| Focus | Objective | Asset Class | Flow USD mn |

| Commodities | INDUSTRIAL METALS | Commodity | 0.23 |

| Commodities | PRECIOUS METAL SECTOR | Equity | -1471.63 |

| Commodities | PRECIOUS METALS | Commodity | 891.58 |

| Commodities | PRECIOUS METALS | Mixed Allocation | -18.26 |

| country | AUSTRALIA | Equity | 11.72 |

| country | AUSTRALIA | Fixed Income | 46.98 |

| country | AUSTRALIA | Mixed Allocation | 0.00 |

| country | BRAZIL | Equity | 214.17 |

| country | BRAZIL | Fixed Income | -98.81 |

| country | CHINA | Equity | -251.39 |

| country | CHINA | Fixed Income | -32.14 |

| Country | EGYPT | Equity | -0.49 |

| country | INDIA | Equity | 668.01 |

| country | INDIA | Fixed Income | 52.80 |

| country | ISRAEL | Equity | -0.31 |

| country | JAPAN | Equity | 122.44 |

| country | JAPAN | Fixed Income | 16.90 |

| country | JAPAN | Mixed Allocation | 1.62 |

| country | KOREA | Equity | -8.50 |

| country | POLAND | Equity | 6.68 |

| country | RUSSIA | Equity | -160.11 |

| country | RUSSIA | Fixed Income | 15.19 |

| country | SOUTH AFRICA | Equity | 6.45 |

| country | SPAIN | Equity | 46.35 |

| Country | TAIWAN | Equity | 0.50 |

| country | TURKEY | Equity | -25.22 |

| country | UNITED KINGDOM | Equity | 42.90 |

| industry | BASIC MATERIALS SECTOR | Equity | -267.17 |

| industry | COMMUNICATIONS SECTOR | Equity | -33.09 |

| industry | ENERGY SECTOR | Equity | 651.22 |

| industry | ENERGY SECTOR | Mixed Allocation | -0.10 |

| industry | FINANCIAL SECTOR | Equity | 406.69 |

| industry | HEALTH CARE SECTOR | Equity | -65.94 |

| industry | INDUSTRIAL SECTOR | Equity | 27.47 |

| industry | MULTIPLE SECTOR | Equity | -0.56 |

| industry | NATURAL RESOURCES SECTOR | Equity | 5.04 |

| industry | REAL ESTATE SECTOR | Alternative | -1.48 |

| industry | REAL ESTATE SECTOR | Equity | -2625.52 |

| industry | TECHNOLOGY SECTOR | Equity | 1388.78 |

| industry | UTILITIES SECTOR | Equity | 386.75 |

| region | AFRICAN REGION | Equity | 1.71 |

| region | AFRICAN REGION | Fixed Income | 0.00 |

| region | ASIAN PACIFIC REGION | Equity | 572.14 |

| region | ASIAN PACIFIC REGION | Fixed Income | 113.59 |

| region | ASIAN PACIFIC REGION | Mixed Allocation | 95.70 |

| region | ASIAN PACIFIC REGION EX JAPAN | Equity | -1179.35 |

| region | ASIAN PACIFIC REGION EX JAPAN | Fixed Income | -265.40 |

| region | ASIAN PACIFIC REGION EX JAPAN | Mixed Allocation | -59.74 |

| region | EASTERN EUROPEAN REGION | Equity | -149.73 |

| region | EASTERN EUROPEAN REGION | Fixed Income | -2.75 |

| region | EASTERN EUROPEAN REGION | Mixed Allocation | -0.43 |

| region | EUROPEAN REGION | Equity | 374.98 |

| region | EUROPEAN REGION | Fixed Income | -748.71 |

| region | EUROPEAN REGION | Mixed Allocation | 44.45 |

| region | LATIN AMERICAN REGION | Equity | 136.62 |

| region | LATIN AMERICAN REGION | Fixed Income | 7.80 |

| region | MIDDLE EAST REGION | Equity | -20.17 |

| region | MIDDLE EAST REGION | Fixed Income | -4.17 |

| region | NORDIC REGION | Equity | -105.30 |

