Fund flow data for the perioud between 2018-06-20 and 2018-05-25

Fund flows: BlackRock cheers, Fidelity fears Unfazed by market fall, investors add equity mutual funds to their ... The Money Shift Taiwan shares plunge over 180 points Indian market weathers strong foreign outflows Suffering losses in Midcap fund? Don't panic and close your SIP ... Smaller fund managers beating bigger peers hands down in a tough ...

Emerging markets fund flow showed -3172.2 USD mn of outflow.. While Frontier Markets funds showed -9.9 USD mn of outflows.

BRAZIL Equity funds showed 244.0 USD mn of inflow.

BRAZIL Fixed Income funds showed -321.1 USD mn of outflow.

CHINA Equity funds showed -159.0 USD mn of outflow.

CHINA Fixed Income funds showed 18.3 USD mn of inflow.

INDIA Equity funds showed -998.1 USD mn of outflow.

INDIA Fixed Income funds showed -30.6 USD mn of outflow.

KOREA Equity funds showed -26.2 USD mn of outflow.

RUSSIA Equity funds showed -372.7 USD mn of outflow.

RUSSIA Fixed Income funds showed -2.0 USD mn of outflow.

SOUTH AFRICA Equity funds showed -33.4 USD mn of outflow.

TURKEY Equity funds showed 182.6 USD mn of inflow.

COMMUNICATIONS SECTOR Equity funds showed 36.5 USD mn of inflow.

ENERGY SECTOR Equity funds showed 153.9 USD mn of inflow.

ENERGY SECTOR Mixed Allocation funds showed -0.2 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed 85.7 USD mn of inflow.

REAL ESTATE SECTOR Alternative funds showed -0.4 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -60.2 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -232.2 USD mn of outflow.

UTILITIES SECTOR Equity funds showed -83.7 USD mn of outflow.

LONG SHORT Alternative funds showed 70.5 USD mn of inflow.

LONG SHORT Equity funds showed -376.4 USD mn of outflow.

LONG SHORT Fixed Income funds showed -1.1 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed 1.7 USD mn of inflow.

Best global markets since the begining of the week USA +1.73%, FM (FRONTIER MARKETS) +0.31%, EUROPE +0.10%,

While worst global markets since the begining of the week EM LATIN AMERICA -5.49%, EM (EMERGING MARKETS) -1.46%, EFM ASIA -0.34%,

Best since the start of the week among various stock markets were ZIMBABWE +14.85%, NEW ZEALAND +6.79%, BAHRAIN +4.84%, NIGERIA +4.71%, KENYA +3.93%, UNITED ARAB EMIRATES +3.86%, NORWAY +3.18%, VIETNAM +2.94%, KUWAIT +2.94%, ROMANIA +2.44%,

While worst since the start of the week among various stock markets were BOTSWANA -9.58%, BRAZIL -9.03%, SOUTH AFRICA -6.65%, TURKEY -6.37%, ARGENTINA -6.37%, RUSSIA -4.86%, MAURITIUS -4.00%, KOREA -3.94%, UKRAINE -3.86%, SINGAPORE -3.70%,

Global Growth Powers International Fund Flows Investors Sell PowerShares FTSE RAFI Developed Markets (PXF ... International ETFs ready for takeoff Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... The rush to emerging markets "Epic" flows to tech funds as "buy-the-dip" rules -BAML Flow Traders US LLC Has $4.90 Million Position in Schwab ... Investors pulled $5.8 billion out of emerging market stocks in February Fund flows into India to be healthy despite LTCG tax: John Praveen ... "Epic" flows to tech funds as "buy-the-dip" rules -BAML Navigating Through Stiff Income Crosswinds: What Are Cash Flow ... Investors Warm Up to Bond ETFs US Fund-Flows Weekly Report: All 4 Fund Macro-Groups Take In ... New Year, Not-So-New Trends in Fund Flows

Weekly Fund Flows By Objective

| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | 59.01 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -671.03 |

| Commodities | PRECIOUS METALS | Commodity | -2254.23 |

| Commodities | PRECIOUS METALS | Mixed Allocation | -55.58 |

| country | AUSTRALIA | Equity | -95.57 |

| country | AUSTRALIA | Fixed Income | -140.83 |

| country | AUSTRALIA | Mixed Allocation | 0.22 |

| country | BRAZIL | Equity | 243.99 |

| country | BRAZIL | Fixed Income | -321.13 |

| country | CHINA | Equity | -158.99 |

| country | CHINA | Fixed Income | 18.25 |

| Country | EGYPT | Equity | -14.88 |

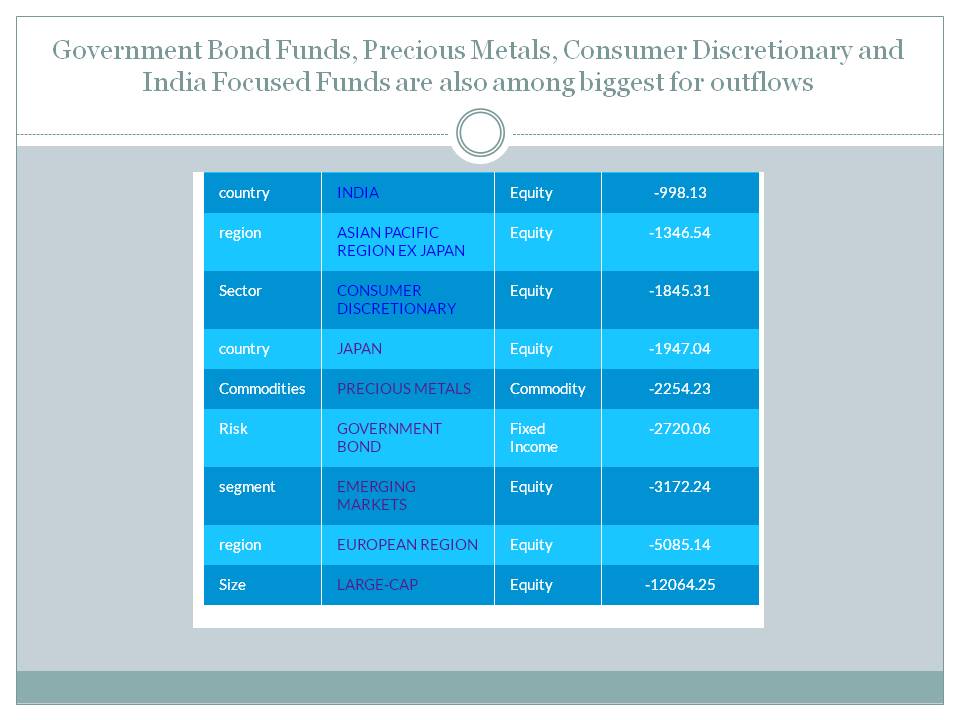

| country | INDIA | Equity | -998.13 |

| country | INDIA | Fixed Income | -30.60 |

| country | ISRAEL | Equity | 4.79 |

| country | JAPAN | Equity | -1947.04 |

| country | JAPAN | Fixed Income | -63.97 |

| country | JAPAN | Mixed Allocation | -20.55 |

| country | KOREA | Equity | -26.19 |

| country | POLAND | Equity | -2.68 |

| country | RUSSIA | Equity | -372.69 |

| country | RUSSIA | Fixed Income | -1.97 |

| country | SOUTH AFRICA | Equity | -33.40 |

| country | SPAIN | Equity | -258.45 |

| Country | TAIWAN | Equity | -65.06 |

| country | TURKEY | Equity | 182.62 |

| country | UNITED KINGDOM | Equity | 221.87 |

| industry | BASIC MATERIALS SECTOR | Equity | -183.08 |

| industry | COMMUNICATIONS SECTOR | Equity | 36.48 |

| industry | ENERGY SECTOR | Equity | 153.91 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.19 |

