNMENT) MTN RegS 28 | Oman | 7.01 | 0.23 |

| OMAN SULTANATE OF (GOVERNMENT) RegS 27 | Oman | 6.90 | 0.21 |

| LEBANON REPUBLIC OF (GOVERNMENT) RegS 30 | Lebanon | 11.00 | 0.14 |

| LEBANON (REPUBLIC OF) MTN RegS 32 | Lebanon | 11.00 | 0.07 |

| CHINA DEVELOPMENT BANK CORP (HONG MTN RegS 22 | China | 3.55 | 0.05 |

| OMAN SULTANATE OF (GOVERNMENT) RegS 47 | Oman | 7.83 | 0.01 |

| OMAN SULTANATE OF (GOVERNMENT) RegS 48 | Oman | 7.90 | 0.00 |

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

| Bond | Country | Yield | Yield Change %pts |

| SRI LANKA DEMOCRATIC SOCIALIST (RE RegS 21 | Sri Lanka | 6.52 | -2.08 |

| SRI LANKA (DEMOCRATIC SOCIALIST RE RegS 23 | Sri Lanka | 6.95 | -1.80 |

| MEXICO CITY AIRPORT TRUST RegS 26 | Mexico | 5.65 | -1.68 |

| SRI LANKA DEMOCRATIC SOCIALIST (RE RegS 22 | Sri Lanka | 7.01 | -1.58 |

| SRI LANKA (DEMOCRATIC SOCIALIST RE RegS 25 | Sri Lanka | 7.39 | -1.57 |

| MEXICO CITY AIRPORT TRUST RegS 28 | Mexico | 5.60 | -1.56 |

| SRI LANKA (DEMOCRATIC SOCIALIST RE RegS 26 | Sri Lanka | 7.46 | -1.52 |

| TURKEY (REPUBLIC OF) 21 | Turkey | 5.38 | -1.48 |

| SRI LANKA (DEMOCRATIC SOCIALIST RE RegS 28 | Sri Lanka | 7.53 | -1.41 |

| SRI LANKA (DEMOCRATIC SOCIALIST RE RegS 27 | Sri Lanka | 7.59 | -1.37 |

| GABONESE REPUBLIC RegS 24 | Gabon | 8.21 | -1.37 |

| MEXICO CITY AIRPORT TRUST RegS 46 | Mexico | 6.45 | -1.32 |

| MEXICO CITY AIRPORT TRUST RegS 47 | Mexico | 6.48 | -1.27 |

| UKRAINE (GOVERNMENT OF) RegS 21 | Ukraine | 8.72 | -1.25 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS 23 | Ecuador | 9.24 | -1.25 |