| region | NORTH AMERICAN REGION | Equity | -102.56 |

| region | NORTH AMERICAN REGION | Fixed Income | -13.03 |

| Risk | GOVERNMENT BOND | Alternative | 0.72 |

| Risk | GOVERNMENT BOND | Equity | -0.11 |

| Risk | GOVERNMENT BOND | Fixed Income | -951.88 |

| Risk | GOVERNMENT BOND | Mixed Allocation | -2.02 |

| Risk | INFLATION PROTECTED | Brazil | -6.54 |

| Risk | INFLATION PROTECTED | Fixed Income | 265.95 |

| Risk | INFLATION PROTECTED | Mixed Allocation | -24.10 |

| Risk | LONG SHORT | Alternative | 107.65 |

| Risk | LONG SHORT | Equity | 14.98 |

| Risk | LONG SHORT | Fixed Income | -4.07 |

| Risk | LONG SHORT | Mixed Allocation | 0.12 |

| Sector | AGRICULTURE | Commodity | -3.55 |

| Sector | AGRICULTURE | Equity | 0.00 |

| Sector | CONSUMER DISCRETIONARY | Equity | 87.32 |

| Sector | CONSUMER STAPLES | Equity | 180.29 |

| segment | BRIC | Equity | 23.65 |

| segment | BRIC | Fixed Income | -40.28 |

| segment | DEVELOPED MARKETS | Equity | -97.24 |

| segment | EMEA | Equity | 4.32 |

| segment | EMEA | Fixed Income | 5.93 |

| segment | EMERGING MARKETS | Equity | 3246.52 |

| segment | GCC | Equity | 4.04 |

| segment | GCC | Fixed Income | 3.79 |

| segment | GCC | Mixed Allocation | -3.50 |

| segment | MENA | Equity | -5.01 |

| segment | MENA | Fixed Income | -0.60 |

| Size | LARGE-CAP | Equity | 2172.84 |

| Size | MID-CAP | Commodity | -0.47 |

| Size | MID-CAP | Equity | 46.44 |

| Size | SMALL-CAP | Equity | 349.10 |

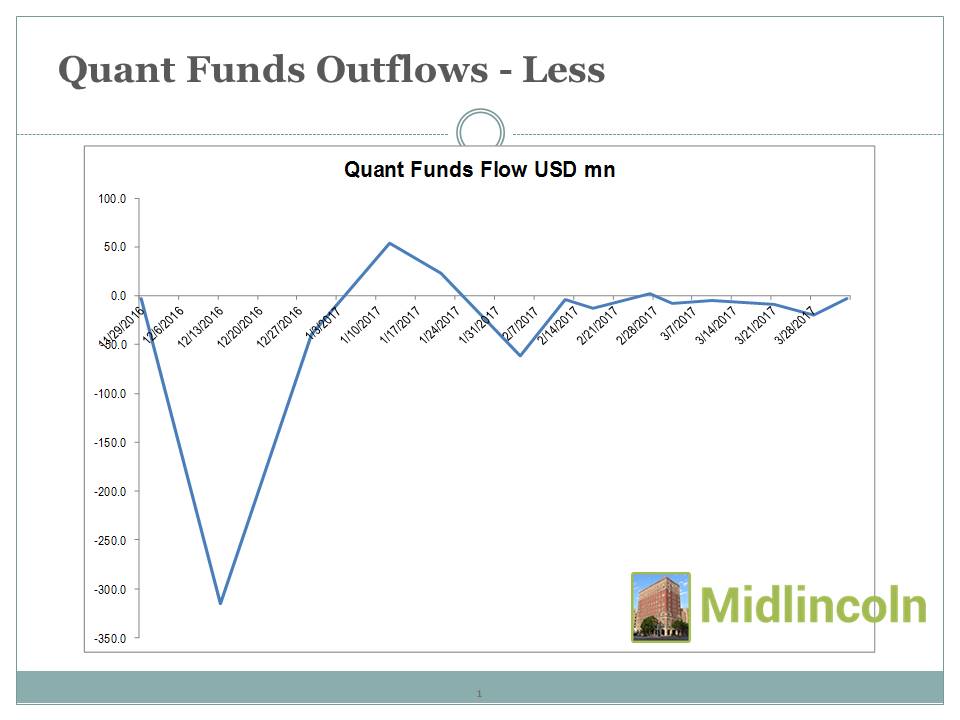

Chart: Quant Funds Outflows - Less

Source: ML

Download file in Power PointEmerging markets fund flow showed 3246.5 USD mn of inflow. While Frontier Markets funds showed 6.3 USD mn of inflows.

BRAZIL Equity funds showed 214.2 USD mn of inflow.

BRAZIL Fixed Income funds showed -98.8 USD mn of outflow.

CHINA Equity funds showed -251.4 USD mn of outflow.

CHINA Fixed Income funds showed -32.1 USD mn of outflow.

INDIA Equity funds showed 668.0 USD mn of inflow.

INDIA Fixed Income funds showed 52.8 USD mn of inflow.

KOREA Equity funds showed -8.5 USD mn of outflow.

RUSSIA Equity funds showed -160.1 USD mn of outflow.

RUSSIA Fixed Income funds showed 15.2 USD mn of inflow.

SOUTH AFRICA Equity funds showed 6.5 USD mn of inflow.

TURKEY Equity funds showed -25.2 USD mn of outflow.

COMMUNICATIONS SECTOR Equity funds showed -33.1 USD mn of outflow.

ENERGY SECTOR Equity funds showed 651.2 USD mn of inflow.

ENERGY SECTOR Mixed Allocation funds showed -0.1 USD mn of outflow.

FINANCIAL SECTOR Equity funds showed 406.7 USD mn of inflow.

REAL ESTATE SECTOR Alternative funds showed -1.5 USD mn of outflow.

REAL ESTATE SECTOR Equity funds showed -2625.5 USD mn of outflow.

TECHNOLOGY SECTOR Equity funds showed 1388.8 USD mn of inflow.

UTILITIES SECTOR Equity funds showed 386.8 USD mn of inflow.

LONG SHORT Alternative funds showed 107.7 USD mn of inflow.

LONG SHORT Equity funds showed 15.0 USD mn of inflow.

LONG SHORT Fixed Income funds showed -4.1 USD mn of outflow.

LONG SHORT Mixed Allocation funds showed 0.1 USD mn of inflow.

