Download a Slide Explaining Fixed Income Weekly

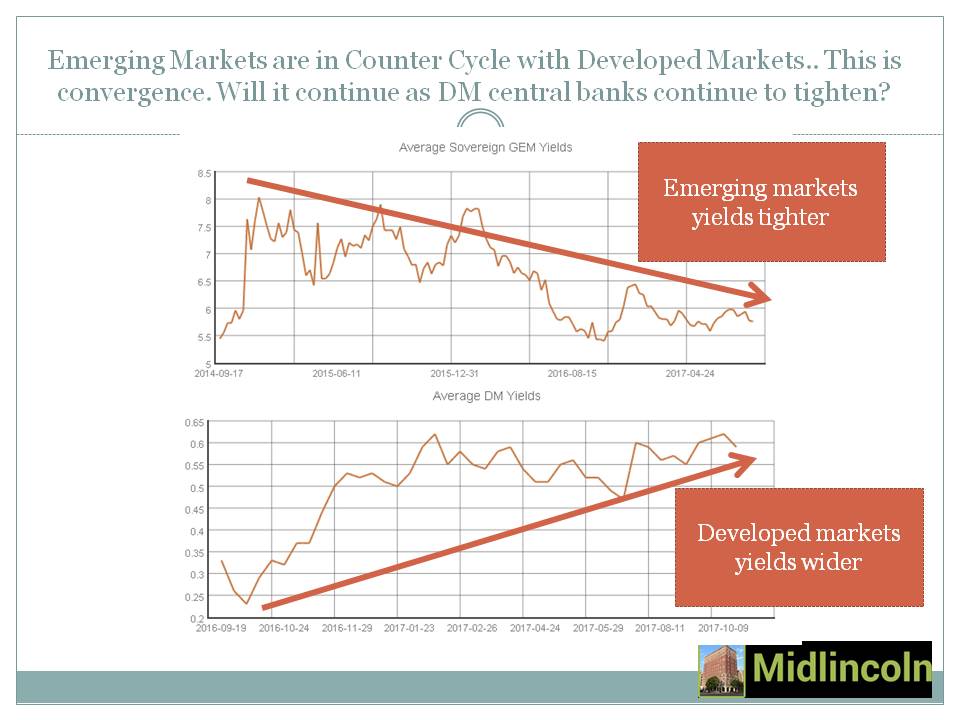

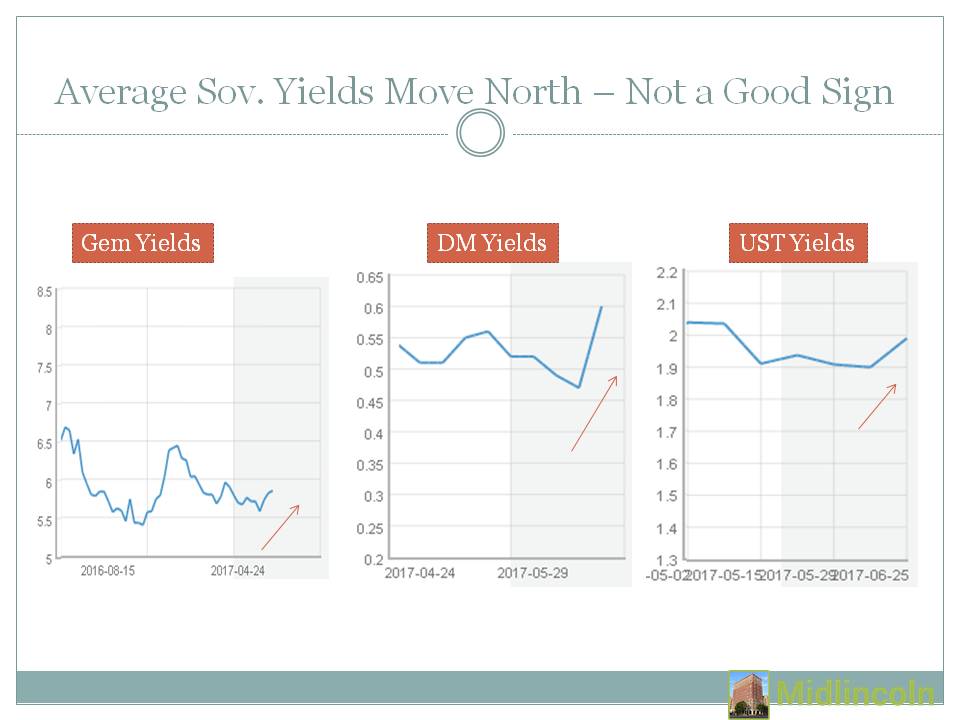

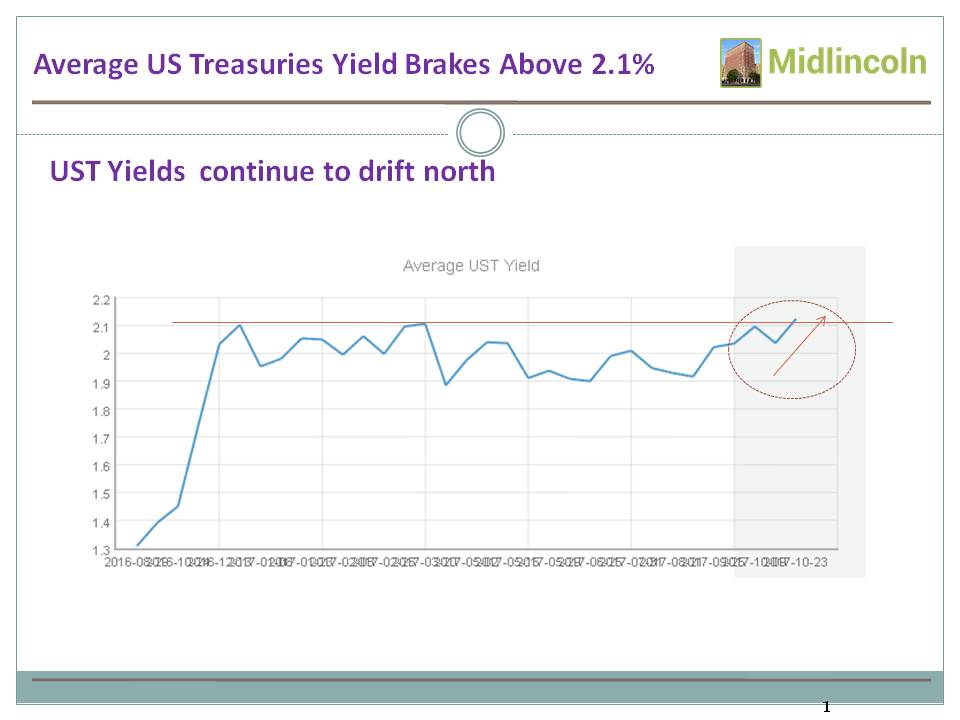

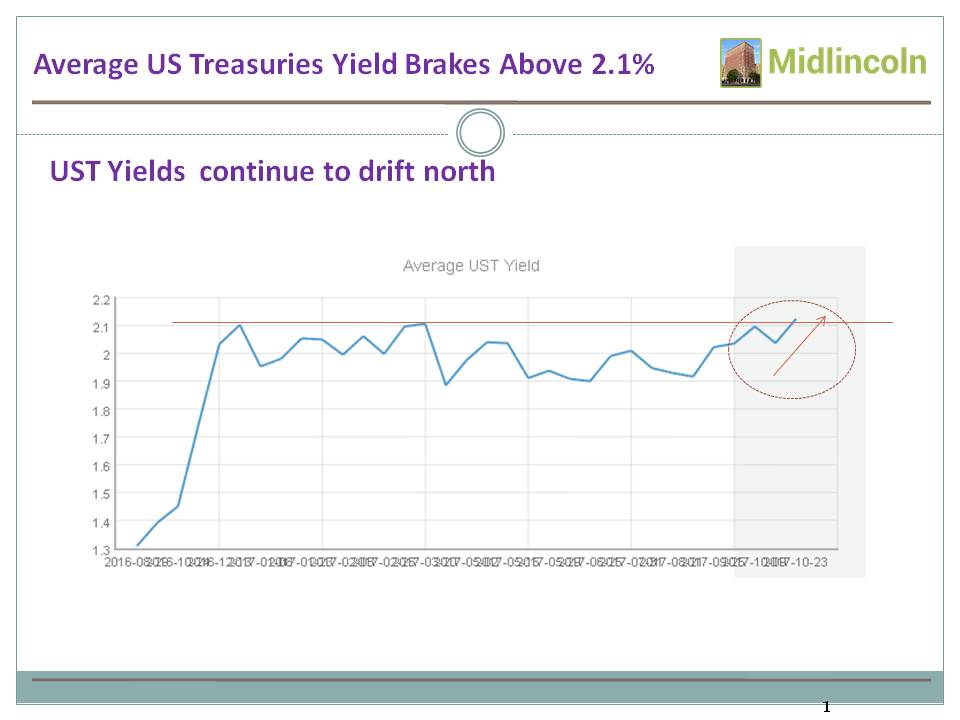

September FED Meeting propelled US yields. Average US treasuries yield moved higher and broke above 2% levels. US Fed has been focusing on inflation US CPI near 2% and core inflation at 1.6% set up a backdrop for a December US rate hike. The market has increased probabilty of a Dec move to over 75%.

Average DM yields moved higher as well the basket including DM bonds from US, Europe and Japan now yields 0.6% and it was below 0.5% still in August.

Catalan vote and ECB focus on tightening as economic condition become more solid the prime reason for yield inflation. It is also widely expected that on its October meeting ECB will announce the end of QE, which will be starting unwinding in Jan 2018.

In UK the focus is on tightening as well. On September meeting Bank of England gave notice to the markets that a rise in interest rates by the end of year was a strong possibility, this pushed UK gilts and stocks lower.

In Japan the backdrop is still for weaker yen. At September meeting a new board member Goushi Kataoka dissented to the BOJ's decision to maintain its interest rate targets, saying current monetary policy was insufficient to push inflation up to 2 percent during fiscal 2019. After three years of huge asset purchases Japan failed to drive up inflation to its 2 percent target. In a widely expected move, the BOJ maintained the 0.1 percent interest rate. But the focus was shifted to target inflation rather than M2 growth.

On the emerging markets in China dollar has stopped its weakness and has moved higher on dollar buying from Chinese firms amid upcoming Communist Party congress.

Despite various market gloomy rumors about the consequences of the congress, the focus in China is still very much rational. The nation’ss longest-serving central bank chief defined a troika of three drivers needed to further open up the economy, citing greater foreign trade and investment, a more market-based foreign-exchange rate mechanism with a reasonable and balanced yuan rate, and the relaxation of capital controls to allow use of the yuan to be gradually freed

In South Korea, bonds are under pressure not only from missile threat but also from higher inflation. Korean inflation quickened to 2.6 percent in August, the fastest since April 2012, before easing back to 2.1 percent in September. The yield on benchmark 10-year bonds was at 2.39 percent on Thursday, up from just 1.36 percent in July 2016.