| GHANA (REPUBLIC OF) RegS 23 | Ghana | 7.22 | -1.24 |

| NIGERIA (FEDERAL REPUBLIC OF) 144A 25 | Nigeria | 7.20 | -1.24 |

| ZAMBIA (REPUBLIC OF) RegS 24 | Zambia | 14.28 | -1.24 |

| ECUADOR (REPUBLIC OF) RegS 24 | Ecuador | 9.51 | -1.21 |

| NIGERIA (FEDERAL REPUBLIC OF) MTN RegS 27 | Nigeria | 7.43 | -1.20 |

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

| Bond | Country | Yield | Yield Change %pts |

| NOSTRUM OIL & GAS FINANCE BV RegS 22 | Kazakhstan | 22.00 | 4.99 |

| SHELF DRILLING HOLDINGS LTD RegS 25 | United Arab Emirates | 10.79 | 1.38 |

| BANK MUSCAT SAOG MTN RegS 21 | Oman | 6.06 | 0.93 |

| PTTEP TREASURY CENTER COMPANY LIMI RegS 49 | Thailand | 6.55 | 0.52 |

| RIO ENERGY SA/UGEN SA/UENSA SA RegS 25 | Argentina | 12.13 | 0.45 |

| CABLEVISION SA RegS 21 | Argentina | 8.07 | 0.42 |

| OZTEL HOLDINGS SPC LTD RegS 28 | Oman | 7.67 | 0.28 |

| FIRST QUANTUM MINERALS LTD RegS 25 | Zambia | 10.03 | 0.27 |

| AMERICA MOVIL SAB DE CV 22 | Mexico | 3.82 | 0.20 |

| INDIKA ENERGY CAPITAL III PTE LTD RegS 24 | Indonesia | 8.50 | 0.16 |

| EMIRATES NBD TIER 1 LTD RegS 49 | United Arab Emirates | 6.40 | 0.14 |

| FIRST QUANTUM MINERALS LTD RegS 23 | Zambia | 9.56 | 0.13 |

| TEVA PHARM FINANCE LLC 36 | Israel | 6.91 | 0.13 |

| SB CAPITAL SA RegS 24 | Russian Federation | 5.03 | 0.12 |

| CHINA CITIC BANK CORP LTD RegS 22 | China | 3.83 | 0.10 |

| INDUSTRIAL AND COMMERCIAL BANK OF MTN RegS 22 | China | 3.78 | 0.09 |

| PROVEN HONOUR CAPITAL LTD RegS 25 | China | 5.63 | 0.09 |

| PETRON CORP RegS 49 | Philippines | 6.41 | 0.08 |

| EMAAR SUKUK LTD MTN RegS 26 | United Arab Emirates | 5.28 | 0.07 |

| DBS GROUP HOLDINGS LTD MTN RegS 22 | Singapore | 3.37 | 0.04 |

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

| Bond | Country | Yield | Yield Change %pts |

| KAISA GROUP HOLDINGS LTD RegS 22 | China | 17.15 | -3.41 |

| OVPH LIMITED RegS 49 | Hong Kong | 8.49 | -2.55 |

| YAPI VE KREDI BANKASI AS MTN RegS 26 | Turkey | 11.46 | -2.49 |

| TURKIYE IS BANKASI AS MTN RegS 21 | Turkey | 8.17 | -2.14 |

| TURKIYE IS BANKASI AS RegS 21 | Turkey | 8.17 | -1.94 |

| TURKIYE IS BANKASI AS MTN RegS 22 | Turkey | 8.55 | -1.71 |

| TURKIYE HALK BANKASI AS RegS 21 | Turkey | 11.82 | -1.55 |

| COUNTRY GARDEN HOLDINGS CO LTD RegS 22 | China | 7.13 | -1.52 |

| DIGICEL LTD RegS 21 | Jamaica | 9.47 | -1.41 |

| SHIMAO PROPERTY HOLDINGS LTD RegS 22 | China | 6.09 | -1.40 |

| VTB CAPITAL SA RegS 22 | Russian Federation | 6.46 | -1.26 |

| TURKIYE VAKIFLAR BANKASI TAO MTN RegS 23 | Turkey | 9.15 | -1.19 |

| CBOM FINANCE PLC - TIER 2 RegS 27 | Russian Federation | 11.68 | -1.19 |

| DAE FUNDING LLC RegS 24 | United Arab Emirates | 5.30 | -1.14 |

| PETROBRAS GLOBAL FINANCE BV 25 | Brazil | 5.33 | -1.14 |

| GRUPO AVAL LTD RegS 22 | Colombia | 5.35 | -1.12 |

| FORTUNE STAR BVI LTD RegS 22 | China | 8.33 | -1.12 |

| CEMEX SAB DE CV RegS 25 | Mexico | 5.79 | -1.11 |

| VEDANTA RESOURCES PLC RegS 21 | India | 7.19 | -1.08 |

| YPF SA RegS 21 | Argentina | 7.67 | -1.06 |

Country Average Sovereign Yield Change USD Eurobonds Weekly

| Country | Average Yield | Yield Average change % pts |

| Lebanon | 12.29 | 1.08 |

| Oman | 6.68 | 0.33 |

| United States | 2.27 | 0.00 |

| Venezuela | 0.00 | 0.00 |

| Trinidad and Tobago | 5.74 | -0.05 |

| Lithuania | 3.43 | -0.14 |

| India | 4.70 | -0.15 |

| Jamaica | 6.31 | -0.15 |

| Jordan | 7.22 | -0.24 |

| Tunisia | 9.21 | -0.24 |

| Slovak Republic | 3.21 | -0.25 |

| China | 3.91 | -0.26 |

| Panama | 4.23 | -0.30 |

| Malaysia | 4.30 | -0.30 |

| Romania | 4.68 | -0.30 |

| Costa Rica | 7.68 | -0.32 |

| Hungary | 3.99 | -0.37 |

| Chile | 4.17 | -0.37 |

| Egypt | 7.72 | -0.38 |

| Poland | 3.29 | -0.38 |

| Philippines | 3.83 | -0.38 |

| Vietnam | 4.38 | -0.39 |

| Peru | 4.38 | -0.40 |

| Serbia | 4.13 | -0.41 |

| Pakistan | 7.43 | -0.42 |

| Colombia | 4.47 | -0.43 |

| Bolivia | 6.33 | -0.44 |

| Uruguay | 4.52 | -0.45 |

| Croatia (Hrvatska) | 3.91 | -0.47 |

| Morocco | 4.04 | -0.48 |

| Indonesia | 4.64 | -0.49 |

| Brazil | 5.09 | -0.52 |

| Dominican Republic | 5.85 | -0.53 |

| Kazakhstan | 4.97 | -0.58 |

| South Africa | 5.99 | -0.60 |

| Paraguay | 5.53 | -0.61 |

| Argentina | 9.60 | -0.62 |

| Russian Federation | 4.90 | -0.62 |

| Mexico | 5.62 | -0.66 |

| Senegal | 7.58 | -0.79 |

| Angola | 8.24 | -0.81 |

| Ghana | 8.43 | -0.82 |

| Turkey | 6.74 | -0.83 |

| Cote D'Ivoire (Ivory Coast) | 7.36 | -0.84 |

| Azerbaijan | 4.81 | -0.85 |

| El Salvador | 7.71 | -0.87 |

| Ecuador | 9.85 | -0.89 |

| Iraq | 7.14 | -0.90 |

| Ukraine | 9.31 | -0.92 |

| Kenya | 8.08 | -1.00 |

| Nigeria | 8.01 | -1.02 |

| Ethiopia | 6.83 | -1.04 |

| Zambia | 13.93 | -1.14 |

| Mongolia | 6.15 | -1.16 |

| Gabon | 8.21 | -1.37 |

| Sri Lanka | 7.21 | -1.62 |

Country Average Corporate Yield Change USD Eurobonds Weekly

| Country | Average Yield | Yield Average change % pts |

| Kazakhstan | 13.41 | 2.17 |

| Oman | 6.87 | 0.61 |

| Zambia | 9.80 | 0.20 |

| Philippines | 5.56 | 0.02 |

| United States | 2.27 | 0.00 |

| Thailand | 4.59 | -0.03 |

| Ukraine | 10.50 | -0.07 |

| Singapore | 4.54 | -0.10 |

| United Arab Emirates | 5.05 | -0.12 |

| Korea (South) | 4.11 | -0.14 |

| Malaysia | 4.43 | -0.16 |

| Israel | 5.94 | -0.20 |

| Qatar | 4.36 | -0.22 |

| Taiwan | 3.90 | -0.23 |

| Saudi Arabia | 5.73 | -0.28 |

| Panama | 5.93 | -0.28 |

| Peru | 5.47 | -0.30 |

| Kuwait | 4.29 | -0.32 |

| India | 5.64 | -0.33 |

| Hong Kong | 4.80 | -0.36 |

| Argentina | 9.20 | -0.37 |

| China | 5.43 | -0.39 |

| Macau | 5.75 | -0.45 |

| Guatemala | 5.88 | -0.45 |

| Indonesia | 6.78 | -0.48 |

| Morocco | 5.66 | -0.50 |

| Mexico | 5.16 | -0.54 |

| Chile | 5.15 | -0.54 |

| Russian Federation | 5.80 | -0.56 |

| Poland | 3.76 | -0.58 |

| Colombia | 5.13 | -0.59 |

| Nigeria | 6.81 | -0.59 |

| Ghana | 7.57 | -0.61 |

| Brazil | 5.86 | -0.65 |

| Supranational | 4.16 | -0.65 |

| South Africa | 6.17 | -0.67 |

| Jamaica | 10.84 | -1.02 |

| Turkey | 8.73 | -1.13 |

Top 30 GEM Souvereign Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| LEBANON (REPUBLIC OF) MTN RegS | XS0250882478 | Lebanon | Apr 12, 2021 | 8.25 | 14.95 |

| ZAMBIA (REPUBLIC OF) RegS | XS1056386714 | Zambia | Apr 14, 2024 | 8.50 | 14.28 |

| ZAMBIA (REPUBLIC OF) RegS | XS1267081575 | Zambia | Jul 30, 2027 | 8.97 | 13.58 |

| LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS | XS0559237796 | Lebanon | Oct 04, 2022 | 6.10 | 13.42 |

| LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS | XS0859367194 | Lebanon | Jan 27, 2023 | 6.00 | 12.84 |

| LEBANON (REPUBLIC OF) RegS | XS1586230051 | Lebanon | Mar 23, 2027 | 6.85 | 11.85 |

| LEBANON (REPUBLIC OF) MTN RegS | XS0707820659 | Lebanon | Nov 27, 2026 | 6.60 | 11.67 |

| LEBANON REPUBLIC OF (GOVERNMENT) MTN RegS | XS0859366899 | Lebanon | Nov 29, 2027 | 6.75 | 11.59 |

| LEBANON REPUBLIC OF (GOVERNMENT) RegS | XS1196419854 | Lebanon | Feb 26, 2030 | 6.65 | 11.00 |

| LEBANON (REPUBLIC OF) MTN RegS | XS1586230481 | Lebanon | Mar 23, 2032 | 7.00 | 11.00 |

| ARGENTINA (REPUBLIC OF) | XS0501194756 | Argentina | Dec 31, 2033 | 8.28 | 10.75 |

