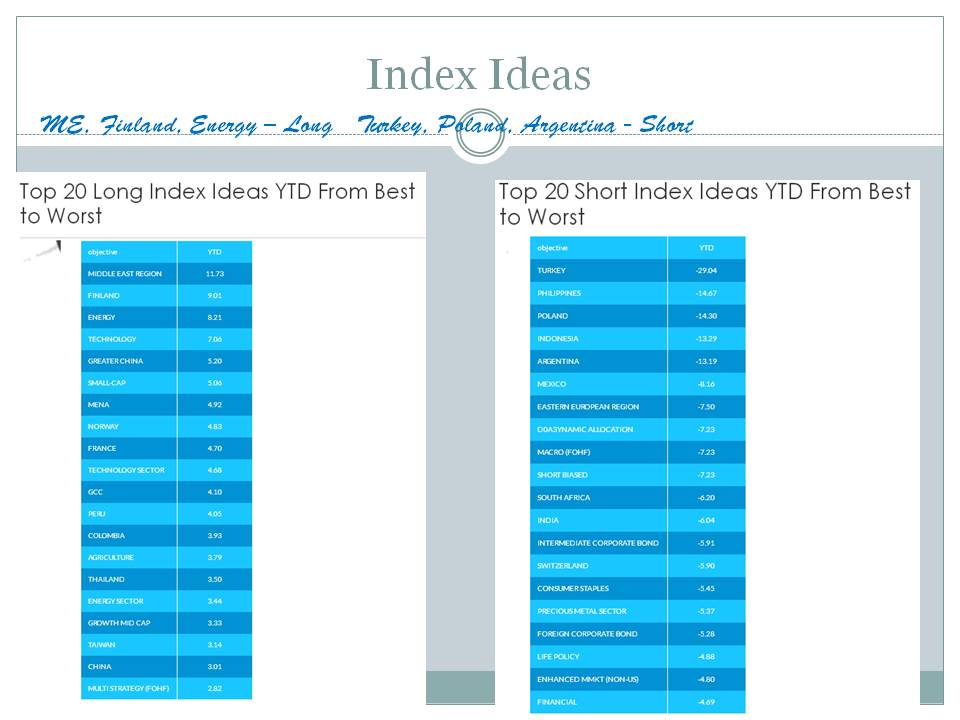

Top 20 Long Index Ideas YTD From Best to Worst

| objective | YTD |

| MIDDLE EAST REGION | 11.73 |

| FINLAND | 9.01 |

| ENERGY | 8.21 |

| TECHNOLOGY | 7.06 |

| GREATER CHINA | 5.20 |

| SMALL-CAP | 5.06 |

| MENA | 4.92 |

| NORWAY | 4.83 |

| FRANCE | 4.70 |

| TECHNOLOGY SECTOR | 4.68 |

| GCC | 4.10 |

| PERU | 4.05 |

| COLOMBIA | 3.93 |

| AGRICULTURE | 3.79 |

| THAILAND | 3.50 |

| ENERGY SECTOR | 3.44 |

| GROWTH MID CAP | 3.33 |

| TAIWAN | 3.14 |

| CHINA | 3.01 |

| MULTI STRATEGY (FOHF) | 2.82 |

Top 20 Short Index Ideas YTD From Best to Worst

| objective | YTD |

| TURKEY | -29.04 |

| PHILIPPINES | -14.67 |

| POLAND | -14.30 |

| INDONESIA | -13.29 |

| ARGENTINA | -13.19 |

| MEXICO | -8.16 |

| EASTERN EUROPEAN REGION | -7.50 |

| D0A3YNAMIC ALLOCATION | -7.23 |

| MACRO (FOHF) | -7.23 |

| SHORT BIASED | -7.23 |

| SOUTH AFRICA | -6.20 |

| INDIA | -6.04 |

| INTERMEDIATE CORPORATE BOND | -5.91 |

| SWITZERLAND | -5.90 |

| CONSUMER STAPLES | -5.45 |

| PRECIOUS METAL SECTOR | -5.37 |

| FOREIGN CORPORATE BOND | -5.28 |

| LIFE POLICY | -4.88 |

| ENHANCED MMKT (NON-US) | -4.80 |

| FINANCIAL | -4.69 |

Combined Performance of Tracked Indexes by Index Provider Top 20 Winners

| sourcename | ytd |

| Bermuda Stock Exchange | 26.3 |

| Saudi Arabian Stock Exchange | 11.73 |

| ICE Benchmark Administration | 10.59 |

| The Royal Bank of Scotland | 9.738333333333333 |

| Deutsche Bank AG | 8.24 |

| Diapason Commodities | 7.58 |

| NYSE Euronext Paris | 7.2 |

| Merrill Lynch | 7.065 |