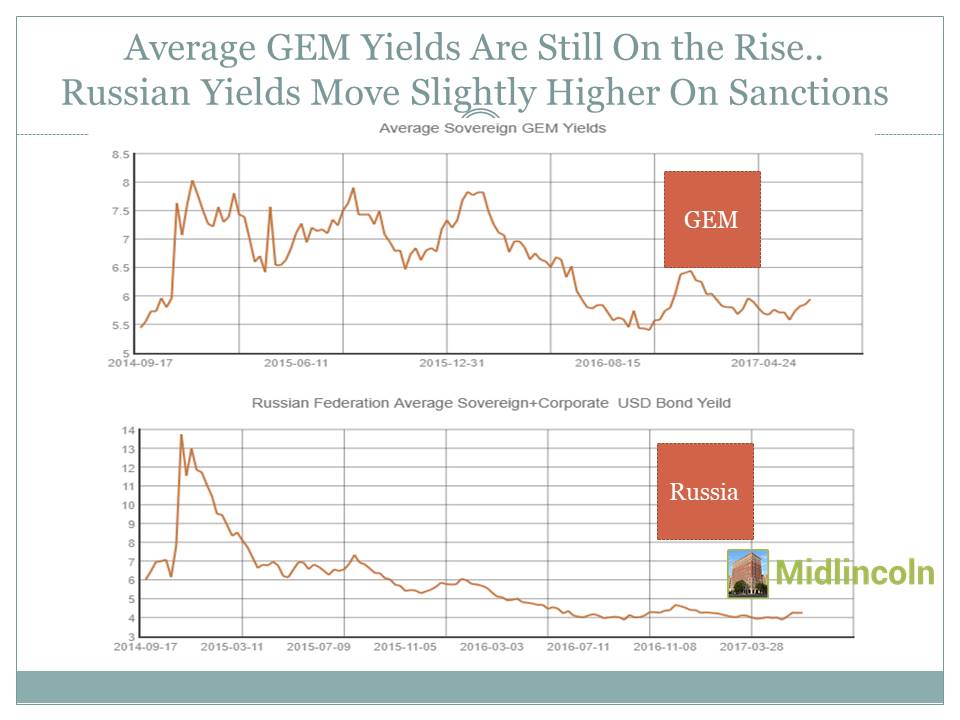

Elsewhere on the emerging markets the focus is on softening as well. There is still room for lower rates in Brazil, Russia and India

In Brazil it is expected that BCB would lower the selic rate from 8.25% to 7.0% by year end 2018.

In Russia CBR continues to cut, albeit reluctant to make larger moves, keeping the carry trade intact.

RBI in India was expected to cut but is on hold for now. Still there is plenty of room to soften.

In Turkey the cuts are on hold for now. The CBT is struggling with higher than expected inflation and will be frustrated about not being able to cut rates earlier.

In South Africa the The central bank left its key rate unchanged at 6.75 percent on Sept. 22 but the economic growth is slowing, providing more room for cuts

2017 Q3 Review and Q4 Outlook From the Bond Squad Markets Hug Flat Line In Early Going; Yellen Speech, Reports Might ... FTSE 100 subdued as UK inflation rises to highest since June 2014 ... Fed milestone: Central bank raises rates, plans to shrink its $4.5T in ... Wage growth closes the gap with inflation but sterling fails to hold ... Time to Hit the Brakes on Caterpillar's Rally Pound hits one-week low after BoE trims inflation forecasts, while ... Inside the September FOMC Meeting: Key Points Fed minutes: December rate hike all but certain despite low inflation ECB meeting this week - preview Morgan Stanley outlook for the ECB meeting this week and BoE next BOJ's Sakurai says no need to take excessive steps to meet price ... In Kuroda's face - researchers find ways to predict central bank ... Morgan Stanley outlook for the ECB meeting this week and BoE next New Bank of England members not ready for rate rise China's Toughest Job? China's money rates fall on ample liquidity after c.bank cash injection China central bank chief warns of 'Minsky moment' Liberal market reformer set to be named as China's next central ... BTG Pactual feels the digital force Shares of Banco Do Brasil SA (OTCMKTS:BDORY) Moving Today RBI should be ready to raise rates: MPC's Michael Patra RBI's rate transmission is broken Russia c.bank mulls "various options" for rate cut next week The Central Bank of Russia Blacklists 120 Otkritie Bankers Halkbank Deputy CEO Hakan Eryilmaz on The Lending Outlook in ... Turkish Lira Slides as "Turkish Central Bank Loses Credibility" South Africa's central bank cautious about more rate cuts UPDATE 1-South Africa's central bank cautious about more rate cuts South Korea central bank seen holding key rate again as worries on ... Bank of Korea Decision-Day Guide: Look Out for Hawkish Comments

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondPETROLEOS DE VENEZUELA SA RegS 22VENEZUELA BOLIVARIAN REPUBLIC OF RegS 22VENEZUELA (BOLIVARIAN REPUBLIC OF) 27VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 23

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondPETROLEOS DE VENEZUELA SA MTN RegS 21IRAQ (REPUBLIC OF) RegS 28UKRAINE (GOVERNMENT OF) RegS 20MONGOLIA (GOVERNMENT) RegS 22

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondNOBLE GROUP LTD RegS 20PETRA DIAMONDS US TREASURY PLC RegS 22EMIRATES NBD BANK PJSC MTN RegS 19ZENITH BANK PLC RegS 22

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondDIGICEL GROUP LTD RegS 20DTEK FINANCE PLC RegS 24CBOM FINANCE PLC - TIER 2 RegS 27GERDAU HOLDINGS INC RegS 20

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryVenezuelaAngolaGabonLebanonArgentina

Country Average Corporate Yield Change USD Eurobonds Weekly

CountryNigeriaHong KongGhanaTaiwanSouth Africa

Top 30 GEM Souvereign Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA RegSPETROLEOS DE VENEZUELA SA MTN RegSVENEZUELA BOLIVARIAN REPUBLIC OF RegS

Top 30 GEM Corporate Eurobonds by Yield

NameNOBLE GROUP LTD RegSODEBRECHT FINANCE LTD RegSCSN RESOURCES SA RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameARGENTINA REPUBLIC OF GOVERNMENTARGENTINA REPUBLIC OF GOVERNMENTARGENTINA REPUBLIC OF GOVERNMENT

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondSPAIN (KINGDOM OF) 27SPAIN (KINGDOM OF) 32SPAIN (KINGDOM OF) 33FRANCE (REPUBLIC OF) 66

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondPORTUGAL (REPUBLIC OF) 19CANADA (GOVERNMENT OF) 19CANADA (GOVERNMENT OF) 20CANADA (GOVERNMENT OF) 21

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsCONCORDIA INTERNATIONAL CORP 144A 22Canada95.8814.93CONCORDIA HEALTHCARE CORP 144A 23Canada75.326.56NOBLE GROUP LTD 144A 20Hong Kong61.474.26NEW LOOK SECURED ISSUER PLC RegS 22United Kingdom19.371.22PUBLIC POWER CORP FINANCE PLC MTN RegS 19Greece10.641.08

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsOBRASCON HUARTE LAIN SA RegS 22Spain4.97-4.22PACIFIC DRILLING SA 144A 20United States53.73-3.80CHS/COMMUNITY HEALTH SYSTEMS INC 20United States12.08-1.87BOMBARDIER INC 144A 21Canada5.23-1.45BOMBARDIER INC 144A 23Canada5.58-1.34

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.103.59AUSTRALIA (COMMONWEALTH OF) RegSAU000XCLWAS7AustraliaMar 21, 20473.003.56BUONI POLIENNALI DEL TESOROIT0005217390ItalyMar 01, 20672.803.41

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWCONCORDIA INTERNATIONAL CORP 144AUS206519AB61CanadaOct 21, 20229.5095.88CONCORDIA HEALTHCARE CORP 144AUS206519AA88CanadaApr 15, 20237.0075.32NOBLE GROUP LTD 144AUS65504RAD61Hong KongJan 29, 20206.7561.47