| industry | FINANCIAL SECTOR | Equity | 85.72 |

| industry | HEALTH CARE SECTOR | Equity | -390.44 |

| industry | INDUSTRIAL SECTOR | Equity | -20.03 |

| industry | MULTIPLE SECTOR | Equity | -0.75 |

| industry | NATURAL RESOURCES SECTOR | Equity | 40.35 |

| industry | REAL ESTATE SECTOR | Alternative | -0.44 |

| industry | REAL ESTATE SECTOR | Equity | -60.22 |

| industry | TECHNOLOGY SECTOR | Equity | -232.25 |

| industry | UTILITIES SECTOR | Equity | -83.69 |

| region | AFRICAN REGION | Equity | -14.29 |

| region | ASIAN PACIFIC REGION | Equity | -507.93 |

| region | ASIAN PACIFIC REGION | Fixed Income | -508.41 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 87.12 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -1346.54 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -683.24 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -96.32 |

| region | EASTERN EUROPEAN REGION | Equity | -242.92 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -5.10 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -1.03 |

| region | EUROPEAN REGION | Equity | -5085.14 |

| region | EUROPEAN REGION | Fixed Income | -647.96 |

| region | EUROPEAN REGION | Mixed Allocation | 5.32 |

| region | LATIN AMERICAN REGION | Equity | -875.31 |

| region | LATIN AMERICAN REGION | Fixed Income | -77.00 |

| region | MIDDLE EAST REGION | Equity | -79.70 |

| region | MIDDLE EAST REGION | Fixed Income | -2.51 |

| region | NORDIC REGION | Equity | -86.99 |

| region | NORTH AMERICAN REGION | Equity | -98.81 |

| region | NORTH AMERICAN REGION | Fixed Income | -57.35 |

| Risk | GOVERNMENT BOND | Alternative | -4.34 |

| Risk | GOVERNMENT BOND | Equity | 0.01 |

| Risk | GOVERNMENT BOND | Fixed Income | -2720.06 |

| Risk | GOVERNMENT BOND | Mixed Allocation | 14.49 |

| Risk | INFLATION PROTECTED | Brazil | -24.99 |

| Risk | INFLATION PROTECTED | Fixed Income | -725.02 |

| Risk | LONG SHORT | Alternative | 70.47 |

| Risk | LONG SHORT | Equity | -376.35 |

| Risk | LONG SHORT | Fixed Income | -1.07 |

| Risk | LONG SHORT | Mixed Allocation | 1.68 |

| Sector | AGRICULTURE | Commodity | -84.60 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Sector | CONSUMER DISCRETIONARY | Equity | -1845.31 |

| Sector | CONSUMER STAPLES | Equity | -89.84 |

| segment | BRIC | Equity | -69.79 |

| segment | BRIC | Fixed Income | -140.02 |

| segment | DEVELOPED MARKETS | Equity | -577.92 |

| segment | EMEA | Equity | -5.45 |

| segment | EMEA | Fixed Income | -1.94 |

| segment | EMERGING MARKETS | Equity | -3172.24 |

| segment | GCC | Equity | -9.74 |

| segment | GCC | Fixed Income | -2.51 |

| segment | GCC | Mixed Allocation | -13.54 |

| segment | MENA | Equity | -2.93 |

| segment | MENA | Fixed Income | -1.85 |

| Size | LARGE-CAP | Equity | -12064.25 |

| Size | MID-CAP | Commodity | -0.52 |

| Size | MID-CAP | Equity | 1127.10 |

| Size | SMALL-CAP | Equity | 7015.04 |

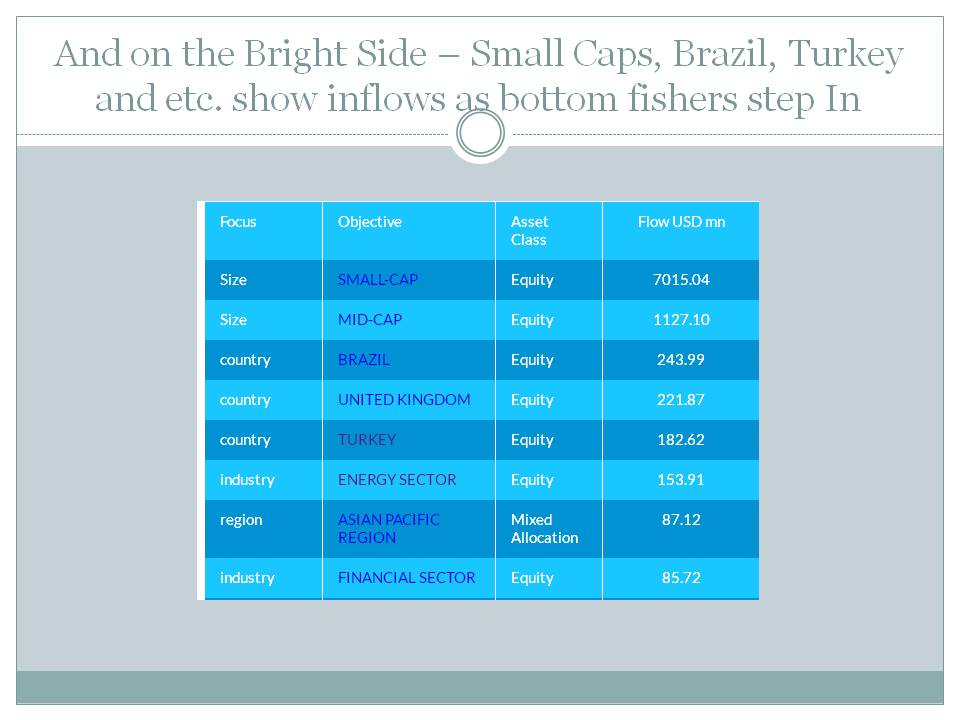

Flows In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| Size | SMALL-CAP | Equity | 7015.04 |

| Size | MID-CAP | Equity | 1127.10 |

| country | BRAZIL | Equity | 243.99 |

| country | UNITED KINGDOM | Equity | 221.87 |

| country | TURKEY | Equity | 182.62 |

| industry | ENERGY SECTOR | Equity | 153.91 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 87.12 |

| industry | FINANCIAL SECTOR | Equity | 85.72 |

| Risk | LONG SHORT | Alternative | 70.47 |

| Commodities | INDUSTRIAL METALS | Commodity | 59.01 |

| industry | NATURAL RESOURCES SECTOR | Equity | 40.35 |

| industry | COMMUNICATIONS SECTOR | Equity | 36.48 |

| country | CHINA | Fixed Income | 18.25 |

| Risk | GOVERNMENT BOND | Mixed Allocation | 14.49 |

| region | EUROPEAN REGION | Mixed Allocation | 5.32 |

| country | ISRAEL | Equity | 4.79 |

| Risk | LONG SHORT | Mixed Allocation | 1.68 |

| country | AUSTRALIA | Mixed Allocation | 0.22 |

| Risk | GOVERNMENT BOND | Equity | 0.01 |

| Sector | AGRICULTURE | Equity | 0.00 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.19 |

| industry | REAL ESTATE SECTOR | Alternative | -0.44 |

| Size | MID-CAP | Commodity | -0.52 |

| industry | MULTIPLE SECTOR | Equity | -0.75 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -1.03 |

| Risk | LONG SHORT | Fixed Income | -1.07 |

| segment | MENA | Fixed Income | -1.85 |

| segment | EMEA | Fixed Income | -1.94 |

| country | RUSSIA | Fixed Income | -1.97 |

| region | MIDDLE EAST REGION | Fixed Income | -2.51 |

| segment | GCC | Fixed Income | -2.51 |

| country | POLAND | Equity | -2.68 |

| segment | MENA | Equity | -2.93 |

| Risk | GOVERNMENT BOND | Alternative | -4.34 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -5.10 |

| segment | EMEA | Equity | -5.45 |

| segment | GCC | Equity | -9.74 |

| segment | GCC | Mixed Allocation | -13.54 |

| region | AFRICAN REGION | Equity | -14.29 |

| Country | EGYPT | Equity | -14.88 |

| industry | INDUSTRIAL SECTOR | Equity | -20.03 |

| country | JAPAN | Mixed Allocation | -20.55 |

| Risk | INFLATION PROTECTED | Brazil | -24.99 |

| country | KOREA | Equity | -26.19 |

| country | INDIA | Fixed Income | -30.60 |

| country | SOUTH AFRICA | Equity | -33.40 |

| Commodities | PRECIOUS METALS | Mixed Allocation | -55.58 |

| region | NORTH AMERICAN REGION | Fixed Income | -57.35 |

| industry | REAL ESTATE SECTOR | Equity | -60.22 |

| country | JAPAN | Fixed Income | -63.97 |

| Country | TAIWAN | Equity | -65.06 |

| segment | BRIC | Equity | -69.79 |

| region | LATIN AMERICAN REGION | Fixed Income | -77.00 |

| region | MIDDLE EAST REGION | Equity | -79.70 |

| industry | UTILITIES SECTOR | Equity | -83.69 |

| Sector | AGRICULTURE | Commodity | -84.60 |

| region | NORDIC REGION | Equity | -86.99 |

| Sector | CONSUMER STAPLES | Equity | -89.84 |

| country | AUSTRALIA | Equity | -95.57 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -96.32 |

