Download a Slide Explaining Fixed Income Weekly

What you need to know after FOMC meeting Fed raises rates at March meeting ECB chairman rallies support for T20 change at Lord´s meeting What to Watch at Thursday's ECB Meeting BOJ March meeting summary: Policy will remain easy for some time BOJ "Summary of Opinions" (March policy meeting) What you need to know after Bank of England meeting Garfield BOE to hold budget meeting, make cuts China's central bank thinks digital currency can do one thing cash can't People's Bank of China Raises Borrowing Costs in Step With Fed Form 6-K Banco Santander (Brasil) For: Mar 28 Week Ahead in Emerging Markets: 27th March Banks bat for relaxed RBI norms on bad loan resolution as deadline ... RBI Likely To Hold Rates At April Review, Say Analysts Russia's central bank reduces key rate in surprise decision Russia: CBR rate decision finely balanced and RUB now ... Fed, BoE, BoJ and CBT on week's agenda USD/TRY likely to witness further upside this year if CBT avoids ... 5-Day Forecast for the Pound to South African Rand Exchange Rate Central Bank may hold rates as interest cap law complicates policy South Korea's new president will have an astronomical level of ... South Korea raises 2016 GDP growth to 2.8%

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondVENEZUELA BOLIVARIAN REPUBLIC OF RegS 22VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 19ECUADOR REPUBLIC OF (GOVERNMENT) RegS 20PETROLEOS DE VENEZUELA SA MTN RegS 21

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondESKOM HOLDINGS SOC LTD MTN RegS 23COSTA RICA (REPUBLIC OF) RegS 23DOMINICAN REPUBLIC RegS 21CROATIA REPUBLIC OF (GOVERNMENT) RegS 21

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondPETROLEOS DE VENEZUELA SA MTN RegS 21CSN RESOURCES SA RegS 20PETROLEOS DE VENEZUELA SA RegS 20PETROLEOS DE VENEZUELA SA RegS 26

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondODEBRECHT OFFSHORE DRILLING FINANC RegS 22ODEBRECHT DRILL VIII/IX RegS 21PETROBRAS GLOBAL FINANCE BV 23ESKOM HOLDINGS SOC LTD MTN RegS 23

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryEcuadorVenezuelaCote D'Ivoire (Ivory Coast)AngolaTrinidad and Tobago

Country Average Corporate Yield Change USD Eurobonds Weekly

CountryTrinidad and TobagoVenezuelaJamaicaPanamaUnited States

Top 30 GEM Souvereign Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSVENEZUELA (BOLVARIAN REPUBLIC OF) RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Corporate Eurobonds by Yield

NameODEBRECHT DRILL VIII/IX RegSPETROLEOS DE VENEZUELA SA MTN RegSODEBRECHT OFFSHORE DRILLING FINANC RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameTURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)BRAZIL FEDERATIVE REPUBLIC OF (GOV

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondUK CONV GILT RegS 19GERMANY (FEDERAL REPUBLIC OF) 19GERMANY (FEDERAL REPUBLIC OF) RegS 18UK CONV GILT RegS 18

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondCANADA (GOVERNMENT OF) 25SPAIN (KINGDOM OF) 30SPAIN (KINGDOM OF) 37SPAIN (KINGDOM OF) 29

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsGRUPO ISOLUX CORSAN SA 21Spain74.9817.30T-MOBILE USA INC 17United States12.937.59CLAIRES STORES INC 144A 19United States70.167.24CONCORDIA HEALTHCARE CORP 144A 22Canada60.507.15GENON ENERGY INC 18United States40.665.33

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsGRUPO ISOLUX CORSAN SA 21Spain145.77-21.16BANCA POPOLARE DI VICENZA MTN RegS 18Italy21.20-5.07VENETO BANCA SCPA MTN RegS 19Italy16.61-3.18BANCA POPOLARE DI VICENZA SCPA MTN RegS 20Italy12.65-2.13INTERNATIONAL PERSONAL FINANCE PLC MTN RegS 21United Kingdom10.95-1.00

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.104.96PORTUGAL (REPUBLIC OF)PTOTE5OE0007PortugalApr 15, 20374.104.69PORTUGAL (REPUBLIC OF)PTOTEROE0014PortugalFeb 15, 20303.884.58