Country Average Sovereign+Corporate USD Yields Ordered by Weekly Change

| country | Yield | YieldChange |

| Venezuela | 33.86 | 1.30 |

| Hong Kong | 9.82 | 0.32 |

| Canada | 8.89 | 0.26 |

| Pakistan | 5.49 | 0.10 |

| Lebanon | 6.48 | 0.06 |

| Korea (South) | 3.58 | 0.06 |

| Saudi Arabia | 4.62 | 0.05 |

| Finland | 3.21 | 0.05 |

| South Africa | 4.72 | 0.04 |

| Nigeria | 6.08 | 0.04 |

| Singapore | 4.46 | 0.04 |

| Thailand | 3.53 | 0.04 |

| Luxembourg | 7.51 | 0.04 |

| Israel | 4.44 | 0.03 |

| United Arab Emirates | 3.71 | 0.03 |

| Argentina | 5.69 | 0.02 |

| Chile | 4.19 | 0.02 |

| Italy | 4.82 | 0.02 |

| Malaysia | 3.38 | 0.01 |

| Serbia | 2.99 | 0.01 |

| Lithuania | 2.25 | 0.01 |

| Azerbaijan | 4.84 | 0.01 |

| Croatia (Hrvatska) | 3.08 | 0.01 |

| Turkey | 5.01 | 0.01 |

| China | 4.39 | 0.01 |

| Indonesia | 3.79 | 0.01 |

| Qatar | 3.69 | 0.01 |

| Kuwait | 3.57 | 0.01 |

| Netherlands | 4.14 | 0.01 |

| Peru | 3.75 | 0.00 |

| Poland | 2.56 | 0.00 |

| Cote D'Ivoire (Ivory Coast) | 5.92 | 0.00 |

| Morocco | 4.01 | 0.00 |

| France | 5.40 | 0.00 |

| Russian Federation | 4.13 | -0.01 |

| Hungary | 2.91 | -0.01 |

| Panama | 3.71 | -0.01 |

| Colombia | 4.41 | -0.01 |

| Oman | 4.64 | -0.01 |

| Philippines | 3.25 | -0.01 |

| Mexico | 4.32 | -0.01 |

| India | 4.10 | -0.01 |

| Costa Rica | 5.74 | -0.01 |

| Bahrain | 5.44 | -0.02 |

| Ireland | 4.78 | -0.02 |

| Germany | 3.95 | -0.02 |

| Romania | 3.28 | -0.03 |

| Kazakhstan | 4.61 | -0.03 |

| Dominican Republic | 4.72 | -0.03 |

| Senegal | 5.36 | -0.03 |

| Vietnam | 3.44 | -0.03 |

| Uruguay | 3.73 | -0.04 |

| United States | 5.50 | -0.04 |

| Guatemala | 4.56 | -0.05 |

| Brazil | 5.25 | -0.06 |

| United Kingdom | 4.82 | -0.06 |

| Egypt | 5.69 | -0.07 |

| Ukraine | 6.56 | -0.07 |

| Ecuador | 7.74 | -0.08 |

| Sri Lanka | 4.47 | -0.08 |

| Trinidad and Tobago | 4.90 | -0.08 |

| Jordan | 5.94 | -0.10 |

| Ghana | 6.34 | -0.11 |

| El Salvador | 6.66 | -0.14 |

| Zambia | 6.63 | -0.17 |

| Jamaica | 6.65 | -0.18 |

Country Average Sovereign+Corporate USD Yields Ordered By YTD Yield Change

| country | Yield | YieldChange |

| Venezuela | 34.50 | 10.80 |

| Canada | 10.15 | 1.98 |

| Qatar | 3.60 | 0.05 |

| Israel | 4.15 | -0.06 |

| United States | 5.51 | -0.22 |

| Korea (South) | 3.79 | -0.22 |

| Oman | 4.70 | -0.23 |

| Bahrain | 5.44 | -0.35 |

| China | 3.83 | -0.37 |

| Philippines | 3.16 | -0.45 |

| Jordan | 5.78 | -0.46 |

| Germany | 3.88 | -0.46 |

| United Arab Emirates | 3.68 | -0.49 |

| Pakistan | 5.25 | -0.51 |

| Lebanon | 6.34 | -0.53 |

| Trinidad and Tobago | 4.87 | -0.54 |

| Thailand | 2.89 | -0.56 |

| Chile | 4.36 | -0.67 |

| Russian Federation | 3.82 | -0.69 |

| Netherlands | 3.97 | -0.69 |

| Peru | 3.52 | -0.70 |

| Morocco | 3.74 | -0.70 |

| Guatemala | 4.20 | -0.70 |

| Lithuania | 2.25 | -0.77 |

| South Africa | 4.68 | -0.79 |

| Azerbaijan | 4.85 | -0.80 |

| Poland | 2.56 | -0.85 |

| Malaysia | 3.36 | -0.85 |

| France | 5.40 | -0.87 |

| Romania | 3.28 | -0.90 |

| Italy | 4.76 | -0.90 |

| Panama | 3.47 | -0.92 |

| United Kingdom | 5.19 | -0.92 |

| Cote D'Ivoire (Ivory Coast) | 5.72 | -0.93 |

| Colombia | 4.26 | -0.93 |

| Mexico | 4.33 | -0.93 |

| Hungary | 2.91 | -0.95 |

| Indonesia | 3.69 | -1.00 |

| Croatia (Hrvatska) | 3.08 | -1.08 |

| Uruguay | 3.73 | -1.12 |

| India | 3.84 | -1.18 |

| Turkey | 4.80 | -1.22 |

| Brazil | 5.16 | -1.23 |

| El Salvador | 6.64 | -1.27 |

| Costa Rica | 5.69 | -1.29 |

| Serbia | 2.99 | -1.37 |

| Vietnam | 3.44 | -1.37 |

| Ecuador | 7.23 | -1.39 |

| Kazakhstan | 4.28 | -1.44 |

| Dominican Republic | 4.70 | -1.60 |

| Egypt | 4.87 | -1.63 |

| Ghana | 6.47 | -1.87 |

| Sri Lanka | 4.37 | -1.93 |

| Argentina | 5.61 | -2.00 |

| Ukraine | 6.49 | -2.21 |

| Jamaica | 6.48 | -2.27 |

| Luxembourg | 7.42 | -3.52 |

Country Average Sovereign+Corporate USD Yields Ordered by Current YTM

| country | Yield | YieldChange |

| Venezuela | 33.86 | 1.30 |

| Hong Kong | 9.82 | 0.32 |

| Canada | 8.89 | 0.26 |

| Ecuador | 7.74 | -0.08 |

| Luxembourg | 7.51 | 0.04 |

| El Salvador | 6.66 | -0.14 |

| Jamaica | 6.65 | -0.18 |

| Zambia | 6.63 | -0.17 |

| Ukraine | 6.56 | -0.07 |

| Lebanon | 6.48 | 0.06 |

| Ghana | 6.34 | -0.11 |

| Nigeria | 6.08 | 0.04 |

| Jordan | 5.94 | -0.10 |

| Cote D'Ivoire (Ivory Coast) | 5.92 | 0.00 |

| Costa Rica | 5.74 | -0.01 |

| Argentina | 5.69 | 0.02 |

| Egypt | 5.69 | -0.07 |

| United States | 5.50 | -0.04 |

| Pakistan | 5.49 | 0.10 |

| Bahrain | 5.44 | -0.02 |

| France | 5.40 | 0.00 |

| Senegal | 5.36 | -0.03 |

| Brazil | 5.25 | -0.06 |

| Turkey | 5.01 | 0.01 |

| Trinidad and Tobago | 4.90 | -0.08 |

| Azerbaijan | 4.84 | 0.01 |

| United Kingdom | 4.82 | -0.06 |

| Italy | 4.82 | 0.02 |

| Ireland | 4.78 | -0.02 |

| Dominican Republic | 4.72 | -0.03 |

| South Africa | 4.72 | 0.04 |

| Oman | 4.64 | -0.01 |

| Saudi Arabia | 4.62 | 0.05 |

| Kazakhstan | 4.61 | -0.03 |

| Guatemala | 4.56 | -0.05 |

| Sri Lanka | 4.47 | -0.08 |

| Singapore | 4.46 | 0.04 |

| Israel | 4.44 | 0.03 |

| Colombia | 4.41 | -0.01 |

| China | 4.39 | 0.01 |

| Mexico | 4.32 | -0.01 |

| Chile | 4.19 | 0.02 |

| Netherlands | 4.14 | 0.01 |

| Russian Federation | 4.13 | -0.01 |

| India | 4.10 | -0.01 |

| Morocco | 4.01 | 0.00 |

| Germany | 3.95 | -0.02 |

| Indonesia | 3.79 | 0.01 |

| Peru | 3.75 | 0.00 |

| Uruguay | 3.73 | -0.04 |

| Panama | 3.71 | -0.01 |

| United Arab Emirates | 3.71 | 0.03 |

| Qatar | 3.69 | 0.01 |

| Korea (South) | 3.58 | 0.06 |

| Kuwait | 3.57 | 0.01 |

| Thailand | 3.53 | 0.04 |

| Vietnam | 3.44 | -0.03 |

| Malaysia | 3.38 | 0.01 |

| Romania | 3.28 | -0.03 |

| Philippines | 3.25 | -0.01 |

| Finland | 3.21 | 0.05 |

| Croatia (Hrvatska) | 3.08 | 0.01 |

| Serbia | 2.99 | 0.01 |

| Hungary | 2.91 | -0.01 |

| Poland | 2.56 | 0.00 |

| Lithuania | 2.25 | 0.01 |

Chart: Average US Treasuries Yield Brakes Above 2.1%

Source: ML

Download file in Power PointKey News

Recent Fixed Income Ideas ChArt

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. Dev. Markets Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sovereign Local Currency Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Bonds Datamine Queries

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondPETROLEOS DE VENEZUELA SA RegS 22VENEZUELA BOLIVARIAN REPUBLIC OF RegS 22VENEZUELA (BOLIVARIAN REPUBLIC OF) 27VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 23

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondPETROLEOS DE VENEZUELA SA MTN RegS 21IRAQ (REPUBLIC OF) RegS 28UKRAINE (GOVERNMENT OF) RegS 20MONGOLIA (GOVERNMENT) RegS 22

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondNOBLE GROUP LTD RegS 20PETRA DIAMONDS US TREASURY PLC RegS 22EMIRATES NBD BANK PJSC MTN RegS 19ZENITH BANK PLC RegS 22

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondDIGICEL GROUP LTD RegS 20DTEK FINANCE PLC RegS 24CBOM FINANCE PLC - TIER 2 RegS 27GERDAU HOLDINGS INC RegS 20

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryVenezuelaAngolaGabonLebanonArgentina

Country Average Corporate Yield Change USD Eurobonds Weekly

CountryNigeriaHong KongGhanaTaiwanSouth Africa

Top 30 GEM Souvereign Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA RegSPETROLEOS DE VENEZUELA SA MTN RegSVENEZUELA BOLIVARIAN REPUBLIC OF RegS

Top 30 GEM Corporate Eurobonds by Yield

NameNOBLE GROUP LTD RegSODEBRECHT FINANCE LTD RegSCSN RESOURCES SA RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameARGENTINA REPUBLIC OF GOVERNMENTARGENTINA REPUBLIC OF GOVERNMENTARGENTINA REPUBLIC OF GOVERNMENT

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondSPAIN (KINGDOM OF) 27SPAIN (KINGDOM OF) 32SPAIN (KINGDOM OF) 33FRANCE (REPUBLIC OF) 66

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondPORTUGAL (REPUBLIC OF) 19CANADA (GOVERNMENT OF) 19CANADA (GOVERNMENT OF) 20CANADA (GOVERNMENT OF) 21

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsCONCORDIA INTERNATIONAL CORP 144A 22Canada95.8814.93CONCORDIA HEALTHCARE CORP 144A 23Canada75.326.56NOBLE GROUP LTD 144A 20Hong Kong61.474.26NEW LOOK SECURED ISSUER PLC RegS 22United Kingdom19.371.22PUBLIC POWER CORP FINANCE PLC MTN RegS 19Greece10.641.08

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsOBRASCON HUARTE LAIN SA RegS 22Spain4.97-4.22PACIFIC DRILLING SA 144A 20United States53.73-3.80CHS/COMMUNITY HEALTH SYSTEMS INC 20United States12.08-1.87BOMBARDIER INC 144A 21Canada5.23-1.45BOMBARDIER INC 144A 23Canada5.58-1.34

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.103.59AUSTRALIA (COMMONWEALTH OF) RegSAU000XCLWAS7AustraliaMar 21, 20473.003.56BUONI POLIENNALI DEL TESOROIT0005217390ItalyMar 01, 20672.803.41

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWCONCORDIA INTERNATIONAL CORP 144AUS206519AB61CanadaOct 21, 20229.5095.88CONCORDIA HEALTHCARE CORP 144AUS206519AA88CanadaApr 15, 20237.0075.32NOBLE GROUP LTD 144AUS65504RAD61Hong KongJan 29, 20206.7561.47