Markets

Best global markets since the begining of the week EFM ASIA +3.34%, EUROPE +3.07%, EM (EMERGING MARKETS) +2.35%,

While worst global markets since the begining of the week USA -0.73%, FM (FRONTIER MARKETS) 1.04%, EM LATIN AMERICA 1.11%,

Best since the start of the week among various stock markets were KENYA +12.85%, ARGENTINA +10.83%, SPAIN +10.28%, GHANA +9.83%, MEXICO +8.13%, PORTUGAL +7.48%, ITALY +7.38%, CHILE +6.65%, ZIMBABWE +6.54%, NIGERIA +6.34%,

While worst since the start of the week among various stock markets were CROATIA -7.29%, OMAN -7.18%, EGYPT -7.12%, MOROCCO -5.64%, NEW ZEALAND -5.46%, PAKISTAN -5.18%, TRINIDAD AND TOBAGO -4.51%, HUNGARY -4.32%, SRI LANKA -4.31%, KUWAIT -4.29%,

Key Fund Flow Headlines

Top 20 Funds Longs Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| CANADIAN LIFE COS SPLIT CORP (LFE) | -3.51 | -2.42 | 10.22 | 67.61 | 80.66 | 35.59 |

| FIRST JANATA BANK MUTUAL FUND (1JANATA) | -0.08 | 1.06 | 13.71 | 46.11 | 63.62 | 27.68 |

| SANTANDER FIC FI VALE 3 ACOES (REALRIO) | -6.60 | -11.90 | 9.44 | 53.19 | 65.30 | 25.00 |

| SAFRA VALE DO RIO DOCE FIC FIA (SAFVRDA) | -6.54 | -12.00 | 8.91 | 51.72 | 63.79 | 24.24 |

| DB X-TRACKERS MSCI AC ASIA EX JAPAN TRN INDEX UCITS ETF (DXS5) | 31.54 | 31.27 | 32.19 | 26.81 | 7.19 | 24.20 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (KYE) | -2.05 | 6.38 | 6.83 | 14.80 | 62.18 | 20.33 |

| TORTOISE ENERGY INFRASTRUCTURE CORP (TYG) | 0.43 | 10.25 | 15.96 | 21.18 | 48.57 | 20.11 |

| NEUBERGER BERMAN MLP INCOME FUND INC (NML) | -1.52 | 3.55 | 8.75 | 16.64 | 60.74 | 19.85 |

| FIA MERLOT (MAXPOWR) | -3.43 | 1.89 | -3.13 | 19.93 | 60.81 | 19.80 |

| MAXWELL POWER (MAXPOWR) | -3.43 | 1.89 | -3.13 | 19.93 | 60.81 | 19.80 |

| NEUBERGER BERMAN MLP INCOME FUND INC (XNMLX) | -2.72 | 0.78 | 3.72 | 15.80 | 59.54 | 18.35 |

| LYXOR ETF IBEX 35 DOBLE APALANCADO DIARIO (IBEXA) | -3.43 | 9.28 | 24.06 | 36.96 | 30.15 | 18.24 |

| GLOBAL X FTSE ARGENTINA 20 ETF (GX0A) | -0.48 | 8.14 | 24.99 | 21.56 | 43.52 | 18.19 |

| FINANCIAL 15 SPLIT CORP (FTN) | -1.27 | 1.66 | 11.59 | 31.43 | 39.16 | 17.74 |

| FIDELITY ASIAN VALUES PLC (FAS) | 2.01 | 11.06 | 17.09 | 19.59 | 34.92 | 16.90 |

| TAYLOR NORTH AMERICAN EQUITY OPPORTUNITIES FUND (TOF-U) | 6.55 | 5.23 | 9.52 | 22.78 | 30.11 | 16.17 |

| KAYNE ANDERSON ENERGY TOTAL RETURN FUND INC (XKYEX) | -1.98 | 3.03 | -2.64 | 6.30 | 57.25 | 16.15 |

| ASIA PACIFIC FUND INC/THE (APB) | 0.49 | 14.06 | 26.03 | 21.51 | 27.45 | 15.88 |

| SECURITY - FONDO DE INVERSION IFUND MSCI BRAZIL SMALL CAP INDEX (IFBRASC) | -1.72 | -1.41 | 19.75 | 11.32 | 55.29 | 15.87 |

| LYXOR ETF BRAZIL IBOVESPA (LYMG) | 0.22 | 0.01 | 20.70 | 24.80 | 38.21 | 15.81 |

Top 20 Funds Shorts Based on Momentum

| Name | 1week | 1month | ytd | 6months | 1yr | Rank |

| LYXOR ETF IBEX 35 DOBLE INVERSO DIARIO (2INVE) | 3.54 | -9.39 | -20.34 | -35.44 | -45.21 | -21.63 |

| LYXOR ETF FTSE MIB DAILY DOUBLE SHORT XBEAR (XBRMIB) | 4.92 | -3.06 | -7.57 | -36.56 | -39.44 | -18.54 |

| SPOTR BEAR OMXS30 (SPBEAOMX) | -2.87 | -3.41 | -12.04 | -25.23 | -40.46 | -17.99 |

| PROSHARES ULTRASHORT MSCI BRAZIL CAPPED (BZQ) | 4.67 | 1.04 | -20.09 | -16.13 | -56.38 | -16.70 |

| PROSHARES ULTRASHORT MSCI MEXICO CAPPED IMI (SMK) | 1.66 | -16.95 | -28.75 | -16.73 | -22.90 | -13.73 |

| CHANGSHENG TELECOM INDUSTRY FUND (CHTEINF) | -2.29 | -5.42 | -5.38 | -17.38 | -28.96 | -13.51 |

| VELOCITYSHARES 3X LONG NATURAL GAS ETN (UGAZ) | -2.97 | 21.76 | -53.97 | -59.63 | -11.56 | -13.10 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | 0.22 | 0.01 | -15.32 | -25.36 | -24.90 | -12.51 |