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWGRUPO ISOLUX CORSAN SAXS1542318388SpainDec 30, 20210.25145.77GRUPO ISOLUX CORSAN SAXS1527710963SpainDec 30, 20213.0074.98CLAIRES STORES INC 144AUS179584AM91United StatesMar 15, 20199.0070.16

Country Average Sovereign+Corporate USD Yields Ordered by Weekly Change

| country | Yield | YieldChange |

| Ecuador | 8.66 | 0.53 |

| Venezuela | 24.04 | 0.45 |

| Canada | 8.33 | 0.40 |

| Trinidad and Tobago | 6.27 | 0.39 |

| Luxembourg | 6.89 | 0.23 |

| Japan | 3.97 | 0.21 |

| Ireland | 5.35 | 0.18 |

| Jamaica | 8.57 | 0.16 |

| Cote D'Ivoire (Ivory Coast) | 6.75 | 0.14 |

| United States | 5.84 | 0.13 |

| New Zealand | 5.43 | 0.12 |

| Finland | 2.71 | 0.12 |

| France | 6.50 | 0.08 |

| United Kingdom | 5.55 | 0.06 |

| Angola | 9.03 | 0.04 |

| El Salvador | 7.83 | 0.02 |

| Italy | 4.89 | 0.01 |

| Singapore | 19.23 | 0.01 |

| Kenya | 7.14 | 0.00 |

| Kuwait | 4.03 | 0.00 |

| Netherlands | 4.87 | -0.01 |

| Hong Kong | 8.38 | -0.01 |

| Qatar | 3.22 | -0.02 |

| Australia | 6.16 | -0.02 |

| Pakistan | 5.31 | -0.03 |

| Nigeria | 5.10 | -0.03 |

| Germany | 3.99 | -0.03 |

| Senegal | 5.15 | -0.05 |

| Morocco | 4.12 | -0.06 |

| Zambia | 7.95 | -0.06 |

| United Arab Emirates | 3.36 | -0.06 |

| Bahrain | 5.40 | -0.07 |

| Peru | 3.91 | -0.08 |

| Chile | 3.82 | -0.08 |

| Slovak Republic | 2.55 | -0.08 |

| Ethiopia | 7.49 | -0.08 |

| Gabon | 6.99 | -0.09 |

| Guatemala | 4.35 | -0.09 |

| Russian Federation | 4.00 | -0.10 |

| Argentina | 6.43 | -0.10 |

| Iraq | 8.09 | -0.10 |

| Vietnam | 4.27 | -0.10 |

| Kazakhstan | 4.93 | -0.11 |

| Korea (South) | 3.07 | -0.11 |

| Barbados | 5.68 | -0.11 |

| Oman | 4.64 | -0.12 |

| Panama | 3.63 | -0.12 |

| Egypt | 5.98 | -0.12 |

| Philippines | 3.25 | -0.12 |

| India | 4.18 | -0.12 |

| China | 3.81 | -0.12 |

| Thailand | 3.46 | -0.12 |

| Lithuania | 2.64 | -0.13 |

| Lebanon | 5.96 | -0.13 |

| Indonesia | 4.24 | -0.13 |

| Jordan | 6.19 | -0.13 |

| Uruguay | 4.42 | -0.14 |