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

| Bond | Country | Yield | Yield Change % pts |

| PETROLEOS DE VENEZUELA SA RegS 22 | Venezuela | 50.28 | 2.36 |

| VENEZUELA BOLIVARIAN REPUBLIC OF RegS 22 | Venezuela | 45.89 | 1.67 |

| VENEZUELA (BOLIVARIAN REPUBLIC OF) 27 | Venezuela | 28.66 | 1.48 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 23 | Venezuela | 38.45 | 1.25 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 28 | Venezuela | 31.55 | 1.24 |

| PETROLEOS DE VENEZUELA SA RegS 26 | Venezuela | 29.64 | 1.13 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) 34 | Venezuela | 28.86 | 0.98 |

| PETROLEOS DE VENEZUELA SA RegS 20 | Venezuela | 19.80 | 0.96 |

| PETROLEOS DE VENEZUELA SA RegS 24 | Venezuela | 36.79 | 0.94 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 38 | Venezuela | 22.65 | 0.80 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 20 | Venezuela | 43.84 | 0.77 |

| VENEZUELA (BOLIVARIAN REPUBLIC OF) RegS 24 | Venezuela | 33.11 | 0.65 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 25 | Venezuela | 31.07 | 0.61 |

| VENEZUELA BOLIVARIAN REPUBLIC OF RegS 31 | Venezuela | 32.14 | 0.58 |

| VENEZUELA BOLIVARIAN REPUBLIC OF RegS 26 | Venezuela | 34.34 | 0.43 |

| PETROLEOS DE VENEZUELA SA RegS 27 | Venezuela | 25.11 | 0.39 |

| PETROLEOS DE VENEZUELA SA RegS 37 | Venezuela | 19.73 | 0.31 |

| STATE GRID OVERSEAS INVESTMENT (20 MTN RegS 22 | China | 2.81 | 0.18 |

| PAKISTAN (ISLAMIC REPUBLIC OF) RegS 24 | Pakistan | 5.99 | 0.14 |

| CHINA DEVELOPMENT BANK CORP MTN RegS 22 | China | 2.80 | 0.14 |

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

| Bond | Country | Yield | Yield Change %pts |

| PETROLEOS DE VENEZUELA SA MTN RegS 21 | Venezuela | 46.81 | -1.97 |

| IRAQ (REPUBLIC OF) RegS 28 | Iraq | 7.12 | -0.34 |

| UKRAINE (GOVERNMENT OF) RegS 20 | Ukraine | 5.14 | -0.33 |

| MONGOLIA (GOVERNMENT) RegS 22 | Mongolia | 5.47 | -0.28 |

| REPUBLIC OF IRAQ 144A 23 | Iraq | 6.85 | -0.28 |

| SRI LANKA DEMOCRATIC SOCIALIST (RE RegS 20 | Sri Lanka | 3.58 | -0.20 |

| EL SALVADOR REPUBLIC RegS 35 | El Salvador | 7.13 | -0.19 |

| UKRAINE (GOVERNMENT OF) RegS 22 | Ukraine | 5.98 | -0.18 |

| PETROLEOS MEXICANOS RegS 27 | Mexico | 5.15 | -0.17 |

| SRI LANKA DEMOCRATIC SOCIALIST (RE RegS 22 | Sri Lanka | 4.13 | -0.17 |

| SRI LANKA DEMOCRATIC SOCIALIST (RE RegS 21 | Sri Lanka | 3.83 | -0.16 |

| ESKOM HOLDINGS SOC LTD MTN RegS 23 | South Africa | 5.79 | -0.16 |

| UKRAINE (GOVERNMENT OF) RegS 21 | Ukraine | 5.70 | -0.15 |

| ARGENTINA (REPUBLIC OF) 33 | Argentina | 6.32 | -0.15 |

| INDONESIA (REPUBLIC OF) RegS 20 | Indonesia | 1.99 | -0.15 |

| PERTAMINA (PERSERO) PT RegS 21 | Indonesia | 2.72 | -0.14 |

| EGYPT (ARAB REPUBLIC OF) MTN RegS 22 | Egypt | 4.98 | -0.13 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS 20 | Ecuador | 6.54 | -0.13 |

| PAKISTAN INTERNATIONAL SUKUK COMPA RegS 19 | Pakistan | 4.39 | -0.13 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS 26 | Ecuador | 8.43 | -0.12 |

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

| Bond | Country | Yield | Yield Change %pts |

| NOBLE GROUP LTD RegS 20 | Hong Kong | 60.90 | 1.20 |

| PETRA DIAMONDS US TREASURY PLC RegS 22 | South Africa | 7.51 | 0.46 |

| EMIRATES NBD BANK PJSC MTN RegS 19 | United Arab Emirates | 3.06 | 0.37 |

| ZENITH BANK PLC RegS 22 | Nigeria | 6.27 | 0.34 |

| ALFA SAB DE CV RegS 24 | Mexico | 4.18 | 0.32 |

| VALE OVERSEAS LTD 21 | Brazil | 3.18 | 0.21 |

| JBS INVESTMENTS GMBH RegS 20 | Brazil | 7.33 | 0.19 |

| LATAM AIRLINES GROUP SA RegS 20 | Chile | 4.60 | 0.18 |

| WOORI BANK MTN RegS 21 | Korea (South) | 2.94 | 0.18 |

| IHS NETHERLANDS HOLDCO BV RegS 21 | Nigeria | 7.62 | 0.16 |

| ODEBRECHT FINANCE LTD RegS 25 | Brazil | 21.12 | 0.16 |

| AMERICA MOVIL SAB DE CV 22 | Mexico | 2.72 | 0.14 |

| COCA-COLA FEMSA SAB DE CV 23 | Mexico | 3.03 | 0.14 |

| COCA-COLA FEMSA SAB DE CV 20 | Mexico | 2.38 | 0.14 |

| SHINHAN BANK MTN RegS 22 | Korea (South) | 3.00 | 0.13 |

| EVRAZ GROUP SA RegS 21 | Russian Federation | 4.12 | 0.13 |

| BANK OF CHINA LTD (MACAU BRANCH) MTN RegS 22 | China | 2.92 | 0.13 |

| EL PUERTO DE LIVERPOOL SAB DE CV RegS 26 | Mexico | 4.04 | 0.13 |

| HUTCHISON WHAMPOA INTERNATIONAL 11 RegS 22 | Hong Kong | 2.77 | 0.12 |

| ANGLOGOLD ASHANTI HOLDINGS PLC 20 | South Africa | 3.35 | 0.12 |

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

| Bond | Country | Yield | Yield Change %pts |

| DIGICEL GROUP LTD RegS 20 | Jamaica | 8.32 | -0.62 |

| DTEK FINANCE PLC RegS 24 | Ukraine | 10.21 | -0.58 |

| CBOM FINANCE PLC - TIER 2 RegS 27 | Russian Federation | 8.59 | -0.51 |

| GERDAU HOLDINGS INC RegS 20 | Brazil | 2.95 | -0.36 |

| DIGICEL GROUP LTD RegS 22 | Jamaica | 8.93 | -0.35 |

| DIGICEL LTD RegS 21 | Jamaica | 6.32 | -0.34 |

| FIRST QUANTUM MINERALS LTD RegS 21 | Zambia | 5.64 | -0.31 |

| CSN RESOURCES SA RegS 20 | Brazil | 10.73 | -0.31 |

| BANCO BTG PACTUAL SA (CAYMAN ISLA MTN RegS 20 | Brazil | 5.13 | -0.30 |

| FIRST QUANTUM MINERALS LTD RegS 23 | Zambia | 6.13 | -0.27 |

| BRASKEM FINANCE LTD RegS 22 | Brazil | 3.67 | -0.25 |

| CHINA EVERGRANDE GROUP RegS 23 | China | 7.28 | -0.22 |

| BANCO DO BRASIL (GRAND CAYMAN BRAN RegS 49 | Brazil | 7.05 | -0.21 |

| ITAU UNIBANCO HOLDING SA MTN RegS 23 | Brazil | 4.11 | -0.20 |

| BANCO DO BRASIL SA RegS 49 | Brazil | 8.32 | -0.18 |

| PETROBRAS GLOBAL FINANCE BV 22 | Brazil | 3.92 | -0.18 |

| DIGICEL LTD RegS 23 | Jamaica | 6.97 | -0.17 |

| DELHI INTERNATIONAL AIRPORT PVT LT RegS 26 | India | 4.90 | -0.15 |

| PETROBRAS GLOBAL FINANCE BV 21 | Brazil | 3.67 | -0.14 |

| YPF SA RegS 21 | Argentina | 4.37 | -0.13 |

Country Average Sovereign Yield Change USD Eurobonds Weekly

| Country | Average Yield | Yield Average change % pts |

| Venezuela | 33.03 | 0.76 |

| Angola | 8.17 | 0.10 |

| Gabon | 6.78 | 0.08 |

| Lebanon | 6.58 | 0.07 |

| Argentina | 5.81 | 0.04 |

| China | 2.92 | 0.04 |

| Serbia | 3.07 | 0.03 |

| Pakistan | 5.11 | 0.03 |

| Bolivia | 4.87 | 0.02 |

| United States | 1.05 | 0.02 |

| Azerbaijan | 4.65 | 0.01 |

| Lithuania | 2.25 | 0.01 |

| Poland | 2.56 | 0.00 |

| Malaysia | 3.28 | 0.00 |

| Panama | 3.24 | 0.00 |

| Trinidad and Tobago | 4.38 | 0.00 |

| Indonesia | 3.71 | 0.00 |

| Russian Federation | 3.91 | 0.00 |

| South Africa | 4.83 | 0.00 |

| Oman | 4.68 | 0.00 |

| Hungary | 2.91 | -0.01 |

| Philippines | 3.23 | -0.01 |

| Croatia (Hrvatska) | 3.08 | -0.01 |

| Morocco | 3.16 | -0.01 |

| India | 3.47 | -0.01 |

| Slovak Republic | 2.38 | -0.01 |

| Colombia | 3.87 | -0.01 |

| Costa Rica | 5.87 | -0.01 |

| Chile | 3.55 | -0.01 |

| Turkey | 4.83 | -0.02 |

| Cote D'Ivoire (Ivory Coast) | 5.98 | -0.02 |

| Ethiopia | 6.08 | -0.02 |

| Peru | 3.94 | -0.02 |

| Romania | 3.28 | -0.03 |

| Kazakhstan | 4.27 | -0.03 |

| Nigeria | 6.78 | -0.03 |

| Vietnam | 3.64 | -0.03 |

| Jamaica | 5.53 | -0.03 |

| Senegal | 5.85 | -0.03 |

| Uruguay | 3.73 | -0.04 |

| Paraguay | 5.12 | -0.04 |

| Zambia | 7.37 | -0.05 |

| Brazil | 4.48 | -0.05 |

| Dominican Republic | 4.73 | -0.05 |

| Mexico | 4.26 | -0.06 |

| Ecuador | 7.74 | -0.06 |

| Tunisia | 6.09 | -0.07 |

| Ukraine | 6.56 | -0.08 |

| Jordan | 6.25 | -0.09 |

| Kenya | 6.32 | -0.09 |

| Ghana | 6.48 | -0.09 |

| Egypt | 5.62 | -0.10 |

| Sri Lanka | 4.51 | -0.13 |

| El Salvador | 7.13 | -0.19 |

| Mongolia | 5.47 | -0.28 |

| Iraq | 6.98 | -0.31 |

Country Average Corporate Yield Change USD Eurobonds Weekly

| Country | Average Yield | Yield Average change % pts |

| Nigeria | 5.86 | 0.17 |

| Hong Kong | 6.95 | 0.10 |

| Ghana | 6.41 | 0.10 |

| Taiwan | 3.34 | 0.10 |

| South Africa | 4.93 | 0.07 |

| Korea (South) | 3.23 | 0.07 |

| Mexico | 4.20 | 0.07 |

| Singapore | 4.25 | 0.06 |

| Saudi Arabia | 4.62 | 0.05 |

| Thailand | 3.35 | 0.04 |

| China | 4.01 | 0.03 |

| Israel | 4.44 | 0.03 |

| United Arab Emirates | 3.71 | 0.03 |

| Chile | 4.09 | 0.03 |

| India | 3.69 | 0.02 |

| Malaysia | 3.51 | 0.02 |

| Peru | 3.53 | 0.02 |

| Kuwait | 3.57 | 0.01 |

| Colombia | 4.71 | 0.01 |

| Kazakhstan | 5.63 | 0.01 |

| United States | 1.04 | 0.01 |

| Turkey | 5.20 | 0.01 |

| Qatar | 3.69 | 0.01 |

| Guatemala | 5.65 | 0.00 |

| Russian Federation | 4.29 | 0.00 |

| Morocco | 4.90 | -0.01 |

| Indonesia | 4.63 | -0.01 |

| Macau | 5.02 | -0.02 |

| Philippines | 3.53 | -0.03 |

| Panama | 4.20 | -0.04 |

| Supranational | 3.22 | -0.04 |

| Argentina | 5.79 | -0.05 |

| Brazil | 5.58 | -0.08 |

| Zambia | 5.89 | -0.29 |

| Ukraine | 7.44 | -0.34 |

| Jamaica | 7.64 | -0.37 |

Top 30 GEM Souvereign Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| PETROLEOS DE VENEZUELA SA RegS | USP7807HAM71 | Venezuela | Feb 17, 2022 | 12.75 | 50.28 |