| ARGENTINA REPUBLIC OF | US040114GL81 | Argentina | Dec 31, 2033 | 8.28 | 10.48 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1626530320 | Ecuador | Jun 02, 2027 | 9.63 | 10.35 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1535071986 | Ecuador | Dec 13, 2026 | 9.65 | 10.30 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1707041262 | Ecuador | Oct 23, 2027 | 8.88 | 10.25 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1755429732 | Ecuador | Jan 23, 2028 | 7.88 | 10.15 |

| UKRAINE REPUBLIC OF (GOVERNMENT) RegS | XS1902171757 | Ukraine | Nov 01, 2028 | 9.75 | 9.81 |

| UKRAINE REPUBLIC OF (GOVERNMENT) 144A | US903724BV36 | Ukraine | Nov 01, 2028 | 9.75 | 9.81 |

| ARGENTINA REPUBLIC OF GOVERNMENT MTN | US040114GX20 | Argentina | Apr 22, 2026 | 7.50 | 9.77 |

| ARGENTINA REPUBLIC OF GOVERNMENT MTN | US040114HL72 | Argentina | Jan 26, 2027 | 6.88 | 9.73 |

| ARGENTINA REPUBLIC OF GOVERNMENT MTN | US040114HG87 | Argentina | Jul 06, 2036 | 7.13 | 9.70 |

| ARGENTINA REPUBLIC OF GOVERNMENT | US040114GY03 | Argentina | Apr 22, 2046 | 7.63 | 9.66 |

| ARGENTINA REPUBLIC OF GOVERNMENT MTN | US040114HF05 | Argentina | Jul 06, 2028 | 6.63 | 9.65 |

| GHANA (REPUBLIC OF) RegS | XS1821416408 | Ghana | Jun 16, 2049 | 8.63 | 9.52 |

| ECUADOR (REPUBLIC OF) RegS | XS1080330704 | Ecuador | Jun 20, 2024 | 7.95 | 9.51 |

| UKRAINE (GOVERNMENT OF) RegS | XS1303926528 | Ukraine | Sep 01, 2026 | 7.75 | 9.51 |

| UKRAINE (GOVERNMENT OF) RegS | XS1303927179 | Ukraine | Sep 01, 2027 | 7.75 | 9.51 |

| ARGENTINA REPUBLIC OF GOVERNMENT | US040114HQ69 | Argentina | Jan 11, 2028 | 5.88 | 9.44 |

| UKRAINE (GOVERNMENT OF) RegS | XS1303925470 | Ukraine | Sep 01, 2025 | 7.75 | 9.44 |

| UKRAINE REPUBLIC OF (GOVERNMENT) RegS | XS1577952952 | Ukraine | Sep 25, 2032 | 7.38 | 9.36 |

Top 30 GEM Corporate Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| ODEBRECHT OFFSHORE DRILLING FINANC RegS | USG6711KAD75 | Brazil | Dec 01, 2026 | 7.72 | 37.78 |

| DIGICEL GROUP THREE LTD 144A | US25382FAA93 | Bermuda | Apr 01, 2024 | 7.98 | 30.26 |

| NOSTRUM OIL & GAS FINANCE BV RegS | USN64884AB02 | Kazakhstan | Jul 25, 2022 | 8.00 | 22.00 |

| KAISA GROUP HOLDINGS LTD RegS | XS1627597955 | China | Jun 30, 2022 | 8.50 | 17.15 |

| TURKIYE IS BANKASI AS RegS | XS1623796072 | Turkey | Jun 29, 2028 | 7.00 | 14.18 |

| CHINA EVERGRANDE GROUP RegS | XS1627599654 | China | Jun 28, 2025 | 8.75 | 12.66 |

| DIGICEL LTD RegS | USG27649AG04 | Jamaica | Mar 01, 2023 | 6.75 | 12.20 |

| STONEWAY CAPITAL CORP RegS | USC86155AA35 | Argentina | Mar 01, 2027 | 10.00 | 12.13 |

| RIO ENERGY SA/UGEN SA/UENSA SA RegS | USP8S12UAA35 | Argentina | Feb 01, 2025 | 6.88 | 12.13 |

| DTEK FINANCE PLC RegS | XS1543030222 | Ukraine | Dec 31, 2024 | 10.75 | 11.99 |

| TURKIYE HALK BANKASI AS RegS | XS1188073081 | Turkey | Feb 11, 2021 | 4.75 | 11.82 |

| CBOM FINANCE PLC - TIER 2 RegS | XS1589106910 | Russian Federation | Oct 05, 2027 | 7.50 | 11.68 |

| YAPI VE KREDI BANKASI AS MTN RegS | XS1376681067 | Turkey | Mar 09, 2026 | 8.50 | 11.46 |

| SHELF DRILLING HOLDINGS LTD RegS | USG23618AC87 | United Arab Emirates | Feb 15, 2025 | 8.25 | 10.79 |

| TURKIYE VAKIFLAR BANKASI TAO RegS | XS0849728190 | Turkey | Nov 01, 2022 | 6.00 | 10.62 |

| FIRST QUANTUM MINERALS LTD RegS | USC3535CAG36 | Zambia | Apr 01, 2025 | 7.50 | 10.03 |

| ALFA BOND ISSUANCE PLC (AT1-P) RegS | XS1513741311 | Russian Federation | Dec 31, 2049 | 8.00 | 9.81 |

| VTB EURASIA LTD RegS | XS0810596832 | Russian Federation | Dec 31, 2049 | 9.50 | 9.74 |

| METINVEST BV RegS | XS1806400708 | Ukraine | Apr 23, 2026 | 8.50 | 9.74 |

| PAMPA ENERGIA SA RegS | USP7464EAA49 | Argentina | Jan 24, 2027 | 7.50 | 9.61 |

| FIRST QUANTUM MINERALS LTD RegS | USC3535CAF52 | Zambia | Apr 01, 2023 | 7.25 | 9.56 |

| OI SA RegS | USP7354PAA23 | Brazil | Jul 27, 2025 | 10.00 | 9.49 |

| DIGICEL LTD RegS | USG27649AE55 | Jamaica | Apr 15, 2021 | 6.00 | 9.47 |

| METINVEST BV RegS | XS1806400534 | Ukraine | Apr 23, 2023 | 7.75 | 9.38 |

| TURKIYE VAKIFLAR BANKASI TAO MTN RegS | XS1760780731 | Turkey | Jan 30, 2023 | 5.75 | 9.15 |

| YPF SA RegS | USP989MJBE04 | Argentina | Jul 28, 2025 | 8.50 | 9.06 |

| PETRA DIAMONDS US TREASURY PLC RegS | USG7028AAB91 | South Africa | May 01, 2022 | 7.25 | 9.04 |

| MHP SA RegS | XS1577965004 | Ukraine | May 10, 2024 | 7.75 | 9.01 |

| DAR AL ARKAN SUKUK CO LTD RegS | XS1794398831 | Saudi Arabia | Mar 21, 2023 | 6.88 | 8.91 |

| MEDCO PLATINUM ROAD PTE LTD RegS | USY59505AA82 | Indonesia | Jan 30, 2025 | 6.75 | 8.90 |

