Weekly Fund Flows By Objective

| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | -1.25 |

| Commodities | PRECIOUS METAL SECTOR | Equity | 318.79 |

| Commodities | PRECIOUS METALS | Commodity | -1415.36 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 14.40 |

| country | AUSTRALIA | Equity | -23.73 |

| country | AUSTRALIA | Fixed Income | 22.08 |

| country | AUSTRALIA | Mixed Allocation | 0.00 |

| country | BRAZIL | Equity | -76.00 |

| country | BRAZIL | Fixed Income | -25.92 |

| country | CHINA | Equity | 291.34 |

| country | CHINA | Fixed Income | -77.38 |

| Country | EGYPT | Equity | 0.03 |

| country | INDIA | Equity | 943.34 |

| country | INDIA | Fixed Income | -37.44 |

| country | ISRAEL | Equity | -10.04 |

| country | JAPAN | Equity | -1124.34 |

| country | JAPAN | Fixed Income | -125.71 |

| country | JAPAN | Mixed Allocation | 0.99 |

| country | KOREA | Equity | -4.55 |

| country | POLAND | Equity | -17.45 |

| country | RUSSIA | Equity | -484.30 |

| country | RUSSIA | Fixed Income | -26.04 |

| country | SOUTH AFRICA | Equity | -54.94 |

| country | SPAIN | Equity | -105.56 |

| Country | TAIWAN | Equity | -158.34 |

| country | TURKEY | Equity | 0.93 |

| country | UNITED KINGDOM | Equity | 67.24 |

| industry | BASIC MATERIALS SECTOR | Equity | 165.80 |

| industry | COMMUNICATIONS SECTOR | Equity | -292.97 |

| industry | ENERGY SECTOR | Equity | 635.61 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.63 |

| industry | FINANCIAL SECTOR | Equity | -47.46 |

| industry | HEALTH CARE SECTOR | Equity | -392.15 |

| industry | INDUSTRIAL SECTOR | Equity | -450.53 |

| industry | MULTIPLE SECTOR | Equity | -2.76 |

| industry | NATURAL RESOURCES SECTOR | Equity | 25.04 |

| industry | REAL ESTATE SECTOR | Alternative | -0.22 |

| industry | REAL ESTATE SECTOR | Equity | 160.81 |

| industry | TECHNOLOGY SECTOR | Equity | 93.95 |

| industry | UTILITIES SECTOR | Equity | 133.15 |

| region | AFRICAN REGION | Equity | -24.39 |

| region | ASIAN PACIFIC REGION | Equity | -3385.43 |

| region | ASIAN PACIFIC REGION | Fixed Income | 39.27 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 286.03 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | 357.30 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -108.35 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -245.64 |

| region | EASTERN EUROPEAN REGION | Equity | -115.44 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -18.17 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -1.51 |

| region | EUROPEAN REGION | Equity | -3880.95 |

| region | EUROPEAN REGION | Fixed Income | -1565.03 |

| region | EUROPEAN REGION | Mixed Allocation | 11.06 |

| region | LATIN AMERICAN REGION | Equity | -33.07 |

| region | LATIN AMERICAN REGION | Fixed Income | -28.41 |

| region | MIDDLE EAST REGION | Equity | -28.27 |

| region | MIDDLE EAST REGION | Fixed Income | -5.31 |

| region | NORDIC REGION | Equity | -264.49 |

| region | NORTH AMERICAN REGION | Equity | -177.88 |

| region | NORTH AMERICAN REGION | Fixed Income | -73.84 |

| Risk | GOVERNMENT BOND | Alternative | -1.21 |

| Risk | GOVERNMENT BOND | Equity | -0.10 |

| Risk | GOVERNMENT BOND | Fixed Income | 542.32 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -33.85 |

| Risk | INFLATION PROTECTED | Brazil | -3.14 |

| Risk | INFLATION PROTECTED | Fixed Income | -285.69 |

| Risk | LONG SHORT | Alternative | 39.14 |

| Risk | LONG SHORT | Equity | -572.00 |

| Risk | LONG SHORT | Fixed Income | -28.51 |

| Risk | LONG SHORT | Mixed Allocation | -0.66 |

| Sector | AGRICULTURE | Commodity | -47.27 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Sector | CONSUMER DISCRETIONARY | Equity | -74.51 |

| Sector | CONSUMER STAPLES | Equity | -648.02 |

| segment | BRIC | Equity | -35.15 |

| segment | BRIC | Fixed Income | -4.71 |

| segment | DEVELOPED MARKETS | Equity | -1593.88 |

| segment | EMEA | Equity | 80.21 |

| segment | EMEA | Fixed Income | -15.22 |

| segment | EMERGING MARKETS | Equity | -412.21 |

| segment | GCC | Equity | -1.62 |

| segment | GCC | Fixed Income | 0.07 |

| segment | GCC | Mixed Allocation | -0.45 |

| segment | MENA | Equity | -5.12 |

| segment | MENA | Fixed Income | -4.96 |

| Size | LARGE-CAP | Equity | 3939.06 |

| Size | MID-CAP | Commodity | -2.00 |

| Size | MID-CAP | Equity | 1624.26 |

| Size | SMALL-CAP | Equity | 981.62 |

Flows In Descending Order

| Focus | Objective | Asset Class | Flow USD mn |

| Size | LARGE-CAP | Equity | 3939.06 |

| Size | MID-CAP | Equity | 1624.26 |

| Size | SMALL-CAP | Equity | 981.62 |

| country | INDIA | Equity | 943.34 |

| industry | ENERGY SECTOR | Equity | 635.61 |

| Risk | GOVERNMENT BOND | Fixed Income | 542.32 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | 357.30 |

| Commodities | PRECIOUS METAL SECTOR | Equity | 318.79 |

| country | CHINA | Equity | 291.34 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 286.03 |

| industry | BASIC MATERIALS SECTOR | Equity | 165.80 |

| industry | REAL ESTATE SECTOR | Equity | 160.81 |

| industry | UTILITIES SECTOR | Equity | 133.15 |

| industry | TECHNOLOGY SECTOR | Equity | 93.95 |

| segment | EMEA | Equity | 80.21 |

| country | UNITED KINGDOM | Equity | 67.24 |

| region | ASIAN PACIFIC REGION | Fixed Income | 39.27 |

| Risk | LONG SHORT | Alternative | 39.14 |

| industry | NATURAL RESOURCES SECTOR | Equity | 25.04 |

| country | AUSTRALIA | Fixed Income | 22.08 |

| Commodities | PRECIOUS METALS | Mixed Allocation | 14.40 |

| region | EUROPEAN REGION | Mixed Allocation | 11.06 |

| country | JAPAN | Mixed Allocation | 0.99 |

| country | TURKEY | Equity | 0.93 |

| segment | GCC | Fixed Income | 0.07 |

| Country | EGYPT | Equity | 0.03 |

| country | AUSTRALIA | Mixed Allocation | 0.00 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Risk | GOVERNMENT BOND | Equity | -0.10 |