| PETROLEOS DE VENEZUELA SA MTN RegS | USP7807HAP03 | Venezuela | Nov 17, 2021 | 9.00 | 46.81 |

| VENEZUELA BOLIVARIAN REPUBLIC OF RegS | USP17625AC16 | Venezuela | Aug 23, 2022 | 12.75 | 45.89 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS | USP97475AG56 | Venezuela | Dec 09, 2020 | 6.00 | 43.84 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS | USP17625AA59 | Venezuela | May 07, 2023 | 9.00 | 38.45 |

| PETROLEOS DE VENEZUELA SA RegS | USP7807HAT25 | Venezuela | May 16, 2024 | 6.00 | 36.79 |

| VENEZUELA BOLIVARIAN REPUBLIC OF RegS | USP17625AE71 | Venezuela | Oct 21, 2026 | 11.75 | 34.34 |

| VENEZUELA (BOLIVARIAN REPUBLIC OF) RegS | USP97475AP55 | Venezuela | Oct 13, 2024 | 8.25 | 33.11 |

| VENEZUELA BOLIVARIAN REPUBLIC OF RegS | USP17625AD98 | Venezuela | Aug 05, 2031 | 11.95 | 32.14 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS | USP17625AB33 | Venezuela | May 07, 2028 | 9.25 | 31.55 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS | XS0217249126 | Venezuela | Apr 21, 2025 | 7.65 | 31.07 |

| PETROLEOS DE VENEZUELA SA RegS | USP7807HAR68 | Venezuela | Nov 15, 2026 | 6.00 | 29.64 |

| PETROLEOS DE VENEZUELA SA RegS | USP7807HAQ85 | Venezuela | May 17, 2035 | 9.75 | 28.87 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) | US922646BL74 | Venezuela | Jan 13, 2034 | 9.38 | 28.86 |

| VENEZUELA (BOLIVARIAN REPUBLIC OF) | US922646AS37 | Venezuela | Sep 15, 2027 | 9.25 | 28.66 |

| PETROLEOS DE VENEZUELA SA RegS | XS0294364954 | Venezuela | Apr 12, 2027 | 5.38 | 25.11 |

| VENEZUELA (BOLVARIAN REPUBLIC OF) RegS | USP97475AJ95 | Venezuela | Mar 31, 2038 | 7.00 | 22.65 |

| PETROLEOS DE VENEZUELA SA RegS | USP7807HAV70 | Venezuela | Oct 27, 2020 | 8.50 | 19.80 |

| PETROLEOS DE VENEZUELA SA RegS | XS0294367205 | Venezuela | Apr 12, 2037 | 5.50 | 19.73 |

| ECUADOR REPUBLIC OF (GOVERNMENT) 144A | XS1707041429 | Ecuador | Oct 23, 2027 | 8.88 | 8.62 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1626530320 | Ecuador | Jun 02, 2027 | 9.63 | 8.58 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1535071986 | Ecuador | Dec 13, 2026 | 9.65 | 8.43 |

| ANGOLA (REPUBLIC OF) RegS | XS1318576086 | Angola | Nov 12, 2025 | 9.50 | 8.17 |

| ECUADOR (REPUBLIC OF) RegS | XS1080330704 | Ecuador | Jun 20, 2024 | 7.95 | 7.85 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1626768730 | Ecuador | Jun 02, 2023 | 8.75 | 7.74 |

| ZAMBIA (REPUBLIC OF) RegS | XS1267081575 | Zambia | Jul 30, 2027 | 8.97 | 7.58 |

| UKRAINE REPUBLIC OF (GOVERNMENT) 144A | US903724BM37 | Ukraine | Sep 25, 2032 | 7.38 | 7.51 |

| EGYPT (ARAB REPUBLIC OF) MTN RegS | XS1558078496 | Egypt | Jan 31, 2047 | 8.50 | 7.41 |

| LEBANON (REPUBLIC OF) MTN RegS | XS1586230481 | Lebanon | Mar 23, 2032 | 7.00 | 7.35 |

| ECUADOR REPUBLIC OF (GOVERNMENT) RegS | XS1458514673 | Ecuador | Mar 28, 2022 | 10.75 | 7.32 |

Top 30 GEM Corporate Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| NOBLE GROUP LTD RegS | USG6542TAE13 | Hong Kong | Jan 29, 2020 | 6.75 | 60.90 |

| ODEBRECHT FINANCE LTD RegS | USG6710EAP54 | Brazil | Apr 25, 2025 | 4.38 | 21.12 |

| CSN RESOURCES SA RegS | USL21779AA88 | Brazil | Jul 21, 2020 | 6.50 | 10.73 |

| DTEK FINANCE PLC RegS | XS1543030222 | Ukraine | Dec 31, 2024 | 10.75 | 10.21 |

| DIGICEL GROUP LTD RegS | USG27631AF05 | Jamaica | Apr 01, 2022 | 7.13 | 8.93 |

| CBOM FINANCE PLC - TIER 2 RegS | XS1589106910 | Russian Federation | Oct 05, 2027 | 7.50 | 8.59 |

| STONEWAY CAPITAL CORP RegS | USC86155AA35 | Argentina | Mar 01, 2027 | 10.00 | 8.42 |

| KAISA GROUP HOLDINGS LTD RegS | XS1627597955 | China | Jun 30, 2022 | 8.50 | 8.40 |

| COLOMBIA TELECOMUNICACIONES SA ESP RegS | USP28768AB86 | Colombia | Dec 31, 2049 | 8.50 | 8.37 |

| DIGICEL GROUP LTD RegS | USG27631AD56 | Jamaica | Sep 30, 2020 | 8.25 | 8.32 |

| BANCO DO BRASIL SA RegS | USP3772WAC66 | Brazil | Dec 31, 2049 | 9.25 | 8.32 |

| CHINA EVERGRANDE GROUP RegS | XS1627599654 | China | Jun 28, 2025 | 8.75 | 8.10 |

| YAPI VE KREDI BANKASI AS MTN RegS | XS1376681067 | Turkey | Mar 09, 2026 | 8.50 | 7.79 |

| IHS NETHERLANDS HOLDCO BV RegS | XS1505674751 | Nigeria | Oct 27, 2021 | 9.50 | 7.62 |

| LIQUID TELECOMMUNICATIONS FINANCIN 144A | US536333AA58 | South Africa | Jul 13, 2022 | 8.50 | 7.60 |

| PETRA DIAMONDS US TREASURY PLC RegS | USG7028AAB91 | South Africa | May 01, 2022 | 7.25 | 7.51 |

| OLAM INTERNATIONAL LTD MTN RegS | XS1452359521 | Singapore | Dec 31, 2049 | 5.35 | 7.41 |

| JBS INVESTMENTS GMBH RegS | USA29866AA70 | Brazil | Oct 28, 2020 | 7.75 | 7.33 |

| CHINA EVERGRANDE GROUP RegS | XS1627599498 | China | Jun 28, 2023 | 7.50 | 7.28 |

| BANCO MERCANTIL DEL NORTE SA NC10 RegS | USP14008AE91 | Mexico | Dec 31, 2049 | 7.63 | 7.06 |

| MARFRIG HOLDINGS (EUROPE) BV RegS | USN54468AF52 | Brazil | Jun 08, 2023 | 8.00 | 7.06 |

| BANCO DO BRASIL (GRAND CAYMAN BRAN RegS | USG07402DP58 | Brazil | Dec 31, 2049 | 6.25 | 7.05 |

| TURKIYE IS BANKASI AS RegS | XS1623796072 | Turkey | Jun 29, 2028 | 7.00 | 7.01 |

| DIGICEL LTD RegS | USG27649AG04 | Jamaica | Mar 01, 2023 | 6.75 | 6.97 |

| NOSTRUM OIL AND GAS BV RegS | USN64884AB02 | Kazakhstan | Jul 25, 2022 | 8.00 | 6.96 |

| TURKIYE VAKIFLAR BANKASI TAO MTN RegS | XS1175854923 | Turkey | Feb 03, 2025 | 6.88 | 6.87 |

| PETROBRAS GLOBAL FINANCE BV | US71647NAK54 | Brazil | Mar 17, 2044 | 7.25 | 6.76 |

| JBS USA LUX SA/JBS USA FINANCE INC RegS | USU0901CAC48 | Brazil | Jun 01, 2021 | 7.25 | 6.73 |

| PETROBRAS GLOBAL FINANCE BV | US71645WAQ42 | Brazil | Jan 20, 2040 | 6.88 | 6.66 |

| PETROBRAS GLOBAL FINANCE BV | US71645WAS08 | Brazil | Jan 27, 2041 | 6.75 | 6.65 |

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| ARGENTINA REPUBLIC OF GOVERNMENT | ARARGE3202H4 | Argentina | Oct 03, 2021 | 18.20 | 16.34 |

| ARGENTINA REPUBLIC OF GOVERNMENT | ARARGE4502J2 | Argentina | Oct 17, 2023 | 16.00 | 15.21 |

| ARGENTINA REPUBLIC OF GOVERNMENT | ARARGE4502K0 | Argentina | Oct 17, 2026 | 15.50 | 14.28 |

| TURKEY (REPUBLIC OF) | TRT100719T18 | Turkey | Jul 10, 2019 | 8.50 | 11.92 |

| TURKEY (REPUBLIC OF) | TRT150120T16 | Turkey | Jan 15, 2020 | 10.50 | 11.90 |

| TURKEY (REPUBLIC OF) | TRT170221T12 | Turkey | Feb 17, 2021 | 10.70 | 11.64 |

| TURKEY (REPUBLIC OF) | TRT120122T17 | Turkey | Jan 12, 2022 | 9.50 | 11.49 |

| TURKEY (REPUBLIC OF) | TRT140922T17 | Turkey | Sep 14, 2022 | 8.50 | 11.33 |

| TURKEY (REPUBLIC OF) | TRT270923T11 | Turkey | Sep 27, 2023 | 8.80 | 11.29 |

| TURKEY (REPUBLIC OF) | TRT120325T12 | Turkey | Mar 12, 2025 | 8.00 | 11.18 |

| TURKEY (REPUBLIC OF) | TRT110226T13 | Turkey | Feb 11, 2026 | 10.60 | 11.17 |

| TURKEY (REPUBLIC OF) | TRT240724T15 | Turkey | Jul 24, 2024 | 9.00 | 11.14 |

| TURKEY (REPUBLIC OF) | TRT240227T17 | Turkey | Feb 24, 2027 | 11.00 | 11.14 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000106972 | South Africa | Jan 31, 2044 | 8.75 | 9.93 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000096173 | South Africa | Feb 28, 2048 | 8.75 | 9.87 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000107012 | South Africa | Jan 31, 2037 | 8.50 | 9.86 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000077488 | South Africa | Feb 28, 2041 | 6.50 | 9.84 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000125972 | South Africa | Feb 28, 2035 | 8.88 | 9.78 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000030404 | South Africa | Mar 31, 2036 | 6.25 | 9.73 |