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| ARGENTINA REPUBLIC OF GOVERNMENT | ARARGE3202H4 | Argentina | Oct 03, 2021 | 18.20 | 28.05 |

| ARGENTINA REPUBLIC OF GOVERNMENT | ARARGE4502K0 | Argentina | Oct 17, 2026 | 15.50 | 20.12 |

| ARGENTINA REPUBLIC OF GOVERNMENT | ARARGE4502J2 | Argentina | Oct 17, 2023 | 16.00 | 19.27 |

| TURKEY (REPUBLIC OF) | TRT050220T17 | Turkey | Feb 05, 2020 | 7.40 | 19.08 |

| TURKEY (REPUBLIC OF) | TRT080720T19 | Turkey | Jul 08, 2020 | 9.40 | 18.56 |

| TURKEY (REPUBLIC OF) | TRT170221T12 | Turkey | Feb 17, 2021 | 10.70 | 18.17 |

| TURKEY (REPUBLIC OF) | TRT120122T17 | Turkey | Jan 12, 2022 | 9.50 | 17.99 |

| TURKEY (REPUBLIC OF) | TRT220921T18 | Turkey | Sep 22, 2021 | 9.20 | 17.68 |

| TURKEY (REPUBLIC OF) | TRT020322T17 | Turkey | Mar 02, 2022 | 11.00 | 17.64 |

| TURKEY (REPUBLIC OF) | TRT180123T10 | Turkey | Jan 18, 2023 | 12.20 | 17.07 |

| TURKEY (REPUBLIC OF) | TRT140922T17 | Turkey | Sep 14, 2022 | 8.50 | 16.67 |

| TURKEY (REPUBLIC OF) | TRT270923T11 | Turkey | Sep 27, 2023 | 8.80 | 16.48 |

| TURKEY (REPUBLIC OF) | TRT240724T15 | Turkey | Jul 24, 2024 | 9.00 | 16.19 |

| TURKEY (REPUBLIC OF) | TRT120325T12 | Turkey | Mar 12, 2025 | 8.00 | 15.98 |

| TURKEY (REPUBLIC OF) | TRT110226T13 | Turkey | Feb 11, 2026 | 10.60 | 15.87 |

| TURKEY (REPUBLIC OF) | TRT240227T17 | Turkey | Feb 24, 2027 | 11.00 | 15.82 |

| TURKEY (REPUBLIC OF) | TRT110827T16 | Turkey | Aug 11, 2027 | 10.50 | 15.69 |

| TURKEY (REPUBLIC OF) | TRT080328T15 | Turkey | Mar 08, 2028 | 12.40 | 15.51 |

| URUGUAY (ORIENTAL REPUBLIC OF) RegS | USP80557BV53 | Uruguay | Mar 15, 2028 | 8.50 | 10.67 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000106972 | South Africa | Jan 31, 2044 | 8.75 | 9.93 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000096173 | South Africa | Feb 28, 2048 | 8.75 | 9.91 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000077488 | South Africa | Feb 28, 2041 | 6.50 | 9.89 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000107012 | South Africa | Jan 31, 2037 | 8.50 | 9.83 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000125972 | South Africa | Feb 28, 2035 | 8.88 | 9.77 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000030404 | South Africa | Mar 31, 2036 | 6.25 | 9.70 |

| URUGUAY (ORIENTAL REPUBLIC OF) RegS | USP96006AE41 | Uruguay | Jun 20, 2022 | 9.88 | 9.62 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000107004 | South Africa | Mar 31, 2032 | 8.25 | 9.60 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000077470 | South Africa | Feb 28, 2031 | 7.00 | 9.48 |

| DOMINICAN REPUBLIC (GOVERNMENT) RegS | USP3579EBZ99 | Dominican Republic | Feb 15, 2023 | 8.90 | 9.40 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000106998 | South Africa | Jan 31, 2030 | 8.00 | 9.37 |

Big Country Table - Stance, Ratings and Datamine

| NCountry | NaCountry | Stance | Avg Sovereign Yield | Sov. Yield Avg Wk Change btps | Avg Corporate Yield | Corp. Yield Avg Wk Change btps | GDP Growth | Total GDP $ bn | GDP per capita PPP $ | Savings to GDP | Inflation | Population | Current Account to GDP | Budget Revenue to GDP | Gov Debt to GDP | Budget Balance to GDP | SandP Rating | Moodys | Fitch | Dgong |

| Angola | Angola | Overweight | 9.06 | 74.00 | -0.118 | 114.504 | 24.256 | 20.006 | 29.178 | -2.149 | 18.701 | -0.791 | BB- | Ba3 | BB- | BB- | ||||

| Argentina | Argentina | Overweight | 10.22 | 31.00 | 9.57 | 16.00 | -2.645 | 475.429 | 16.302 | 40.453 | 44.57 | -3.687 | 35.549 | -3.848 | SD | Caa1 | RD | D | ||

| Azerbaijan | Azerbaijan | Overweight | 5.65 | 65.00 | 1.303 | 45.592 | 30.469 | 3.5 | 9.94 | 6.624 | 40.335 | BBB- | Baa3 | BBB- | ||||||

| Brazil | Brazil | Underweight | 5.46 | -9.00 | 7.76 | 78.00 | 1.435 | 1909.386 | 14.762 | 4.162 | 209.205 | -1.301 | 29.218 | 56.477 | -7.342 | BB+ | Baa3 | BBB | A- | |

| Chile | Chile | Overweight | 4.54 | 15.00 | 5.70 | 43.00 | 3.975 | 299.887 | 20.47 | 2.9 | 18.576 | -2.473 | 23.476 | 5.827 | -1.807 | AA- | Aa3 | A+ | AA | |

| China | China | Overweight | 4.21 | -5.00 | 5.83 | 40.00 | 6.595 | 13457.267 | 44.908 | 2.55 | 1396.982 | 0.725 | 28.692 | -4.178 | AA- | Aa3 | A+ | AA+ | ||

| Colombia | Colombia | Overweight | 4.90 | 28.00 | 5.72 | 46.00 | 2.806 | 336.94 | 19.116 | 3.057 | 49.834 | -2.431 | 25.675 | 39.074 | -2.081 | BBB | Baa2 | BBB | BBB+ | |

| Costa Rica | Costa Rica | Underweight | 7.99 | 52.00 | 3.3 | 60.816 | 14.442 | 2.2 | 5.028 | -3.314 | 13.417 | -7.193 | BB | Baa3 | BB+ | |||||

| C?te dIvoire | Cote D'Ivoire (Ivory Coast) | Overweight | 8.21 | 64.00 | ||||||||||||||||

| Croatia | Croatia (Hrvatska) | Overweight | 4.38 | 27.00 | 2.8 | 59.971 | 23.15 | 1.3 | 4.097 | 2.704 | 46.745 | n/a | -0.037 | BB+ | Baa3 | BBB | BBB- | |||