| industry | REAL ESTATE SECTOR | Alternative | -0.22 |

| segment | GCC | Mixed Allocation | -0.45 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.63 |

| Risk | LONG SHORT | Mixed Allocation | -0.66 |

| Risk | GOVERNMENT BOND | Alternative | -1.21 |

| Commodities | INDUSTRIAL METALS | Commodity | -1.25 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -1.51 |

| segment | GCC | Equity | -1.62 |

| Size | MID-CAP | Commodity | -2.00 |

| industry | MULTIPLE SECTOR | Equity | -2.76 |

| Risk | INFLATION PROTECTED | Brazil | -3.14 |

| country | KOREA | Equity | -4.55 |

| segment | BRIC | Fixed Income | -4.71 |

| segment | MENA | Fixed Income | -4.96 |

| segment | MENA | Equity | -5.12 |

| region | MIDDLE EAST REGION | Fixed Income | -5.31 |

| country | ISRAEL | Equity | -10.04 |

| segment | EMEA | Fixed Income | -15.22 |

| country | POLAND | Equity | -17.45 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -18.17 |

| country | AUSTRALIA | Equity | -23.73 |

| region | AFRICAN REGION | Equity | -24.39 |

| country | BRAZIL | Fixed Income | -25.92 |

| country | RUSSIA | Fixed Income | -26.04 |

| region | MIDDLE EAST REGION | Equity | -28.27 |

| region | LATIN AMERICAN REGION | Fixed Income | -28.41 |

| Risk | LONG SHORT | Fixed Income | -28.51 |

| region | LATIN AMERICAN REGION | Equity | -33.07 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -33.85 |

| segment | BRIC | Equity | -35.15 |

| country | INDIA | Fixed Income | -37.44 |

| Sector | AGRICULTURE | Commodity | -47.27 |

| industry | FINANCIAL SECTOR | Equity | -47.46 |

| country | SOUTH AFRICA | Equity | -54.94 |

| region | NORTH AMERICAN REGION | Fixed Income | -73.84 |

| Sector | CONSUMER DISCRETIONARY | Equity | -74.51 |

| country | BRAZIL | Equity | -76.00 |

| country | CHINA | Fixed Income | -77.38 |

| country | SPAIN | Equity | -105.56 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -108.35 |

| region | EASTERN EUROPEAN REGION | Equity | -115.44 |

| country | JAPAN | Fixed Income | -125.71 |

| Country | TAIWAN | Equity | -158.34 |

| region | NORTH AMERICAN REGION | Equity | -177.88 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -245.64 |

| region | NORDIC REGION | Equity | -264.49 |

| Risk | INFLATION PROTECTED | Fixed Income | -285.69 |

| industry | COMMUNICATIONS SECTOR | Equity | -292.97 |

| industry | HEALTH CARE SECTOR | Equity | -392.15 |

| segment | EMERGING MARKETS | Equity | -412.21 |

| industry | INDUSTRIAL SECTOR | Equity | -450.53 |

| country | RUSSIA | Equity | -484.30 |

| Risk | LONG SHORT | Equity | -572.00 |

| Sector | CONSUMER STAPLES | Equity | -648.02 |

| country | JAPAN | Equity | -1124.34 |

| Commodities | PRECIOUS METALS | Commodity | -1415.36 |

| region | EUROPEAN REGION | Fixed Income | -1565.03 |

| segment | DEVELOPED MARKETS | Equity | -1593.88 |

| region | ASIAN PACIFIC REGION | Equity | -3385.43 |

| region | EUROPEAN REGION | Equity | -3880.95 |

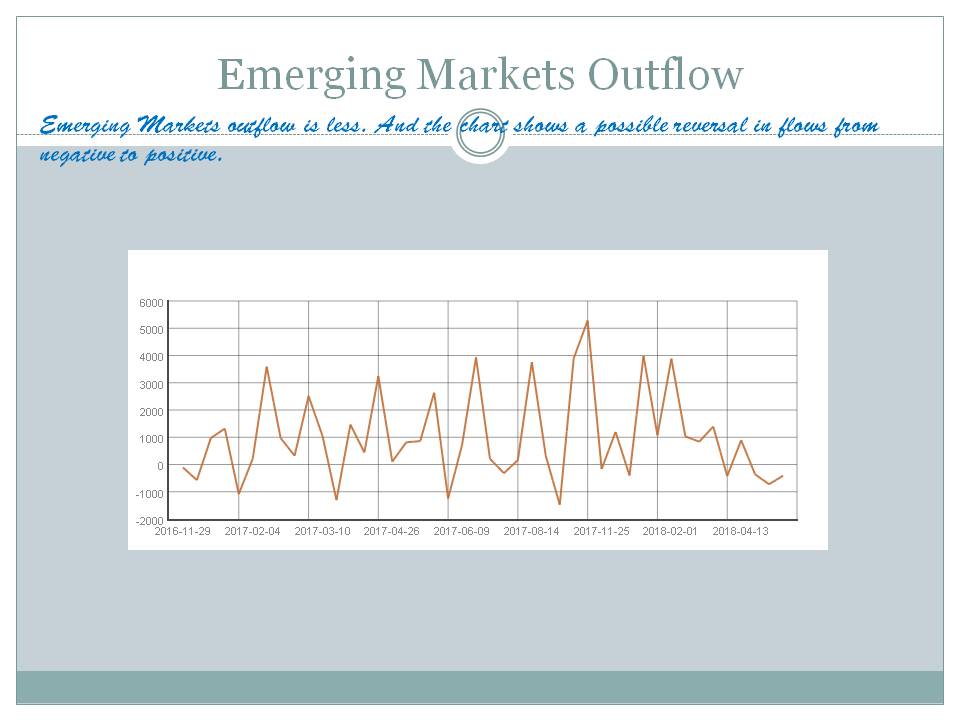

Chart: Emerging Markets Outflow

Emerging Markets outflow is less. And the chart shows a possible reversal in flows from negative to positive.

