Download a Slide Explaining Fixed Income Weekly

FOMC meeting: no game changer for the USD Street Aims For Mixed Opening Ahead Of FOMC Meeting April ECB meeting and gold ECB meeting and Draghi undercut remaining interest in the final PMI ... BOJ March meeting minutes BOJ to offer upbeat economic view at policy meeting, talk down early ... Lakewood Schools BOE meeting upcoming Board member scorches Plainfield BOE for missing meeting No PBOC USD/CNY mid-rate today (China on holiday) China's yuan firms, market shrugs off weaker midpoint Banco do Brasil ratings affirmed, outlook still negative Banks announce reduction of interest rates after Selic cut Reserve Bank of India sets rupee reference rate at 64.2072 against ... RBI to keep rates unchanged, says poll Russia: Everything is aligned for more rate cuts to follow from CBR ... CBR: Aggressive cut, improving hopes for economy Turkey's monetary tightening supports lira amid EM weakness Forex News – Turkey's economic outlook depends on referendum ... South Africa Central Bank Governor Says Rate Cuts Are 'Off the Table' Scope for Rate Cuts in South Africa Limited, Central Bank Says South Korea April inflation slows, but still near central bank target South Korea central bank chief says April rate decision was ...

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondPETROLEOS DE VENEZUELA SA MTN RegS 21PETROLEOS MEXICANOS 22TRINIDAD AND TOBAGO (REPUBLIC OF) RegS 26GHANA (REPUBLIC OF) RegS 23

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondVENEZUELA BOLIVARIAN REPUBLIC OF RegS 26VENEZUELA (BOLIVARIAN REPUBLIC OF) 27VENEZUELA BOLIVARIAN REPUBLIC OF RegS 31VENEZUELA (BOLIVARIAN REPUBLIC OF) RegS 24

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCSN RESOURCES SA RegS 20PETROLEOS MEXICANOS 22BRASKEM FINANCE LTD RegS 22ODEBRECHT DRILL VIII/IX RegS 21

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondODEBRECHT FINANCE LTD RegS 25DIGICEL GROUP LTD RegS 20PETROLEOS DE VENEZUELA SA RegS 20PETROLEOS DE VENEZUELA SA RegS 35

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryTrinidad and TobagoGhanaChinaSri LankaColombia

Country Average Corporate Yield Change USD Eurobonds Weekly

CountryKorea (South)ThailandMalaysiaTaiwanChina

Top 30 GEM Souvereign Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSVENEZUELA (BOLVARIAN REPUBLIC OF) RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Corporate Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSPETROLEOS DE VENEZUELA SA RegSODEBRECHT DRILL VIII/IX RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameTURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondGERMANY (FEDERAL REPUBLIC OF) 46FINLAND (REPUBLIC OF) 42GERMANY (FEDERAL REPUBLIC OF) 39AUSTRIA (REPUBLIC OF) 62

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondPORTUGAL (REPUBLIC OF) 19FRANCE (REPUBLIC OF) RegS 22FRANCE (REPUBLIC OF) RegS 23FRANCE (REPUBLIC OF) 20

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsGENON ENERGY INC 18United States49.037.87GENON ENERGY INC 20United States27.432.41GRUPO ISOLUX CORSAN SA 21Spain401.862.40GRUPO ISOLUX CORSAN SA 21Spain150.261.89GENWORTH HOLDINGS INC MTN 18United States7.641.16

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsCONCORDIA HEALTHCARE CORP 144A 22Canada63.70-3.11ALGECO SCOTSMAN GLOBAL FINANCE PLC 144A 18United Kingdom12.55-1.53CONCORDIA HEALTHCARE CORP 144A 23Canada57.91-1.52CLAIRES STORES INC 144A 19United States61.40-1.44VALEANT PHARMACEUTICALS INTERNATIO 144A 20United States11.20-0.87

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.104.47PORTUGAL (REPUBLIC OF)PTOTE5OE0007PortugalApr 15, 20374.104.28PORTUGAL (REPUBLIC OF)PTOTEROE0014PortugalFeb 15, 20303.884.17