| BRAZIL FEDERATIVE REPUBLIC OF (GO | BRSTNCNTF1P8 | Brazil | Jan 01, 2027 | 10.00 | 9.64 |

| BRAZIL FEDERATIVE REPUBLIC OF | BRSTNCNTF170 | Brazil | Jan 01, 2025 | 10.00 | 9.50 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000106998 | South Africa | Jan 31, 2030 | 8.00 | 9.39 |

| BRAZIL FEDERATIVE REPUBLIC OF (GO | BRSTNCNTF147 | Brazil | Jan 01, 2023 | 10.00 | 9.29 |

| BRAZIL FEDERATIVE REPUBLIC OF (GO | US105756BN96 | Brazil | Jan 10, 2028 | 10.25 | 8.92 |

| SOUTH AFRICA (REPUBLIC OF) | ZAG000016320 | South Africa | Dec 21, 2026 | 10.50 | 8.81 |

| BRAZIL FEDERATIVE REPUBLIC OF (GO | BRSTNCNTF0N5 | Brazil | Jan 01, 2021 | 10.00 | 8.73 |

| BRAZIL FEDERATIVE REPUBLIC OF (GO | US105756BL31 | Brazil | Jan 05, 2022 | 12.50 | 8.60 |

| BRAZIL FEDERATIVE REPUBLIC OF (GOV | BRSTNCLTN7F8 | Brazil | Jul 01, 2020 | 0.00 | 8.55 |

| BRAZIL FEDERATIVE REPUBLIC OF (GO | BRSTNCLTN7B7 | Brazil | Jan 01, 2020 | 0.00 | 8.18 |

| BRAZIL FEDERATIVE REPUBLIC OF (GO | US105756BT66 | Brazil | Jan 05, 2024 | 8.50 | 8.13 |

Big Country Table - Stance, Ratings and Datamine

| NCountry | NaCountry | Stance | Avg Sovereign Yield | Sov. Yield Avg Wk Change btps | Avg Corporate Yield | Corp. Yield Avg Wk Change btps | GDP Growth | Total GDP $ bn | GDP per capita PPP $ | Savings to GDP | Inflation | Population | Current Account to GDP | Budget Revenue to GDP | Gov Debt to GDP | Budget Balance to GDP | SandP Rating | Moodys | Fitch | Dgong |

| Angola | Angola | Overweight | 8.45 | -17.00 | 2.698 | 86.287 | 7460.737 | 2.739 | 14.000 | 26.644 | -8.814 | 22.991 | BB- | Ba3 | BB- | BB- | ||||

| Argentina | Argentina | Overweight | 6.59 | 5.00 | 6.78 | 23.00 | 2.776 | 447.827 | 22984.620 | 16.897 | 20.000 | 44.045 | -2.235 | 35.526 | -5.330 | SD | Caa1 | RD | D | |

| Azerbaijan | Azerbaijan | Overweight | 4.93 | -37.00 | 0.988 | 36.195 | 17761.014 | 26.684 | 1.000 | 9.568 | 0.177 | 34.731 | BBB- | Baa3 | BBB- | |||||

| Brazil | Brazil | Underweight | 4.88 | -22.00 | 5.81 | -119.00 | -0.009 | 1556.435 | 15138.980 | 17.644 | 6.041 | 207.661 | -1.518 | 32.623 | 47.579 | -6.971 | BB+ | Baa3 | BBB | A- |

| Chile | Chile | Overweight | 2.77 | -12.00 | 4.11 | 0.00 | 2.100 | 243.924 | 24382.243 | 19.490 | 3.000 | 18.387 | -2.697 | 24.541 | 1.696 | -1.767 | AA- | Aa3 | A+ | AA |

| China | China | Overweight | 2.93 | -6.00 | 3.63 | -9.00 | 6.200 | 12263.429 | 16171.986 | 42.907 | 2.000 | 1388.322 | 2.060 | 28.356 | -2.593 | AA- | Aa3 | A+ | AA+ | |

| Colombia | Colombia | Overweight | 4.00 | -1.00 | 4.69 | -6.00 | 2.969 | 278.594 | 14627.237 | 18.537 | 3.325 | 49.303 | -4.323 | 25.482 | 41.241 | -1.540 | BBB | Baa2 | BBB | BBB+ |

| Costa Rica | Costa Rica | Underweight | 6.05 | -3.00 | 4.250 | 60.803 | 16784.858 | 15.030 | 3.000 | 4.964 | -4.303 | 15.521 | BB | Baa3 | BB+ | |||||

| C?te dIvoire | Cote D'Ivoire (Ivory Coast) | Overweight | 6.10 | -29.00 | ||||||||||||||||

| Croatia | Croatia (Hrvatska) | Overweight | 3.10 | -25.00 | 2.100 | 51.945 | 23171.337 | 21.368 | 1.500 | 4.187 | 2.077 | 44.447 | -2.405 | BB+ | Baa3 | BBB | BBB- | |||

| Dominican Republic | Dominican Republic | Underweight | 4.98 | -26.00 | 4.500 | 75.372 | 16535.651 | 19.649 | 4.000 | 10.208 | -2.176 | 14.458 | 35.853 | -3.021 | B+ | B1 | B | |||

| Ecuador | Ecuador | Overweight | 8.81 | -38.00 | -4.288 | 91.156 | 10227.317 | 12.306 | 0.000 | 16.777 | -0.198 | 30.877 | 3.928 | B+ | Caa1 | B | B- | |||

| Egypt | Egypt | Underweight | 5.95 | -27.00 | 4.256 | n/a | 12551.879 | 11.510 | 10.401 | 92.007 | -5.308 | 22.532 | 81.331 | -9.842 | CCC+ | Caa1 | B- | B- | ||

| El Salvador | El Salvador | Underweight | 8.56 | 23.00 | 2.600 | 28.536 | 8866.446 | 10.284 | 2.000 | 6.429 | -4.123 | 18.477 | BB- | Ba2 | BB- | |||||

| Gabon | Gabon | Overweight | 6.92 | 3.00 | 4.501 | 15.605 | 20008.436 | 29.852 | 2.500 | 1.908 | -5.823 | 20.189 | BB- | BB- | ||||||

| Ghana | Ghana | Underweight | 7.37 | -27.00 | 8.09 | -35.00 | 7.695 | 40.926 | 4674.620 | 18.921 | 7.055 | 28.278 | -5.435 | 20.266 | 70.470 | B | B+ | B | ||

| Hungary | Hungary | Overweight | 3.10 | -12.00 | 2.450 | 120.116 | 28254.757 | 28.327 | 2.600 | 9.814 | 5.169 | 44.855 | 70.852 | BB | Ba1 | BB+ | BBB- | |||

| Indonesia | Indonesia | Overweight | 3.88 | -12.00 | 5.71 | -20.00 | 5.300 | 1024.001 | 12258.793 | 32.543 | 4.400 | 262.185 | -2.846 | 14.344 | -2.782 | BB+ | Baa3 | BBB- | BBB- | |

| Iraq | Iraq | Overweight | 7.44 | -65.00 | 3.277 | 164.418 | 16661.618 | 10.786 | 2.000 | 36.996 | -10.956 | 38.743 | ||||||||

| Kazakhstan | Kazakhstan | Overweight | 4.56 | -16.00 | 5.14 | -32.00 | 1.050 | 135.133 | 24402.736 | 24.991 | 9.000 | 18.216 | -1.485 | 18.509 | -20.325 | -3.407 | BBB+ | Baa2 | BBB | BBB- |

| Kenya | Kenya | Underweight | 6.49 | 0.00 | 6.130 | 69.074 | 3493.695 | 15.245 | 5.500 | 46.756 | -6.940 | 20.753 | 52.959 | B+ | B+ | B | ||||

| Latvia | Latvia | Underweight | 3.643 | 29.860 | 27333.258 | 20.122 | 2.064 | 1.966 | -2.236 | 35.887 | 31.915 | -1.448 | A- | Baa1 | A- | BB | ||||

| Lebanon | Lebanon | Underweight | 6.50 | 7.00 | 2.000 | 54.063 | 18872.476 | -1.230 | 2.000 | 4.642 | -21.171 | 19.834 | 140.163 | -12.203 | B | B1 | B | |||

| Lithuania | Lithuania | Underweight | 2.39 | 1.00 | 3.140 | 45.397 | 31386.107 | 16.504 | 2.262 | 2.846 | -2.948 | 33.980 | 38.816 | -0.735 | A- | Baa1 | A- | BBB- | ||

| Malaysia | Malaysia | Overweight | 3.27 | -1.00 | 3.71 | -4.00 | 4.800 | 344.848 | 28497.681 | 27.529 | 2.882 | 32.059 | 1.921 | 21.203 | -2.920 | A- | A3 | A- | A+ | |

| Mexico | Mexico | Underweight | 4.28 | -18.00 | 4.06 | -9.00 | 2.573 | 1166.601 | 18392.290 | 21.150 | 3.023 | 130.223 | -2.558 | 21.979 | 48.555 | -3.589 | AAA | A3 | BBB+ | BBB |

| Mongolia | Mongolia | Overweight | 6.00 | -51.00 | 2.537 | 12.112 | 12426.635 | 18.929 | 6.508 | 3.059 | -17.691 | 25.436 | BB- | B1 | B+ | BB- | ||||

| Morocco | Morocco | Underweight | 3.01 | -30.00 | 4.86 | 0.00 | 4.122 | 114.342 | 8730.520 | 35.614 | 2.000 | 34.150 | 0.131 | 26.639 | 63.466 | -3.855 | BBB- | Ba1 | BBB- | BBB |

| Pakistan | Pakistan | Underweight | 5.16 | 30.00 | 4.700 | n/a | 5385.477 | 14.086 | 5.000 | 193.623 | -1.613 | 16.279 | 57.512 | B- | Caa1 | CCC | ||||

| Panama | Panama | Underweight | 3.34 | -16.00 | 3.98 | 8.00 | 6.400 | 60.510 | 24176.747 | 39.016 | 2.000 | 4.168 | -4.984 | 20.210 | 35.079 | 0.462 | BBB | Baa2 | BBB | A- |

| Paraguay | Paraguay | Underweight | 5.23 | -10.00 | 3.228 | 27.906 | 9181.630 | 15.289 | 4.500 | 7.221 | -1.050 | 21.961 | 24.011 | -2.502 | BB- | B1 | B+ | |||