Source: ML

Download file in Power PointKey Topics and News

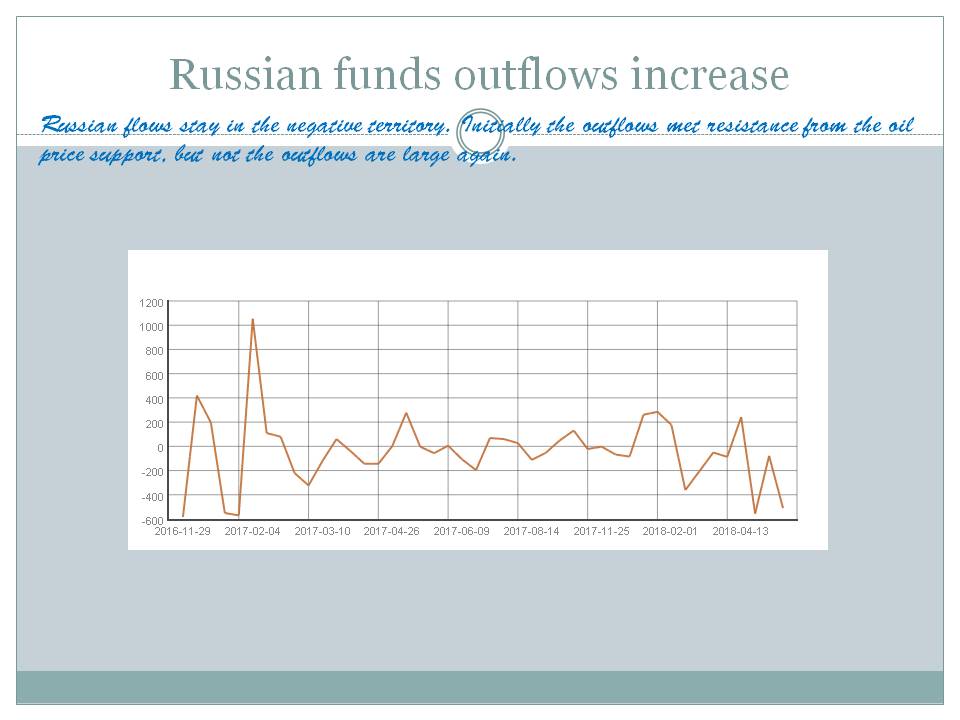

Russian funds outflows increase

- Energy ETFs slide as Russia, OPEC consider raising oil production

- Russia Loses Its Edge as Oil Drop Spurs Worst ETF Flows in Year

- Putin wants growth but we won't sacrifice stability, Russia's central ...

- Debt and equity markets: Foreign investment outflow in May hits 18 ...

- Will IT & pharma really make the most of rupee slide to benefit ...

- Tracking Illicit Russian Financial Flows | The German Marshall Fund ...

- TABLE-Russia's top banks saw moderate outflows in Jan | Reuters

- Five large banks in Russia saw outflows from corporate accounts in ...

- Investors pile in as Russia comes in from the cold - Financial Times

- Russia Hemorrhages at Least US$211.5 Billion in Illicit Financial ...

- Capital flight and capital outflows from Russia [EBRD - Working ...

- Russia Economic Report - The World Bank Group

- Russia Opportunity Fund - GPB Asset Management SA

- Statistics on Savings and Investment in Russia - Wiley Online Library

- Offshore orientation of Russian Federation FDI by ... - UNCTAD

Russian flows stay in the negative territory. Initially the outflows met resistance from the oil price support, but not the outflows are large again.

Source:

Basic Materials Sector Records Inflows

- Fixed Income Leads ETFs Higher in April

- Outflows from Italy funds hit record high - BAML

- Huge YTD Flows Into 2 Gold ETFs

- OPINION | Yes, it is indeed time for Africa to present a united front

- Australia: Shares hit near 3-month high on materials, weaker currency

- Global Stock Inflows on $700 Billion Pace, Topping Bonds for 1st ...

- Inflows to Materials ETFs Rise Amid Trade War Talk | ETF Trends

- ETF Inflows Hit Record Highs in 2017 - Market Realist

- Inflows to Materials ETFs Rise Amid Trade War Talk - Yahoo Finance

- Record ETF Inflows Not What They Seem | ETF.com

- 2017 ETF Flow Recap and 2018 Outlook - Oppenheimer Funds

- record flows and growing imbalances - Rhodium Group

- World Investment Report 2017 - UNCTAD

- CHAPTER II Regional Investment Trends - UNCTAD

- measuring material flows and resource productivity - OECD.org

This is after a long streak of outflows. There is some hope for residual risk appetite

Source: ML

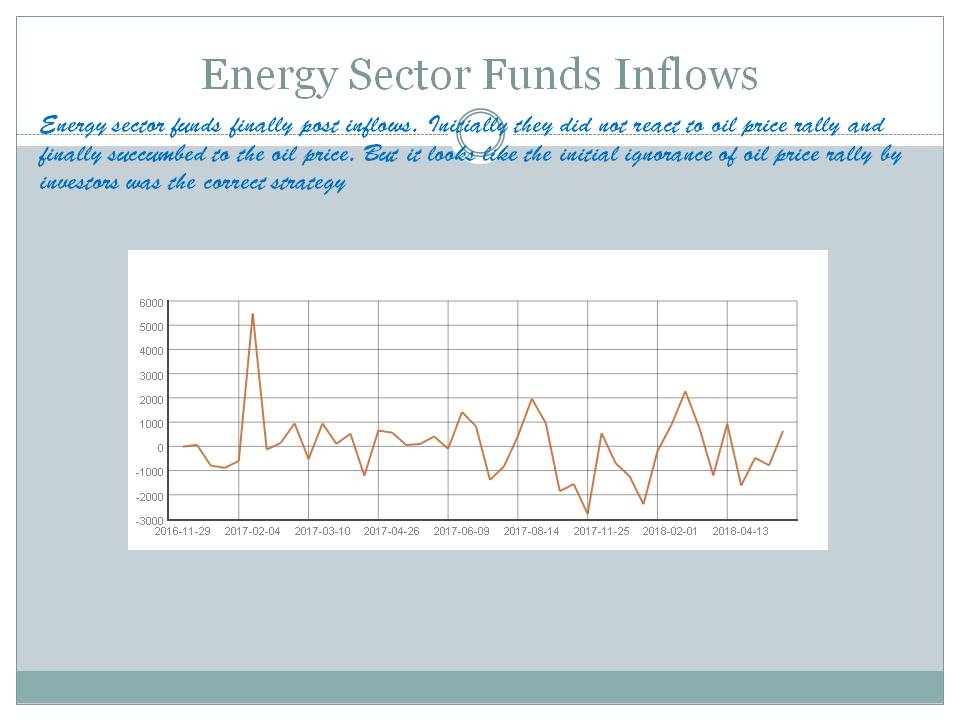

Energy Sector Funds Inflows

- FUND FLOWS: High Oil Prices Modestly Boost Energy Sector Fund ...

- Energy ETFs slide as Russia, OPEC consider raising oil production

- Funds snapped up energy stocks as crude oil rebounded

- The best year for mutual funds in over a decade?

