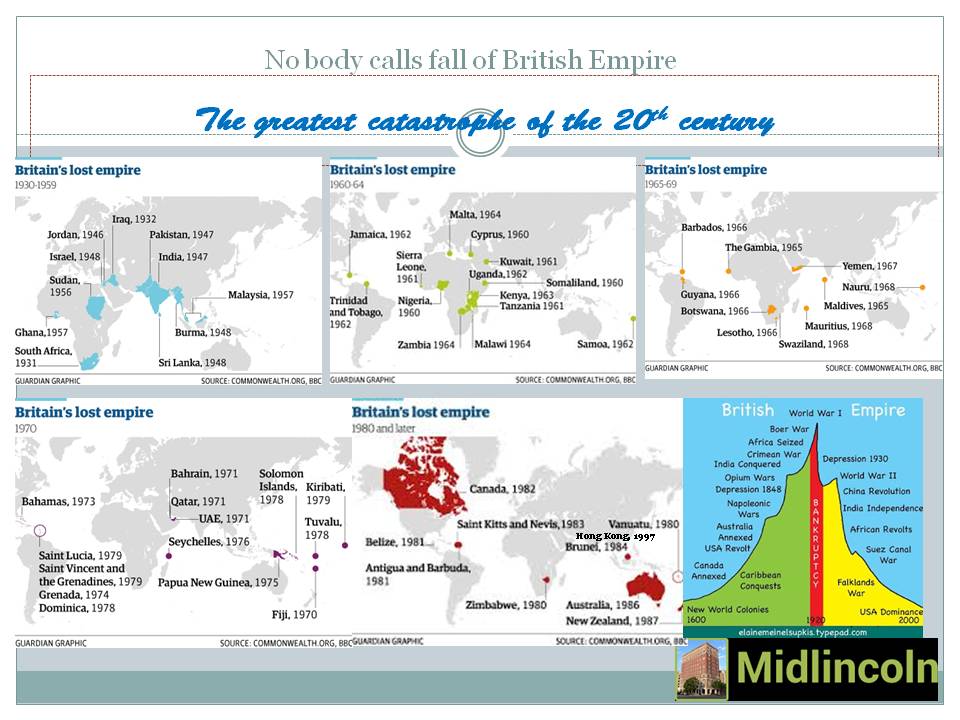

Chart: No body calls fall of British Empire

The greatest catastrophe of the 20th century

Source: ML

Download file in Power PointCalls made to install plaque commemorating comedian Sir Ken ...Empire strikes back: why former colonies don't need Britain after BrexitThe story behind the skull found in a London pubWill the Church's secrets and lies never end?Good Old GibThe Miracle Mile: Roger Bannister, John Landy and an epic encounterRecent Strategy Chart Art

Strategy

What is in common between Kazakhstan and Botswana? They were among 12 markets that remained in the positive territory in February. Kazkhstan equities added 6.5% in February while Botswana +1.06%. The remaining 10 markets were TUNISIA 3.88, JORDAN 3.11, FINLAND 2.35, THAILAND 2.06, BAHRAIN 1.80, KENYA 1.46, KUWAIT 1.15, TRINIDAD AND TOBAGO 1.14, RUSSIA 0.93, ROMANIA 0.19. The rest of the 44 markets out of 56 that Midlincoln tracks ended up in red for the month. As you see there is no great pattern among the markets that sustained February volatility and most likely this markets were able to hold on to gains because they are off radar of most investors. Are they?

Kazakhstan is not off radars. This market is investors focus for the last couple of years. Kazakhstan mostly is the oil producer. The volume of oil production in Kazakhstan in 2017 amounted to 86.2 million tonnes (an increase of 10.5% from 2016). Most of the increase came from Kashagan oil field which produced 8.35 million tonnes of oil and 5.1 billion cubic metres of gas in 2017 and is on the plan to produce 11mn tones in 2018.

Kashagan now producers roughly 300Kboe per day and this will go up to 400Kboe in the next couple of years. This is roughly equal to a cut in oil production that Russia pledged to make under OPEC agreement. Hopefully this does not offend Putin too much.