| region | NORTH AMERICAN REGION | Equity | -98.81 |

| segment | BRIC | Fixed Income | -140.02 |

| country | AUSTRALIA | Fixed Income | -140.83 |

| country | CHINA | Equity | -158.99 |

| industry | BASIC MATERIALS SECTOR | Equity | -183.08 |

| industry | TECHNOLOGY SECTOR | Equity | -232.25 |

| region | EASTERN EUROPEAN REGION | Equity | -242.92 |

| country | SPAIN | Equity | -258.45 |

| country | BRAZIL | Fixed Income | -321.13 |

| country | RUSSIA | Equity | -372.69 |

| Risk | LONG SHORT | Equity | -376.35 |

| industry | HEALTH CARE SECTOR | Equity | -390.44 |

| region | ASIAN PACIFIC REGION | Equity | -507.93 |

| region | ASIAN PACIFIC REGION | Fixed Income | -508.41 |

| segment | DEVELOPED MARKETS | Equity | -577.92 |

| region | EUROPEAN REGION | Fixed Income | -647.96 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -671.03 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -683.24 |

| Risk | INFLATION PROTECTED | Fixed Income | -725.02 |

| region | LATIN AMERICAN REGION | Equity | -875.31 |

| country | INDIA | Equity | -998.13 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -1346.54 |