- High-Flying Mutual Funds Begin to Favor Energy but Tech Still ...

Energy sector funds finally post inflows. Initially they did not react to oil price rally and finally succumbed to the oil price. But it looks like the initial ignorance of oil price rally by investors was the correct strategy

Source: ML

Emerging markets fund flow showed -412.2 USD mn of outflow.. While Frontier Markets funds showed -0.2 USD mn of outflows.

BRAZIL Equity funds showed -76.0 USD mn of outflow.

BRAZIL Fixed Income funds showed -25.9 USD mn of outflow.

CHINA Equity funds showed 291.3 USD mn of inflow.

CHINA Fixed Income funds showed -77.4 USD mn of outflow.

INDIA Equity funds showed 943.3 USD mn of inflow.

INDIA Fixed Income funds showed -37.4 USD mn of outflow.

KOREA Equity funds showed -4.5 USD mn of outflow.

RUSSIA Equity funds showed -484.3 USD mn of outflow.

RUSSIA Fixed Income funds showed -26.0 USD mn of outflow.

SOUTH AFRICA Equity funds showed -54.9 USD mn of outflow.

TURKEY Equity funds showed 0.9 USD mn of inflow.

COMMUNICATIONS SECTOR Equity funds showed -293.0 USD mn of outflow.

ENERGY SECTOR Equity funds showed 635.6 USD mn of inflow.

ENERGY SECTOR Mixed Allocation funds showed -0.6 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed -47.5 USD mn of outflow.

REAL ESTATE SECTOR Alternative funds showed -0.2 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed 160.8 USD mn of inflow.

TECHNOLOGY SECTOR Equity funds showed 94.0 USD mn of inflow.

UTILITIES SECTOR Equity funds showed 133.2 USD mn of inflow.

LONG SHORT Alternative funds showed 39.1 USD mn of inflow.

LONG SHORT Equity funds showed -572.0 USD mn of outflow.

LONG SHORT Fixed Income funds showed -28.5 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed -0.7 USD mn of outflow.

Latest ML Comics

Markets

Best global markets since the begining of the week USA +2.97%, EUROPE +0.86%, EFM ASIA-0.88%,

While worst global markets since the begining of the week EM LATIN AMERICA -9.54%, FM (FRONTIER MARKETS) -5.55%, EM (EMERGING MARKETS) -2.24%,

Best since the start of the week among various stock markets were UKRAINE +7.55%, ISRAEL +6.30%, IRELAND +5.67%, PORTUGAL +5.13%, SWEDEN +4.80%, CANADA +4.21%, RUSSIA +3.78%, BAHRAIN +3.22%, TRINIDAD AND TOBAGO +3.03%, UNITED KINGDOM +2.99%,

While worst since the start of the week among various stock markets were GREECE -14.31%, ARGENTINA -14.03%, TURKEY -12.43%, MEXICO -11.80%, EGYPT -11.28%, PAKISTAN -10.43%, BRAZIL -9.92%, HUNGARY -9.33%, INDONESIA -9.10%, BANGLADESH -8.12%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| DWS RUSSIA BOND FUND - EUR DIST (DWSRUBD) | 1.69 | 176.22 | 159.06 | 165.39 | 169.04 | 128.08 |

| DWS BRAZIL BOND FUND - EUR DIST (DWSBRZB) | 1.46 | 110.89 | 109.65 | 105.26 | 125.86 | 85.87 |

| DB PHYSICAL RHODIUM ETC (XRH0) | 2.33 | 10.15 | 37.50 | 52.31 | 141.48 | 51.57 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -3.40 | 19.99 | 38.44 | 53.67 | 83.65 | 38.48 |

| SANTANDER FIC FI PETROBRAS 3 ACOES (REALPET) | -6.93 | 11.68 | 45.36 | 44.19 | 66.39 | 28.83 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -7.26 | 2.02 | 31.36 | 36.41 | 82.45 | 28.41 |

| SAFRA PETROBRAS FIC FIA (SAFPETR) | -6.80 | 11.36 | 43.90 | 42.57 | 63.88 | 27.75 |

| SANTANDER FIC FI VALE 3 ACOES (REALRIO) | -2.18 | 4.48 | 17.81 | 29.99 | 69.36 | 25.41 |

| SAFRA VALE DO RIO DOCE FIC FIA (SAFVRDA) | -2.12 | 4.28 | 17.16 | 29.01 | 67.33 | 24.63 |

| ETFS NICKEL (NICK) | 1.39 | 5.96 | 20.66 | 22.92 | 60.87 | 22.79 |

| SCB OIL FUND (SCBOILH) | 0.16 | 4.67 | 23.27 | 26.64 | 55.36 | 21.71 |

| K OIL FUND (KASOILF) | 0.17 | 4.68 | 22.94 | 26.31 | 54.30 | 21.37 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | 0.91 | 7.27 | 23.29 | 25.91 | 51.29 | 21.35 |

| BB ACOES SIDERURGIA FICFI (BBACOSI) | -0.17 | -4.72 | 11.09 | 17.45 | 64.56 | 19.28 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | 0.97 | 9.57 | 20.88 | 19.65 | 39.79 | 17.49 |

| MORGAN STANLEY CHINA A SHARE FUND INC (CAF) | 2.57 | 9.43 | 15.14 | 16.96 | 35.43 | 16.10 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | -1.11 | 5.46 | 19.92 | 23.34 | 36.13 | 15.96 |

| ETFS WTI CRUDE OIL (CRUD) | 0.84 | 1.56 | 22.49 | 19.90 | 40.99 | 15.82 |

| ALLAN GRAY AFRICA EQUITY FUND LIMITED (ORBAFRI) | -1.22 | -3.76 | 9.06 | 19.30 | 47.91 | 15.56 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | -1.57 | 5.10 | 19.14 | 23.26 | 34.81 | 15.40 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| 49 NORTH RESOURCES INC (FNR) | -7.72 | -25.12 | -49.37 | -15.10 | -40.30 | -22.06 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | -5.08 | -16.88 | -27.88 | -18.39 | -21.73 | -15.52 |

| LYXOR ETF TURKEY EURO (TURU) | -4.63 | -15.99 | -27.98 | -18.03 | -21.78 | -15.11 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | -4.03 | -16.61 | -27.61 | -16.81 | -20.03 | -14.37 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | -3.43 | -15.58 | -26.89 | -17.37 | -20.67 | -14.26 |

| FINAM MANAGEMENT LLC (FINMIT) | 1.28 | -1.10 | -18.51 | -27.06 | -29.24 | -14.03 |

| COHEN RENTA FIJA FONDO COMUN DE INVERSION - A-MINORISTA (CRTAFAM) | 0.36 | -17.20 | -15.25 | -21.45 | -17.63 | -13.98 |

