Chart: May Strategy. US Trade Balance Deteriorates and other 10 slides.

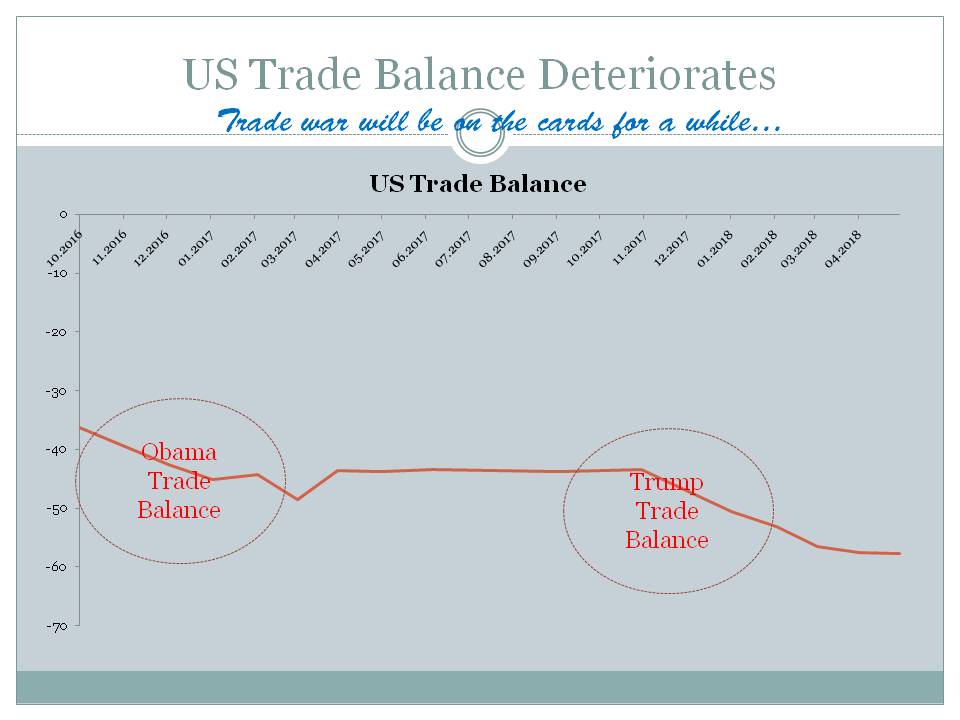

Trade war will be on the cards for a while… But it is not the solution

Source: ML

Download file in Power PointThe Australian dollar remains under pressureArgentina Raises Key Rate to 40%, Bringing Economic UncertaintyMnuchin's Treasury Poised to Rev Up Supply as Budget Gap WidensWill the ECB Send EURO to 1.20?US bank earnings in focus as Syria and trade tensions easeTreasury poised to rev up supply as budget gap widensCONSOL Energy Announces Results for the First Quarter 2018Recent Strategy Chart Art

Strategy

Zimbabwe, Greece the best markets in April. Turkey and Kazakhstan – the worst.

Tunisia, Romania, Saudi Arabia – the best markets YTD. Turkey and Philippines are the worst.

US, Ireland, Canada are the best bond markets YTD while Russia and Argentina are the worst.

Steel, cocking coal, and Platinum – the worst commodities in April. Crude oil and wheat – the best.

DXY was getting weaker ever since Trump took the office, but started advancing last month. Weaker DXY did not help US trade balance which continues to deteriorate and was in much better shape under Obama, perhaps highlighting that currency rates are not the reason for weaker US trade and trade wars will not really help to improve it. But trade war is still very much on.

Emerging market Eurobonds are weaker. The central banks that were in the counter cycle to the US FED like Russian CB, for example, stopped cutting rates.

Euro is weaker vs. USD and more importantly weaker against Yen. Some larger carry trades will be reversed and some smaller carry trades e.g. Ruble trade are not likely to continue.

The risk appetite is smaller. But most of the global growth is still delivered from emerging markets, and investment levels in developed markets are quite strong. So it still looks manageable at the current moment.

US fixed income environment is the key. Most developed markets are coming off. Gold price is off the recent highs too. Oil price is still holding up but is unlikely to keep at current levels if the dollar is to advance higher.

More geopolitical optimism is coming from the Far East. North-South Korean meeting, upcoming Putin talks with Abe in May, 19km bridge to Crimea is to be launched before summer, Armenia political change and Russian new prime minister could also be the source of optimism.

It looks as if sell in May rule is holding up this year but it is unlikely that the sell-off will be strong.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

Comment

Monthly performance is between 2018-05-01 and 2018-03-30

Best global markets YTD EM LATIN AMERICA +5.11%, EFM ASIA +0.77%, EM (EMERGING MARKETS) +0.35%,

While worst global markets YTD EUROPE -1.31%, USA -0.55%, FM (FRONTIER MARKETS) -0.44%,

Best global markets last month EUROPE +1.29%, USA +0.54%, EFM ASIA +0.06%,

While worst global markets last month FM (FRONTIER MARKETS) -4.61%, EM LATIN AMERICA -1.98%, EM (EMERGING MARKETS) -0.72%, Why the US stock market has become a drag on bullish sentimentUS Stocks' Afternoon Rally Sputters Out Late: Markets WrapEmerging markets sell-off stops at AsiaEmerging market currencies slip after worst week since 2016China stocks lead Asia higher, lifted by commoditiesChina stocks rise on economic optimism despite lingering trade ...US Investors Desert European EquitiesEuropean equities open a little mixed to kick start the weekNever Trust A Banker About Oil PricesThe Next Big Trend In Offshore Oil & GasConstruction kicks off as lumber, steel prices jumpArgentina's domestic steel prices stable but currency fears increaseGold Prices Rise Today, Silver Also Gain: 5 Things To KnowGold price in India today: 24 karat, 22 karat prices rise as dollar slips

Best last month among various countries' equity markets were ZIMBABWE +26.77%, GREECE +14.86%, COLOMBIA +9.46%, MAURITIUS +6.54%, QATAR +6.08%, SINGAPORE +4.77%, BOTSWANA +4.69%, ITALY +4.46%, INDIA +4.11%, FRANCE +3.62%,

While worst last month among various countries' equity markets were TURKEY -12.37%, BAHRAIN -9.80%, KAZAKHSTAN -9.42%, VIETNAM -8.84%, RUSSIA -8.20%, KENYA -6.94%, ARGENTINA -6.62%, UKRAINE -6.28%, PAKISTAN -5.36%, BELGIUM -5.11%,

Best YTD among various country equities were TUNISIA +25.96%, ROMANIA +16.43%, SAUDI ARABIA DOMESTIC +16.30%, COLOMBIA +14.24%, KENYA +13.68%, JORDAN +13.54%, EGYPT +12.32%, ZIMBABWE +11.22%, LITHUANIA +11.16%, PERU +10.76%,

While worst YTD among various country equities were MAURITIUS -20.79%, TURKEY -17.76%, PHILIPPINES -13.05%, ARGENTINA -12.57%, INDONESIA -12.16%, ESTONIA -10.68%, OMAN -10.43%, BAHRAIN -9.42%, POLAND -8.73%, NEW ZEALAND -7.49%,