| AlphaShares | 4.88 |

| Hang Seng Bank Ltd | 4.8133333333333335 |

| Sao Paulo Stock Exchange - SAO | 4.8 |

| Nikkei | 4.568750000000001 |

| Russell | 4.493750000000001 |

| NYSE AMEX | 4.24 |

| Barclays Indices | 4.24 |

| Kuwait Stock Exchange | 4.21 |

| Zacks | 4.08 |

| Bolsa de Valores de Colombia | 3.79 |

| Russell Equity Indices | 3.63 |

| Standard & Poor's Index Alert | 3.5444444444444443 |

Combined Performance of Tracked Indexes by Index Provider Top 20 Losers

| sourcename | ytd |

| Istanbul Stock Exchange | -28.25 |

| BOVESPA | -12.815 |

| National Stock Exchange of Ind | -12.16 |

| Cushing | -9.92 |

| Bulgaria Stock Exchange | -8.08 |

| Government Debt Management Age | -8.08 |

| Banco Central do Brasil | -7.23 |

| WisdomTree | -6.56 |

| Anbima | -6.4 |

| Bahrain Bourse | -5.28 |

| Market Vectors Index Solutions | -5.26 |

| BSE India | -4.91 |

| London Metal Exchange - LME | -4.885 |

| NYSE Euronext Brussels | -4.84 |

| Madrid Stock Exchange | -4.66 |

| Stuttgart Stock Exchange | -4.345000000000001 |

| Teucrium | -4.300000000000001 |

| Cohen and Steers | -4.1 |

| iBoxx | -4.0525 |

| Shenzhen Stock Exchange | -3.95 |

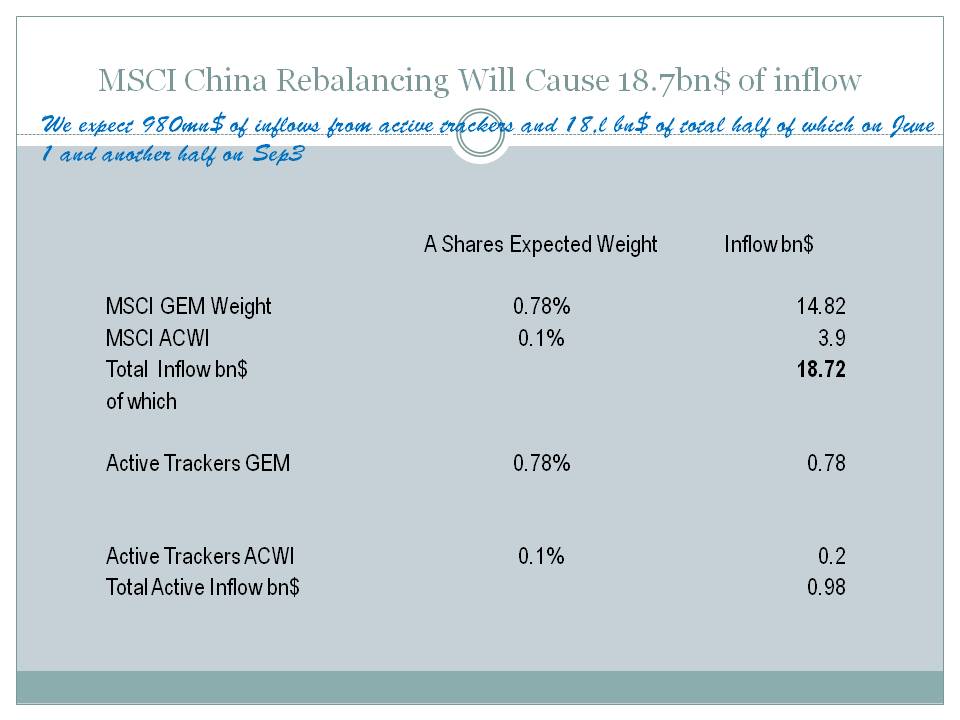

Chart: Index IdeasME, Finland, Energy – Long Turkey, Poland, Argentina - Short  Source: ML Download file in Power PointKey Topics and NewsMSCI China Rebalancing Will Cause 18.7bn$ of inflow

We expect 980mn$ of inflows from active trackers and 18,l bn$ of total half of which on June 1 and another half on Sep3  Source: ML MSCI Country Classification