| Dominican Republic | Dominican Republic | Underweight | 6.38 | 25.00 | 6.411 | 81.103 | 22.651 | 4.101 | 10.278 | -1.638 | 15.049 | 27.219 | -3.341 | B+ | B1 | B | ||||

| Ecuador | Ecuador | Overweight | 10.73 | 100.00 | 1.107 | 107.266 | 24.773 | 0.678 | 17.023 | -0.5 | 35.492 | -2.222 | B+ | Caa1 | B | B- | ||||

| Egypt | Egypt | Underweight | 8.09 | 42.00 | 5.3 | 249.471 | 12.911 | 14.384 | 96.98 | -2.555 | 20.583 | 81.194 | -20.117 | CCC+ | Caa1 | B- | B- | |||

| El Salvador | El Salvador | Underweight | 8.58 | 32.00 | 2.5 | 25.855 | 12.11 | 1.402 | 6.398 | -3.946 | 21.955 | -2.28 | BB- | Ba2 | BB- | |||||

| Gabon | Gabon | Overweight | 9.58 | 120.00 | 2.042 | 17.212 | 28.774 | 2.8 | 2.053 | -1.634 | 18.524 | BB- | BB- | |||||||

| Ghana | Ghana | Underweight | 9.25 | 110.00 | 8.18 | 151.00 | 6.293 | 51.815 | 9.71 | 8 | 29.001 | -4.059 | 17.587 | 64.436 | B | B+ | B | |||

| Hungary | Hungary | Overweight | 4.36 | 22.00 | 4 | 156.393 | 25.595 | 3.101 | 9.765 | 2.319 | 45.514 | 68.002 | -2.838 | BB | Ba1 | BB+ | BBB- | |||

| Indonesia | Indonesia | Overweight | 5.10 | 15.00 | 7.26 | 62.00 | 5.137 | 1005.268 | 31.038 | 3.633 | 265.316 | -2.38 | 14.633 | 26.05 | -2.147 | BB+ | Baa3 | BBB- | BBB- | |

| Iraq | Iraq | Overweight | 8.04 | 63.00 | 1.546 | 230.911 | 26.027 | 2 | 39.857 | 6.863 | 43.998 | |||||||||

| Kazakhstan | Kazakhstan | Overweight | 5.55 | 44.00 | 9.42 | 255.00 | 3.665 | 184.209 | 25.353 | 6.03 | 18.463 | -0.153 | 20.238 | -15.688 | 1.55 | BBB+ | Baa2 | BBB | BBB- | |

| Kenya | Kenya | Underweight | 9.08 | 87.00 | 5.966 | 89.591 | 11.181 | 6.881 | 48.033 | -5.639 | 18.795 | 51.626 | B+ | B+ | B | |||||

| Latvia | Latvia | Underweight | 3.719 | 34.286 | 21.281 | 2.719 | 1.944 | -1.972 | 36.611 | 27.651 | -1.648 | A- | Baa1 | A- | BB | |||||

| Lebanon | Lebanon | Underweight | 11.21 | 50.00 | 1 | 56.709 | -2.568 | 5.354 | 4.554 | -25.641 | 22.618 | 144.081 | -10.122 | B | B1 | B | ||||

| Lithuania | Lithuania | Underweight | 3.57 | 6.00 | 3.543 | 52.468 | 18.593 | 2.199 | 2.782 | 0.311 | 34.453 | 30.519 | 0.603 | A- | Baa1 | A- | BBB- | |||

| Malaysia | Malaysia | Overweight | 4.60 | 15.00 | 4.60 | 1.00 | 4.7 | 347.29 | 27.233 | 3.032 | 32.446 | 2.902 | 19.597 | -2.666 | A- | A3 | A- | A+ | ||

| Mexico | Mexico | Underweight | 6.34 | 93.00 | 5.70 | 66.00 | 2.193 | 1199.264 | 21.218 | 4.349 | 124.738 | -1.277 | 22.236 | 45.532 | -2.635 | AAA | A3 | BBB+ | BBB | |

| Mongolia | Mongolia | Overweight | 7.31 | 104.00 | 6.2 | 12.724 | 26.484 | 8 | 3.105 | -8.284 | 26.807 | BB- | B1 | B+ | BB- | |||||

| Morocco | Morocco | Underweight | 4.52 | 11.00 | 6.16 | 31.00 | 3.234 | 118.178 | 30.168 | 2.4 | 35.22 | -4.27 | 26.294 | 64.045 | -3.749 | BBB- | Ba1 | BBB- | BBB | |

| Pakistan | Pakistan | Underweight | 7.85 | 55.00 | 5.792 | 306.897 | 10.504 | 5.212 | 200.96 | -5.921 | 15.388 | 67.602 | B- | Caa1 | CCC | |||||

| Panama | Panama | Underweight | 4.53 | 15.00 | 6.21 | 55.00 | 4.6 | 66.031 | 36.505 | 2 | 4.159 | -6.995 | 20.07 | 35.283 | -1.136 | BBB | Baa2 | BBB | A- | |

| Paraguay | Paraguay | Underweight | 6.14 | 23.00 | 4.443 | 41.851 | 18.269 | 4.1 | 7.053 | -1.343 | 19.277 | 16.707 | -1.281 | BB- | B1 | B+ | ||||

| Peru | Peru | Overweight | 4.78 | 12.00 | 5.77 | 36.00 | 4.102 | 228.944 | 20.588 | 2.446 | 32.162 | -1.755 | 19.161 | 10.81 | -2.405 | BBB+ | A3 | BBB+ | BBB+ | |

| Philippines | Philippines | Overweight | 4.16 | -8.00 | 4.73 | 2.00 | 6.517 | 331.678 | 25.994 | 5.2 | 107.018 | -1.51 | 19.839 | -1.074 | BBB | Baa3 | BBB- | BBB | ||

| Poland | Poland | Underweight | 3.67 | 1.00 | 4.34 | 22.00 | 4.351 | 549.478 | 20.71 | 2.323 | 37.977 | -0.796 | 40.344 | 45.264 | -2.084 | A- | A2 | A- | A- | |

| Romania | Romania | Underweight | 4.99 | 29.00 | 3.963 | 239.44 | 20.881 | 3.469 | 19.643 | -3.496 | 28.384 | 28.848 | -4.006 | BBB- | Baa3 | BBB- | BB+ | |||

| Russia | Russian Federation | Overweight | 5.53 | -4.00 | 7.30 | 24.00 | 1.705 | 1576.488 | 27.346 | 3.587 | 143.965 | 6.158 | 35.474 | 1.624 | BB+ | Ba1 | BBB- | A | ||

| Serbia | Serbia | Underweight | 4.54 | 49.00 | 3.997 | 47.654 | 15.651 | 2.441 | 6.993 | -5.685 | 43.24 | 56.318 | 0.827 | BB- | B1 | B+ | BB- | |||