| Sector | CONSUMER DISCRETIONARY | Equity | -1845.31 |

| country | JAPAN | Equity | -1947.04 |

| Commodities | PRECIOUS METALS | Commodity | -2254.23 |

| Risk | GOVERNMENT BOND | Fixed Income | -2720.06 |

| segment | EMERGING MARKETS | Equity | -3172.24 |

| region | EUROPEAN REGION | Equity | -5085.14 |

| Size | LARGE-CAP | Equity | -12064.25 |

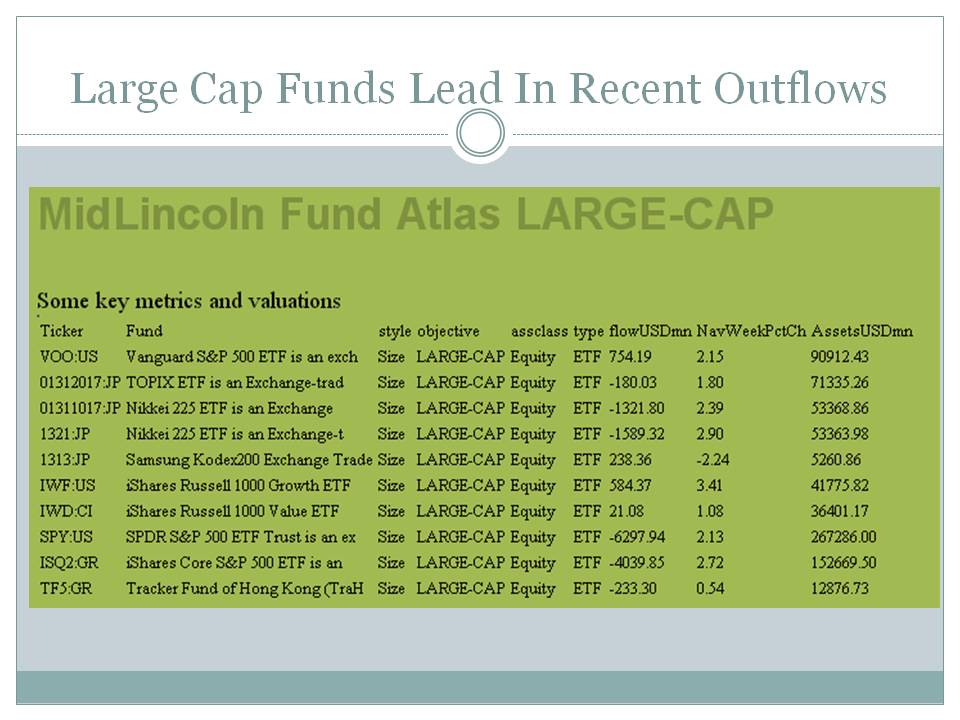

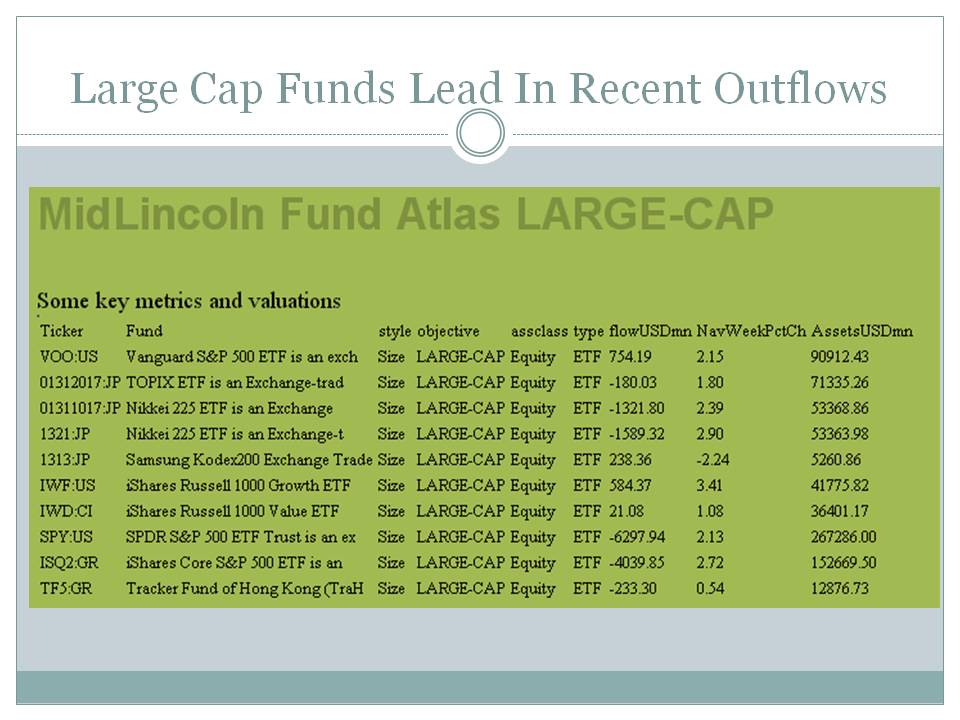

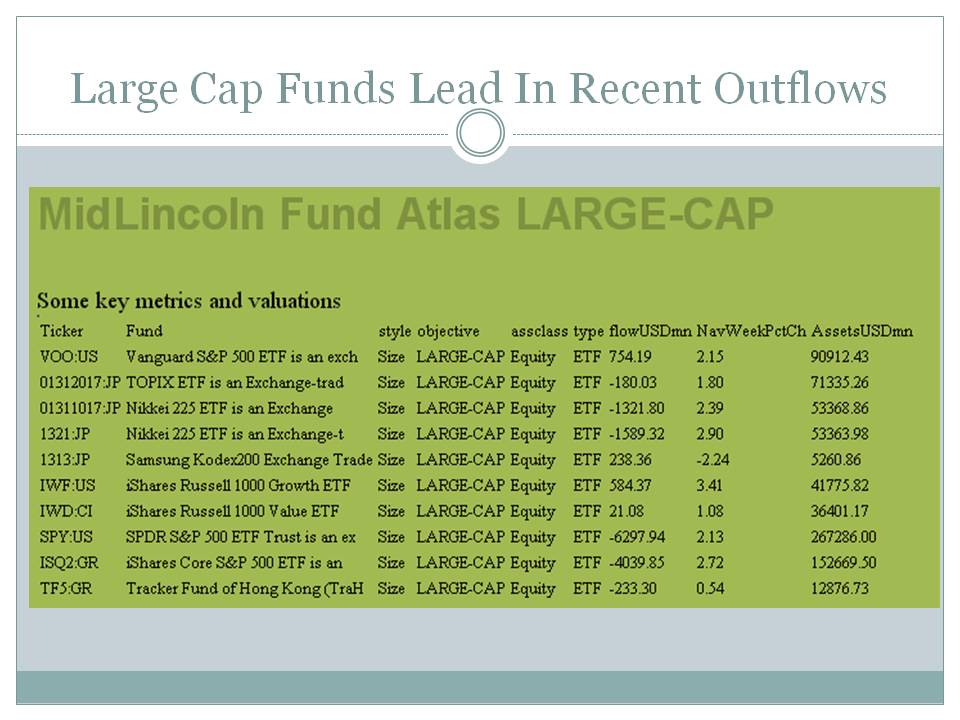

Chart: Large Cap Funds Lead In Recent Outflows

Source: ML

Download file in Power PointKey Topics and News

Small Caps, Brazil, Turkey and etc. show inflows

- The Daily Shot: Firms Are Easing Drug Testing Requirements to ...

- Market Update: Stocks Steady as Fed Interest-Rate Decision Looms

- Technical Scoop - Weekend Update June 11 2018

- The Daily Shot: The Spike in Steel Prices is a New Tax on Americans

- JP Morgan Exchange-Traded Funds

- Emerging Markets Watch - EM capital flows: Singling out the ...

- Push factors and capital flows to EMs: Why knowing ... - Banco Central

- The "hot money" phenomenon in Brazil - SciELO

- All Hands on Deck: Confronting the Challenges of Capital Flows ...

- Brazil, developing economies and private international capital flows ...

- Recent Experiences With Capital Controls: Is There A ... - TCMB

- The "hot money" phenomenon in Brazil - SciELO

- Capital account regulation in Brazil - SciELO

- Claessens - Federal Reserve Bank of San Francisco

- Macroprudential, Monetary and Capital Flows Management Policies ...

as bottom fishers step-in

Source: ML

Government Bond Funds, Precious Metals Funds In Outflow Mode

- 'Sell Any Rip' Seen Beating Buy-the-Dip as Treasuries Gain Favor

- Investors pull billions from US stocks in longest outflow streak since ...

- How RBI Minutes aided rupee's crash bonds and the rupee

- Expect monthly inflows in MFs at Rs 20000-30000 cr in 2019: A ...

- Crescat Capital Quarterly Investor Letter Q4 2018

- 15 Best Equity Precious Metals Mutual Funds - US News Money

- 7 Best Equity Precious Metals Funds - US News Money

- Are European fund investors in “risk-on” mode? - Investment Europe

- Top 62 Precious Metals Funds - MutualFunds.com

- MAXfunds.com | A better way of looking at mutual funds.

- Investment Policy Statement of Labor Funds

- NBI Precious Metals Fund - National Bank

- Precious Metals Fund - Wells Fargo Funds

- Vanguard Precious Metals and Mining Fund - The Vanguard Group

- Franklin Gold and Precious Metals Fund Prospectus

Consumer Discretionary and India Focused Funds are also among biggest for outflows

Source: ML

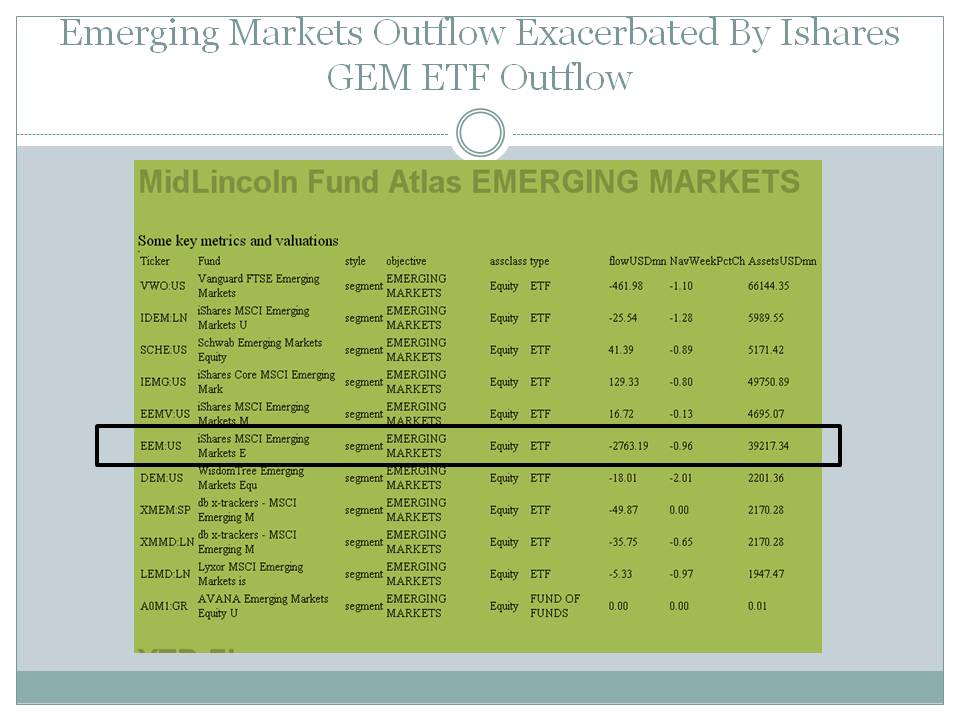

Emerging Markets Outflow

- Why Emerging-Market Funds Are Seeing Their Biggest Outflows In ...

- Emerging Markets in May Saw Biggest Outflows in 18 Months

- Investors pull $5.5 bln out of emerging markets in last week -IIF

- Emerging Market Outflows

- Emerging Markets Get Pounded by Trade War Concerns

Exacerbated By Ishares GEM ETF Outflow

Source:

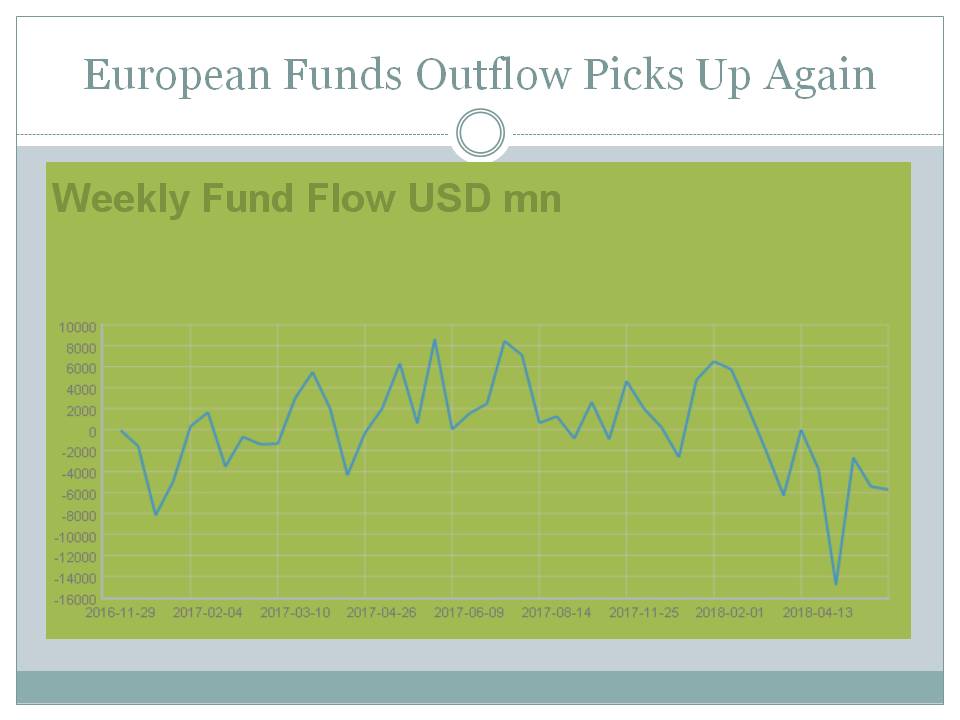

European Funds Outflow Picks Up Again

- FUND FLOWS: US Wins, Europe Loses for Equity Funds in Early June

- The Return of 'The Italian Question'

- Stock Flows Haven't Been This 'America First' Since Trump Won

- German ETFs hit by concerns over EU migrant crisis

- Investors already bailing on Europe funds amid turmoil, pause ...