| Peru | Peru | Overweight | 3.71 | -6.00 | 3.47 | -3.00 | 4.120 | 189.710 | 13077.160 | 20.612 | 2.495 | 32.907 | -3.258 | 20.847 | 8.539 | -1.202 | BBB+ | A3 | BBB+ | BBB+ |

| Philippines | Philippines | Overweight | 3.25 | -3.00 | 3.74 | -5.00 | 6.199 | 345.308 | 8035.337 | 25.577 | 3.200 | 106.279 | 2.445 | 19.505 | -0.718 | BBB | Baa3 | BBB- | BBB | |

| Poland | Poland | Underweight | 2.69 | 2.00 | 3.592 | 495.389 | 29065.496 | 18.693 | 1.744 | 37.996 | -2.141 | 39.631 | 27.945 | -3.292 | A- | A2 | A- | A- | ||

| Romania | Romania | Underweight | 3.40 | -10.00 | 3.602 | 194.295 | 23071.450 | 22.217 | 3.400 | 19.824 | -2.467 | 29.613 | -2.692 | BBB- | Baa3 | BBB- | BB+ | |||

| Russia | Russian Federation | Overweight | 3.97 | -7.00 | 4.35 | -2.00 | 0.812 | 1267.551 | 25740.366 | 26.151 | 5.904 | 146.300 | 5.071 | 31.175 | -3.034 | BB+ | Ba1 | BBB- | A | |

| Serbia | Serbia | Underweight | 2.99 | -28.00 | 2.250 | 38.876 | 14561.335 | 14.920 | 3.330 | 7.132 | -4.337 | 39.290 | 74.780 | -2.115 | BB- | B1 | B+ | BB- | ||

| Slovak Republic | Slovak Republic | Overweight | 2.33 | -3.00 | 3.426 | 94.489 | 32514.733 | 22.081 | 1.827 | 5.418 | -1.015 | 38.408 | -2.033 | |||||||

| South Africa | South Africa | Underweight | 4.92 | -11.00 | 4.16 | -4.00 | 1.206 | 273.726 | 13297.595 | 13.629 | 5.800 | 56.718 | -4.863 | 30.245 | 47.116 | -2.910 | BBB- | Baa1 | BBB | A |

| Sri Lanka | Sri Lanka | Underweight | 5.12 | -30.00 | 5.000 | 91.906 | 11764.555 | 29.078 | 5.000 | 21.397 | -1.445 | 13.603 | B+ | B1 | BB- | B+ | ||||

| Turkey | Turkey | Underweight | 4.82 | -13.00 | 5.08 | -21.00 | 3.432 | 791.239 | 22002.647 | 14.953 | 6.539 | 79.366 | -4.068 | 35.845 | 20.588 | -1.438 | BB+ | Baa3 | BBB- | BB- |

| Ukraine | Ukraine | Underweight | 7.26 | -37.00 | 8.98 | 105.00 | 2.540 | 93.547 | 8526.919 | 14.482 | 8.483 | 42.412 | -2.260 | 37.697 | 90.372 | -2.241 | BBB- | Caa1 | CCC | B- |

| Uruguay | Uruguay | Underweight | 3.97 | -9.00 | 2.592 | 54.941 | 22748.213 | 15.025 | 8.070 | 3.439 | -3.677 | 28.668 | 27.743 | -3.498 | BBB- | Baa2 | BBB- | BB+ | ||

| Venezuela | Venezuela | Underweight | 31.26 | 415.00 | -4.500 | 149.508 | 14539.054 | 10.962 | 2200.023 | 31.907 | -2.475 | 11.991 | B | B2 | B+ | BB+ | ||||

| Vietnam | Vietnam | Underweight | 3.98 | 2.00 | 6.200 | 217.838 | 6818.893 | 27.625 | 2.600 | 93.607 | 0.193 | 22.003 | BB- | B1 | B+ | B+ | ||||

| Zambia | Zambia | Overweight | 7.54 | -30.00 | 6.23 | -73.00 | 4.779 | 19.255 | 4035.842 | 29.881 | 8.702 | 17.238 | -1.722 | 17.228 | 56.675 | B+ | B+ | |||

| Hong Kong | Hong Kong | Underweight | 8.11 | 67.00 | AAA | Aa1 | AA+ | AAA | ||||||||||||

| India | India | Underweight | 3.63 | -1.00 | 3.70 | -12.00 | 7.494 | 2487.937 | 7098.050 | 30.756 | 5.426 | 1326.944 | -2.082 | 20.844 | -6.639 | BBB- | Baa3 | BBB- | BBB+ | |

| Israel | Israel | Underweight | 3.94 | -3.00 | 3.018 | 316.770 | 35260.750 | 23.711 | 1.207 | 8.673 | 3.526 | 37.311 | 64.418 | -3.637 | A+ | A1 | A | A- | ||

| Jamaica | Jamaica | Underweight | 5.65 | -7.00 | 8.16 | -44.00 | 2.548 | 14.556 | 9297.115 | 13.714 | 6.500 | 2.844 | -2.608 | 27.591 | CCC+ | B3 | B- | |||

| Korea | Korea (South) | Overweight | 3.07 | -6.00 | 2.868 | 1379.315 | 39156.417 | 34.709 | 2.396 | 51.042 | 7.385 | 20.611 | 35.591 | 0.793 | ||||||

| Qatar | Qatar | Overweight | 3.66 | -23.00 | 3.433 | 181.255 | 129959.025 | 53.876 | 2.694 | -4.861 | 25.437 | -107.728 | AA | Aa2 | AA- | |||||

| Singapore | Singapore | Overweight | 3.58 | -4.00 | 2.159 | 304.097 | 89276.246 | 46.711 | 1.900 | 5.626 | 20.494 | 21.910 | 2.074 | AAA | Aaa | AAA | AAA | |||

| Thailand | Thailand | Underweight | 3.39 | -4.00 | 3.223 | 428.756 | 17454.056 | 32.270 | 1.795 | 69.095 | 5.743 | 22.138 | -0.250 | BBB+ | Baa1 | BBB+ | BBB | |||

| United Arab Emirates | United Arab Emirates | Overweight | 3.72 | -6.00 | 2.623 | 357.269 | 68717.029 | 26.850 | 2.701 | 10.139 | 0.104 | 26.577 | -251.159 | Aa2 | BBB+ |