| LYXOR UCITS ETF IBEX 35 INVERSO DIARIO (INVEX) | 1.98 | -4.70 | -10.24 | -20.62 | -26.66 | -12.50 |

| DB X-TRACKERS SHORTDAX DAILY UCITS ETF (XSDX) | 1.06 | -1.35 | -5.45 | -17.70 | -25.02 | -10.75 |

| LYXOR ETF FTSE MIB DAILY SHORT BEAR (BERMIB) | 2.73 | -1.56 | -3.47 | -21.38 | -22.65 | -10.72 |

| COMSTAGE ETF CAC 40 SHORT GR UCITS ETF (CBCACSEU) | 1.04 | -2.25 | -4.87 | -16.54 | -23.08 | -10.21 |

| ETFS DAILY SHORT COPPER (SCOP) | 2.43 | 2.36 | -3.62 | -19.68 | -18.62 | -8.38 |

| IPATH DOW JONES-UBS SUGAR SUBINDEX TOTAL RETURN ETN (SGG) | -0.71 | -9.05 | -16.41 | -29.64 | 12.05 | -6.84 |

| HARVEST DUOLI CLASSIFICATION BOND FUND (HARDCLB) | 0.38 | -7.12 | -6.50 | -10.24 | -10.23 | -6.80 |

| CAPITAL CHINA NEW OPPORTUNITY EQUITY FUND - USD (CAPGNEU) | -1.79 | 2.15 | 7.14 | -8.40 | -18.17 | -6.55 |

| AUSTRALIA EQUITY INCOME FUND (DWAUEIP) | -0.77 | 0.70 | -0.38 | -9.06 | -16.78 | -6.48 |

| ETFS WHEAT (OD7S) | 1.95 | -1.00 | 3.73 | -5.36 | -20.96 | -6.34 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.92 | 0.64 | -8.41 | -7.70 | -16.59 | -5.68 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 1.45 | 0.58 | -8.79 | -7.92 | -16.27 | -5.54 |

Best Fundses last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (01313087) | 0.20 | 8.16 | 3.89 | 2.20 | 13.66 | 9.45 | 7.30 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (1323) | -1.11 | 6.38 | 3.61 | -3.98 | 2.76 | -0.09 | 0.58 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | 0.94 | -4.65 | 3.57 | 8.60 | -1.77 | 6.01 | 4.10 |

| GOLDMAN SACHS US REIT FUND A COURSE - COLUMBUS EGG (3531103A) | 0.34 | 9.28 | 3.21 | 9.99 | -4.23 | 3.78 | 3.19 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (01312115) | 1.06 | 11.18 | 2.74 | 7.49 | 15.81 | 18.45 | 11.12 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 0.89 | -10.12 | 2.41 | 12.81 | 11.75 | 30.34 | 14.33 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.60 | -5.38 | 2.06 | 8.13 | -2.71 | 7.01 | 3.62 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.04 | 21.65 | 1.96 | 4.65 | 31.55 | 19.08 | 14.31 |

| ISTANBUL GOLD EXCHANGE TRADED FUND (GLDTR) | 0.11 | 10.85 | 1.83 | 6.04 | 2.20 | 2.92 | 3.25 |

| FINAM MANAGEMENT LLC (FINMIT) | -0.04 | 8.10 | 1.74 | 6.43 | 11.28 | 16.29 | 8.93 |

| UBS AUSTRALIA BOND OPEN - MONTHLY DIVIDEND (50311038) | 1.22 | 7.41 | 1.56 | 3.02 | 0.31 | 1.51 | 1.60 |

| NOMURA NEXT FUNDS FTSE BURSA MALAYSIA KLCI EXCHANGE TRADED FUND (01313115) | 1.00 | 9.37 | 1.53 | 2.50 | 1.47 | -9.98 | -1.12 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | -0.63 | -0.68 | 1.51 | -8.08 | 8.22 | 3.20 | 1.21 |

| HSBC FIC FI MULTIMERCADO LONGO PRAZO DIVERSIFICACAO (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HSBC YATIRIM B TIPI ALTIN FONU (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.86 | -8.79 | 1.45 | 0.58 | -7.92 | -16.27 | -5.54 |

| E FUND GOLD THEME FUND QDII LOF (161116) | 0.04 | 8.07 | 1.27 | 4.65 | 1.04 | 2.13 | 2.27 |

| HARVEST GOLD FUND (160719) | 0.04 | 8.27 | 1.16 | 4.62 | 0.27 | 1.15 | 1.80 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (1559) | -0.23 | 12.53 | 0.99 | 4.33 | 5.92 | 12.28 | 5.88 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.10 | -8.41 | 0.92 | 0.64 | -7.70 | -16.59 | -5.68 |

