Tockenising Midlincoln Crafts

This section contains links to materials about Midlincoln Rural Crafts Initiatives

Midlincoln is testing rural co-working model as its core business. Half of the co-working space is dedicated to investment analytics service and half of the space is industrial, creative environment with machines and tools which can be used in product development and small scale production.

Investing into Midlincoln Craft fund tokens is a comprehensive investment into all of the portfolio companies and funds. But each of the mentioned companies and funds are also accessible for investment directly also via tokens. Each of the portfolio company or a fund can be considered as a standalone franchise and Stoken could provide security token investment for qualified investors in any of them.

Select Midlincoln Research Reports

Top 20 Long Index Ideas YTD From Best to Worst

| objective | YTD |

| ARGENTINA | 12.10 |

| ENERGY | 9.14 |

| COLOMBIA | 8.51 |

| BRAZIL | 8.14 |

| PHILIPPINES | 8.01 |

| MEXICO | 7.88 |

| LATIN AMERICAN REGION | 7.04 |

| SMALL-CAP | 6.96 |

| FINLAND | 6.77 |

| NORWAY | 6.76 |

| CHILE | 6.65 |

| AGGREGATE BOND USD FOCUSED | 6.60 |

| RUSSIA | 6.36 |

| ENERGY SECTOR | 6.33 |

| LONG TERM CORPORATE BOND | 6.28 |

| NATURAL RESOURCES SECTOR | 6.04 |

| IRELAND | 6.01 |

| BLEND SMALL CAP | 5.98 |

| VALUE SMALL CAP | 5.91 |

| GOVERNMENT ULTRA SHORT | 5.76 |

Top 20 Short Index Ideas YTD From Best to Worst

| objective | YTD |

| TURKEY | -1.81 |

| TAIWAN | -0.68 |

| INDIA | -0.57 |

| EQUITY HEDGE DIVERSIFIED | -0.05 |

| EVENT DRIVEN SPECIAL SITUATION | 0.13 |

| FIXED INCOME ARBITRAGE | 0.13 |

| FOREIGN A00001106GGREGATE BOND | 0.25 |

| KOREA | 1.03 |

| SINGLE REGION | 1.15 |

| SPAIN | 1.16 |

| AGGREGATE BOND EURO FOCUSED | 1.55 |

| PRECIOUS METALS | 1.62 |

| EVENT DRIVEN MERGER ARBITRAGE | 1.70 |

| FIXED INCOME DIVERSIFIED | 1.70 |

| OECD COUNTRIES | 1.75 |

| INDUSTRIAL METALS | 1.85 |

| SPECIALTY | 1.97 |