| Slovak Republic | Slovak Republic | Overweight | 3.46 | 8.00 | 3.9 | 106.94 | 21.695 | 2.799 | 5.444 | -1.784 | 38.36 | -1.032 | ||||||||

| South Africa | South Africa | Underweight | 6.73 | 19.00 | 6.88 | 37.00 | 0.758 | 376.679 | 14.908 | 5.3 | 57.42 | -3.209 | 29.027 | 50.874 | -3.899 | BBB- | Baa1 | BBB | A | |

| Sri Lanka | Sri Lanka | Underweight | 8.83 | 167.00 | 3.742 | 92.504 | 33.896 | 4.7 | 21.688 | -2.887 | 14.458 | B+ | B1 | BB- | B+ | |||||

| Turkey | Turkey | Underweight | 7.58 | -28.00 | 9.86 | -129.00 | 3.477 | 713.513 | 25.103 | 20 | 81.867 | -5.702 | 30.34 | 29.41 | -4.852 | BB+ | Baa3 | BBB- | BB- | |

| Ukraine | Ukraine | Underweight | 10.18 | 153.00 | 10.57 | 134.00 | 3.539 | 126.39 | 15.677 | 9.031 | 42.639 | -3.104 | 40.471 | -2.573 | BBB- | Caa1 | CCC | B- | ||

| Uruguay | Uruguay | Underweight | 4.97 | 27.00 | 2 | 60.933 | 18.662 | 7.898 | 3.506 | 0.901 | 29.807 | 34.062 | -2.834 | BBB- | Baa2 | BBB- | BB+ | |||

| Venezuela | Venezuela | Underweight | 0.00 | 0.00 | -18 | 96.328 | 14.606 | 2500000 | 29.187 | 6.128 | 10.388 | B | B2 | B+ | BB+ | |||||

| Vietnam | Vietnam | Underweight | 4.77 | 12.00 | 6.6 | 241.434 | 29.644 | 4 | 94.575 | 2.164 | 23.277 | BB- | B1 | B+ | B+ | |||||

| Zambia | Zambia | Overweight | 15.07 | -60.00 | 8.96 | 25.00 | 3.816 | 25.778 | 40.424 | 8.5 | 17.773 | -3.974 | 17.832 | 65.316 | B+ | B+ | ||||

| Hong Kong | Hong Kong | Underweight | 5.13 | 18.00 | AAA | Aa1 | AA+ | AAA | ||||||||||||

| India | India | Underweight | 4.84 | -13.00 | 5.97 | 19.00 | 7.3 | 2689.992 | 28.475 | 5.139 | 1334.221 | -2.99 | 20.839 | -6.554 | BBB- | Baa3 | BBB- | BBB+ | ||

| Israel | Israel | Underweight | 6.13 | 20.00 | 3.597 | 365.599 | 23.213 | 1.182 | 8.878 | 2.275 | 36.797 | 58.669 | -3.18 | A+ | A1 | A | A- | |||

| Jamaica | Jamaica | Underweight | 6.45 | 23.00 | 17.12 | 283.00 | 1.186 | 15.424 | 16.102 | 3.464 | 2.86 | -4.902 | 29.13 | CCC+ | B3 | B- | ||||

| Korea | Korea (South) | Overweight | 4.25 | -10.00 | 2.762 | 1655.608 | 36.163 | 1.6 | 51.663 | 4.971 | 23.306 | 12.244 | 2.401 | |||||||

| Qatar | Qatar | Overweight | 4.59 | 10.00 | 2.685 | 188.295 | 55.62 | 2.776 | 4.832 | 33.237 | AA | Aa2 | AA- | |||||||

| Singapore | Singapore | Overweight | 4.64 | 17.00 | 2.926 | 346.621 | 46.339 | 2.007 | 5.661 | 18.491 | 20.73 | 2.153 | AAA | Aaa | AAA | AAA | ||||

| Thailand | Thailand | Underweight | 4.62 | -2.00 | 4.596 | 490.12 | 32.545 | 0.535 | 69.182 | 9.145 | 20.931 | -0.787 | BBB+ | Baa1 | BBB+ | BBB | ||||

| United Arab Emirates | United Arab Emirates | Overweight | 5.18 | 20.00 | 2.905 | 432.612 | 29.709 | 3.525 | 10.43 | 7.209 | 29.71 | Aa2 | BBB+ |