Worst Funds last Week

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -1.98 | -10.96 | -4.86 | -0.68 | 10.66 | 32.11 | 9.31 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.04 | -4.42 | -3.16 | 1.31 | -9.38 | 1.38 | -2.46 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | -0.94 | -1.44 | -2.57 | -4.96 | 4.95 | -1.74 | -1.08 |

| CHANGSHENG TELECOM INDUSTRY FUND (CHTEINF) | -1.06 | -5.38 | -2.29 | -5.42 | -17.38 | -28.96 | -13.51 |

| GREAT WALL CONSUMPTION APPRECIATION EQUITY FUND (GWCONSU) | -1.03 | 6.23 | -2.03 | 1.87 | -8.70 | -2.03 | -2.72 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | -0.72 | 7.30 | -1.58 | 1.67 | -5.63 | -10.81 | -4.09 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND-MAIN - MAIN (CITICFI) | -0.62 | 0.43 | -1.52 | -2.26 | -2.29 | -2.17 | -2.06 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (01311087) | -1.45 | 8.47 | -1.47 | -3.56 | 3.90 | 29.95 | 7.21 |

| CHINA SOUTHERN GRAIN & OIL COMMODITY FUND (CSG0CMD) | -0.90 | 6.38 | -1.26 | 0.48 | -2.41 | -1.89 | -1.27 |

| SCHRODER BRICS SECURITIES FEEDER INVESTMENT TRUST A - EQUITY (0525291) | -0.71 | 15.17 | -1.21 | 3.75 | 3.89 | 23.63 | 7.52 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -0.37 | 13.92 | -1.14 | 1.79 | 6.64 | 10.51 | 4.45 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -0.36 | 14.66 | -1.10 | 1.98 | 7.81 | 12.96 | 5.41 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -1.70 | 14.23 | -1.09 | -3.81 | 8.32 | 21.31 | 6.18 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | -0.77 | 9.93 | -1.09 | 0.42 | 3.49 | 3.44 | 1.57 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (1325) | -2.37 | 7.99 | -1.07 | -4.78 | 3.42 | 31.29 | 7.22 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 0.65 | 18.95 | -0.85 | -1.14 | 13.50 | 24.45 | 8.99 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | -0.47 | 12.17 | -0.57 | 6.73 | -2.67 | -12.92 | -2.36 |

| CHINA AMC HANG SENG INDEX ETF (159920) | -1.09 | 9.26 | -0.43 | 0.41 | 2.97 | 15.89 | 4.71 |

| DAIWA J-REIT OPEN (0431103B) | -0.40 | 0.71 | -0.42 | 2.33 | -5.55 | -6.28 | -2.48 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 0.77 | 19.25 | -0.27 | 5.00 | 3.82 | 7.76 | 4.08 |

Best Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 0.89 | -10.12 | 2.41 | 12.81 | 11.75 | 30.34 | 14.33 |

| GOLDMAN SACHS US REIT FUND A COURSE - COLUMBUS EGG (3531103A) | 0.34 | 9.28 | 3.21 | 9.99 | -4.23 | 3.78 | 3.19 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | 0.94 | -4.65 | 3.57 | 8.60 | -1.77 | 6.01 | 4.10 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.60 | -5.38 | 2.06 | 8.13 | -2.71 | 7.01 | 3.62 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (01312115) | 1.06 | 11.18 | 2.74 | 7.49 | 15.81 | 18.45 | 11.12 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | -0.47 | 12.17 | -0.57 | 6.73 | -2.67 | -12.92 | -2.36 |

| FINAM MANAGEMENT LLC (FINMIT) | -0.04 | 8.10 | 1.74 | 6.43 | 11.28 | 16.29 | 8.93 |

| ISTANBUL GOLD EXCHANGE TRADED FUND (GLDTR) | 0.11 | 10.85 | 1.83 | 6.04 | 2.20 | 2.92 | 3.25 |

| HSBC FIC FI MULTIMERCADO LONGO PRAZO DIVERSIFICACAO (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HSBC YATIRIM B TIPI ALTIN FONU (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 0.77 | 19.25 | -0.27 | 5.00 | 3.82 | 7.76 | 4.08 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.04 | 21.65 | 1.96 | 4.65 | 31.55 | 19.08 | 14.31 |

| E FUND GOLD THEME FUND QDII LOF (161116) | 0.04 | 8.07 | 1.27 | 4.65 | 1.04 | 2.13 | 2.27 |

| HARVEST GOLD FUND (160719) | 0.04 | 8.27 | 1.16 | 4.62 | 0.27 | 1.15 | 1.80 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -0.08 | 12.33 | 0.70 | 4.51 | 11.35 | 18.21 | 8.69 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (1559) | -0.23 | 12.53 | 0.99 | 4.33 | 5.92 | 12.28 | 5.88 |

| SCHRODER BRICS SECURITIES FEEDER INVESTMENT TRUST A - EQUITY (0525291) | -0.71 | 15.17 | -1.21 | 3.75 | 3.89 | 23.63 | 7.52 |

| NOMURA NEXT FUNDS FTSE BURSA MALAYSIA KLCI EXCHANGE TRADED FUND (1560) | 0.19 | 9.29 | 0.91 | 3.74 | -2.09 | -8.15 | -1.40 |

| UBS AUSTRALIA BOND OPEN - MONTHLY DIVIDEND (50311038) | 1.22 | 7.41 | 1.56 | 3.02 | 0.31 | 1.51 | 1.60 |

| FONDUL PROPRIETATEA SA/FUND (FP) | -0.11 | 20.27 | -0.23 | 2.89 | 12.94 | 23.71 | 9.83 |

Worst Funds last Month

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 0.89 | -10.12 | 2.41 | 12.81 | 11.75 | 30.34 | 14.33 |

| GOLDMAN SACHS US REIT FUND A COURSE - COLUMBUS EGG (3531103A) | 0.34 | 9.28 | 3.21 | 9.99 | -4.23 | 3.78 | 3.19 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | 0.94 | -4.65 | 3.57 | 8.60 | -1.77 | 6.01 | 4.10 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.60 | -5.38 | 2.06 | 8.13 | -2.71 | 7.01 | 3.62 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (01312115) | 1.06 | 11.18 | 2.74 | 7.49 | 15.81 | 18.45 | 11.12 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | -0.47 | 12.17 | -0.57 | 6.73 | -2.67 | -12.92 | -2.36 |