| GOVERNMENT INTERMEDIATE | 2.02 |

| FOREIGN AGGREGATE BOND | 2.18 |

| FRANCE | 2.25 |

Combined Performance of Tracked Indexes by Index Provider Top 20 Winners

| sourcename | ytd |

| Market Vectors Index Solutions | 11.94 |

| BOVESPA | 10.635 |

| Cushing | 9.14 |

| Stuttgart Stock Exchange | 8.845 |

| Bolsa de Valores de Colombia | 7.77 |

| Zacks | 7.06 |

| Bolsa de Comercio de Santiago | 6.74 |

| Bank of New York | 6.51 |

| New York Stock Exchange (NYSE) | 6.282631578947368 |

| S-Network Global Indexes LLC | 5.890000000000001 |

| Shenzhen Stock Exchange | 5.72 |

| Russell | 5.505200000000001 |

| SIX AB | 5.47 |

| NYSE Euronext Brussels | 5.42 |

| Diapason Commodities | 5.42 |

| Anbima | 5.38 |

| Saudi Arabian Stock Exchange | 5.29 |

| Standard & Poor's Index Alert | 5.113888888888889 |

| NYSE AMEX | 5.055 |

| Banco Central do Brasil | 4.95 |

Combined Performance of Tracked Indexes by Index Provider Top 20 Losers

| sourcename | ytd |

| Nigerian Stock Exchange | -5.29 |

| Bulgaria Stock Exchange | -4.23 |

| NASDAQ OMX Iceland | -3.87 |

| National Stock Exchange of Ind | -3.0999999999999996 |

| Istanbul Stock Exchange | -3.07 |

| BSE India | -2.12 |

| Colombo Stock Exchange | -0.85 |

| The Association of Banks in Si | -0.15 |

| Analistas Financieros Internac | -0.09 |

| Mauritius Stock Exchange | -0.05 |

| Taiwan Stock Exchange | -0.025000000000000022 |

| WisdomTree | -0.020000000000000018 |

| Deutsche Bank Securities Inc. | 0.07 |

| Bahrain Bourse | 0.31 |

| ProShares | 0.41 |

| KOSPI Stock Market | 0.5381818181818183 |

| Government Debt Management Age | 0.71 |

| iBoxx | 0.7525 |

| ICE Benchmark Administration | 0.7666666666666667 |

| CQG | 0.79 |

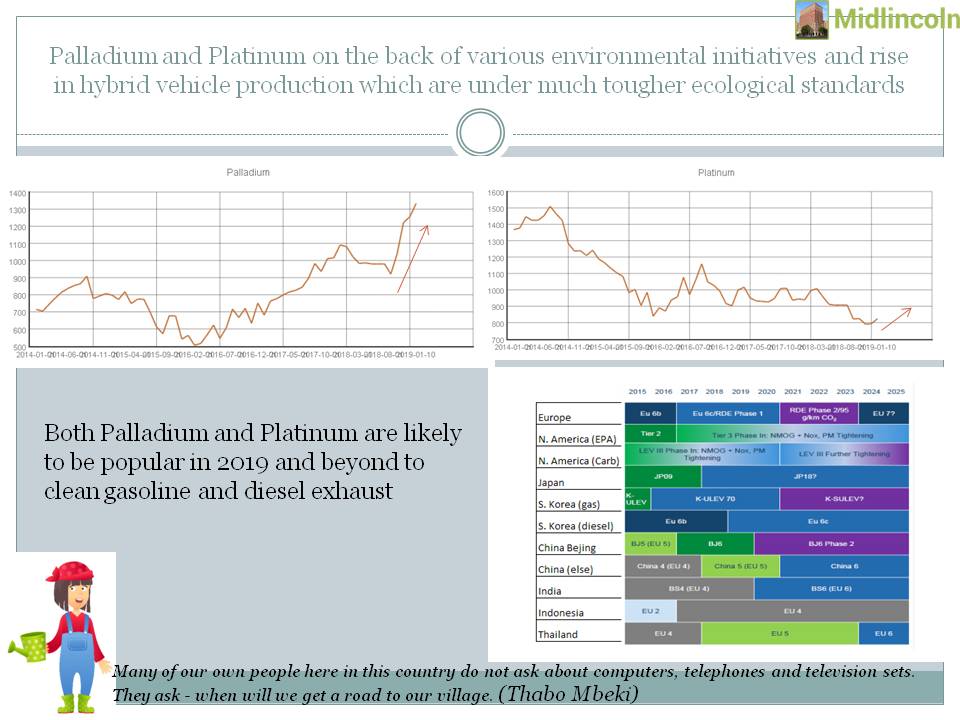

Chart: Index Atlas Trade Ideas for 2019 Source: ML Download file in Power PointKey Topics and NewsLong Palladium and Platinum

on the back of various environmental initiatives and rise in hybrid vehicle production which are under much tougher ecological standards