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWGRUPO ISOLUX CORSAN SAXS1542318388SpainDec 30, 20210.25401.86GRUPO ISOLUX CORSAN SAXS1527710963SpainDec 30, 20213.00150.26CONCORDIA HEALTHCARE CORP 144AUS206519AB61CanadaOct 21, 20229.5063.70

Country Average Sovereign+Corporate USD Yields Ordered by Weekly Change

| country | Yield | YieldChange |

| Hong Kong | 8.56 | 0.09 |

| Korea (South) | 3.08 | 0.07 |

| Thailand | 3.38 | 0.05 |

| Malaysia | 3.29 | 0.04 |

| Ghana | 8.15 | 0.04 |

| Taiwan | 3.66 | 0.04 |

| Croatia (Hrvatska) | 3.55 | 0.03 |

| Philippines | 3.26 | 0.03 |

| China | 3.86 | 0.03 |

| Mexico | 4.73 | 0.03 |

| Costa Rica | 6.08 | 0.03 |

| Pakistan | 5.55 | 0.03 |

| Chile | 3.67 | 0.02 |

| Sri Lanka | 5.12 | 0.02 |

| Indonesia | 4.22 | 0.02 |

| Uruguay | 4.29 | 0.01 |

| Bolivia | 4.85 | 0.01 |

| United Arab Emirates | 3.26 | 0.01 |

| Colombia | 4.46 | 0.00 |

| Oman | 4.61 | 0.00 |

| Lithuania | 2.49 | 0.00 |

| Jordan | 5.90 | 0.00 |

| Israel | 3.55 | 0.00 |

| Bahrain | 5.34 | 0.00 |

| Hungary | 3.31 | -0.01 |

| Romania | 3.60 | -0.01 |

| Dominican Republic | 5.20 | -0.02 |

| Slovak Republic | 2.47 | -0.03 |

| Russian Federation | 3.93 | -0.04 |

| Peru | 3.75 | -0.04 |

| Paraguay | 5.56 | -0.04 |

| Barbados | 5.30 | -0.04 |

| Poland | 2.76 | -0.05 |

| Panama | 3.51 | -0.05 |

| Egypt | 6.08 | -0.05 |

| Lebanon | 5.73 | -0.05 |

| Vietnam | 4.15 | -0.05 |

| Guatemala | 4.10 | -0.05 |

| Australia | 6.05 | -0.05 |

| India | 4.36 | -0.06 |

| Serbia | 3.31 | -0.07 |

| Brazil | 5.70 | -0.07 |

| South Africa | 5.07 | -0.07 |

| Kazakhstan | 4.87 | -0.08 |

| United States | 5.50 | -0.08 |

| Qatar | 3.06 | -0.08 |

| Kuwait | 3.96 | -0.08 |

| Finland | 2.51 | -0.08 |

| Morocco | 3.96 | -0.09 |

| New Zealand | 5.04 | -0.09 |

| Argentina | 5.87 | -0.10 |

| Azerbaijan | 5.16 | -0.12 |

| Tunisia | 6.06 | -0.12 |

| Trinidad and Tobago | 5.87 | -0.13 |

| Mongolia | 6.14 | -0.13 |

| United Kingdom | 5.25 | -0.13 |

| Italy | 4.52 | -0.13 |

| Canada | 8.41 | -0.13 |

| Germany | 3.64 | -0.13 |

| El Salvador | 8.26 | -0.15 |

| Turkey | 4.93 | -0.16 |