Tunisia the next best market in February as Tunisia is on track to post 3.5% GDP growth in 2018 on higher spending, investment and middle class spending fuelled by 2.5% budget deficit.

Finland is supported by its IT sector stocks.

Russia is supported by higher oil prices.

Romania and Kenya make top frontier markets this year.

The rest of the markets were in red. China lost over 6% with Poland, Greece and Canada leading the losers.

With US rates are higher, global economic outlook additionally clouded by US taxes, US stocks lost 3.8% in February. Even machine managed funds could not sustain pressure in February posting very bad results in February.

Gold is still supported, although the pressure and uncertainty mounts.

Oil lost its beginning of the year shine.

Steel and cocking coal prices are still strong pointing that infrastructure theme is still pretty much alive.

But investors move into US bond funds with bond yields back to old normal and decent corporate credit yielding enough to sustain risk of volatile equity markets.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Choose A Country

ARGENTINA: EMERGING MARKETS-Brazil equities mixed as corruption probe ...

| AUSTRALIA: Oil prices, receding trade war fears support Australia shares; NZ up

| AUSTRIA: European Equity Benchmarks Close Higher; EU Mulls Retaliation ...

| BAHRAIN: Nomura bullish on long term Saudi equities investment prospects

| BELGIUM: European Equity Benchmarks Close Higher; EU Mulls Retaliation ...

|

BRAZIL: EMERGING MARKETS-Brazil equities mixed as corruption probe ...

| BRITAIN: British investors sell stocks but wary of calling market top - Reuters poll

| CANADA: Canadian stocks to buy in the current environment

| CHILE: EMERGING MARKETS-Brazil equities mixed as corruption probe ...

| CHINA: China stocks slide on growth and rate-rise fears

|

COLOMBIA: EMERGING MARKETS-Brazil equities mixed as corruption probe ...

| CZECH: Czech Republic - Factors To Watch on March 5

| DENMARK: Investment returns: Record year for equities boosts European ...

| EGYPT: Winners Rise Among Cairo Stocks as Egypt Starts to Cut Rates

| FINLAND: Finnish state pension fund shifts towards equities

|

FRANCE: French and Benelux stocks-Factors to watch on March 6

| GERMANY: Germany ETFs Step Into Spotlight

| GREECE: New Greece bond slumps after equities extend lower

| HONG KONG: HK equities: Near-term turbulence won't alter long-term uptrend

| HUNGARY: CEE MARKETS-Dollar rally hits asset prices, Hungary's bonds draw ...

|

INDIA: Why It's Not Time To Squeeze The Brakes On Indian Equities

| INDONESIA: Asia's Biggest Currency Gain in 20 Years May Be About to End

| IRELAND: Accenture plc Class A (Ireland) (ACN) Dips 3.02% for March 01

| ISRAEL: Israel's Psagot Boosts Global Exposure for $17 Billion Fund

| ITALY: Global markets stumble, rattled by trade war fears and political ...

|

JAPAN: Japan Looks Ready to Sustain Gains

| KAZAKHSTAN: Kazakhstan's frozen billions sound alarm for sovereign funds

| LEBANON: Expert: US Miscalculations in Lebanon Strengthen Iran, Hezbollah ...

| MALAYSIA: Malaysia, Singapore stocks extend losses amid global trade war fears

| MEXICO: Mexico stocks clock worst month in 6-1/2 years on Fed, NAFTA worries

|

NETHERLANDS: Investment returns: Record year for equities boosts European ...

| NEW ZEALAND: New Zealand shares join global rally

| NIGERIA: Equities open with N229b gain

| NORWAY: Norway's SWF makes 14% in 2017 after EM equities soar

| OMAN: Oman Blockchain Club to hold seminar in Sohar today

|

PAKISTAN: Pakistan equities expected to remain in consolidation phase next ...

| PERU: EMERGING MARKETS-Brazil equities mixed as corruption probe ...

| PHILIPPINES: SE Asia Stocks-Rise as trade war concerns ebb; Philippines down

| POLAND: Warsaw bourse an oasis of calm as global equities slide

| PORTUGAL: Global stocks fall amid the fear of a trade war

|

QATAR: Qatar shares drop to below 8500 as selling pressure weighs

| QATAR: Qatar shares drop to below 8500 as selling pressure weighs

| ROMANIA: Romania - Factors to watch on Feb. 27

| RUSSIA: EMERGING MARKETS-Stocks clock 2nd week of gains, Russia ...