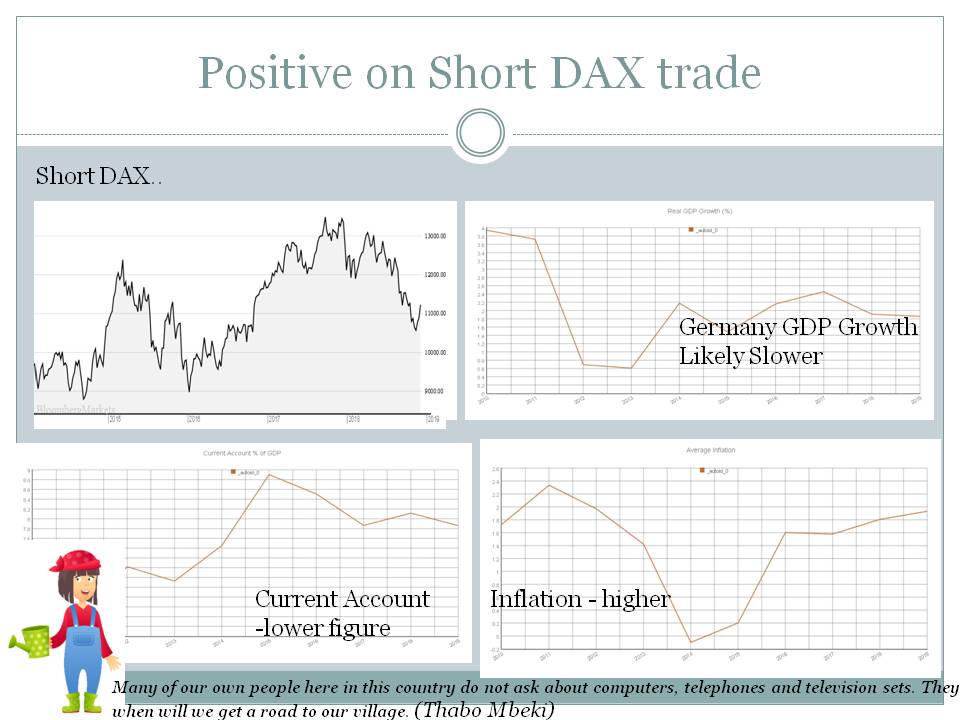

Source: ML Short DAX

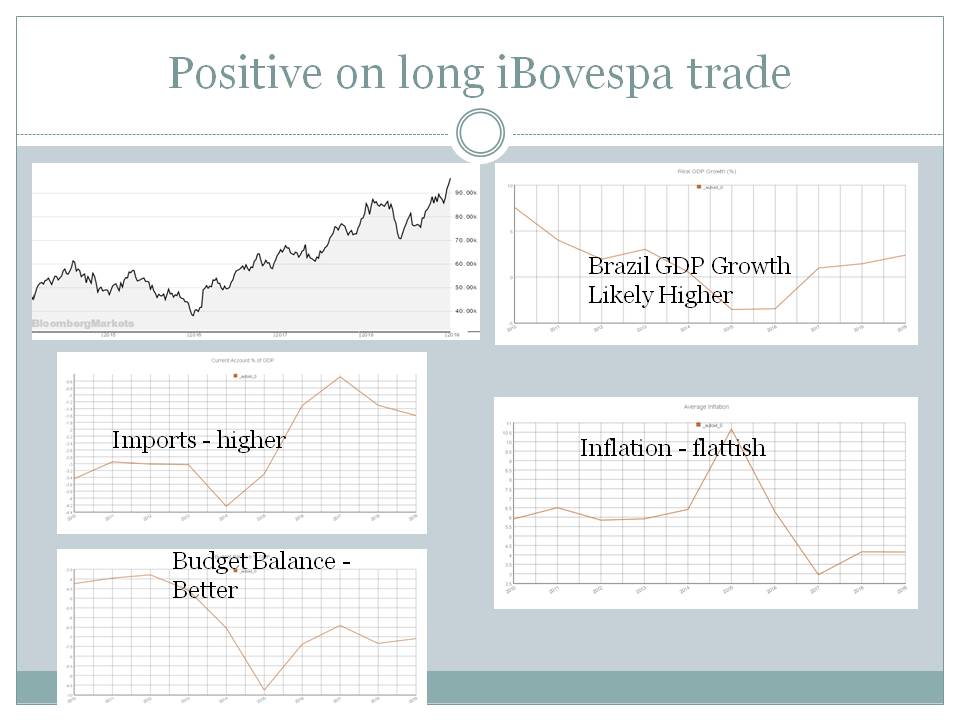

Long iBovespa

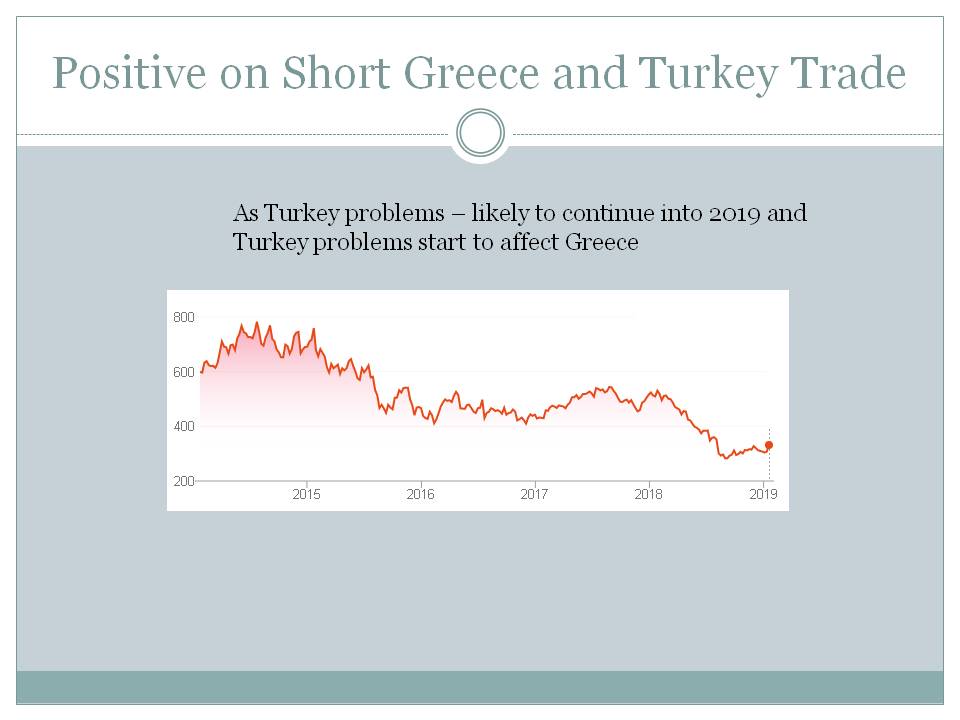

Source: ML Short Greece and Turkey Index

As Turkey problems – likely to continue into 2019 and Turkey problems