| ISHARES MSCI TURKEY ETF (ISVZ) | -3.81 | -15.57 | -26.27 | -15.58 | -18.83 | -13.45 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -3.97 | -28.87 | -26.84 | -27.88 | 7.23 | -13.37 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 11.81 | 14.61 | -4.99 | -11.77 | -63.31 | -12.17 |

| AUSTRALIA EQUITY INCOME FUND (DWAUEIP) | 0.31 | -1.18 | -16.88 | -17.63 | -27.71 | -11.55 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -7.65 | -28.74 | -20.27 | -18.67 | 10.53 | -11.13 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | -0.12 | -32.72 | 0.12 | 1.54 | -5.92 | -9.31 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | 3.53 | -1.08 | -19.16 | -14.42 | -24.71 | -9.17 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -7.66 | -5.11 | -6.99 | -5.89 | -13.86 | -8.13 |

| DB X-TRACKERS MSCI MEXICO TRN INDEX UCITS ETF (D5BI) | -0.44 | -10.35 | -7.22 | -6.21 | -15.37 | -8.09 |

| LYXOR ETF WIG20 (ETFW20L) | -2.68 | -8.55 | -16.19 | -15.60 | -4.72 | -7.89 |

| ISHARES MSCI MEXICO CAPPED UCITS ETF (CMXC) | 1.21 | -8.89 | -6.54 | -10.14 | -11.95 | -7.44 |

| HSBC MSCI MEXICO CAPPED UCITS ETF (HMEX) | 0.06 | -8.62 | -7.11 | -10.00 | -11.16 | -7.43 |

| HSBC MSCI MEXICO CAPPED UCITS ETF (HMED) | 1.27 | -8.94 | -6.25 | -9.95 | -11.88 | -7.38 |

Best Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 0.77 | -4.99 | 11.81 | 14.61 | -11.77 | -63.31 | -12.17 |

| MARKET VECTORS INDONESIA INDEX ETF (IDX) | 1.13 | -10.14 | 6.34 | -2.19 | -6.23 | -3.94 | -1.51 |

| ETFS WHEAT (OD7S) | -0.47 | 17.18 | 6.29 | 9.43 | 14.18 | 2.67 | 8.14 |

| HSBC MSCI INDONESIA UCITS ETF (HIDD) | 1.63 | -14.20 | 6.12 | -3.14 | -10.02 | -5.95 | -3.25 |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 3.61 | -3.29 | 5.57 | -4.11 | -3.78 | 13.28 | 2.74 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF (XMIN) | 0.56 | -13.84 | 4.53 | -3.57 | -9.54 | -6.77 | -3.84 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | 1.57 | -15.93 | 4.48 | -6.77 | -11.13 | -6.99 | -5.10 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 2.24 | -15.86 | 4.16 | 3.55 | -11.13 | -19.18 | -5.65 |

| HSBC CHINA DRAGON FUND (820) | -0.13 | 6.95 | 4.00 | 8.22 | -0.63 | 24.37 | 8.99 |

| MERCANTILE INVESTMENT CO LTD (21IA) | 3.37 | -0.12 | 3.95 | -2.42 | 9.32 | 20.12 | 7.74 |

| GOLDMAN SACHS US REIT FUND A COURSE - COLUMBUS EGG (3531103A) | -0.17 | -2.45 | 3.89 | 4.91 | -4.01 | -3.05 | 0.44 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -2.33 | -19.16 | 3.53 | -1.08 | -14.42 | -24.71 | -9.17 |

| COLUMBIA SELIGMAN PREMIUM TECHNOLOGY GROWTH FUND INC (STK) | -0.53 | 5.58 | 3.44 | 8.50 | 1.75 | 8.58 | 5.57 |

| MIRAE ROGERS AGRICULTURAL PRODUCT INDEX SPECIAL ASSET INVEST CMDTY-DERIVATIVE (5620974) | 0.88 | 4.89 | 3.35 | 4.92 | 5.66 | 3.85 | 4.45 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF - 2C (3099) | 0.76 | -14.62 | 3.01 | -4.50 | -10.04 | -7.08 | -4.65 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | 1.50 | -3.19 | 3.00 | 0.11 | -5.61 | 36.97 | 8.62 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 2.17 | 5.68 | 2.98 | 22.22 | 3.42 | -30.11 | -0.37 |

| SCHWAB U.S. REIT ETF (SCHH) | 0.13 | -4.14 | 2.70 | 5.40 | -4.52 | -0.77 | 0.70 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | 1.84 | -2.42 | 2.60 | -3.82 | -2.25 | 9.78 | 1.58 |

| MORGAN STANLEY CHINA A SHARE FUND INC (CAF) | 0.04 | 15.14 | 2.57 | 9.43 | 16.96 | 35.43 | 16.10 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF FTSE MIB DAILY LEVERAGED (LEVMI) | -6.34 | 1.90 | -7.98 | -15.40 | -1.07 | 17.37 | -1.77 |

| MARKET VECTORS OIL SERVICE ETF (OIH) | -4.30 | 3.61 | -7.79 | -0.37 | 14.29 | 5.81 | 2.98 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -4.70 | -6.99 | -7.66 | -5.11 | -5.89 | -13.86 | -8.13 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -2.54 | -20.27 | -7.65 | -28.74 | -18.67 | 10.53 | -11.13 |

| ALPHA TRUST - ANDROMEDA INVESTMENT TRUST SA (ANDRO) | 0.89 | 2.42 | -7.47 | -12.14 | 4.97 | 34.99 | 5.09 |

| DB X-TRACKERS FTSE VIETNAM UCITS ETF (XVTD) | -0.84 | -3.14 | -7.41 | -10.17 | 6.80 | 33.33 | 5.64 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -5.47 | 31.36 | -7.26 | 2.02 | 36.41 | 82.45 | 28.41 |

| MARKET VECTORS VIETNAM ETF (VNM) | -0.91 | -8.67 | -6.79 | -9.67 | -2.65 | 15.06 | -1.01 |

| BLACKROCK GLOBAL FUNDS - WORLD ENERGY FUND (H2Z6) | -2.98 | -0.42 | -6.71 | -3.16 | 6.64 | 16.71 | 3.37 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | -2.68 | -27.34 | -6.58 | -0.99 | -23.08 | 8.09 | -5.64 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | -0.06 | -14.23 | -6.20 | -12.33 | -20.54 | 15.45 | -5.91 |