| Netherlands | 4.40 | -0.18 |

| Cote D'Ivoire (Ivory Coast) | 6.23 | -0.19 |

| Kenya | 6.67 | -0.20 |

| Luxembourg | 6.64 | -0.20 |

| Nigeria | 6.23 | -0.21 |

| Ethiopia | 6.88 | -0.24 |

| Ireland | 4.65 | -0.25 |

| Japan | 3.14 | -0.27 |

| Iraq | 7.91 | -0.28 |

| Senegal | 4.70 | -0.30 |

| France | 6.11 | -0.30 |

| Singapore | 18.08 | -0.30 |

| Angola | 8.70 | -0.31 |

| Gabon | 6.78 | -0.34 |

| Jamaica | 7.66 | -0.34 |

| Ukraine | 8.17 | -0.39 |

| Zambia | 7.78 | -0.46 |

| Venezuela | 23.90 | -0.58 |

| Ecuador | 8.63 | -0.64 |

Country Average Sovereign+Corporate USD Yields Ordered By YTD Yield Chance

| country | Yield | YieldChange |

| Canada | 8.81 | 0.79 |

| El Salvador | 8.26 | 0.35 |

| Venezuela | 24.00 | 0.07 |

| Australia | 6.05 | -0.01 |

| Ghana | 8.21 | -0.13 |

| Finland | 2.51 | -0.21 |

| Korea (South) | 3.09 | -0.22 |

| Ecuador | 8.39 | -0.23 |

| Philippines | 3.23 | -0.25 |

| United States | 5.50 | -0.25 |

| Slovak Republic | 2.47 | -0.26 |

| Germany | 3.70 | -0.32 |

| China | 3.82 | -0.33 |

| United Arab Emirates | 3.39 | -0.38 |

| United Kingdom | 5.34 | -0.38 |

| Malaysia | 3.24 | -0.39 |

| Qatar | 3.06 | -0.39 |

| Barbados | 5.30 | -0.39 |

| Thailand | 3.04 | -0.40 |

| Poland | 2.76 | -0.41 |

| Ukraine | 8.17 | -0.41 |

| France | 6.11 | -0.41 |

| Peru | 3.81 | -0.43 |

| Cote D'Ivoire (Ivory Coast) | 6.23 | -0.43 |

| South Africa | 5.08 | -0.43 |

| New Zealand | 5.04 | -0.44 |

| Azerbaijan | 5.20 | -0.45 |

| Jordan | 5.88 | -0.45 |

| Bahrain | 5.34 | -0.45 |

| Morocco | 3.96 | -0.48 |

| Israel | 3.55 | -0.48 |

| Taiwan | 3.66 | -0.48 |

| Pakistan | 5.27 | -0.49 |

| Oman | 4.42 | -0.51 |

| Colombia | 4.53 | -0.51 |

| Netherlands | 4.16 | -0.51 |

| Trinidad and Tobago | 5.87 | -0.52 |

| Lithuania | 2.49 | -0.53 |

| Paraguay | 5.56 | -0.54 |

| Hungary | 3.31 | -0.55 |

| Uruguay | 4.29 | -0.56 |

| Russian Federation | 3.88 | -0.57 |

| Italy | 4.35 | -0.57 |

| Panama | 3.51 | -0.58 |

| Romania | 3.60 | -0.59 |

| Croatia (Hrvatska) | 3.55 | -0.61 |

| Chile | 3.59 | -0.62 |

| Indonesia | 4.20 | -0.62 |