start to affect Greece  Source: ML Long Singapore SIBOR rate

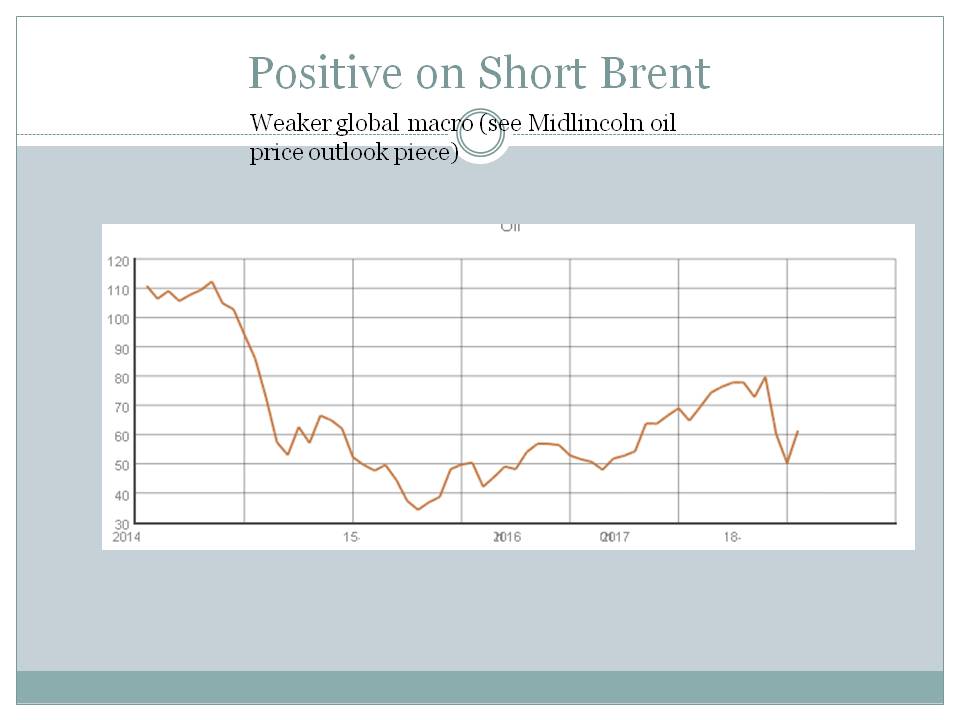

Singapore local credit rates were quite tight and dollar was appreciating, stimulating a carry trade that has started to reverse..  Source: ML Short Brent Oil Price Index