| Malaysia | 3.17 | -0.14 |

| Poland | 2.85 | -0.15 |

| Israel | 3.73 | -0.15 |

| Taiwan | 3.61 | -0.15 |

| Ukraine | 8.62 | -0.16 |

| Hungary | 3.50 | -0.17 |

| Sri Lanka | 5.34 | -0.17 |

| Colombia | 4.63 | -0.18 |

| Azerbaijan | 5.45 | -0.18 |

| Dominican Republic | 5.39 | -0.19 |

| Mexico | 4.81 | -0.19 |

| Spain | 4.38 | -0.19 |

| South Africa | 4.91 | -0.20 |

| Turkey | 5.28 | -0.20 |

| Ghana | 8.33 | -0.20 |

| Romania | 3.67 | -0.25 |

| Croatia (Hrvatska) | 3.56 | -0.25 |

| Serbia | 3.59 | -0.26 |

| Mongolia | 6.43 | -0.27 |

| Tunisia | 6.51 | -0.28 |

| Paraguay | 5.65 | -0.29 |

| Costa Rica | 6.23 | -0.30 |

| Brazil | 6.31 | -0.34 |

Country Average Sovereign+Corporate USD Yields Ordered By YTD Yield Chance

| country | Yield | YieldChange |

| Canada | 8.51 | 0.78 |

| Venezuela | 24.14 | 0.21 |

| Japan | 3.97 | 0.15 |

| United States | 5.83 | 0.11 |

| Australia | 6.16 | 0.10 |

| Cote D'Ivoire (Ivory Coast) | 6.75 | 0.09 |

| Germany | 4.11 | 0.09 |

| Ghana | 8.39 | 0.05 |

| Ukraine | 8.62 | 0.04 |

| Barbados | 5.68 | -0.01 |

| Finland | 2.71 | -0.01 |

| Jamaica | 8.57 | -0.03 |

| France | 6.50 | -0.03 |

| Netherlands | 4.64 | -0.04 |

| New Zealand | 5.43 | -0.05 |

| Ecuador | 8.54 | -0.08 |

| El Salvador | 7.83 | -0.08 |

| Ireland | 6.28 | -0.10 |

| United Kingdom | 5.60 | -0.11 |

| Trinidad and Tobago | 6.27 | -0.13 |

| Slovak Republic | 2.55 | -0.18 |

| Jordan | 6.15 | -0.18 |

| Italy | 4.73 | -0.18 |

| Azerbaijan | 5.47 | -0.19 |

| Philippines | 3.22 | -0.21 |

| Korea (South) | 3.11 | -0.21 |

| Spain | 4.38 | -0.21 |

| Qatar | 3.21 | -0.25 |

| Thailand | 3.17 | -0.28 |

| Oman | 4.64 | -0.29 |

| United Arab Emirates | 3.47 | -0.30 |

| Israel | 3.73 | -0.31 |

| Luxembourg | 7.13 | -0.31 |

| Peru | 3.91 | -0.32 |

| Poland | 2.85 | -0.32 |

| China | 3.76 | -0.32 |

| Morocco | 4.12 | -0.32 |

| Pakistan | 5.19 | -0.34 |

| Hungary | 3.50 | -0.36 |

| Colombia | 4.68 | -0.36 |

| Malaysia | 3.18 | -0.38 |

| Lithuania | 2.64 | -0.38 |