| FINAM MANAGEMENT LLC (FINMIT) | -0.04 | 8.10 | 1.74 | 6.43 | 11.28 | 16.29 | 8.93 |

| ISTANBUL GOLD EXCHANGE TRADED FUND (GLDTR) | 0.11 | 10.85 | 1.83 | 6.04 | 2.20 | 2.92 | 3.25 |

| HSBC FIC FI MULTIMERCADO LONGO PRAZO DIVERSIFICACAO (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HSBC YATIRIM B TIPI ALTIN FONU (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 0.77 | 19.25 | -0.27 | 5.00 | 3.82 | 7.76 | 4.08 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.04 | 21.65 | 1.96 | 4.65 | 31.55 | 19.08 | 14.31 |

| E FUND GOLD THEME FUND QDII LOF (161116) | 0.04 | 8.07 | 1.27 | 4.65 | 1.04 | 2.13 | 2.27 |

| HARVEST GOLD FUND (160719) | 0.04 | 8.27 | 1.16 | 4.62 | 0.27 | 1.15 | 1.80 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -0.08 | 12.33 | 0.70 | 4.51 | 11.35 | 18.21 | 8.69 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (1559) | -0.23 | 12.53 | 0.99 | 4.33 | 5.92 | 12.28 | 5.88 |

| SCHRODER BRICS SECURITIES FEEDER INVESTMENT TRUST A - EQUITY (0525291) | -0.71 | 15.17 | -1.21 | 3.75 | 3.89 | 23.63 | 7.52 |

| NOMURA NEXT FUNDS FTSE BURSA MALAYSIA KLCI EXCHANGE TRADED FUND (1560) | 0.19 | 9.29 | 0.91 | 3.74 | -2.09 | -8.15 | -1.40 |

| UBS AUSTRALIA BOND OPEN - MONTHLY DIVIDEND (50311038) | 1.22 | 7.41 | 1.56 | 3.02 | 0.31 | 1.51 | 1.60 |

| FONDUL PROPRIETATEA SA/FUND (FP) | -0.11 | 20.27 | -0.23 | 2.89 | 12.94 | 23.71 | 9.83 |

Best Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.04 | 21.65 | 1.96 | 4.65 | 31.55 | 19.08 | 14.31 |

| FONDUL PROPRIETATEA SA/FUND (FP) | -0.11 | 20.27 | -0.23 | 2.89 | 12.94 | 23.71 | 9.83 |

| HANWHA CHINA MAINLAND SECURITIES FEEDER INVESTMENT TRUST H - EQUITY - C-F (3991497) | 0.77 | 19.25 | -0.27 | 5.00 | 3.82 | 7.76 | 4.08 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 0.65 | 18.95 | -0.85 | -1.14 | 13.50 | 24.45 | 8.99 |

| SCHRODER BRICS SECURITIES FEEDER INVESTMENT TRUST A - EQUITY (0525291) | -0.71 | 15.17 | -1.21 | 3.75 | 3.89 | 23.63 | 7.52 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -0.36 | 14.66 | -1.10 | 1.98 | 7.81 | 12.96 | 5.41 |

| SAMSUNG KODEX 200 EXCHANGE TRADED FUNDS (1313) | 0.72 | 14.64 | 0.38 | 1.80 | 11.32 | 17.13 | 7.66 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -1.70 | 14.23 | -1.09 | -3.81 | 8.32 | 21.31 | 6.18 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -0.37 | 13.92 | -1.14 | 1.79 | 6.64 | 10.51 | 4.45 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (1559) | -0.23 | 12.53 | 0.99 | 4.33 | 5.92 | 12.28 | 5.88 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -0.08 | 12.33 | 0.70 | 4.51 | 11.35 | 18.21 | 8.69 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | -0.47 | 12.17 | -0.57 | 6.73 | -2.67 | -12.92 | -2.36 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (01312115) | 1.06 | 11.18 | 2.74 | 7.49 | 15.81 | 18.45 | 11.12 |

| ISTANBUL GOLD EXCHANGE TRADED FUND (GLDTR) | 0.11 | 10.85 | 1.83 | 6.04 | 2.20 | 2.92 | 3.25 |

| CHINA UNIVERSAL CONSUMER SECTOR FUND (CNUNCSF) | -0.77 | 9.93 | -1.09 | 0.42 | 3.49 | 3.44 | 1.57 |

| NOMURA NEXT FUNDS FTSE BURSA MALAYSIA KLCI EXCHANGE TRADED FUND (01313115) | 1.00 | 9.37 | 1.53 | 2.50 | 1.47 | -9.98 | -1.12 |

| HSBC FIC FI MULTIMERCADO LONGO PRAZO DIVERSIFICACAO (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HSBC YATIRIM B TIPI ALTIN FONU (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| NOMURA NEXT FUNDS FTSE BURSA MALAYSIA KLCI EXCHANGE TRADED FUND (1560) | 0.19 | 9.29 | 0.91 | 3.74 | -2.09 | -8.15 | -1.40 |