Weaker global macro (see Midlincoln oil price outlook piece)  Source: ML Positive on Long BRICs

BRICs is an even set of importers and exporters – and overall could be immune to commodities price fluctuation. In addition the longer push for economic rebalance of BRICs could start giving some small results.  Source: ML Positive on 12m Libor rate in USD

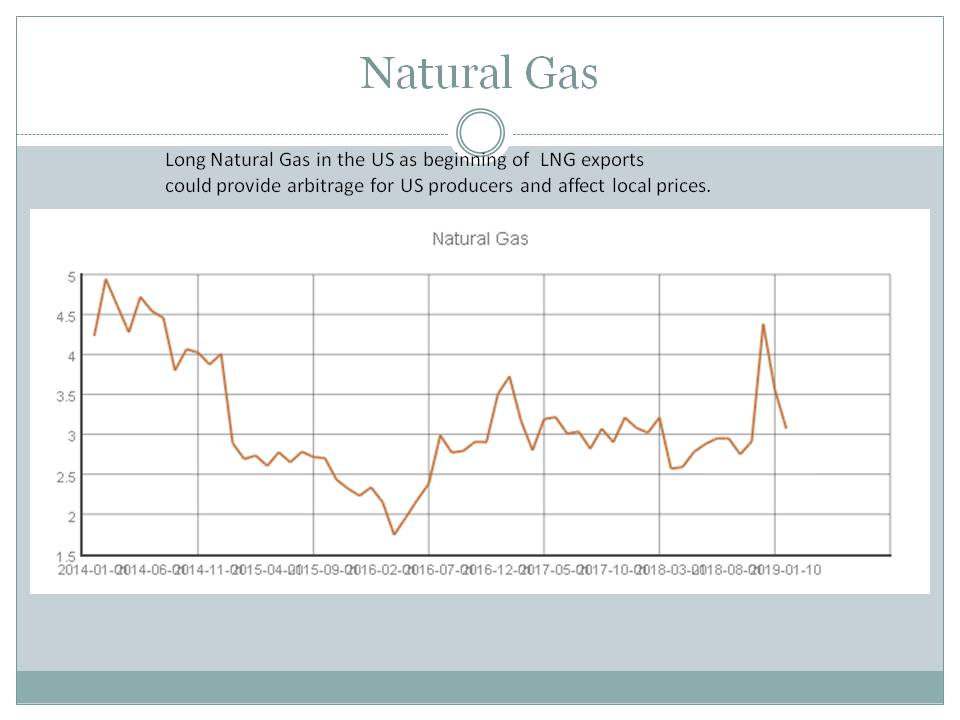

Just a bet on rising rates.  Source: ML Long Natural Gas in the US

Long Natural Gas in the US as beginning of LNG exports could provide arbitrage for US producers and affect local prices. Besides all the temporal demand factors  Source: ML Short Nikkei Index

Japan stocks had a good run and now look toppish  Source: ML Recent Index Atlas Ideas ChartArtIndex Rebalancing NewsMSCI Standard & Poor's Index Hang Seng FTSE Bloomberg Indices Dow Jones Moex Indexes Index Futures TradingTop 20 Index Longs Based on Momentum

Top 20 Index Shorts Based on Momentum

Best Indexes last Week

Worst Indexes last Week

Best Indexes last Month

Worst Indexes last Month

Best Indexes YTD

Worst Indexes YTD

Best Indexes 1yr

Worst Indexes 1yr

Latest ML ComicsRecent ML Rural Highlights. Small Towns and Villages

|