| Kuwait | 3.91 | -0.64 |

| Vietnam | 4.15 | -0.65 |

| Mexico | 4.72 | -0.66 |

| Ireland | 5.70 | -0.68 |

| Japan | 3.14 | -0.68 |

| India | 4.14 | -0.77 |

| Luxembourg | 6.91 | -0.78 |

| Nigeria | 4.81 | -0.79 |

| Guatemala | 4.10 | -0.80 |

| Tunisia | 6.06 | -0.83 |

| Kazakhstan | 4.70 | -0.89 |

| Jamaica | 7.66 | -0.94 |

| Gabon | 6.78 | -0.96 |

| Brazil | 5.70 | -0.98 |

| Costa Rica | 5.98 | -1.00 |

| Senegal | 4.70 | -1.01 |

| Serbia | 3.31 | -1.05 |

| Turkey | 4.89 | -1.10 |

| Sri Lanka | 5.17 | -1.10 |

| Lebanon | 5.76 | -1.11 |

| Dominican Republic | 5.18 | -1.13 |

| Ethiopia | 6.88 | -1.14 |

| Kenya | 6.67 | -1.17 |

| Egypt | 5.18 | -1.31 |

| Zambia | 7.78 | -1.32 |

| Iraq | 7.91 | -1.34 |

| Argentina | 5.84 | -1.41 |

| Angola | 8.70 | -1.42 |

| Mongolia | 6.14 | -2.18 |

| Hong Kong | 8.56 | -4.54 |

Country Average Sovereign+Corporate USD Yields Ordered by Current YTM

| country | Yield | YieldChange |

| Venezuela | 23.90 | -0.58 |

| Singapore | 18.08 | -0.30 |

| Angola | 8.70 | -0.31 |

| Ecuador | 8.63 | -0.64 |

| Hong Kong | 8.56 | 0.09 |

| Canada | 8.41 | -0.13 |

| El Salvador | 8.26 | -0.15 |

| Ukraine | 8.17 | -0.39 |

| Ghana | 8.15 | 0.04 |

| Iraq | 7.91 | -0.28 |

| Zambia | 7.78 | -0.46 |

| Jamaica | 7.66 | -0.34 |

| Ethiopia | 6.88 | -0.24 |

| Gabon | 6.78 | -0.34 |

| Kenya | 6.67 | -0.20 |

| Luxembourg | 6.64 | -0.20 |

| Cote D'Ivoire (Ivory Coast) | 6.23 | -0.19 |

| Nigeria | 6.23 | -0.21 |

| Mongolia | 6.14 | -0.13 |

| France | 6.11 | -0.30 |

| Egypt | 6.08 | -0.05 |

| Costa Rica | 6.08 | 0.03 |

| Tunisia | 6.06 | -0.12 |

| Australia | 6.05 | -0.05 |

| Jordan | 5.90 | 0.00 |

| Argentina | 5.87 | -0.10 |

| Trinidad and Tobago | 5.87 | -0.13 |

| Lebanon | 5.73 | -0.05 |

| Brazil | 5.70 | -0.07 |

| Paraguay | 5.56 | -0.04 |

| Pakistan | 5.55 | 0.03 |

| United States | 5.50 | -0.08 |

| Bahrain | 5.34 | 0.00 |

| Barbados | 5.30 | -0.04 |

| United Kingdom | 5.25 | -0.13 |

| Dominican Republic | 5.20 | -0.02 |

| Azerbaijan | 5.16 | -0.12 |

| Sri Lanka | 5.12 | 0.02 |

| South Africa | 5.07 | -0.07 |

| New Zealand | 5.04 | -0.09 |