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

| Bond | Country | Yield | Yield Change % pts |

| SPAIN (KINGDOM OF) 27 | Spain | 1.56 | 0.08 |

| SPAIN (KINGDOM OF) 32 | Spain | 2.09 | 0.08 |

| SPAIN (KINGDOM OF) 27 | Spain | 1.67 | 0.08 |

| SPAIN (KINGDOM OF) 33 | Spain | 2.30 | 0.08 |

| FRANCE (REPUBLIC OF) 66 | France | 1.99 | 0.08 |

| DENMARK (KINGDOM OF) 21 | Denmark | -0.29 | 0.07 |

| SPAIN (KINGDOM OF) 37 | Spain | 2.44 | 0.07 |

| SPAIN (KINGDOM OF) 29 | Spain | 1.77 | 0.07 |

| SPAIN (KINGDOM OF) 24 | Spain | 0.87 | 0.07 |

| SPAIN (KINGDOM OF) 24 | Spain | 0.99 | 0.07 |

| SPAIN (KINGDOM OF) 40 | Spain | 2.63 | 0.07 |

| SPAIN (KINGDOM OF) 41 | Spain | 2.66 | 0.07 |

| SPAIN (KINGDOM OF) 30 | Spain | 2.00 | 0.07 |

| SPAIN (KINGDOM OF) 25 | Spain | 1.25 | 0.07 |

| FRANCE (REPUBLIC OF) RegS 60 | France | 1.93 | 0.07 |

| SPAIN (KINGDOM OF) 26 | Spain | 1.43 | 0.07 |

| SPAIN (KINGDOM OF) 26 | Spain | 1.37 | 0.07 |

| SPAIN (KINGDOM OF) 28 | Spain | 1.76 | 0.07 |

| SPAIN (KINGDOM OF) 26 | Spain | 1.35 | 0.07 |

| SPAIN (KINGDOM OF) 46 | Spain | 2.90 | 0.07 |

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

| Bond | Country | Yield | Yield Change % pts |

| PORTUGAL (REPUBLIC OF) 19 | Portugal | -0.09 | -0.07 |

| CANADA (GOVERNMENT OF) 19 | Canada | 1.45 | -0.07 |

| CANADA (GOVERNMENT OF) 19 | Canada | 1.44 | -0.07 |

| CANADA (GOVERNMENT OF) 19 | Canada | 1.37 | -0.07 |

| CANADA (GOVERNMENT OF) 19 | Canada | 1.44 | -0.07 |

| CANADA (GOVERNMENT OF) 20 | Canada | 1.48 | -0.06 |

| CANADA (GOVERNMENT OF) 21 | Canada | 1.56 | -0.06 |

| CANADA (GOVERNMENT OF) 20 | Canada | 1.51 | -0.06 |

| ITALY (REPUBLIC OF) 21 | Italy | 0.27 | -0.06 |

| CANADA (GOVERNMENT OF) 20 | Canada | 1.52 | -0.06 |

| ITALY (REPUBLIC OF) RegS 20 | Italy | -0.01 | -0.06 |

| ITALY (REPUBLIC OF) 20 | Italy | 0.04 | -0.06 |

| ITALY (REPUBLIC OF) RegS 20 | Italy | -0.07 | -0.06 |

| CANADA (GOVERNMENT OF) 19 | Canada | 1.47 | -0.06 |

| ITALY (REPUBLIC OF) RegS 21 | Italy | 0.27 | -0.06 |

| BUONI POLIENNALI DEL TESORO RegS 21 | Italy | 0.48 | -0.06 |

| ITALY (REPUBLIC OF) 21 | Italy | 0.41 | -0.05 |

| PORTUGAL (REPUBLIC OF) 30 | Portugal | 2.79 | -0.05 |

| ITALY (REPUBLIC OF) RegS 22 | Italy | 0.56 | -0.05 |

| ITALY (REPUBLIC OF) RegS 22 | Italy | 0.74 | -0.05 |

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

| Bond | Country | Yield | Yield Change %pts |

| CONCORDIA INTERNATIONAL CORP 144A 22 | Canada | 95.88 | 14.93 |

| CONCORDIA HEALTHCARE CORP 144A 23 | Canada | 75.32 | 6.56 |

| NOBLE GROUP LTD 144A 20 | Hong Kong | 61.47 | 4.26 |

| NEW LOOK SECURED ISSUER PLC RegS 22 | United Kingdom | 19.37 | 1.22 |

| PUBLIC POWER CORP FINANCE PLC MTN RegS 19 | Greece | 10.64 | 1.08 |

| EP ENER/EVEREST 23 | United States | 18.72 | 0.99 |

| INTELSAT LUXEMBOURG SA 21 | Luxembourg | 19.02 | 0.92 |

| INTELSAT LUXEMBOURG SA 23 | Luxembourg | 16.88 | 0.55 |

| DENBURY RESOURCES INC 23 | United States | 17.66 | 0.55 |

| IHEARTCOMMUNICATIONS INC 19 | United States | 23.68 | 0.41 |

| SPRINGLEAF FINANCE CORP 20 | United States | 4.39 | 0.34 |

| SPRINGLEAF FINANCE CORP 21 | United States | 4.47 | 0.33 |

| FRONTIER COMMUNICATIONS CORP 19 | United States | 7.17 | 0.33 |

| EP ENERGY LLC/EVEREST ACQUISITION 144A 25 | United States | 14.03 | 0.30 |

| SPRINGLEAF FINANCE CORP 19 | United States | 3.71 | 0.25 |

| ENVISION HEALTHCARE CORP (DELAWARE 22 | United States | 5.12 | 0.24 |

| ALBERTSONS COMPANIES LLC 25 | United States | 7.89 | 0.24 |

| DISH DBS CORP 23 | United States | 5.17 | 0.23 |

| DISH DBS CORP 22 | United States | 5.09 | 0.22 |

| NEMEAN BONDCO PLC RegS 24 | United Kingdom | 8.39 | 0.22 |

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

| Bond | Country | Yield | Yield Change %pts |

| OBRASCON HUARTE LAIN SA RegS 22 | Spain | 4.97 | -4.22 |

| PACIFIC DRILLING SA 144A 20 | United States | 53.73 | -3.80 |

| CHS/COMMUNITY HEALTH SYSTEMS INC 20 | United States | 12.08 | -1.87 |

| BOMBARDIER INC 144A 21 | Canada | 5.23 | -1.45 |

| BOMBARDIER INC 144A 23 | Canada | 5.58 | -1.34 |

| BOMBARDIER INC 144A 22 | Canada | 5.41 | -1.33 |

| BOMBARDIER INC MTN RegS 21 | Canada | 3.22 | -1.30 |

| WINDSTREAM CORP 22 | United States | 14.50 | -1.06 |

| BOMBARDIER INC 144A 25 | Canada | 6.52 | -1.05 |

| COMMUNITY HEALTH SYSTEMS INC 19 | United States | 9.67 | -0.99 |

| BOMBARDIER INC 144A 22 | Canada | 5.89 | -0.98 |

| BOMBARDIER INC 144A 20 | Canada | 4.05 | -0.94 |

| CHS/COMMUNITY HEALTH SYSTEMS INC 22 | United States | 14.76 | -0.93 |

| ALGECO SCOTSMAN GLOBAL FINANCE PLC 144A 18 | United Kingdom | 11.62 | -0.89 |

| WINDSTREAM CORP 20 | United States | 12.81 | -0.88 |

| CMF SPA RegS 22 | Italy | 8.05 | -0.84 |

| NEIMAN MARCUS GROUP LTD LLC 144A 21 | United States | 25.49 | -0.83 |

| BOMBARDIER INC 144A 19 | Canada | 3.25 | -0.79 |

| NAVIOS MARITIME HOLDINGS INC 144A 22 | United States | 13.03 | -0.70 |

| TENET HEALTHCARE CORPORATION 23 | United States | 7.65 | -0.67 |

Top 30 DM Souvereign Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| PORTUGAL (REPUBLIC OF) | PTOTEBOE0020 | Portugal | Feb 15, 2045 | 4.10 | 3.59 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAS7 | Australia | Mar 21, 2047 | 3.00 | 3.56 |

| BUONI POLIENNALI DEL TESORO | IT0005217390 | Italy | Mar 01, 2067 | 2.80 | 3.41 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAP3 | Australia | Jun 21, 2039 | 3.25 | 3.38 |

| PORTUGAL (REPUBLIC OF) | PTOTE5OE0007 | Portugal | Apr 15, 2037 | 4.10 | 3.34 |

| ITALY (REPUBLIC OF) | IT0005273013 | Italy | Mar 01, 2048 | 3.45 | 3.28 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU3TB0000192 | Australia | Apr 21, 2037 | 3.75 | 3.27 |

| SPAIN (KINGDOM OF) | ES00000128E2 | Spain | Jul 30, 2066 | 3.45 | 3.22 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAM0 | Australia | Jun 21, 2035 | 2.75 | 3.21 |

| ITALY (REPUBLIC OF) | IT0005162828 | Italy | Mar 01, 2047 | 2.70 | 3.20 |

| ITALY (REPUBLIC OF) | IT0005083057 | Italy | Sep 01, 2046 | 3.25 | 3.17 |

| ITALY (REPUBLIC OF) | IT0004923998 | Italy | Sep 01, 2044 | 4.75 | 3.16 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAG2 | Australia | Apr 21, 2033 | 4.50 | 3.07 |

| ITALY (REPUBLIC OF) RegS | IT0004532559 | Italy | Sep 01, 2040 | 5.00 | 3.07 |

| ITALY (REPUBLIC OF) RegS | IT0004286966 | Italy | Aug 01, 2039 | 5.00 | 2.95 |

| SPAIN (KINGDOM OF) | ES00000128C6 | Spain | Oct 31, 2046 | 2.90 | 2.90 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU3TB0000150 | Australia | Apr 21, 2029 | 3.25 | 2.88 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAU3 | Australia | Nov 21, 2028 | 2.75 | 2.85 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAR9 | Australia | May 21, 2028 | 2.25 | 2.83 |

| SPAIN (KINGDOM OF) | ES00000124H4 | Spain | Oct 31, 2044 | 5.15 | 2.81 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAQ1 | Australia | Nov 21, 2027 | 2.75 | 2.79 |

| PORTUGAL (REPUBLIC OF) | PTOTEROE0014 | Portugal | Feb 15, 2030 | 3.88 | 2.79 |

| ITALY (REPUBLIC OF) RegS | IT0003934657 | Italy | Feb 01, 2037 | 4.00 | 2.79 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU3TB0000135 | Australia | Apr 21, 2027 | 4.75 | 2.74 |

| ITALY (REPUBLIC OF) | IT0005177909 | Italy | Sep 01, 2036 | 2.25 | 2.74 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU000XCLWAI8 | Australia | Apr 21, 2026 | 4.25 | 2.70 |

| ITALY (REPUBLIC OF) RegS | IT0003535157 | Italy | Aug 01, 2034 | 5.00 | 2.66 |

| SPAIN (KINGDOM OF) | ES00000121S7 | Spain | Jul 30, 2041 | 4.70 | 2.66 |

| AUSTRALIA (COMMONWEALTH OF) RegS | AU3TB0000168 | Australia | Apr 21, 2025 | 3.25 | 2.63 |

| SPAIN (KINGDOM OF) | ES00000120N0 | Spain | Jul 30, 2040 | 4.90 | 2.63 |

Top 30 DM Corporate Eurobonds by Yield

| Name | ISIN | country | Maturity | Coupon | YTW |

| CONCORDIA INTERNATIONAL CORP 144A | US206519AB61 | Canada | Oct 21, 2022 | 9.50 | 95.88 |

| CONCORDIA HEALTHCARE CORP 144A | US206519AA88 | Canada | Apr 15, 2023 | 7.00 | 75.32 |

| NOBLE GROUP LTD 144A | US65504RAD61 | Hong Kong | Jan 29, 2020 | 6.75 | 61.47 |

| PACIFIC DRILLING SA 144A | US69419BAA35 | United States | Jun 01, 2020 | 5.38 | 53.73 |

| CLAIRES STORES INC 144A | US179584AM91 | United States | Mar 15, 2019 | 9.00 | 52.10 |

| MURRAY ENERGY CORP 144A | US62704PAF09 | United States | Apr 15, 2021 | 11.25 | 31.03 |

| NEIMAN MARCUS GROUP LTD LLC 144A | US570254AA03 | United States | Oct 15, 2021 | 8.00 | 25.49 |

| HEXION US FINANCE CORP/HEXION NOVA | US428303AM35 | United States | Nov 15, 2020 | 9.00 | 25.41 |

| IHEARTCOMMUNICATIONS INC 144A | US45174HAF47 | United States | Mar 01, 2021 | 11.25 | 23.91 |

| IHEARTCOMMUNICATIONS INC | US184502BL58 | United States | Dec 15, 2019 | 9.00 | 23.68 |

| IHEARTCOMMUNICATIONS INC | US184502BN15 | United States | Mar 01, 2021 | 11.25 | 22.68 |

| IHEARTCOMMUNICATIONS INC | US184502BG63 | United States | Mar 01, 2021 | 9.00 | 19.83 |

| CALIFORNIA RESOURCES CORP 144A | US13057QAG29 | United States | Dec 15, 2022 | 8.00 | 19.57 |

| DENBURY RESOURCES INC | US247916AD13 | United States | May 01, 2022 | 5.50 | 19.43 |

| NEW LOOK SECURED ISSUER PLC RegS | XS1248516616 | United Kingdom | Jul 01, 2022 | 6.50 | 19.37 |

| INTELSAT LUXEMBOURG SA | US458204AP96 | Luxembourg | Jun 01, 2021 | 7.75 | 19.02 |

| EP ENERGY LLC/EVEREST ACQUISITION | US29977HAB69 | United States | May 01, 2020 | 9.38 | 18.84 |

| EP ENER/EVEREST | US268787AD07 | United States | Jun 15, 2023 | 6.38 | 18.72 |

| IHEARTCOMMUNICATIONS INC | US45174HAC16 | United States | Mar 15, 2023 | 10.63 | 18.48 |

| DENBURY RESOURCES INC | US24823UAH14 | United States | Jul 15, 2023 | 4.63 | 17.66 |

| JUPITER RESOURCES INC 144A | US48207LAA17 | Canada | Oct 01, 2022 | 8.50 | 17.49 |

| IHEARTCOMMUNICATIONS INC | US45174HAA59 | United States | Sep 15, 2022 | 9.00 | 17.12 |

| INTELSAT LUXEMBOURG SA | US458204AQ79 | Luxembourg | Jun 01, 2023 | 8.13 | 16.88 |

| WINDSTREAM CORP | US97381WAT18 | United States | Oct 01, 2021 | 7.75 | 15.90 |

| CHS/COMMUNITY HEALTH SYSTEMS INC | US12543DAV29 | United States | Feb 01, 2022 | 6.88 | 14.76 |

| WINDSTREAM CORP | US97381WAX20 | United States | Jun 01, 2022 | 7.50 | 14.50 |

| FRONTIER COMMUNICATIONS CORP | US35906AAZ12 | United States | Sep 15, 2025 | 11.00 | 14.42 |

| FRONTIER COMMUNICATIONS CORP | US35906AAK43 | United States | Apr 15, 2022 | 8.75 | 14.24 |

| FRONTIER COMMUNICATIONS CORP | US35906AAW80 | United States | Sep 15, 2022 | 10.50 | 14.19 |

| EP ENERGY LLC/EVEREST ACQUISITION 144A | US268787AF54 | United States | Feb 15, 2025 | 8.00 | 14.03 |

ML Comics: Markets have been rising on fears of attack on North Korea, then they were rising as the threat of North Korea risk off was less. After some huff and puff - Rob decided to try and raise some money for his future automotive engineering business.

He put together a presentation

Source: ML Comics

Latest ML Comics

Recent ML Rural Highlights. Small Towns and Villages

Vaskoh-Romania | Artvin-Turkey | Gorishkino-Russia |