| Tunisia | 6.51 | -0.38 |

| Bahrain | 5.40 | -0.39 |

| Uruguay | 4.42 | -0.43 |

| Russian Federation | 3.96 | -0.45 |

| Paraguay | 5.65 | -0.45 |

| Panama | 3.63 | -0.46 |

| Chile | 3.74 | -0.47 |

| Nigeria | 5.10 | -0.50 |

| Romania | 3.67 | -0.52 |

| Ethiopia | 7.49 | -0.53 |

| Taiwan | 3.61 | -0.53 |

| Argentina | 6.46 | -0.54 |

| Vietnam | 4.27 | -0.54 |

| Mexico | 4.81 | -0.55 |

| Guatemala | 4.35 | -0.55 |

| Senegal | 5.15 | -0.56 |

| Indonesia | 4.23 | -0.57 |

| Croatia (Hrvatska) | 3.56 | -0.61 |

| South Africa | 4.92 | -0.62 |

| India | 4.14 | -0.66 |

| Kenya | 7.14 | -0.70 |

| Kuwait | 3.83 | -0.72 |

| Turkey | 5.22 | -0.74 |

| Gabon | 6.99 | -0.75 |

| Serbia | 3.59 | -0.77 |

| Kazakhstan | 4.76 | -0.83 |

| Brazil | 6.18 | -0.83 |

| Sri Lanka | 5.40 | -0.87 |

| Lebanon | 5.99 | -0.88 |

| Costa Rica | 6.20 | -0.90 |

| Dominican Republic | 5.38 | -0.92 |

| Angola | 9.03 | -1.09 |

| Zambia | 7.95 | -1.15 |

| Iraq | 8.09 | -1.16 |

| Egypt | 5.25 | -1.25 |

| Mongolia | 6.43 | -1.89 |

| Hong Kong | 8.38 | -4.72 |

Country Average Sovereign+Corporate USD Yields Ordered by Current YTM

| country | Yield | YieldChange |

| Venezuela | 24.04 | 0.45 |

| Singapore | 19.23 | 0.01 |

| Angola | 9.03 | 0.04 |

| Ecuador | 8.66 | 0.53 |

| Ukraine | 8.62 | -0.16 |

| Jamaica | 8.57 | 0.16 |

| Hong Kong | 8.38 | -0.01 |

| Ghana | 8.33 | -0.20 |

| Canada | 8.33 | 0.40 |

| Iraq | 8.09 | -0.10 |

| Zambia | 7.95 | -0.06 |

| El Salvador | 7.83 | 0.02 |

| Ethiopia | 7.49 | -0.08 |

| Kenya | 7.14 | 0.00 |

| Gabon | 6.99 | -0.09 |

| Luxembourg | 6.89 | 0.23 |

| Cote D'Ivoire (Ivory Coast) | 6.75 | 0.14 |

| Tunisia | 6.51 | -0.28 |

| France | 6.50 | 0.08 |

| Argentina | 6.43 | -0.10 |

| Mongolia | 6.43 | -0.27 |

| Brazil | 6.31 | -0.34 |

| Trinidad and Tobago | 6.27 | 0.39 |

| Costa Rica | 6.23 | -0.30 |

| Jordan | 6.19 | -0.13 |

| Australia | 6.16 | -0.02 |

| Egypt | 5.98 | -0.12 |

| Lebanon | 5.96 | -0.13 |

| United States | 5.84 | 0.13 |

