Top 20 Long Index Ideas YTD From Best to Worst

| objective | YTD |

| POLAND | 49.85 |

| TURKEY | 42.62 |

| ARGENTINA | 37.02 |

| DENMARK | 34.46 |

| CHINA | 31.10 |

| GREATER CHINA | 30.49 |

| EQUITY HEDGE DIVERSIFIED | 30.47 |

| CHILE | 30.42 |

| NETHERLANDS | 29.41 |

| FRANCE | 29.27 |

| INDIA | 28.42 |

| ITALY | 27.21 |

| GOVERNMENT ULTRA SHORT | 26.77 |

| TECHNOLOGY | 26.12 |

| BRIC | 26.04 |

| EMERGING MARKETS | 25.99 |

| KOREA | 25.24 |

| LATIN AMERICAN REGION | 25.18 |

| BELGIUM | 24.73 |

| TAIWAN | 24.68 |

Top 20 Short Index Ideas YTD From Best to Worst

| objective | YTD |

| ENERGY | -3.69 |

| AGRICULTURE | -3.37 |

| MANAGED FUTURES DISCRETIONARY | -2.95 |

| RUSSIA | 0.90 |

| ENERGY SECTOR | 2.27 |

| MORTGAGE-BACKED ARBITRAGE | 2.34 |

| SPECIALTY | 4.05 |

| AGGREGATE BOND EURO FOCUSED | 4.07 |

| VALUE MID CAP | 4.44 |

| DERIVATIVE | 4.51 |

| BROAD BASED | 4.54 |

| GCC | 4.65 |

| EURO FOCUSED (NON-US) | 4.89 |

| MUNI NATIONAL INTERMEDIATE | 5.04 |

| MUNI SINGLE STATE LONG | 5.20 |

| MUNI NATIONAL SHORT | 5.24 |

| MUNI CA INTERMEDIATE AND SHORT | 5.42 |

| VALUE SMALL CAP | 5.45 |

| AGGREGATE BOND YEN FOCUSED | 5.52 |

| MUNICIPALS | 5.84 |

Combined Performance of Tracked Indexes by Index Provider Top 20 Winners

| sourcename | ytd |

| Bolsa De Valores De Caracas (C | 1103.81 |

| Federal Reserve Bank of New Yo | 110.91 |

| US Treasury | 87.1 |

| SAUDI INVESTMENT BANK | 54.295 |

| NASDAQ OMX Riga | 53.21 |

| JASDAQ | 51.04 |

| AlphaShares | 50.379999999999995 |

| Ukrainian Stock Exchange | 46.75 |

| Istanbul Stock Exchange | 42.236666666666665 |

| Wiener Boerse | 42.08 |

| UK Office for National Statist | 41.555 |

| Palestine Exchange | 38.48 |

| Athens Stock Exchange | 38.47 |

| CEE Stock Exchange Group | 38.45 |

| Warsaw Stock Exchange | 38.43333333333333 |

| Central Bank of the UAE | 36.19 |

| Budapest Stock Exchange | 34.87 |

| Mercado De Valores Mendoza (Bu | 34.406666666666666 |

| BOVESPA | 33.586666666666666 |

| Intesa Sanpaolo | 33.494285714285716 |

Combined Performance of Tracked Indexes by Index Provider Top 20 Losers

| sourcename | ytd |

| Saudi Arabian Monetary Agency | -81.91 |

| CETIP | -40.28 |

| European Money Markets Institu | -35.28 |

| BofA Merrill Lynch | -29.91 |

| Qatar Exchange | -20.38 |

| Teucrium | -13.57 |

| Muscat Securities Market | -12.92 |

| Karachi Stock Exchange | -11.74 |

| Alerian Capital Management LLC | -7.029999999999999 |

| Cushing | -6.6499999999999995 |

| Bursa Malaysia Berhad | -5.94 |

| Royal Bank of Scotland | -5.48 |

| Goldman Sachs Commodity Index | -4.84 |

| Organization for Economic Coop | -4.67 |

| Beirut Stock Exchange | -4.25 |

| The Royal Bank of Scotland | -3.6345454545454534 |

| Mt. Lucas | -3.37 |

| Morningstar Inc. | -2.615 |

| Fundacao Getulio Vargas | -2.56 |

| Brazilian Mercantile & Futures | -2.39 |

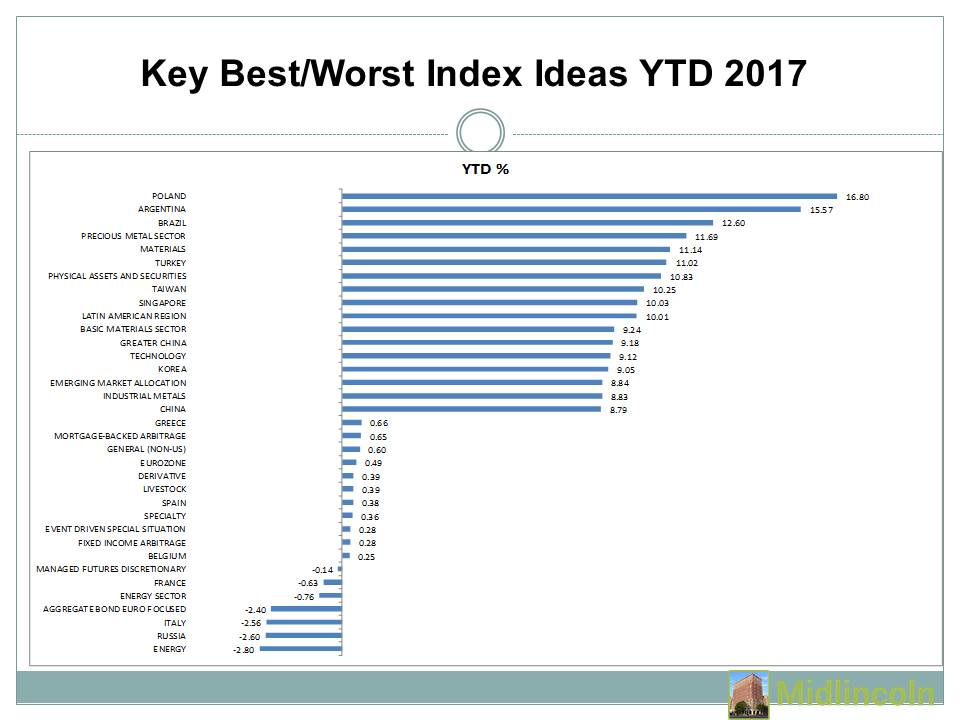

Chart: Half of a BRIC is Back YTD?India +28% , China +31% and Brazil +23% Russia -2.3%  Source: ML Download file in Power PointRecent Index Atlas Ideas ChartArtIndex Rebalancing NewsMSCI Standard & Poor's Index FTSE Bloomberg Indices Dow Jones STOXX Index Futures TradingTop 20 Index Longs Based on Momentum

Top 20 Index Shorts Based on Momentum

Best Indexes last Week

Worst Indexes last Week

Best Indexes last Month

Worst Indexes last Month

Best Indexes YTD

Worst Indexes YTD

Best Indexes 1yr

Worst Indexes 1yr

Latest ML ComicsRecent ML Rural Highlights. Small Towns and Villages

|