Source: ML

Large Cap Funds Lead In Recent Outflows

- Fund flows: BlackRock cheers, Fidelity fears

- Unfazed by market fall, investors add equity mutual funds to their ...

- The Money Shift

- Taiwan shares plunge over 180 points

- Indian market weathers strong foreign outflows

Source: ML

Emerging markets fund flow showed -3172.2 USD mn of outflow.. While Frontier Markets funds showed -9.9 USD mn of outflows.

BRAZIL Equity funds showed 244.0 USD mn of inflow.

BRAZIL Fixed Income funds showed -321.1 USD mn of outflow.

CHINA Equity funds showed -159.0 USD mn of outflow.

CHINA Fixed Income funds showed 18.3 USD mn of inflow.

INDIA Equity funds showed -998.1 USD mn of outflow.

INDIA Fixed Income funds showed -30.6 USD mn of outflow.

KOREA Equity funds showed -26.2 USD mn of outflow.

RUSSIA Equity funds showed -372.7 USD mn of outflow.

RUSSIA Fixed Income funds showed -2.0 USD mn of outflow.

SOUTH AFRICA Equity funds showed -33.4 USD mn of outflow.

TURKEY Equity funds showed 182.6 USD mn of inflow.

COMMUNICATIONS SECTOR Equity funds showed 36.5 USD mn of inflow.

ENERGY SECTOR Equity funds showed 153.9 USD mn of inflow.

ENERGY SECTOR Mixed Allocation funds showed -0.2 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed 85.7 USD mn of inflow.

REAL ESTATE SECTOR Alternative funds showed -0.4 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -60.2 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed -232.2 USD mn of outflow.

UTILITIES SECTOR Equity funds showed -83.7 USD mn of outflow.

LONG SHORT Alternative funds showed 70.5 USD mn of inflow.

LONG SHORT Equity funds showed -376.4 USD mn of outflow.

LONG SHORT Fixed Income funds showed -1.1 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed 1.7 USD mn of inflow.

Latest ML Comics

Markets

Market performance is between 2018-06-15 and 2018-06-01Best global markets since the begining of the week USA +1.73%, FM (FRONTIER MARKETS) +0.31%, EUROPE +0.10%,

While worst global markets since the begining of the week EM LATIN AMERICA -5.49%, EM (EMERGING MARKETS) -1.46%, EFM ASIA -0.34%,

Best since the start of the week among various stock markets were ZIMBABWE +14.85%, NEW ZEALAND +6.79%, BAHRAIN +4.84%, NIGERIA +4.71%, KENYA +3.93%, UNITED ARAB EMIRATES +3.86%, NORWAY +3.18%, VIETNAM +2.94%, KUWAIT +2.94%, ROMANIA +2.44%,

While worst since the start of the week among various stock markets were BOTSWANA -9.58%, BRAZIL -9.03%, SOUTH AFRICA -6.65%, TURKEY -6.37%, ARGENTINA -6.37%, RUSSIA -4.86%, MAURITIUS -4.00%, KOREA -3.94%, UKRAINE -3.86%, SINGAPORE -3.70%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| DWS RUSSIA BOND FUND - EUR DIST (DWSRUBD) | -0.58 | -1.06 | 152.23 | 160.53 | 162.23 | 80.28 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 2.27 | 10.47 | 40.63 | 60.71 | 152.32 | 56.44 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -1.41 | -1.22 | 32.29 | 50.42 | 133.89 | 45.42 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | 3.29 | -12.66 | 23.29 | 36.06 | 107.02 | 33.43 |

| ETFS NICKEL (NICK) | -1.01 | 5.60 | 23.64 | 31.90 | 69.16 | 26.41 |

| SANTANDER FIC FI VALE 3 ACOES (REALRIO) | 2.73 | -6.88 | 14.66 | 26.22 | 74.48 | 24.14 |

| SAFRA VALE DO RIO DOCE FIC FIA (SAFVRDA) | 2.68 | -6.70 | 14.18 | 25.51 | 72.59 | 23.52 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | 3.41 | 9.25 | 29.96 | 29.00 | 52.06 | 23.43 |

| POWERSHARES NASDAQ INTERNET PORTFOLIO (PNQI) | 3.71 | 10.63 | 26.22 | 26.12 | 43.46 | 20.98 |

| SCB OIL FUND (SCBOILH) | 1.41 | -4.09 | 18.33 | 23.84 | 58.17 | 19.83 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -1.24 | 1.43 | 21.26 | 26.32 | 52.00 | 19.63 |

| K OIL FUND (KASOILF) | 1.40 | -4.11 | 18.01 | 23.45 | 57.11 | 19.46 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | 2.24 | 6.60 | 24.45 | 22.14 | 41.86 | 18.21 |

| FIDELITY SELECT RETAILING PORTFOLIO (FSRPX) | 1.43 | 8.15 | 18.52 | 20.62 | 35.93 | 16.53 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 1.82 | -5.02 | 13.05 | 19.82 | 49.37 | 16.50 |

| POLAR CAPITAL TECHNOLOGY TRUST PLC (PCT) | 1.05 | 5.23 | 14.10 | 17.70 | 39.21 | 15.80 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 8.68 | 45.24 | 36.68 | 22.75 | -14.25 | 15.61 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | 0.56 | -5.57 | 12.68 | 18.97 | 48.45 | 15.60 |

| FIRST STATE GLOBAL UMBRELLA PLC - CHINA GROWTH FUND - I DIS (CRECHID) | 0.05 | 2.51 | 10.43 | 15.11 | 42.11 | 14.95 |

| FIRST TRUST TECHNOLOGY ALPHADEX FUND (FXL) | 1.90 | 5.26 | 16.26 | 16.24 | 35.72 | 14.78 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -12.53 | -48.82 | -54.59 | -47.17 | -27.19 | -33.93 |

| FINAM MANAGEMENT LLC (FINMIT) | -15.30 | -15.40 | -32.00 | -33.97 | -39.80 | -26.12 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -7.55 | -38.83 | -40.39 | -29.76 | -14.28 | -22.61 |

| LYXOR ETF TURKEY EURO (TURU) | -7.30 | -12.94 | -34.39 | -30.11 | -31.00 | -20.34 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -8.30 | -12.23 | -33.81 | -28.72 | -29.52 | -19.69 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | -7.14 | -11.56 | -33.17 | -28.98 | -29.64 | -19.33 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -6.85 | -11.32 | -32.96 | -28.81 | -29.55 | -19.13 |

| ISHARES MSCI TURKEY ETF (ISVZ) | -7.59 | -11.75 | -32.04 | -27.39 | -27.65 | -18.60 |

| COHEN RENTA FIJA FONDO COMUN DE INVERSION - A-MINORISTA (CRTAFAM) | -7.40 | -9.51 | -23.49 | -29.49 | -27.29 | -18.42 |

| 49 NORTH RESOURCES INC (FNR) | -22.94 | 5.91 | -41.78 | -19.05 | -32.26 | -17.09 |

| AUSTRALIA EQUITY INCOME FUND (DWAUEIP) | -4.72 | -3.69 | -20.49 | -18.95 | -28.94 | -14.08 |

| LYXOR ETF BRAZIL IBOVESPA (LYMG) | -20.04 | -20.66 | -14.17 | -10.91 | -0.50 | -13.03 |

| BB ACOES SETOR FINANCEIRO FIC FI (BBACOEB) | -2.02 | -16.40 | -19.42 | -16.52 | -5.80 | -10.18 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | -3.54 | -19.72 | -20.79 | -14.85 | -2.31 | -10.11 |

| LATIN AMERICAN DISCOVERY FUND INC/THE (XLDFX) | -3.21 | -13.88 | -16.72 | -13.66 | -8.92 | -9.92 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | -3.54 | -6.50 | -17.56 | -14.97 | -14.38 | -9.85 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | -10.95 | 9.62 | -17.35 | -13.72 | -23.28 | -9.58 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | -2.35 | -13.52 | -17.91 | -14.29 | -8.15 | -9.58 |

| DB X-TRACKERS MSCI PHILIPPINES IM TRN INDEX UCITS ETF (N2E) | -3.03 | -6.04 | -17.73 | -14.69 | -14.03 | -9.45 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | -6.77 | -8.46 | -19.42 | -20.28 | -1.35 | -9.22 |