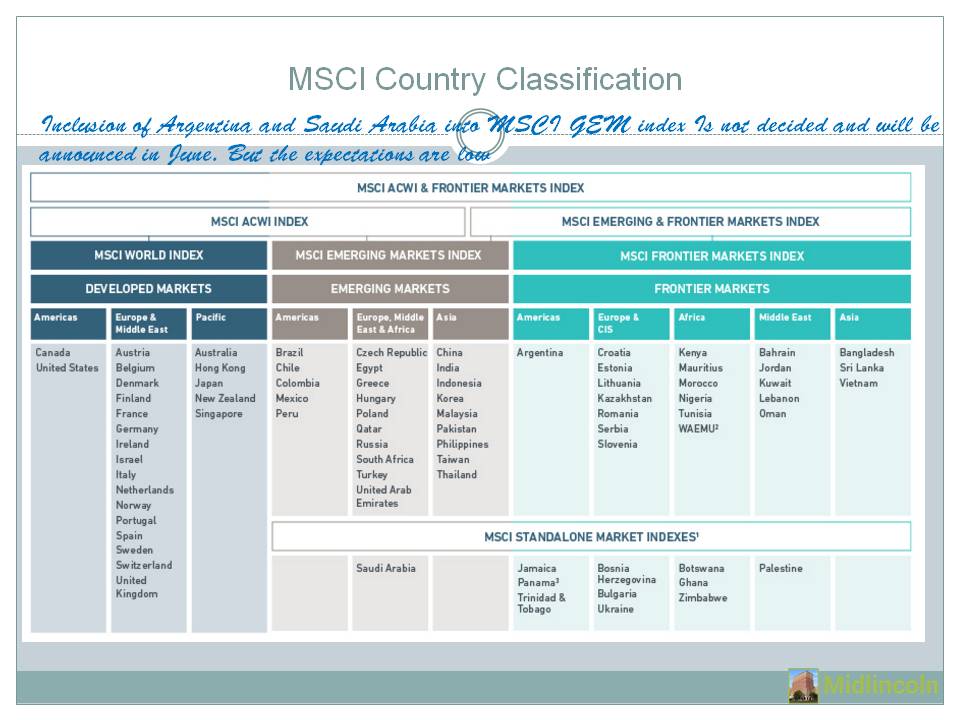

Inclusion of Argentina and Saudi Arabia into MSCI GEM index Is not decided and will be announced in June. But the expectations are low  Source: ML FTSE Country Classification

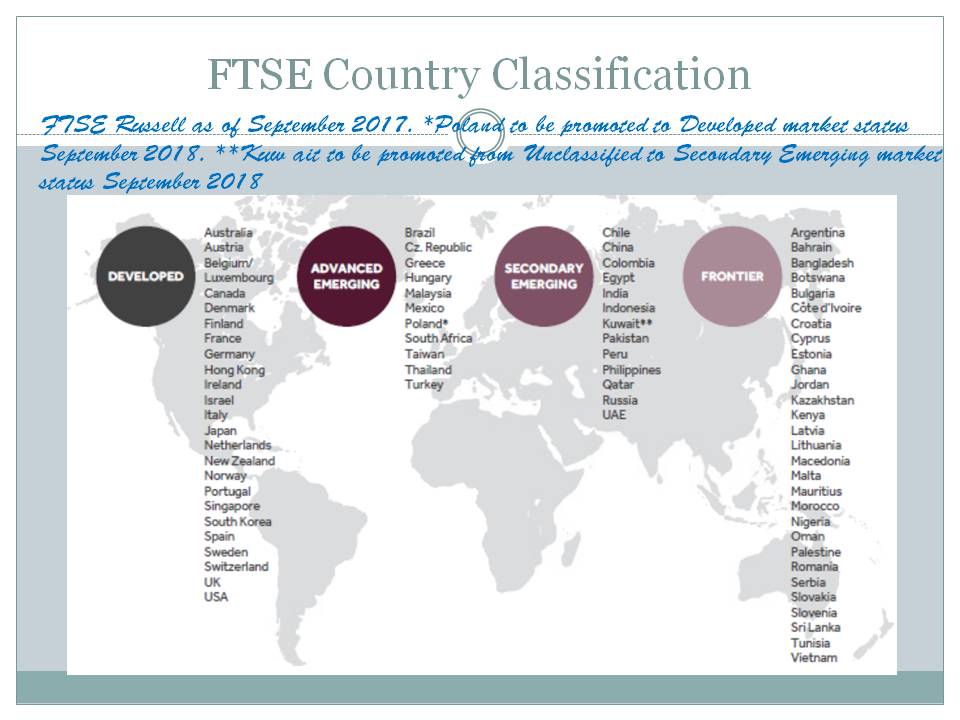

FTSE Russell as of September 2017. *Poland to be promoted to Developed market status September 2018. **Kuw ait to be promoted from Unclassified to Secondary Emerging market status September 2018  Source: ML Recent Index Atlas Ideas ChartArtIndex Rebalancing NewsMSCI Standard & Poor's Index Hang Seng FTSE Bloomberg Indices Dow Jones Moex Indexes Index Futures TradingTop 20 Index Longs Based on Momentum

Top 20 Index Shorts Based on Momentum

Best Indexes last Week

Worst Indexes last Week

Best Indexes last Month

Worst Indexes last Month

Best Indexes YTD

Worst Indexes YTD

Best Indexes 1yr

Worst Indexes 1yr

Latest ML ComicsRecent ML Rural Highlights. Small Towns and Villages

|