| Turkey | 4.93 | -0.16 |

| Kazakhstan | 4.87 | -0.08 |

| Bolivia | 4.85 | 0.01 |

| Mexico | 4.73 | 0.03 |

| Senegal | 4.70 | -0.30 |

| Ireland | 4.65 | -0.25 |

| Oman | 4.61 | 0.00 |

| Italy | 4.52 | -0.13 |

| Colombia | 4.46 | 0.00 |

| Netherlands | 4.40 | -0.18 |

| India | 4.36 | -0.06 |

| Uruguay | 4.29 | 0.01 |

| Indonesia | 4.22 | 0.02 |

| Vietnam | 4.15 | -0.05 |

| Guatemala | 4.10 | -0.05 |

| Morocco | 3.96 | -0.09 |

| Kuwait | 3.96 | -0.08 |

| Russian Federation | 3.93 | -0.04 |

| China | 3.86 | 0.03 |

| Peru | 3.75 | -0.04 |

| Chile | 3.67 | 0.02 |

| Taiwan | 3.66 | 0.04 |

| Germany | 3.64 | -0.13 |

| Romania | 3.60 | -0.01 |

| Croatia (Hrvatska) | 3.55 | 0.03 |

| Israel | 3.55 | 0.00 |

| Panama | 3.51 | -0.05 |

| Thailand | 3.38 | 0.05 |

| Hungary | 3.31 | -0.01 |

| Serbia | 3.31 | -0.07 |

| Malaysia | 3.29 | 0.04 |

| Philippines | 3.26 | 0.03 |

| United Arab Emirates | 3.26 | 0.01 |

| Japan | 3.14 | -0.27 |

| Korea (South) | 3.08 | 0.07 |

| Qatar | 3.06 | -0.08 |

| Poland | 2.76 | -0.05 |

| Finland | 2.51 | -0.08 |

| Lithuania | 2.49 | 0.00 |

| Slovak Republic | 2.47 | -0.03 |

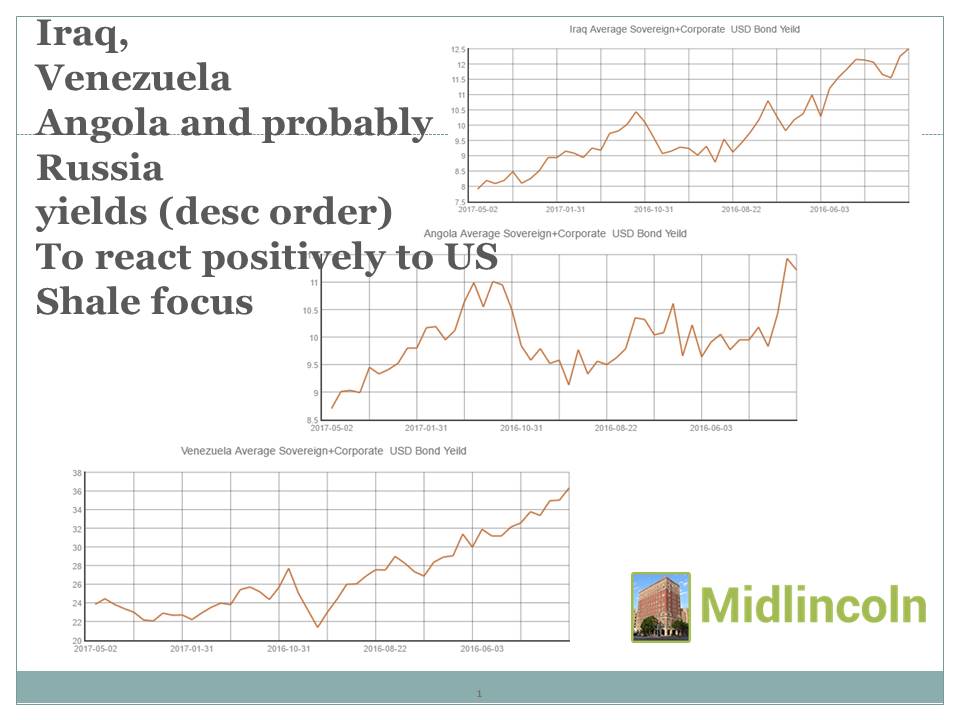

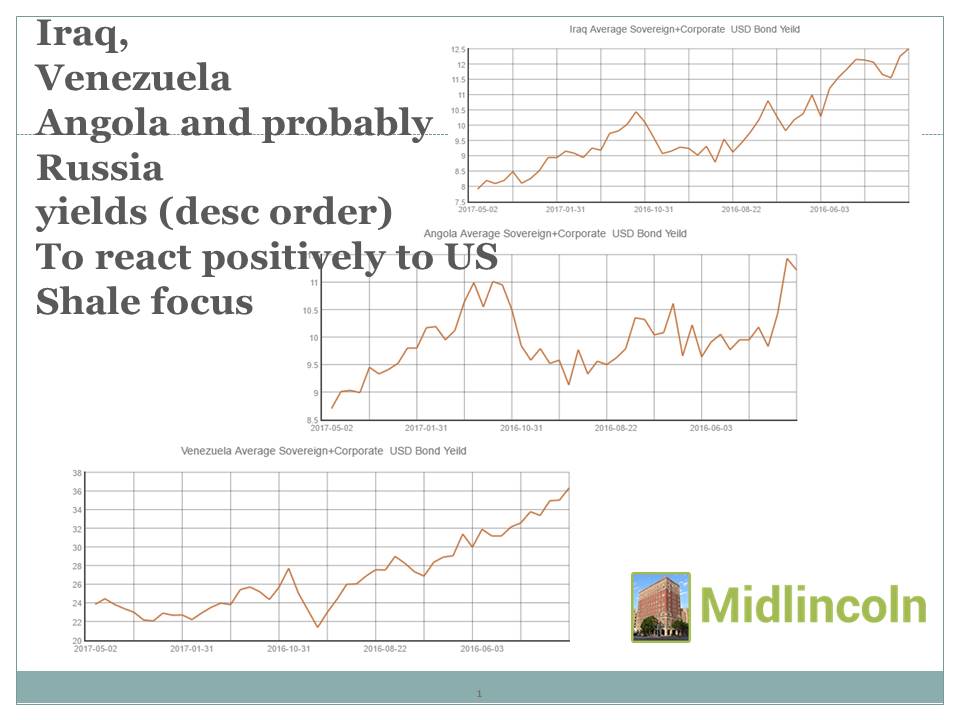

Chart: Iraq, Venezuela, Angola and probably Russia yields

(desc timeline on charts) To react positively to US Shale focus

Source: ML

Download file in Power PointKey News

Average Sovereign GEM Yields (USD)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average Sov. DEM Yields (blended currency)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Bonds Datamine Queries

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondPETROLEOS DE VENEZUELA SA MTN RegS 21PETROLEOS MEXICANOS 22TRINIDAD AND TOBAGO (REPUBLIC OF) RegS 26GHANA (REPUBLIC OF) RegS 23

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondVENEZUELA BOLIVARIAN REPUBLIC OF RegS 26VENEZUELA (BOLIVARIAN REPUBLIC OF) 27VENEZUELA BOLIVARIAN REPUBLIC OF RegS 31VENEZUELA (BOLIVARIAN REPUBLIC OF) RegS 24

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCSN RESOURCES SA RegS 20PETROLEOS MEXICANOS 22BRASKEM FINANCE LTD RegS 22ODEBRECHT DRILL VIII/IX RegS 21