Best Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF FTSE MIB DAILY LEVERAGED (LEVMI) | 1.52 | 2.65 | 7.51 | -13.43 | 4.15 | 23.47 | 5.43 |

| MONTANARO EUROPEAN SMALLER COS TRUST PLC (MTE) | 1.95 | 11.46 | 5.16 | 7.75 | 13.71 | 23.45 | 12.52 |

| AMUNDI ETF FTSE MIB UCITS ETF (FMI) | -0.48 | 1.19 | 3.47 | -8.29 | 2.29 | 15.15 | 3.16 |

| POWERSHARES DYNAMIC FOOD & BEVERAGE PORTFOLIO (P3W8) | 4.39 | -2.08 | 3.24 | 2.20 | -0.27 | 2.09 | 1.82 |

| DB X-TRACKERS FTSE MIB INDEX UCITS ETF DR (XMIB) | -0.68 | 0.13 | 3.01 | -8.55 | 1.68 | 13.88 | 2.51 |

| ISHARES MSCI ITALY CAPPED ETF (ISVQ) | -1.39 | -2.11 | 2.66 | -9.49 | -0.33 | 10.19 | 0.76 |

| ALLIANZ EUROPE EQUITY GROWTH - AEUR (UQ2A) | 0.26 | 3.55 | 2.32 | 2.64 | 7.41 | 13.20 | 6.39 |

| WORLDWIDE HEALTHCARE TRUST PLC (P8W) | 1.85 | 4.59 | 2.17 | 3.69 | 6.94 | 15.53 | 7.08 |

| UBS ETF - MSCI SWITZERLAND 20/35 100% HEDGED TO USD UCITS ETF (S2USBH) | -0.14 | -3.19 | 2.07 | -2.75 | -3.23 | 4.05 | 0.03 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 0.14 | 12.06 | 2.05 | 5.02 | 13.00 | 33.18 | 13.31 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED UCITS ETF-GBP (X03E) | 1.73 | -1.42 | 2.01 | 1.74 | -1.68 | 3.92 | 1.50 |

| EAST CAPITAL LUX - RUSSIAN FUND (EC0A) | 2.91 | -3.24 | 1.99 | 3.66 | -1.41 | 12.56 | 4.20 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | -0.53 | -16.99 | 1.91 | -10.80 | -17.57 | 11.85 | -3.65 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 1.24 | 13.05 | 1.82 | -5.02 | 19.82 | 49.37 | 16.50 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 2.40 | 0.32 | 1.82 | 3.02 | 0.47 | 1.74 | 1.76 |

| ISHARES US TELECOMMUNICATIONS ETF (ISQC) | 3.06 | -5.34 | 1.76 | 3.24 | -3.03 | -13.81 | -2.96 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.51 | -6.18 | 1.73 | 2.46 | -8.13 | -19.44 | -5.85 |

| JUPITER EUROPEAN OPPORTUNITIES TRUST PLC (JEO) | 0.12 | 8.04 | 1.73 | -0.36 | 10.28 | 19.63 | 7.82 |

| LATIN AMERICAN DISCOVERY FUND INC/THE (LDF) | 1.17 | -16.10 | 1.73 | -13.41 | -12.72 | -7.95 | -8.09 |

| NEW INDIA INVESTMENT TRUST PLC (NIQ) | 2.39 | -3.06 | 1.55 | 1.18 | 0.09 | 3.81 | 1.66 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | -0.08 | -17.35 | -10.95 | 9.62 | -13.72 | -23.28 | -9.58 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -1.31 | -33.81 | -8.30 | -12.23 | -28.72 | -29.52 | -19.69 |

| ISHARES MSCI TURKEY ETF (ISVZ) | -0.84 | -32.04 | -7.59 | -11.75 | -27.39 | -27.65 | -18.60 |

| LYXOR ETF TURKEY EURO (TURU) | -2.61 | -34.39 | -7.30 | -12.94 | -30.11 | -31.00 | -20.34 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | -1.88 | -33.17 | -7.14 | -11.56 | -28.98 | -29.64 | -19.33 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -1.98 | -32.96 | -6.85 | -11.32 | -28.81 | -29.55 | -19.13 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | -4.27 | -19.42 | -6.77 | -8.46 | -20.28 | -1.35 | -9.22 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -0.15 | -10.36 | -6.41 | 3.41 | -7.64 | -9.97 | -5.15 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 1.40 | -6.77 | -4.66 | 2.53 | -3.24 | 5.99 | 0.15 |

| VALUE KOREA ETF (3041) | -2.86 | -7.08 | -4.34 | -5.68 | -7.18 | -3.73 | -5.23 |

| LYXOR ETF MSCI KOREA (KOR) | -1.96 | -6.86 | -4.30 | -3.95 | -3.89 | 7.75 | -1.10 |

| BARRAMUNDI LTD (BRM) | -2.24 | -0.83 | -3.88 | 1.74 | 3.88 | 2.62 | 1.09 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON LATIN AMERICA FUND - A YDISEUR (XQ1H) | -3.65 | -14.11 | -3.81 | -12.31 | -10.46 | -5.26 | -7.96 |

| MARKET VECTORS AFRICA INDEX ETF (VEF2) | -3.17 | -4.08 | -3.69 | -7.48 | -1.18 | 10.48 | -0.47 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -0.37 | 2.75 | -3.63 | -5.19 | 9.54 | 38.60 | 9.83 |

| DB X-TRACKERS MSCI SINGAPORE IM INDEX UCITS ETF (3065) | -0.88 | -1.34 | -3.62 | -6.44 | -0.61 | 12.07 | 0.35 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | -3.62 | -20.79 | -3.54 | -19.72 | -14.85 | -2.31 | -10.11 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.29 | -17.56 | -3.54 | -6.50 | -14.97 | -14.38 | -9.85 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -2.39 | -12.26 | -3.50 | -6.42 | -9.54 | 19.57 | 0.03 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -2.39 | -11.38 | -3.45 | -6.24 | -8.56 | 22.25 | 1.00 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | -0.08 | -17.35 | -10.95 | 9.62 | -13.72 | -23.28 | -9.58 |

| MONTANARO EUROPEAN SMALLER COS TRUST PLC (MTE) | 1.95 | 11.46 | 5.16 | 7.75 | 13.71 | 23.45 | 12.52 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 1.08 | -11.64 | -1.07 | 7.71 | -5.32 | -5.39 | -1.02 |

| ISHARES CORE S&P SMALL-CAP ETF (IJR) | 1.07 | 10.79 | 0.56 | 6.35 | 14.09 | 22.71 | 10.93 |

| ETFS NICKEL (NICK) | 0.49 | 23.64 | -1.01 | 5.60 | 31.90 | 69.16 | 26.41 |

| ISHARES MSCI ISRAEL CAPPED ETF (ISVY) | 0.08 | 3.33 | -0.34 | 5.46 | 6.85 | 1.54 | 3.38 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 0.14 | 12.06 | 2.05 | 5.02 | 13.00 | 33.18 | 13.31 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 0.22 | 5.25 | 1.27 | 4.88 | 6.05 | 11.34 | 5.89 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.38 | 15.52 | 0.38 | 4.58 | 17.03 | 36.60 | 14.65 |