| SINGAPORE: Malaysia, Singapore stocks extend losses amid global trade war fears

|

SOUTH AFRICA: Fear in Stock Market Spurs South African Fund Manager's Quiet Picks

| SOUTH KOREA: Risk Appetite Returns to Asian Equities

| SPAIN: LIVE MARKETS-Wanna buy cheap euros? How about Spanish ...

| SWEDEN: Sweden: D Carnegie to raise cash for pipeline

| SWITZERLAND: Transocean Ltd (Switzerland) (RIG) Rises 2.74% for March 01

|

TAIWAN: Asia Stocks Rise, Paced by Technology Shares; HK, Taiwan Advance

| THAILAND: Malaysia and Thailand a haven from sell-off volatility

| TURKEY: Turkey's 'Big Year' for IPOs Gets Off to an Underwhelming Start

| UAE: Video: Where are UAE equities headed in 2018?

| UKRAINE: Russia-Ukraine Spat Adds Stress to EU Gas Market Hit by Cold

|

UNITED STATES: US Equities Stage Dynamic Recovery Indicating Trade War Fears ...

| VIETNAM: Vietnam Snatches Back Asia's Equity Crown as Foreigners Buy

|

Comment

Monthly performance is between 2018-02-28 and 2018-01-31

Best global markets YTD EM LATIN AMERICA +8.46%, FM (FRONTIER MARKETS) +4.00%, EM (EMERGING MARKETS) +3.17%,

While worst global markets YTD EUROPE -1.05%, USA 1.54%, EFM ASIA 2.16%,

Best global markets last month FM (FRONTIER MARKETS)-1.63%, USA-3.87%, EM LATIN AMERICA-4.08%,

While worst global markets last month EUROPE -6.09%, EFM ASIA -5.40%, EM (EMERGING MARKETS) -4.73%, These Three Options Charts Point to More Gains for US StocksAsian Stocks Mixed Ahead of US Data; Yen Falls: Markets WrapEmerging markets maven Mark Mobius to launch a new firm with ...EMERGING MARKETS-Emerging stocks leap to 2-week high as ...China stocks rise for 3rd day, material firms leadHong Kong stocks fall ahead of key US, China economic data that ...European Equities Close Mostly HigherDarius McDermott: Five European funds to watchGlut Or Deficit: Where Are Oil Markets Headed?Another Oil-Backed Cryptocurrency LaunchesIn a Perfect Trump World, US Steel Could Double Under TariffsTariffs: Giving Steel Prices Another NudgeGold price today in India: Yellow metal drops to Rs 32000-mask as ...Gold prices edge higher as dollar sags

Best last month among various countries' equity markets were KAZAKHSTAN +6.56%, TUNISIA +3.88%, JORDAN +3.11%, FINLAND +2.35%, THAILAND +2.06%, BAHRAIN +1.80%, KENYA +1.46%, KUWAIT +1.15%, TRINIDAD AND TOBAGO +1.14%, BOTSWANA +1.06%,

While worst last month among various countries' equity markets were MAURITIUS -10.32%, POLAND -9.91%, QATAR -9.20%, GREECE -8.19%, SPAIN -8.01%, HUNGARY -7.67%, CANADA -7.45%, GERMANY -7.42%, MEXICO -7.27%, COLOMBIA -7.18%,

Best YTD among various country equities were KAZAKHSTAN +18.71%, ROMANIA +13.84%, RUSSIA +13.57%, BRAZIL +13.53%, NIGERIA +12.69%, KENYA +11.37%, THAILAND +10.70%, TUNISIA +10.65%, UKRAINE +10.16%, VIETNAM +10.07%,

While worst YTD among various country equities were MAURITIUS -18.46%, ZIMBABWE -12.47%, CANADA -6.75%, PHILIPPINES -6.01%, IRELAND -4.60%, UNITED KINGDOM -4.21%, QATAR -3.91%, INDIA -3.69%, NEW ZEALAND -3.62%, ARGENTINA -3.59%,