| SPDR S&P OIL & GAS EXPLORATION & PRODUCTION ETF (XOP) | -4.01 | 9.16 | -6.07 | 3.55 | 15.07 | 20.65 | 8.30 |

| ISHARES GLOBAL ENERGY ETF (ISQQ) | -2.65 | 2.55 | -5.98 | -0.60 | 8.93 | 14.60 | 4.24 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (TYG) | -2.68 | -0.80 | -5.57 | 1.20 | 12.20 | -7.72 | 0.03 |

| LYXOR ETF EASTERN EUROPE CECE EUR (CEC) | -5.27 | -12.55 | -5.27 | -10.52 | -12.63 | 0.24 | -7.05 |

| VANGUARD ENERGY ETF (VDE) | -3.19 | 3.95 | -5.23 | 1.03 | 11.31 | 15.38 | 5.62 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.95 | -27.88 | -5.08 | -16.88 | -18.39 | -21.73 | -15.52 |

| ISHARES MSCI SPAIN CAPPED ETF (ISVS) | -3.08 | -5.40 | -5.07 | -6.80 | -3.41 | -4.61 | -4.97 |

| LYXOR ETF FTSE ATHEX 20 (GRE) | -2.28 | -7.73 | -4.85 | -13.04 | 3.51 | -1.87 | -4.06 |

| NEUBERGER BERMAN MLP INCOME FUND INC (NML) | -2.36 | -4.70 | -4.83 | 4.22 | 7.46 | -4.27 | 0.65 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 2.17 | 5.68 | 2.98 | 22.22 | 3.42 | -30.11 | -0.37 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -1.86 | 38.44 | -3.40 | 19.99 | 53.67 | 83.65 | 38.48 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 0.77 | -4.99 | 11.81 | 14.61 | -11.77 | -63.31 | -12.17 |

| DB PHYSICAL RHODIUM ETC (XRH0) | -1.13 | 37.50 | 2.33 | 10.15 | 52.31 | 141.48 | 51.57 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | 0.02 | 20.88 | 0.97 | 9.57 | 19.65 | 39.79 | 17.49 |

| ETFS WHEAT (OD7S) | -0.47 | 17.18 | 6.29 | 9.43 | 14.18 | 2.67 | 8.14 |

| MORGAN STANLEY CHINA A SHARE FUND INC (CAF) | 0.04 | 15.14 | 2.57 | 9.43 | 16.96 | 35.43 | 16.10 |

| ISHARES US TECHNOLOGY ETF (IYW) | 0.17 | 10.99 | 1.51 | 8.58 | 9.11 | 26.11 | 11.33 |

| COLUMBIA SELIGMAN PREMIUM TECHNOLOGY GROWTH FUND INC (STK) | -0.53 | 5.58 | 3.44 | 8.50 | 1.75 | 8.58 | 5.57 |

| FIDELITY MSCI INFORMATION TECHNOLOGY INDEX ETF (FTEC) | 0.09 | 11.32 | 1.24 | 8.44 | 9.53 | 27.66 | 11.72 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 1.06 | 7.90 | 1.78 | 8.39 | 6.52 | 26.22 | 10.73 |

| VANGUARD INFORMATION TECHNOLOGY ETF (VGT) | 0.12 | 11.26 | 1.27 | 8.36 | 9.55 | 27.50 | 11.67 |

| HSBC CHINA DRAGON FUND (820) | -0.13 | 6.95 | 4.00 | 8.22 | -0.63 | 24.37 | 8.99 |

| POLAR CAPITAL TECHNOLOGY TRUST PLC (PCT) | 0.21 | 8.00 | 1.04 | 7.87 | 4.85 | 28.55 | 10.58 |

| TECHNOLOGY SELECT SECTOR SPDR FUND (XLK) | 0.07 | 9.50 | 1.36 | 7.76 | 8.99 | 25.60 | 10.93 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -0.19 | 23.29 | 0.91 | 7.27 | 25.91 | 51.29 | 21.35 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | -0.02 | 18.15 | 0.63 | 7.15 | 14.80 | 31.48 | 13.52 |

| GUGGENHEIM S&P 500 EQUAL WEIGHT TECHNOLOGY ETF (RYT) | -0.14 | 11.68 | 0.66 | 6.81 | 9.60 | 26.18 | 10.81 |

| ISHARES MSCI ISRAEL CAPPED ETF (ISVY) | 0.67 | 1.27 | 1.77 | 6.81 | 8.24 | 1.19 | 4.50 |

| POWERSHARES NASDAQ INTERNET PORTFOLIO (PNQI) | 0.58 | 15.82 | 1.79 | 6.65 | 14.23 | 27.53 | 12.55 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 2.17 | 5.68 | 2.98 | 22.22 | 3.42 | -30.11 | -0.37 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -1.86 | 38.44 | -3.40 | 19.99 | 53.67 | 83.65 | 38.48 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 0.77 | -4.99 | 11.81 | 14.61 | -11.77 | -63.31 | -12.17 |

| DB PHYSICAL RHODIUM ETC (XRH0) | -1.13 | 37.50 | 2.33 | 10.15 | 52.31 | 141.48 | 51.57 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | 0.02 | 20.88 | 0.97 | 9.57 | 19.65 | 39.79 | 17.49 |

| ETFS WHEAT (OD7S) | -0.47 | 17.18 | 6.29 | 9.43 | 14.18 | 2.67 | 8.14 |

| MORGAN STANLEY CHINA A SHARE FUND INC (CAF) | 0.04 | 15.14 | 2.57 | 9.43 | 16.96 | 35.43 | 16.10 |

| ISHARES US TECHNOLOGY ETF (IYW) | 0.17 | 10.99 | 1.51 | 8.58 | 9.11 | 26.11 | 11.33 |

| COLUMBIA SELIGMAN PREMIUM TECHNOLOGY GROWTH FUND INC (STK) | -0.53 | 5.58 | 3.44 | 8.50 | 1.75 | 8.58 | 5.57 |

| FIDELITY MSCI INFORMATION TECHNOLOGY INDEX ETF (FTEC) | 0.09 | 11.32 | 1.24 | 8.44 | 9.53 | 27.66 | 11.72 |

| HENDERSON HORIZON - GLOBAL TECHNOLOGY FUND - A2 (HZ5I) | 1.06 | 7.90 | 1.78 | 8.39 | 6.52 | 26.22 | 10.73 |

| VANGUARD INFORMATION TECHNOLOGY ETF (VGT) | 0.12 | 11.26 | 1.27 | 8.36 | 9.55 | 27.50 | 11.67 |

| HSBC CHINA DRAGON FUND (820) | -0.13 | 6.95 | 4.00 | 8.22 | -0.63 | 24.37 | 8.99 |

| POLAR CAPITAL TECHNOLOGY TRUST PLC (PCT) | 0.21 | 8.00 | 1.04 | 7.87 | 4.85 | 28.55 | 10.58 |

| TECHNOLOGY SELECT SECTOR SPDR FUND (XLK) | 0.07 | 9.50 | 1.36 | 7.76 | 8.99 | 25.60 | 10.93 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -0.19 | 23.29 | 0.91 | 7.27 | 25.91 | 51.29 | 21.35 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | -0.02 | 18.15 | 0.63 | 7.15 | 14.80 | 31.48 | 13.52 |