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

| Bond | Country | Yield | Yield Change % pts |

| SPAIN (KINGDOM OF) 19 | Spain | -0.26 | 0.10 |

| UK CONV GILT RegS 21 | United Kingdom | 0.83 | 0.09 |

| IRELAND (REPUBLIC OF) 20 | Ireland | -0.36 | 0.08 |

| NETHERLANDS (KINGDOM OF) 20 | Netherlands | -0.56 | 0.08 |

| FRANCE (REPUBLIC OF) RegS 19 | France | -0.49 | 0.08 |

| UK CONV GILT RegS 20 | United Kingdom | 0.83 | 0.08 |

| UK CONV GILT RegS 21 | United Kingdom | 0.82 | 0.08 |

| UK CONV GILT RegS 22 | United Kingdom | 0.91 | 0.07 |

| FRANCE (REPUBLIC OF) RegS 20 | France | -0.52 | 0.07 |

| FRANCE (REPUBLIC OF) RegS 20 | France | -0.52 | 0.07 |

| IRELAND (REPUBLIC OF) 20 | Ireland | -0.36 | 0.06 |

| FRANCE (REPUBLIC OF) RegS 20 | France | -0.50 | 0.06 |

| UK CONV GILT RegS 23 | United Kingdom | 0.98 | 0.06 |

| UK CONV GILT RegS 22 | United Kingdom | 0.88 | 0.06 |

| UK CONV GILT RegS 25 | United Kingdom | 1.08 | 0.06 |

| SPAIN (KINGDOM OF) 20 | Spain | -0.30 | 0.06 |

| GERMANY (FEDERAL REPUBLIC OF) RegS 20 | Germany | -0.58 | 0.06 |

| UK CONV GILT RegS 21 | United Kingdom | 0.83 | 0.06 |

| UK CONV GILT RegS 22 | United Kingdom | 0.85 | 0.06 |

| SWEDEN (KINGDOM OF) 20 | Sweden | -0.35 | 0.06 |

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

| Bond | Country | Yield | Yield Change % pts |

| ITALY (REPUBLIC OF) RegS 22 | Italy | 1.22 | -0.82 |

| ITALY (REPUBLIC OF) RegS 23 | Italy | 1.57 | -0.80 |

| ITALY (REPUBLIC OF) RegS 22 | Italy | 1.33 | -0.79 |

| ITALY (REPUBLIC OF) 22 | Italy | 1.17 | -0.78 |

| ITALY (REPUBLIC OF) 23 | Italy | 1.49 | -0.77 |

| ITALY (REPUBLIC OF) RegS 24 | Italy | 1.76 | -0.77 |

| ITALY (REPUBLIC OF) RegS 22 | Italy | 1.07 | -0.77 |

| ITALY (REPUBLIC OF) RegS 22 | Italy | 1.21 | -0.77 |

| ITALY (REPUBLIC OF) RegS 23 | Italy | 1.44 | -0.77 |

| ITALY (REPUBLIC OF) RegS 22 | Italy | 1.06 | -0.77 |

| ITALY (REPUBLIC OF) 22 | Italy | 1.04 | -0.77 |

| ITALY (REPUBLIC OF) RegS 23 | Italy | 1.38 | -0.75 |

| ITALY (REPUBLIC OF) RegS 21 | Italy | 0.86 | -0.74 |

| ITALY (REPUBLIC OF) RegS 23 | Italy | 1.37 | -0.74 |

| ITALY (REPUBLIC OF) 24 | Italy | 1.77 | -0.74 |

| ITALY (REPUBLIC OF) RegS 23 | Italy | 1.48 | -0.74 |

| ITALY (REPUBLIC OF) RegS 21 | Italy | 0.82 | -0.72 |

| ITALY (REPUBLIC OF) RegS 24 | Italy | 1.90 | -0.72 |

| BUONI POLIENNALI DEL TESORO RegS 21 | Italy | 0.89 | -0.72 |

| ITALY (REPUBLIC OF) RegS 24 | Italy | 1.90 | -0.70 |

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

| Bond | Country | Yield | Yield Change %pts |

| NEW LOOK SECURED ISSUER PLC RegS 22 | United Kingdom | 50.00 | 19.58 |

| NEIMAN MARCUS GROUP LTD LLC 144A 21 | United States | 50.00 | 16.37 |

| BANCA MONTE DEI PASCHI DI SIENA SP RegS 28 | Italy | 32.36 | 13.36 |

| SENVION HOLDING GMBH RegS 22 | Germany | 23.43 | 9.45 |

| NORDDEUTSCHE LANDESBANK NY GIROZEN MTN 20 | Germany | 13.81 | 5.77 |

| JONES ENERGY HOLDINGS LLC / JONES 144A 23 | United States | 16.50 | 5.62 |

| PERMIAN RESOURCES/AEPB 144A 21 | United States | 50.00 | 5.21 |

| OBRASCON HUARTE LAIN SA RegS 22 | Spain | 29.42 | 4.92 |

| SESI LLC 24 | United States | 13.43 | 3.55 |

| FRONTIER COMMUNICATIONS CORP 22 | United States | 21.26 | 3.28 |

| SESI LLC 21 | United States | 12.25 | 3.11 |

| HEXION INC 20 | United States | 24.22 | 2.97 |

| NYRSTAR NETHERLANDS HOLDINGS BV MTN RegS 24 | Netherlands | 33.05 | 2.78 |

| WEATHERFORD INTERNATIONAL LTD 22 | United States | 21.16 | 2.70 |

| K HOVNANIAN ENTERPRISES INC 144A 24 | United States | 16.07 | 2.65 |

| SALINI IMPREGILO SPA RegS 21 | Italy | 11.56 | 2.57 |

| K HOVNANIAN ENTERPRISES INC 144A 22 | United States | 15.12 | 2.56 |

| LA FINANCIERE ATALIAN SAS RegS 25 | France | 10.38 | 2.55 |

| FRONTIER COMMUNICATIONS CORP 22 | United States | 22.54 | 2.54 |

| EP ENERGY LLC 144A 24 | United States | 27.19 | 2.51 |

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

| Bond | Country | Yield | Yield Change %pts |

| CHS/COMMUNITY HEALTH SYSTEMS INC 22 | United States | 29.85 | -5.33 |

| HARLAND CLARKE HOLDINGS CORP 144A 21 | United States | 10.52 | -3.22 |

| REYNOLDS GROUP ISSUER LLC 20 | United States | 2.60 | -3.19 |

| TRANSDIGM INC 20 | United States | 2.36 | -3.19 |

| CODERE FINANCE 2 (LUXEMBOURG) SA RegS 21 | Spain | 9.56 | -3.00 |

| T-MOBILE USA INC 24 | United States | 2.18 | -2.93 |

| BROOKFIELD RESIDENTIAL PROPERTIES 144A 20 | Canada | 3.70 | -2.82 |

| CONSTELLIUM NV MTN RegS 21 | Netherlands | 2.25 | -2.23 |

| CASINO GUICHARD PERRACHON SA MTN 20 | France | 1.53 | -2.22 |

| INFOR US INC 22 | United States | 4.43 | -2.09 |

| DEA FINANCE SA RegS 22 | Luxembourg | 2.66 | -2.09 |

| SOLERA LLC / SOLERA FINANCE INC 144A 24 | United States | 5.79 | -1.96 |

| CHS/COMMUNITY HEALTH SYSTEMS INC 144A 23 | United States | 14.54 | -1.81 |

| CALUMET SPECIALTY PRODUCTS PARTNER 21 | United States | 9.72 | -1.69 |

| CASINO GUICHARD PERRACHON SA MTN RegS 21 | France | 3.52 | -1.68 |

| SCIENTIFIC GAMES INTERNATIONAL INC 22 | United States | 6.26 | -1.61 |

| SAIPEM FINANCE INTERNATIONAL BV MTN RegS 22 | Italy | 1.96 | -1.61 |

| SAIPEM FINANCE INTERNATIONAL BV MTN RegS 21 | Italy | 1.37 | -1.59 |

| CCO HLDGS LLC/CAP CORP 21 | United States | 3.60 | -1.59 |

| TRANSOCEAN INC 22 | United States | 6.60 | -1.57 |

Top 30 DM Souvereign Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| ITALY (REPUBLIC OF) | IT0004923998 | Italy | Sep 01, 2044 | 4.75 | 3.64 |