| Barbados | 5.68 | -0.11 |

| Paraguay | 5.65 | -0.29 |

| United Kingdom | 5.55 | 0.06 |

| Azerbaijan | 5.45 | -0.18 |

| New Zealand | 5.43 | 0.12 |

| Bahrain | 5.40 | -0.07 |

| Dominican Republic | 5.39 | -0.19 |

| Ireland | 5.35 | 0.18 |

| Sri Lanka | 5.34 | -0.17 |

| Pakistan | 5.31 | -0.03 |

| Turkey | 5.28 | -0.20 |

| Senegal | 5.15 | -0.05 |

| Nigeria | 5.10 | -0.03 |

| Kazakhstan | 4.93 | -0.11 |

| South Africa | 4.91 | -0.20 |

| Italy | 4.89 | 0.01 |

| Netherlands | 4.87 | -0.01 |

| Mexico | 4.81 | -0.19 |

| Oman | 4.64 | -0.12 |

| Colombia | 4.63 | -0.18 |

| Uruguay | 4.42 | -0.14 |

| Spain | 4.38 | -0.19 |

| Guatemala | 4.35 | -0.09 |

| Vietnam | 4.27 | -0.10 |

| Indonesia | 4.24 | -0.13 |

| India | 4.18 | -0.12 |

| Morocco | 4.12 | -0.06 |

| Kuwait | 4.03 | 0.00 |

| Russian Federation | 4.00 | -0.10 |

| Germany | 3.99 | -0.03 |

| Japan | 3.97 | 0.21 |

| Peru | 3.91 | -0.08 |

| Chile | 3.82 | -0.08 |

| China | 3.81 | -0.12 |

| Israel | 3.73 | -0.15 |

| Romania | 3.67 | -0.25 |

| Panama | 3.63 | -0.12 |

| Taiwan | 3.61 | -0.15 |

| Serbia | 3.59 | -0.26 |

| Croatia (Hrvatska) | 3.56 | -0.25 |

| Hungary | 3.50 | -0.17 |

| Thailand | 3.46 | -0.12 |

| United Arab Emirates | 3.36 | -0.06 |

| Philippines | 3.25 | -0.12 |

| Qatar | 3.22 | -0.02 |

| Malaysia | 3.17 | -0.14 |

| Korea (South) | 3.07 | -0.11 |

| Poland | 2.85 | -0.15 |

| Finland | 2.71 | 0.12 |

| Lithuania | 2.64 | -0.13 |

| Slovak Republic | 2.55 | -0.08 |

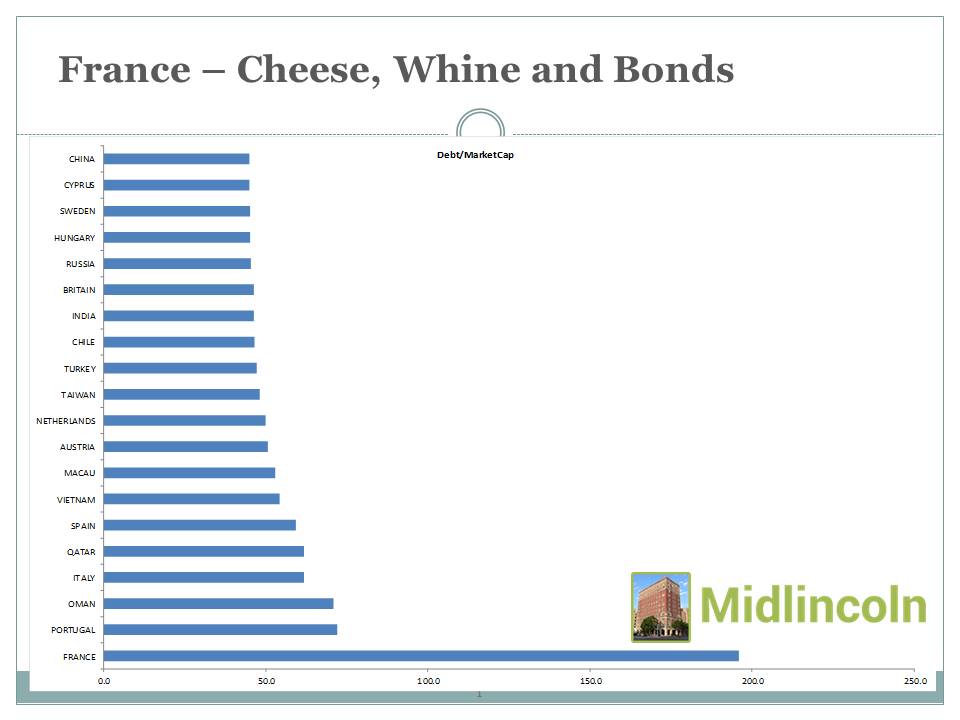

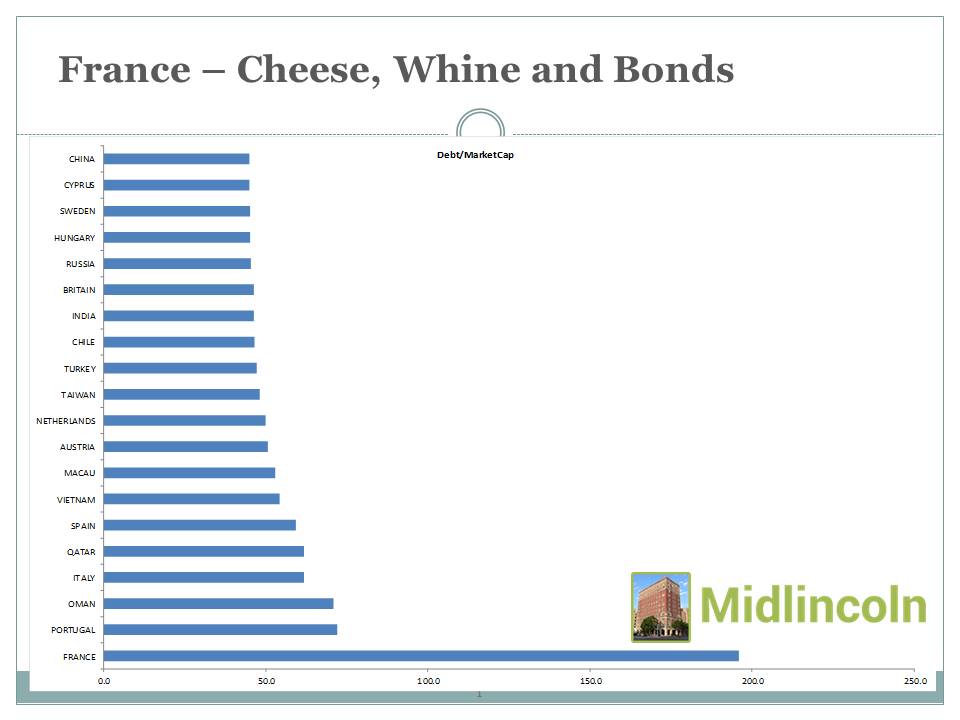

Chart: Average Debt To MarketCap across Countries

France - a country where debt meets equity

Source:

Download file in Power PointKey News

Average UST Yield

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Bonds Datamine Queries

Top 20 GEM Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondVENEZUELA BOLIVARIAN REPUBLIC OF RegS 22VENEZUELA (BOLVARIAN REPUBLIC OF) RegS 19ECUADOR REPUBLIC OF (GOVERNMENT) RegS 20PETROLEOS DE VENEZUELA SA MTN RegS 21