| GOLDMAN SACHS US REIT FUND A COURSE - COLUMBUS EGG (3531103A) | 0.34 | 9.28 | 3.21 | 9.99 | -4.23 | 3.78 | 3.19 |

Worst Funds YTD

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -1.98 | -10.96 | -4.86 | -0.68 | 10.66 | 32.11 | 9.31 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 0.89 | -10.12 | 2.41 | 12.81 | 11.75 | 30.34 | 14.33 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.86 | -8.79 | 1.45 | 0.58 | -7.92 | -16.27 | -5.54 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.10 | -8.41 | 0.92 | 0.64 | -7.70 | -16.59 | -5.68 |

| HARVEST DUOLI CLASSIFICATION BOND FUND (HARDCLB) | 0.03 | -6.50 | 0.38 | -7.12 | -10.24 | -10.23 | -6.80 |

| WTI CRUDE OIL PRICE LINKED ETF (1671) | 0.60 | -5.38 | 2.06 | 8.13 | -2.71 | 7.01 | 3.62 |

| CHANGSHENG TELECOM INDUSTRY FUND (CHTEINF) | -1.06 | -5.38 | -2.29 | -5.42 | -17.38 | -28.96 | -13.51 |

| WTI CRUDE OIL PRICE LINKED ETF (9D311097) | 0.94 | -4.65 | 3.57 | 8.60 | -1.77 | 6.01 | 4.10 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.04 | -4.42 | -3.16 | 1.31 | -9.38 | 1.38 | -2.46 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | -0.94 | -1.44 | -2.57 | -4.96 | 4.95 | -1.74 | -1.08 |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (099340) | -0.63 | -0.68 | 1.51 | -8.08 | 8.22 | 3.20 | 1.21 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND-MAIN - MAIN (CITICFI) | -0.62 | 0.43 | -1.52 | -2.26 | -2.29 | -2.17 | -2.06 |

| DAIWA J-REIT OPEN (0431103B) | -0.40 | 0.71 | -0.42 | 2.33 | -5.55 | -6.28 | -2.48 |

| AMASSURANCE AGRIBUSINESS FUND (AMAGRIB) | -0.46 | 3.45 | 0.43 | 1.29 | 5.56 | 4.29 | 2.89 |

| CHANGSHENG TONG-XIANG RESOURCES FUND (CHATXRS) | -0.22 | 3.48 | 0.27 | 1.34 | 1.04 | -1.09 | 0.39 |

| NOMURA ETF - NIKKEI 225 EXCHANGE TRADED FUND (01311017) | -0.07 | 3.70 | 0.50 | -0.64 | 4.97 | 9.10 | 3.48 |

| NOMURA ETF - NIKKEI 225 EXCHANGE TRADED FUND (1321) | -0.26 | 3.75 | 0.31 | -0.69 | 4.76 | 10.81 | 3.80 |

| NOMURA TOPIX EXCHANGE TRADED FUND (01312017) | -0.21 | 4.13 | 0.20 | -1.33 | 4.79 | 6.87 | 2.63 |

| MIRAE ROGERS AGRICULTURAL PRODUCT INDEX SPECIAL ASSET INVEST CMDTY-DERIVATIVE (5620974) | -0.11 | 6.03 | 0.24 | -1.33 | 1.20 | 3.72 | 0.96 |

| GREAT WALL CONSUMPTION APPRECIATION EQUITY FUND (GWCONSU) | -1.03 | 6.23 | -2.03 | 1.87 | -8.70 | -2.03 | -2.72 |

Best Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| UBS HANA AMBATOVY NICKEL OVERSEAS INVESTMENT COMPANY 1 (2772642) | -1.98 | -10.96 | -4.86 | -0.68 | 10.66 | 32.11 | 9.31 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (1325) | -2.37 | 7.99 | -1.07 | -4.78 | 3.42 | 31.29 | 7.22 |

| NEXT NOTES NIKKEI TOCOM LEVERAGED CRUDE OIL ETN (2038) | 0.89 | -10.12 | 2.41 | 12.81 | 11.75 | 30.34 | 14.33 |

| NEXT FUNDS IBOVESPA LINKED EXCHANGE TRADED FUND (01311087) | -1.45 | 8.47 | -1.47 | -3.56 | 3.90 | 29.95 | 7.21 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (9D31112C) | 0.65 | 18.95 | -0.85 | -1.14 | 13.50 | 24.45 | 8.99 |

| FONDUL PROPRIETATEA SA/FUND (FP) | -0.11 | 20.27 | -0.23 | 2.89 | 12.94 | 23.71 | 9.83 |

| SCHRODER BRICS SECURITIES FEEDER INVESTMENT TRUST A - EQUITY (0525291) | -0.71 | 15.17 | -1.21 | 3.75 | 3.89 | 23.63 | 7.52 |

| SIMPLEX CHINA BULL 2X H-SHARE ETF (1572) | -1.70 | 14.23 | -1.09 | -3.81 | 8.32 | 21.31 | 6.18 |

| CITIC-PRUDENTIAL CSI 800 NONFERROUS METAL INDEX FUND (150151) | 0.04 | 21.65 | 1.96 | 4.65 | 31.55 | 19.08 | 14.31 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (01312115) | 1.06 | 11.18 | 2.74 | 7.49 | 15.81 | 18.45 | 11.12 |