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondODEBRECHT FINANCE LTD RegS 25DIGICEL GROUP LTD RegS 20PETROLEOS DE VENEZUELA SA RegS 20PETROLEOS DE VENEZUELA SA RegS 35

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryTrinidad and TobagoGhanaChinaSri LankaColombia

Country Average Corporate Yield Change USD Eurobonds Weekly

CountryKorea (South)ThailandMalaysiaTaiwanChina

Top 30 GEM Souvereign Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSVENEZUELA (BOLVARIAN REPUBLIC OF) RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Corporate Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSPETROLEOS DE VENEZUELA SA RegSODEBRECHT DRILL VIII/IX RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameTURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondGERMANY (FEDERAL REPUBLIC OF) 46FINLAND (REPUBLIC OF) 42GERMANY (FEDERAL REPUBLIC OF) 39AUSTRIA (REPUBLIC OF) 62

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondPORTUGAL (REPUBLIC OF) 19FRANCE (REPUBLIC OF) RegS 22FRANCE (REPUBLIC OF) RegS 23FRANCE (REPUBLIC OF) 20

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsGENON ENERGY INC 18United States49.037.87GENON ENERGY INC 20United States27.432.41GRUPO ISOLUX CORSAN SA 21Spain401.862.40GRUPO ISOLUX CORSAN SA 21Spain150.261.89GENWORTH HOLDINGS INC MTN 18United States7.641.16

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsCONCORDIA HEALTHCARE CORP 144A 22Canada63.70-3.11ALGECO SCOTSMAN GLOBAL FINANCE PLC 144A 18United Kingdom12.55-1.53CONCORDIA HEALTHCARE CORP 144A 23Canada57.91-1.52CLAIRES STORES INC 144A 19United States61.40-1.44VALEANT PHARMACEUTICALS INTERNATIO 144A 20United States11.20-0.87

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.104.47PORTUGAL (REPUBLIC OF)PTOTE5OE0007PortugalApr 15, 20374.104.28PORTUGAL (REPUBLIC OF)PTOTEROE0014PortugalFeb 15, 20303.884.17

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWGRUPO ISOLUX CORSAN SAXS1542318388SpainDec 30, 20210.25401.86GRUPO ISOLUX CORSAN SAXS1527710963SpainDec 30, 20213.00150.26CONCORDIA HEALTHCARE CORP 144AUS206519AB61CanadaOct 21, 20229.5063.70