| ITALY (REPUBLIC OF) RegS | IT0004532559 | Italy | Sep 01, 2040 | 5.00 | 3.61 |

| ITALY (REPUBLIC OF) | IT0005273013 | Italy | Mar 01, 2048 | 3.45 | 3.61 |

| ITALY (REPUBLIC OF) | IT0004286966 | Italy | Aug 01, 2039 | 5.00 | 3.54 |

| BUONI POLIENNALI DEL TESORO | IT0005217390 | Italy | Mar 01, 2067 | 2.80 | 3.53 |

| ITALY (REPUBLIC OF) | IT0005083057 | Italy | Sep 01, 2046 | 3.25 | 3.52 |

| ITALY (REPUBLIC OF) | IT0005162828 | Italy | Mar 01, 2047 | 2.70 | 3.44 |

| ITALY (REPUBLIC OF) | IT0005321325 | Italy | Sep 01, 2038 | 2.95 | 3.40 |

| ITALY (REPUBLIC OF) | IT0003934657 | Italy | Feb 01, 2037 | 4.00 | 3.32 |

| ITALY (REPUBLIC OF) | IT0003535157 | Italy | Aug 01, 2034 | 5.00 | 3.21 |

| ITALY (REPUBLIC OF) | IT0005177909 | Italy | Sep 01, 2036 | 2.25 | 3.17 |

| ITALY (REPUBLIC OF) RegS | IT0003256820 | Italy | Feb 01, 2033 | 5.75 | 3.16 |

| ITALY (REPUBLIC OF) | IT0005240350 | Italy | Sep 01, 2033 | 2.45 | 3.08 |

| ITALY (REPUBLIC OF) RegS | IT0001444378 | Italy | May 01, 2031 | 6.00 | 3.02 |

| ITALY (REPUBLIC OF) | IT0005094088 | Italy | Mar 01, 2032 | 1.65 | 2.93 |

| ITALY (REPUBLIC OF) MTN | IT0005024234 | Italy | Mar 01, 2030 | 3.50 | 2.90 |

| SPAIN (KINGDOM OF) | ES00000128E2 | Spain | Jul 30, 2066 | 3.45 | 2.86 |

| ITALY (REPUBLIC OF) RegS | IT0001278511 | Italy | Nov 01, 2029 | 5.25 | 2.85 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAS7 | Australia | Mar 21, 2047 | 3.00 | 2.83 |

| PORTUGAL (REPUBLIC OF) | PTOTEBOE0020 | Portugal | Feb 15, 2045 | 4.10 | 2.80 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU0000018442 | Australia | May 21, 2041 | 2.75 | 2.78 |

| ITALY (REPUBLIC OF) RegS | IT0005340929 | Italy | Dec 01, 2028 | 2.80 | 2.73 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAP3 | Australia | Jun 21, 2039 | 3.25 | 2.71 |

| ITALY (REPUBLIC OF) | IT0004889033 | Italy | Sep 01, 2028 | 4.75 | 2.64 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU3TB0000192 | Australia | Apr 21, 2037 | 3.75 | 2.64 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAM0 | Australia | Jun 21, 2035 | 2.75 | 2.57 |

| SPAIN (KINGDOM OF) | ES0000012B47 | Spain | Oct 31, 2048 | 2.70 | 2.57 |

| BUONI POLIENNALI DEL TESORO RegS | IT0001174611 | Italy | Nov 01, 2027 | 6.50 | 2.55 |

| ITALY (REPUBLIC OF) RegS | IT0005323032 | Italy | Feb 01, 2028 | 2.00 | 2.54 |

| ITALY (REPUBLIC OF) | IT0005274805 | Italy | Aug 01, 2027 | 2.05 | 2.51 |

Top 30 DM Corporate Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| NEIMAN MARCUS GROUP LTD LLC 144A | US570254AA03 | United States | Oct 15, 2021 | 8.00 | 50.00 |

| NEW LOOK SECURED ISSUER PLC RegS | XS1248516616 | United Kingdom | Jul 01, 2022 | 6.50 | 50.00 |

| HEXION US FINANCE CORP/HEXION NOVA | US428303AM35 | United States | Nov 15, 2020 | 9.00 | 50.00 |

| SANCHEZ ENERGY CORP | US79970YAD76 | United States | Jan 15, 2023 | 6.13 | 50.00 |

| PERMIAN RESOURCES/AEPB 144A | US02563LAC28 | United States | Nov 01, 2021 | 7.38 | 50.00 |

| SABLE PERMIAN RESOURCES LAND LLC / 144A | US02563LAB45 | United States | Nov 01, 2020 | 7.13 | 50.00 |

| SANCHEZ ENERGY CORP | US79970YAB11 | United States | Jun 15, 2021 | 7.75 | 50.00 |

| NYRSTAR NETHERLANDS HOLDINGS BV MTN RegS | XS1574789746 | Netherlands | Mar 15, 2024 | 6.88 | 33.05 |

| BANCA MONTE DEI PASCHI DI SIENA SP RegS | XS1752894292 | Italy | Jan 18, 2028 | 5.38 | 32.36 |

| CHS/COMMUNITY HEALTH SYSTEMS INC | US12543DAV29 | United States | Feb 01, 2022 | 6.88 | 29.85 |

| OBRASCON HUARTE LAIN SA RegS | XS1043961439 | Spain | Mar 15, 2022 | 4.75 | 29.42 |

| EP ENERGY LLC 144A | US268787AH11 | United States | May 01, 2024 | 9.38 | 27.19 |

| NAVIOS MARITIME HOLDINGS INC 144A | US639365AG06 | United States | Jan 15, 2022 | 7.38 | 24.65 |

| EP ENERGY LLC 144A | US268787AF54 | United States | Feb 15, 2025 | 8.00 | 24.59 |

| HEXION INC | US428302AA14 | United States | Apr 15, 2020 | 6.63 | 24.22 |

| SENVION HOLDING GMBH RegS | XS1608040090 | Germany | Oct 25, 2022 | 3.88 | 23.43 |

| FRONTIER COMMUNICATIONS CORP | US35906AAK43 | United States | Apr 15, 2022 | 8.75 | 22.54 |

| FRONTIER COMMUNICATIONS CORP | US35906AAM09 | United States | Jan 15, 2023 | 7.13 | 22.41 |

| FRONTIER COMMUNICATIONS CORP | US35906AAN81 | United States | Apr 15, 2024 | 7.63 | 22.24 |

| WEATHERFORD INTERNATIONAL LTD | US947075AN70 | Bermuda | Feb 15, 2024 | 9.88 | 21.87 |

| WEATHERFORD INTERNATIONAL LTD | US947075AK32 | United States | Jun 15, 2023 | 8.25 | 21.83 |

| JC PENNEY CORPORATION INC 144A | US708160CD64 | United States | Mar 15, 2025 | 8.63 | 21.67 |

| FRONTIER COMMUNICATIONS CORP | US35906AAW80 | United States | Sep 15, 2022 | 10.50 | 21.26 |

| WEATHERFORD INTERNATIONAL LTD | US94707VAC46 | United States | Apr 15, 2022 | 4.50 | 21.16 |

| PETSMART INC 144A | US04021LAA89 | United States | Mar 15, 2023 | 7.13 | 20.69 |

| FRONTIER COMMUNICATIONS CORP | US35906AAZ12 | United States | Sep 15, 2025 | 11.00 | 20.57 |

| WEATHERFORD INTERNATIONAL LLC 144A | US94707JAA51 | United States | Mar 01, 2025 | 9.88 | 20.53 |

| FRONTIER COMMUNICATIONS CORP | US35906AAQ13 | United States | Jan 15, 2025 | 6.88 | 20.47 |

| VERITAS US INC/VERITAS BERMUDA LTD 144A | US92346LAA17 | United States | Feb 01, 2024 | 10.50 | 19.56 |

| PETSMART INC 144A | US716768AD81 | United States | Jun 01, 2025 | 8.88 | 18.79 |

ML Comics: Rob is penetrating wrestling craft

Rob was wondering if wrestling falls into health-care sector or consumer entertainment

Source: ML Comics

Latest ML Comics

Recent ML Rural Highlights. Small Towns and Villages

Vaskoh-Romania | Artvin-Turkey | Gorishkino-Russia |