| GUGGENHEIM S&P 500 EQUAL WEIGHT TECHNOLOGY ETF (RYT) | -0.14 | 11.68 | 0.66 | 6.81 | 9.60 | 26.18 | 10.81 |

| ISHARES MSCI ISRAEL CAPPED ETF (ISVY) | 0.67 | 1.27 | 1.77 | 6.81 | 8.24 | 1.19 | 4.50 |

| POWERSHARES NASDAQ INTERNET PORTFOLIO (PNQI) | 0.58 | 15.82 | 1.79 | 6.65 | 14.23 | 27.53 | 12.55 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -1.86 | 38.44 | -3.40 | 19.99 | 53.67 | 83.65 | 38.48 |

| DB PHYSICAL RHODIUM ETC (XRH0) | -1.13 | 37.50 | 2.33 | 10.15 | 52.31 | 141.48 | 51.57 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -5.47 | 31.36 | -7.26 | 2.02 | 36.41 | 82.45 | 28.41 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -0.19 | 23.29 | 0.91 | 7.27 | 25.91 | 51.29 | 21.35 |

| ETFS WTI CRUDE OIL (CRUD) | -5.56 | 22.49 | 0.84 | 1.56 | 19.90 | 40.99 | 15.82 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | 0.02 | 20.88 | 0.97 | 9.57 | 19.65 | 39.79 | 17.49 |

| ETFS NICKEL (NICK) | 0.54 | 20.66 | 1.39 | 5.96 | 22.92 | 60.87 | 22.79 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | -1.61 | 19.92 | -1.11 | 5.46 | 23.34 | 36.13 | 15.96 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | -1.42 | 19.14 | -1.57 | 5.10 | 23.26 | 34.81 | 15.40 |

| ISHARES NORTH AMERICAN TECH-SOFTWARE ETF (IGV) | -0.02 | 18.15 | 0.63 | 7.15 | 14.80 | 31.48 | 13.52 |

| ETFS WHEAT (OD7S) | -0.47 | 17.18 | 6.29 | 9.43 | 14.18 | 2.67 | 8.14 |

| POWERSHARES NASDAQ INTERNET PORTFOLIO (PNQI) | 0.58 | 15.82 | 1.79 | 6.65 | 14.23 | 27.53 | 12.55 |

| UNITED STATES OIL FUND LP (U9N) | -2.95 | 15.70 | -3.63 | 1.21 | 18.25 | 37.13 | 13.24 |

| MORGAN STANLEY CHINA A SHARE FUND INC (CAF) | 0.04 | 15.14 | 2.57 | 9.43 | 16.96 | 35.43 | 16.10 |

| ISHARES GLOBAL TIMBER & FORESTRY ETF (WOOD) | -0.40 | 14.75 | -0.69 | 0.28 | 15.51 | 36.26 | 12.84 |

| FIRST TRUST TECHNOLOGY ALPHADEX FUND (FXL) | 0.12 | 11.83 | 1.20 | 6.46 | 7.12 | 28.48 | 10.82 |

| GUGGENHEIM S&P 500 EQUAL WEIGHT TECHNOLOGY ETF (RYT) | -0.14 | 11.68 | 0.66 | 6.81 | 9.60 | 26.18 | 10.81 |

| ISHARES NORTH AMERICAN TECH ETF (ISQ8) | 0.03 | 11.44 | 0.56 | 6.63 | 11.45 | 29.98 | 12.16 |

| FIDELITY MSCI INFORMATION TECHNOLOGY INDEX ETF (FTEC) | 0.09 | 11.32 | 1.24 | 8.44 | 9.53 | 27.66 | 11.72 |

| VANGUARD INFORMATION TECHNOLOGY ETF (VGT) | 0.12 | 11.26 | 1.27 | 8.36 | 9.55 | 27.50 | 11.67 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| LYXOR ETF TURKEY EURO (TURU) | 1.97 | -27.98 | -4.63 | -15.99 | -18.03 | -21.78 | -15.11 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.95 | -27.88 | -5.08 | -16.88 | -18.39 | -21.73 | -15.52 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | 0.54 | -27.61 | -4.03 | -16.61 | -16.81 | -20.03 | -14.37 |

| CANADIAN LIFE COS SPLIT CORP (LFE) | -2.68 | -27.34 | -6.58 | -0.99 | -23.08 | 8.09 | -5.64 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 2.63 | -26.89 | -3.43 | -15.58 | -17.37 | -20.67 | -14.26 |

| DIREXION DAILY BRAZIL BULL 3X SHARES (BRZU) | -2.23 | -26.84 | -3.97 | -28.87 | -27.88 | 7.23 | -13.37 |

| ISHARES MSCI TURKEY ETF (ISVZ) | 1.50 | -26.27 | -3.81 | -15.57 | -15.58 | -18.83 | -13.45 |

| DIREXION DAILY LATIN AMERICA BULL 3X SHARES (LBJ) | -2.54 | -20.27 | -7.65 | -28.74 | -18.67 | 10.53 | -11.13 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -2.33 | -19.16 | 3.53 | -1.08 | -14.42 | -24.71 | -9.17 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.54 | -17.64 | -3.38 | -10.62 | -12.00 | 43.63 | 4.41 |

| LYXOR ETF WIG20 (ETFW20L) | -0.64 | -16.19 | -2.68 | -8.55 | -15.60 | -4.72 | -7.89 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | 1.57 | -15.93 | 4.48 | -6.77 | -11.13 | -6.99 | -5.10 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 2.24 | -15.86 | 4.16 | 3.55 | -11.13 | -19.18 | -5.65 |

| ISHARES MSCI POLAND UCITS ETF (IPOL) | -0.86 | -15.15 | -2.09 | -8.15 | -14.91 | -3.24 | -7.10 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -0.36 | -15.00 | 1.24 | -4.09 | -14.37 | -11.22 | -7.11 |