| GAM STAR FUND PLC - CHINA EQUITY (GAF4) | -0.39 | 9.15 | 1.31 | 4.23 | 12.77 | 28.81 | 11.78 |

| UBS LUX EQUITY FUND - ASIAN CONSUMPTION USD - P ACC (UBFM) | -0.78 | 2.59 | -1.27 | 3.80 | 5.40 | 22.57 | 7.63 |

| WORLDWIDE HEALTHCARE TRUST PLC (P8W) | 1.85 | 4.59 | 2.17 | 3.69 | 6.94 | 15.53 | 7.08 |

| PICTET - DIGITAL COMMUNICATION - P$ (PBF1) | 0.98 | 8.46 | 1.28 | 3.67 | 10.61 | 22.95 | 9.63 |

| EAST CAPITAL LUX - RUSSIAN FUND (EC0A) | 2.91 | -3.24 | 1.99 | 3.66 | -1.41 | 12.56 | 4.20 |

| ISHARES MSCI NEW ZEALAND CAPPED ETF (3ISI) | -2.61 | 3.92 | -2.15 | 3.57 | 5.34 | 12.63 | 4.85 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 2.23 | 5.11 | -0.19 | 3.48 | 8.12 | 39.21 | 12.66 |

| MARKET VECTORS RETAIL ETF (VEFW) | -2.43 | 8.08 | -1.07 | 3.43 | 10.16 | 23.66 | 9.05 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -0.15 | -10.36 | -6.41 | 3.41 | -7.64 | -9.97 | -5.15 |

| ISHARES US TELECOMMUNICATIONS ETF (ISQC) | 3.06 | -5.34 | 1.76 | 3.24 | -3.03 | -13.81 | -2.96 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 2.40 | 0.32 | 1.82 | 3.02 | 0.47 | 1.74 | 1.76 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | -0.08 | -17.35 | -10.95 | 9.62 | -13.72 | -23.28 | -9.58 |

| MONTANARO EUROPEAN SMALLER COS TRUST PLC (MTE) | 1.95 | 11.46 | 5.16 | 7.75 | 13.71 | 23.45 | 12.52 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | 1.08 | -11.64 | -1.07 | 7.71 | -5.32 | -5.39 | -1.02 |

| ISHARES CORE S&P SMALL-CAP ETF (IJR) | 1.07 | 10.79 | 0.56 | 6.35 | 14.09 | 22.71 | 10.93 |

| ETFS NICKEL (NICK) | 0.49 | 23.64 | -1.01 | 5.60 | 31.90 | 69.16 | 26.41 |

| ISHARES MSCI ISRAEL CAPPED ETF (ISVY) | 0.08 | 3.33 | -0.34 | 5.46 | 6.85 | 1.54 | 3.38 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 0.14 | 12.06 | 2.05 | 5.02 | 13.00 | 33.18 | 13.31 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 0.22 | 5.25 | 1.27 | 4.88 | 6.05 | 11.34 | 5.89 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.38 | 15.52 | 0.38 | 4.58 | 17.03 | 36.60 | 14.65 |

| GAM STAR FUND PLC - CHINA EQUITY (GAF4) | -0.39 | 9.15 | 1.31 | 4.23 | 12.77 | 28.81 | 11.78 |

| UBS LUX EQUITY FUND - ASIAN CONSUMPTION USD - P ACC (UBFM) | -0.78 | 2.59 | -1.27 | 3.80 | 5.40 | 22.57 | 7.63 |

| WORLDWIDE HEALTHCARE TRUST PLC (P8W) | 1.85 | 4.59 | 2.17 | 3.69 | 6.94 | 15.53 | 7.08 |

| PICTET - DIGITAL COMMUNICATION - P$ (PBF1) | 0.98 | 8.46 | 1.28 | 3.67 | 10.61 | 22.95 | 9.63 |

| EAST CAPITAL LUX - RUSSIAN FUND (EC0A) | 2.91 | -3.24 | 1.99 | 3.66 | -1.41 | 12.56 | 4.20 |

| ISHARES MSCI NEW ZEALAND CAPPED ETF (3ISI) | -2.61 | 3.92 | -2.15 | 3.57 | 5.34 | 12.63 | 4.85 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 2.23 | 5.11 | -0.19 | 3.48 | 8.12 | 39.21 | 12.66 |

| MARKET VECTORS RETAIL ETF (VEFW) | -2.43 | 8.08 | -1.07 | 3.43 | 10.16 | 23.66 | 9.05 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -0.15 | -10.36 | -6.41 | 3.41 | -7.64 | -9.97 | -5.15 |

| ISHARES US TELECOMMUNICATIONS ETF (ISQC) | 3.06 | -5.34 | 1.76 | 3.24 | -3.03 | -13.81 | -2.96 |

| DB X-TRACKERS II IBOXX GLOBAL INFLATION-LINKED TOTAL RETURN INDEX HEDGED ETF-USD (XG7U) | 2.40 | 0.32 | 1.82 | 3.02 | 0.47 | 1.74 | 1.76 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -0.71 | 32.29 | -1.41 | -1.22 | 50.42 | 133.89 | 45.42 |

| ETFS NICKEL (NICK) | 0.49 | 23.64 | -1.01 | 5.60 | 31.90 | 69.16 | 26.41 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -0.18 | 21.26 | -1.24 | 1.43 | 26.32 | 52.00 | 19.63 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.38 | 15.52 | 0.38 | 4.58 | 17.03 | 36.60 | 14.65 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 1.24 | 13.05 | 1.82 | -5.02 | 19.82 | 49.37 | 16.50 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 0.14 | 12.06 | 2.05 | 5.02 | 13.00 | 33.18 | 13.31 |

| MONTANARO EUROPEAN SMALLER COS TRUST PLC (MTE) | 1.95 | 11.46 | 5.16 | 7.75 | 13.71 | 23.45 | 12.52 |

| ISHARES CORE S&P SMALL-CAP ETF (IJR) | 1.07 | 10.79 | 0.56 | 6.35 | 14.09 | 22.71 | 10.93 |

| VALUE TAIWAN ETF (3060) | -0.01 | 9.85 | -1.80 | -0.88 | 9.89 | 15.10 | 5.58 |

| GAM STAR FUND PLC - CHINA EQUITY (GAF4) | -0.39 | 9.15 | 1.31 | 4.23 | 12.77 | 28.81 | 11.78 |

| UNITED STATES OIL FUND LP (U9N) | -2.56 | 9.09 | -1.34 | -8.87 | 14.67 | 43.41 | 11.97 |

| PICTET - DIGITAL COMMUNICATION - P$ (PBF1) | 0.98 | 8.46 | 1.28 | 3.67 | 10.61 | 22.95 | 9.63 |

| MARKET VECTORS RETAIL ETF (VEFW) | -2.43 | 8.08 | -1.07 | 3.43 | 10.16 | 23.66 | 9.05 |

| JUPITER EUROPEAN OPPORTUNITIES TRUST PLC (JEO) | 0.12 | 8.04 | 1.73 | -0.36 | 10.28 | 19.63 | 7.82 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (1323) | -0.49 | 7.64 | -1.32 | -6.24 | 19.26 | 19.50 | 7.80 |

| FONDUL PROPRIETATEA SA/FUND (FP) | -0.22 | 7.24 | -2.52 | -4.01 | 9.23 | 13.32 | 4.01 |

| GLOBAL X FTSE COLOMBIA 20 ETF (4GXB) | -0.05 | 6.75 | 0.03 | -0.53 | 10.54 | 9.35 | 4.85 |

| HSBC CHINA DRAGON FUND (820) | -0.69 | 6.34 | -0.39 | 2.86 | 2.77 | 19.81 | 6.26 |

| SPDR FTSE GREATER CHINA ETF (3073) | -0.01 | 5.63 | -0.16 | 0.69 | 8.54 | 22.58 | 7.91 |

| BLACKROCK GLOBAL FUNDS - WORLD HEALTHSCIENCE FUND - EURA2 (ERDV) | 0.22 | 5.25 | 1.27 | 4.88 | 6.05 | 11.34 | 5.89 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF TURKEY EURO (TURU) | -2.61 | -34.39 | -7.30 | -12.94 | -30.11 | -31.00 | -20.34 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -1.31 | -33.81 | -8.30 | -12.23 | -28.72 | -29.52 | -19.69 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | -1.88 | -33.17 | -7.14 | -11.56 | -28.98 | -29.64 | -19.33 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -1.98 | -32.96 | -6.85 | -11.32 | -28.81 | -29.55 | -19.13 |