Top 20 GEM Sovereign Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondESKOM HOLDINGS SOC LTD MTN RegS 23COSTA RICA (REPUBLIC OF) RegS 23DOMINICAN REPUBLIC RegS 21CROATIA REPUBLIC OF (GOVERNMENT) RegS 21

Top 10 GEM Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondPETROLEOS DE VENEZUELA SA MTN RegS 21CSN RESOURCES SA RegS 20PETROLEOS DE VENEZUELA SA RegS 20PETROLEOS DE VENEZUELA SA RegS 26

Top 10 GEM Corporate Bonds Yields Drops USD Eurobonds (Winners) Weekly

BondODEBRECHT OFFSHORE DRILLING FINANC RegS 22ODEBRECHT DRILL VIII/IX RegS 21PETROBRAS GLOBAL FINANCE BV 23ESKOM HOLDINGS SOC LTD MTN RegS 23

Country Average Sovereign Yield Change USD Eurobonds Weekly

CountryEcuadorVenezuelaCote D'Ivoire (Ivory Coast)AngolaTrinidad and Tobago

Country Average Corporate Yield Change USD Eurobonds Weekly

CountryTrinidad and TobagoVenezuelaJamaicaPanamaUnited States

Top 30 GEM Souvereign Eurobonds by Yield

NamePETROLEOS DE VENEZUELA SA MTN RegSVENEZUELA (BOLVARIAN REPUBLIC OF) RegSPETROLEOS DE VENEZUELA SA RegS

Top 30 GEM Corporate Eurobonds by Yield

NameODEBRECHT DRILL VIII/IX RegSPETROLEOS DE VENEZUELA SA MTN RegSODEBRECHT OFFSHORE DRILLING FINANC RegS

Top 30 GEM Local (reasonably rated) Currency Bonds by Yield

NameTURKEY (REPUBLIC OF)TURKEY (REPUBLIC OF)BRAZIL FEDERATIVE REPUBLIC OF (GOV

Big Country Table - Stance, Ratings and Datamine

Top 20 Developed Markets Sovereign Bonds Yields Climbs Change USD Eurobonds (Losers) Weekly

BondUK CONV GILT RegS 19GERMANY (FEDERAL REPUBLIC OF) 19GERMANY (FEDERAL REPUBLIC OF) RegS 18UK CONV GILT RegS 18

Top 20 Developed Markets Sovereign Bonds Yields Drops Change USD Eurobonds (Winners) Weekly

BondCANADA (GOVERNMENT OF) 25SPAIN (KINGDOM OF) 30SPAIN (KINGDOM OF) 37SPAIN (KINGDOM OF) 29

Top 10 Developed Markets Corporate Bonds Yields Climbs Week Change USD Eurobonds (Losers)

BondCountryYieldYield Change %ptsGRUPO ISOLUX CORSAN SA 21Spain74.9817.30T-MOBILE USA INC 17United States12.937.59CLAIRES STORES INC 144A 19United States70.167.24CONCORDIA HEALTHCARE CORP 144A 22Canada60.507.15GENON ENERGY INC 18United States40.665.33

Top 10 Developed Markets Corporate Bonds Yields Drops Week Change USD Eurobonds (Winners)

BondCountryYieldYield Change %ptsGRUPO ISOLUX CORSAN SA 21Spain145.77-21.16BANCA POPOLARE DI VICENZA MTN RegS 18Italy21.20-5.07VENETO BANCA SCPA MTN RegS 19Italy16.61-3.18BANCA POPOLARE DI VICENZA SCPA MTN RegS 20Italy12.65-2.13INTERNATIONAL PERSONAL FINANCE PLC MTN RegS 21United Kingdom10.95-1.00

Top 30 DM Souvereign Eurobonds by Yield

NameISINcountryMaturityCouponYTWPORTUGAL (REPUBLIC OF)PTOTEBOE0020PortugalFeb 15, 20454.104.96PORTUGAL (REPUBLIC OF)PTOTE5OE0007PortugalApr 15, 20374.104.69PORTUGAL (REPUBLIC OF)PTOTEROE0014PortugalFeb 15, 20303.884.58

Top 30 DM Corporate Eurobonds by Yield

NameISINcountryMaturityCouponYTWGRUPO ISOLUX CORSAN SAXS1542318388SpainDec 30, 20210.25145.77GRUPO ISOLUX CORSAN SAXS1527710963SpainDec 30, 20213.0074.98CLAIRES STORES INC 144AUS179584AM91United StatesMar 15, 20199.0070.16