| CHINA UNIVERSAL CSI CONSUMER STAPLES INDEX ETF (159928) | -0.08 | 12.33 | 0.70 | 4.51 | 11.35 | 18.21 | 8.69 |

| SAMSUNG KODEX 200 EXCHANGE TRADED FUNDS (1313) | 0.72 | 14.64 | 0.38 | 1.80 | 11.32 | 17.13 | 7.66 |

| FINAM MANAGEMENT LLC (FINMIT) | -0.04 | 8.10 | 1.74 | 6.43 | 11.28 | 16.29 | 8.93 |

| CHINA AMC HANG SENG INDEX ETF (159920) | -1.09 | 9.26 | -0.43 | 0.41 | 2.97 | 15.89 | 4.71 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC MASTER INVST TRUST-EQUITY-DERV FOF (3AF8884) | -0.36 | 14.66 | -1.10 | 1.98 | 7.81 | 12.96 | 5.41 |

| NOMURA NEXT FUNDS THAI STOCK SET50 EXCHANGE TRADED FUND (1559) | -0.23 | 12.53 | 0.99 | 4.33 | 5.92 | 12.28 | 5.88 |

| NOMURA ETF - NIKKEI 225 EXCHANGE TRADED FUND (1321) | -0.26 | 3.75 | 0.31 | -0.69 | 4.76 | 10.81 | 3.80 |

| KB CHINA MAINLAND A SHARE LEVERAGE SEC FEEDER INVST TRUST-EQUITY-DERV FOF (3AF8926) | -0.37 | 13.92 | -1.14 | 1.79 | 6.64 | 10.51 | 4.45 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (01313087) | 0.20 | 8.16 | 3.89 | 2.20 | 13.66 | 9.45 | 7.30 |

| NOMURA ETF - NIKKEI 225 EXCHANGE TRADED FUND (01311017) | -0.07 | 3.70 | 0.50 | -0.64 | 4.97 | 9.10 | 3.48 |

Worst Funds 1yr

| Name | yesterday | ytd | 1week | 1month | 6months | 1yr | Rank |

| CHANGSHENG TELECOM INDUSTRY FUND (CHTEINF) | -1.06 | -5.38 | -2.29 | -5.42 | -17.38 | -28.96 | -13.51 |

| YINHUA CONSUMPTION THEME FUND (150048) | -0.15 | 6.27 | 0.04 | 2.09 | 2.93 | -19.67 | -3.65 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (1573) | 0.10 | -8.41 | 0.92 | 0.64 | -7.70 | -16.59 | -5.68 |

| SIMPLEX CHINA BEAR 1X H-SHARE ETF (9D31212C) | 0.86 | -8.79 | 1.45 | 0.58 | -7.92 | -16.27 | -5.54 |

| MIRAE ASSET TIGER CHINA CONSUMER ETF (150460) | -0.47 | 12.17 | -0.57 | 6.73 | -2.67 | -12.92 | -2.36 |

| MIRAE ASSET TIGER CONSUMER STAPLES ETF (139280) | -0.72 | 7.30 | -1.58 | 1.67 | -5.63 | -10.81 | -4.09 |

| HARVEST DUOLI CLASSIFICATION BOND FUND (HARDCLB) | 0.03 | -6.50 | 0.38 | -7.12 | -10.24 | -10.23 | -6.80 |

| NOMURA NEXT FUNDS FTSE BURSA MALAYSIA KLCI EXCHANGE TRADED FUND (01313115) | 1.00 | 9.37 | 1.53 | 2.50 | 1.47 | -9.98 | -1.12 |

| NOMURA NEXT FUNDS FTSE BURSA MALAYSIA KLCI EXCHANGE TRADED FUND (1560) | 0.19 | 9.29 | 0.91 | 3.74 | -2.09 | -8.15 | -1.40 |

| DAIWA J-REIT OPEN (0431103B) | -0.40 | 0.71 | -0.42 | 2.33 | -5.55 | -6.28 | -2.48 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND-MAIN - MAIN (CITICFI) | -0.62 | 0.43 | -1.52 | -2.26 | -2.29 | -2.17 | -2.06 |

| GREAT WALL CONSUMPTION APPRECIATION EQUITY FUND (GWCONSU) | -1.03 | 6.23 | -2.03 | 1.87 | -8.70 | -2.03 | -2.72 |

| CHINA SOUTHERN GRAIN & OIL COMMODITY FUND (CSG0CMD) | -0.90 | 6.38 | -1.26 | 0.48 | -2.41 | -1.89 | -1.27 |

| CITIC-PRUDENTIAL CSI 800 FINANCIAL INDEX CLASSIFIED FUND (150158) | -0.94 | -1.44 | -2.57 | -4.96 | 4.95 | -1.74 | -1.08 |

| CHANGSHENG TONG-XIANG RESOURCES FUND (CHATXRS) | -0.22 | 3.48 | 0.27 | 1.34 | 1.04 | -1.09 | 0.39 |

| NEXT FUNDS FTSE/JSE AFRICA TOP40 LINKED NOMURA ETF (1323) | -1.11 | 6.38 | 3.61 | -3.98 | 2.76 | -0.09 | 0.58 |

| HSBC FIC FI MULTIMERCADO LONGO PRAZO DIVERSIFICACAO (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HSBC YATIRIM B TIPI ALTIN FONU (HSBCALT) | -0.68 | 9.35 | 1.48 | 5.56 | 0.71 | 0.49 | 2.06 |

| HARVEST GOLD FUND (160719) | 0.04 | 8.27 | 1.16 | 4.62 | 0.27 | 1.15 | 1.80 |

| YINHUA CSI CHINA MAINLAND NATURAL RESOURCE INDEX FUND (150059) | 0.04 | -4.42 | -3.16 | 1.31 | -9.38 | 1.38 | -2.46 |