| ISHARES MSCI TURKEY ETF (ISVZ) | -0.84 | -32.04 | -7.59 | -11.75 | -27.39 | -27.65 | -18.60 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 2.42 | -23.29 | -2.10 | -9.52 | -15.50 | 23.90 | -0.80 |

| ISHARES MSCI BRAZIL UCITS ETF (INC) (IBZL) | -3.62 | -20.79 | -3.54 | -19.72 | -14.85 | -2.31 | -10.11 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | -4.27 | -19.42 | -6.77 | -8.46 | -20.28 | -1.35 | -9.22 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | -2.91 | -17.91 | -2.35 | -13.52 | -14.29 | -8.15 | -9.58 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.29 | -17.56 | -3.54 | -6.50 | -14.97 | -14.38 | -9.85 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | -0.08 | -17.35 | -10.95 | 9.62 | -13.72 | -23.28 | -9.58 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | -0.53 | -16.99 | 1.91 | -10.80 | -17.57 | 11.85 | -3.65 |

| LATIN AMERICAN DISCOVERY FUND INC/THE (LDF) | 1.17 | -16.10 | 1.73 | -13.41 | -12.72 | -7.95 | -8.09 |

| FIDELITY FUNDS - LATIN AMERICA FUND - A (FJRC) | -1.16 | -15.30 | -2.50 | -14.21 | -11.77 | -5.21 | -8.42 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON EASTERN EUROPE FUND - A (TEP7) | 0.90 | -15.19 | -0.98 | -5.24 | -12.00 | 2.36 | -3.97 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | -0.55 | -14.74 | -1.05 | -2.72 | -8.52 | -8.83 | -5.28 |

| LYXOR ETF WIG20 (ETFW20L) | -0.56 | -14.44 | -2.17 | -3.19 | -10.10 | -0.46 | -3.98 |

| BLACKROCK GLOBAL FUNDS - LATIN AMERICA FUND - EURA2 (ERDP) | -1.29 | -14.12 | -3.09 | -14.67 | -10.00 | -1.08 | -7.21 |

| FRANKLIN TEMPLETON INVESTMENT FUNDS - TEMPLETON LATIN AMERICA FUND - A YDISEUR (XQ1H) | -3.65 | -14.11 | -3.81 | -12.31 | -10.46 | -5.26 | -7.96 |

| LYXOR ETF MSCI EM LATIN AMERICA EUR (LATAM) | -2.75 | -14.00 | -2.04 | -12.94 | -9.36 | -1.67 | -6.50 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -0.71 | 32.29 | -1.41 | -1.22 | 50.42 | 133.89 | 45.42 |

| ETFS NICKEL (NICK) | 0.49 | 23.64 | -1.01 | 5.60 | 31.90 | 69.16 | 26.41 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -0.18 | 21.26 | -1.24 | 1.43 | 26.32 | 52.00 | 19.63 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 1.24 | 13.05 | 1.82 | -5.02 | 19.82 | 49.37 | 16.50 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -0.92 | 5.01 | -0.08 | 2.56 | 6.83 | 47.93 | 14.31 |

| UNITED STATES OIL FUND LP (U9N) | -2.56 | 9.09 | -1.34 | -8.87 | 14.67 | 43.41 | 11.97 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | -2.33 | -3.57 | -1.42 | 2.05 | 0.98 | 40.55 | 10.54 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | 2.23 | 5.11 | -0.19 | 3.48 | 8.12 | 39.21 | 12.66 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -0.37 | 2.75 | -3.63 | -5.19 | 9.54 | 38.60 | 9.83 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | -1.38 | 15.52 | 0.38 | 4.58 | 17.03 | 36.60 | 14.65 |

| BLACKROCK GLOBAL FUNDS - WORLD MINING FUND (B92A) | -0.62 | -3.27 | -2.95 | -4.00 | 7.73 | 35.96 | 9.19 |

| BLACKROCK WORLD MINING TRUST PLC (BRWM) | -0.13 | 3.45 | -1.82 | -1.97 | 13.27 | 34.38 | 10.97 |

| SPDR S&P METALS & MINING ETF (SSGG) | -1.43 | 3.25 | -1.18 | 2.37 | 13.86 | 33.22 | 12.07 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 0.14 | 12.06 | 2.05 | 5.02 | 13.00 | 33.18 | 13.31 |

| BAILLIE GIFFORD JAPAN TRUST PLC/THE (BGFD) | -0.37 | 2.73 | 0.18 | 1.91 | 6.08 | 31.60 | 9.94 |

| HSBC GLOBAL INVESTMENT FUNDS - CHINESE EQUITY (JHSB) | -0.36 | 3.35 | 0.25 | 0.49 | 8.36 | 31.17 | 10.07 |

| JPMORGAN FUNDS - GLOBAL NATURAL RESOURCES FUND (JP5B) | 0.19 | 5.09 | -0.84 | -0.74 | 13.54 | 30.73 | 10.67 |

| ASIAN TOTAL RETURN INVESTMENT CO PLC (ATR) | 1.10 | 2.73 | -0.83 | 0.83 | 7.17 | 29.22 | 9.10 |

| GAM STAR FUND PLC - CHINA EQUITY (GAF4) | -0.39 | 9.15 | 1.31 | 4.23 | 12.77 | 28.81 | 11.78 |

| ETFS INDUSTRIAL METALS DJ-UBSCISM (AIGI) | -0.33 | 1.67 | -1.74 | 2.78 | 7.82 | 28.37 | 9.31 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF TURKEY EURO (TURU) | -2.61 | -34.39 | -7.30 | -12.94 | -30.11 | -31.00 | -20.34 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | -1.88 | -33.17 | -7.14 | -11.56 | -28.98 | -29.64 | -19.33 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -1.98 | -32.96 | -6.85 | -11.32 | -28.81 | -29.55 | -19.13 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -1.31 | -33.81 | -8.30 | -12.23 | -28.72 | -29.52 | -19.69 |

| ISHARES MSCI TURKEY ETF (ISVZ) | -0.84 | -32.04 | -7.59 | -11.75 | -27.39 | -27.65 | -18.60 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | -0.08 | -17.35 | -10.95 | 9.62 | -13.72 | -23.28 | -9.58 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.51 | -6.18 | 1.73 | 2.46 | -8.13 | -19.44 | -5.85 |

| ETFS COFFEE (COFF) | 0.19 | -9.63 | -0.44 | -0.24 | -6.97 | -17.00 | -6.16 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | -1.22 | -4.57 | -0.68 | -2.70 | -2.17 | -14.44 | -5.00 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.29 | -17.56 | -3.54 | -6.50 | -14.97 | -14.38 | -9.85 |

| ISHARES US TELECOMMUNICATIONS ETF (ISQC) | 3.06 | -5.34 | 1.76 | 3.24 | -3.03 | -13.81 | -2.96 |

| INVESCO KOREAN EQUITY FUND - A INC (IUVD) | -2.73 | -13.88 | -3.39 | -2.21 | -13.06 | -10.15 | -7.20 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | -0.15 | -10.36 | -6.41 | 3.41 | -7.64 | -9.97 | -5.15 |

| BLACKROCK GLOBAL FUNDS - WORLD GOLD FUND - A2EUR HEDGED (H2ZG) | -0.55 | -14.74 | -1.05 | -2.72 | -8.52 | -8.83 | -5.28 |

| CONSUMER STAPLES SELECT SECTOR SPDR FUND (SD7I) | -0.95 | -11.16 | 0.10 | 2.72 | -9.13 | -8.75 | -3.77 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -1.82 | -5.19 | 1.53 | -8.02 | -5.03 | -8.42 | -4.98 |

| ETFS AGRICULTURE DJ-UBSCI (AIGA) | -1.10 | -1.99 | -3.04 | -3.75 | -1.26 | -8.19 | -4.06 |

| JPMORGAN FUNDS - LATIN AMERICA EQUITY FUND (JPJ0) | -2.91 | -17.91 | -2.35 | -13.52 | -14.29 | -8.15 | -9.58 |

| LATIN AMERICAN DISCOVERY FUND INC/THE (LDF) | 1.17 | -16.10 | 1.73 | -13.41 | -12.72 | -7.95 | -8.09 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF - 2C (3099) | -0.09 | -13.37 | -0.92 | 2.26 | -8.86 | -6.38 | -3.47 |