| DB X-TRACKERS MSCI PHILIP IM INDEX UCITS ETF (3016) | 0.04 | -14.88 | -1.19 | 1.74 | -11.19 | -10.48 | -5.28 |

| DB X-TRACKERS MSCI PHILIPPINES IM TRN INDEX UCITS ETF (N2E) | 0.11 | -14.83 | -0.60 | 2.13 | -10.95 | -10.25 | -4.92 |

| DB X-TRACKERS MSCI INDONESIA TRN INDEX UCITS ETF - 2C (3099) | 0.76 | -14.62 | 3.01 | -4.50 | -10.04 | -7.08 | -4.65 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | -0.06 | -14.23 | -6.20 | -12.33 | -20.54 | 15.45 | -5.91 |

| HSBC MSCI INDONESIA UCITS ETF (HIDD) | 1.63 | -14.20 | 6.12 | -3.14 | -10.02 | -5.95 | -3.25 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| DB PHYSICAL RHODIUM ETC (XRH0) | -1.13 | 37.50 | 2.33 | 10.15 | 52.31 | 141.48 | 51.57 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | -1.86 | 38.44 | -3.40 | 19.99 | 53.67 | 83.65 | 38.48 |

| PROSHARES ULTRA DJ-UBS CRUDE OIL (UCO) | -5.47 | 31.36 | -7.26 | 2.02 | 36.41 | 82.45 | 28.41 |

| ETFS NICKEL (NICK) | 0.54 | 20.66 | 1.39 | 5.96 | 22.92 | 60.87 | 22.79 |

| HBM HEALTHCARE INVESTMENTS AG (5H5A) | -0.19 | 23.29 | 0.91 | 7.27 | 25.91 | 51.29 | 21.35 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | 0.53 | 0.35 | -2.29 | 2.72 | 7.59 | 49.55 | 14.39 |

| FIDELITY JAPANESE VALUES PLC (FJV) | -0.45 | 4.40 | 1.22 | 2.82 | 8.41 | 46.88 | 14.83 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.54 | -17.64 | -3.38 | -10.62 | -12.00 | 43.63 | 4.41 |

| ETFS WTI CRUDE OIL (CRUD) | -5.56 | 22.49 | 0.84 | 1.56 | 19.90 | 40.99 | 15.82 |

| FIRST TRUST DOW JONES INTERNET INDEX FUND (FDN) | 0.02 | 20.88 | 0.97 | 9.57 | 19.65 | 39.79 | 17.49 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 1.02 | 4.40 | -2.59 | -1.07 | 3.02 | 38.00 | 9.34 |

| BAILLIE GIFFORD JAPAN TRUST PLC/THE (BGFD) | -0.21 | 2.13 | 0.62 | 0.80 | 2.39 | 37.55 | 10.34 |

| UNITED STATES OIL FUND LP (U9N) | -2.95 | 15.70 | -3.63 | 1.21 | 18.25 | 37.13 | 13.24 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | 1.50 | -3.19 | 3.00 | 0.11 | -5.61 | 36.97 | 8.62 |

| JPMORGAN CHINESE INVESTMENT TRUST PLC (JMC) | -0.77 | -0.49 | -2.56 | 3.46 | -5.38 | 36.75 | 8.07 |

| ISHARES GLOBAL TIMBER & FORESTRY ETF (WOOD) | -0.40 | 14.75 | -0.69 | 0.28 | 15.51 | 36.26 | 12.84 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | -1.61 | 19.92 | -1.11 | 5.46 | 23.34 | 36.13 | 15.96 |

| MORGAN STANLEY CHINA A SHARE FUND INC (CAF) | 0.04 | 15.14 | 2.57 | 9.43 | 16.96 | 35.43 | 16.10 |

| ALPHA TRUST - ANDROMEDA INVESTMENT TRUST SA (ANDRO) | 0.89 | 2.42 | -7.47 | -12.14 | 4.97 | 34.99 | 5.09 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | -1.42 | 19.14 | -1.57 | 5.10 | 23.26 | 34.81 | 15.40 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | 0.77 | -4.99 | 11.81 | 14.61 | -11.77 | -63.31 | -12.17 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 2.17 | 5.68 | 2.98 | 22.22 | 3.42 | -30.11 | -0.37 |

| DIREXION DAILY GOLD MINERS BULL 3X SHARES (NUGT) | -2.33 | -19.16 | 3.53 | -1.08 | -14.42 | -24.71 | -9.17 |

| LYXOR ETF TURKEY EURO (TURU) | 1.97 | -27.98 | -4.63 | -15.99 | -18.03 | -21.78 | -15.11 |

| HSBC MSCI TURKEY UCITS ETF (HTRY) | 0.95 | -27.88 | -5.08 | -16.88 | -18.39 | -21.73 | -15.52 |

| ISHARES MSCI TURKEY UCITS ETF (IDTK) | 2.63 | -26.89 | -3.43 | -15.58 | -17.37 | -20.67 | -14.26 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | -0.57 | -6.24 | 1.22 | 1.08 | -5.43 | -20.53 | -5.92 |

| HSBC MSCI TURKEY UCITS ETF (H4Z2) | 0.54 | -27.61 | -4.03 | -16.61 | -16.81 | -20.03 | -14.37 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | -0.07 | -6.30 | 1.10 | -1.37 | -4.42 | -19.82 | -6.13 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 2.24 | -15.86 | 4.16 | 3.55 | -11.13 | -19.18 | -5.65 |

| ISHARES MSCI TURKEY ETF (ISVZ) | 1.50 | -26.27 | -3.81 | -15.57 | -15.58 | -18.83 | -13.45 |

| ETFS COFFEE (COFF) | -0.47 | -6.81 | 1.87 | 1.58 | -9.79 | -15.13 | -5.37 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -4.70 | -6.99 | -7.66 | -5.11 | -5.89 | -13.86 | -8.13 |

| ISHARES US TELECOMMUNICATIONS ETF (ISQC) | -0.30 | -8.06 | 0.42 | -1.77 | -5.22 | -13.73 | -5.08 |

| ETRACS ALERIAN MLP INFRASTRUCTURE INDEX ETN (MLPI) | -2.22 | -3.98 | -4.02 | 0.72 | 1.96 | -13.27 | -3.65 |

| REAVES UTILITY INCOME FUND (UTG) | -0.14 | -6.81 | 0.67 | 0.64 | -5.45 | -13.14 | -4.32 |

| ASA GOLD AND PRECIOUS METALS LTD (ASA) | -0.58 | -7.26 | 0.08 | -1.96 | -6.52 | -11.99 | -5.10 |

| ISHARES MSCI MEXICO CAPPED UCITS ETF (CMXC) | -0.12 | -6.54 | 1.21 | -8.89 | -10.14 | -11.95 | -7.44 |

| ALERIAN MLP ETF (AMLP) | -2.11 | -4.00 | -4.20 | 0.39 | 1.95 | -11.81 | -3.42 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -0.36 | -15.00 | 1.24 | -4.09 | -14.37 | -11.22 | -7.11 |